October 28, 2024

Gladiator Resources Ltd (ASX: GLA) (Gladiator or the Company) is pleased to provide shareholders with the Company’s Activities and Appendix 5B Cashflow Report for the quarter ending 30 September 2024.

HIGHLIGHTS

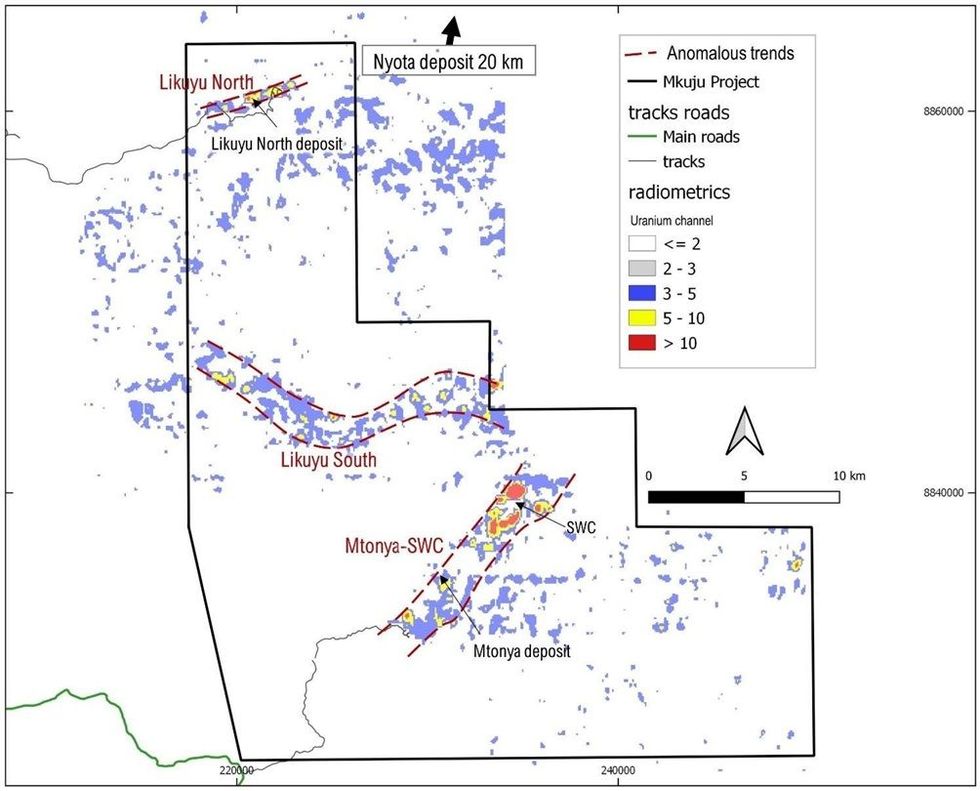

- Completion of drilling at the Mkuju Project - 20 diamond core holes for 2800 m of drilling, testing the SWC and Mtonya targets, and testing potential extensions to the Likuyu North deposit.

- At SWC, high-grade uranium from surface including:

- 3.8m @ 2,458ppm eU3O8 from surface,

- 2.4m @ 3,528ppm eU3O8 from surface,

- 1.8m @ 3,089ppm eU3O8 from surface and 1.2m @ 988ppm eU3O8 from 5.9m depth

- At Mtonya, best interval of 2.3m @ 372ppm eU3O8 from 6.16m depth.

- At Likuyu North, possible moderate extension to the deposit indicated by visual mineralisation in LNDD015, now awaiting assays; and

- LNDD020 drilled central to the Likuyu North deposit to provide information for an initial assessment of In-Situ Recovery (ISR); intersected 6 mineralised intervals including:

- 2.5 metres with an average grade of 438 ppm eU3O8 from 17.1m depth.

- 7.1 metres with an average grade of 1,963 ppm eU3O8 from 63.1m depth.

MKUJU URANIUM PROJECT - TANZANIA

Table 1 summarises the work completed during the quarter at the Mkuju Project.

SWC TARGET EXPLORATION

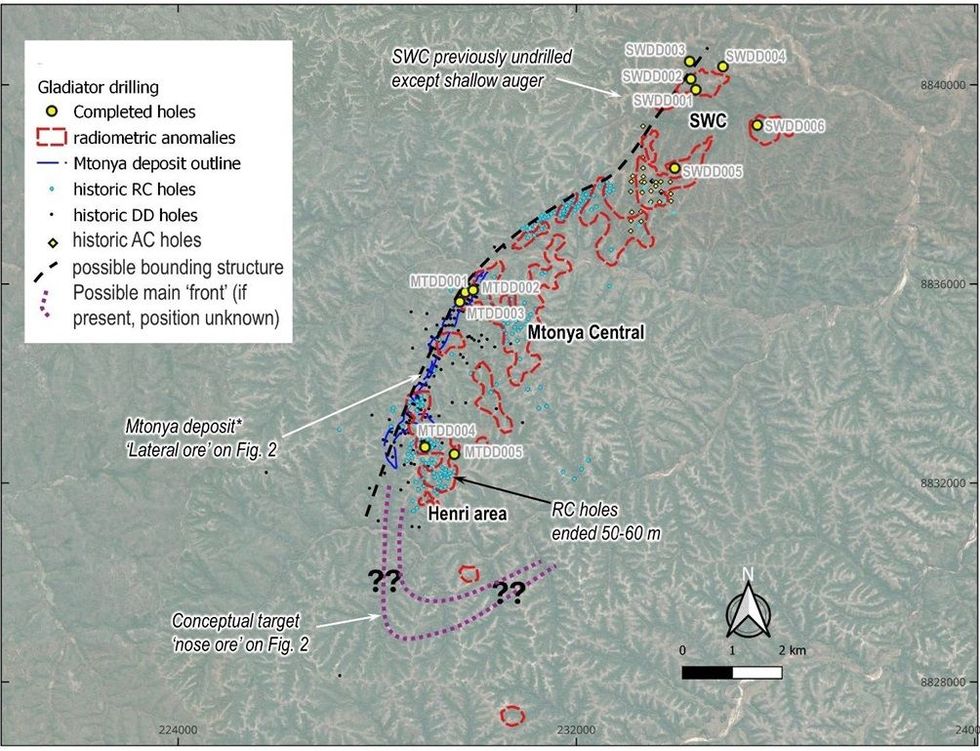

During May 2024 a camp was constructed and a drilling and exploration crew was mobilized. The holes drilled at SWC are shown on Figure 2. Table 2 provides the results of the SWC and Mtonya drilling. The drilling at SWC was to follow-up on the high-grade intervals achieved from the trenches reported in the Company announcement dated 9th January 2024.

All holes were vertical, drilling was by diamond core and the deepest was 188.7 metres. The results were reported in announcements dated 24th June and 16th August 2024. Selected results are provided below:

- SWDD001: 3.8m @ 2,458ppm eU3O8 from surface.

- SWDD002: 2.4m @ 3,528ppm eU3O8 from surface.

- SWDD005: 1.8m @ 3,089ppm eU3O8 from surface and 1.2m @ 988ppm eU3O8 from 5.9m depth

- SWDD006: 5.3m @ 143ppm eU3O8 from 3.0m depth

The trench and high-grade drilling intersections are interpreted to be the remains of a layer that is preserved on topographic highs within a relatively downthrown block, as illustrated in Figure 3, which represents a cross-sectional interpretation through SWC. Where the layer is at or very near surface as in SWDD001 and SWDD002, enrichment by supergene processes may have occurred whereas where deeper and unaffected by the surficial enrichment, as in SWDD006, grades are lower. No significant mineralisaton was intersected deeper in the holes drilled at SWC.

Click here for the full ASX Release

This article includes content from Gladiator Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLA:AU

The Conversation (0)

29 May 2024

Gladiator Resources

Capitalizing on the uranium momentum with prolific assets in Tanzania

Capitalizing on the uranium momentum with prolific assets in Tanzania Keep Reading...

9h

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00