October 09, 2024

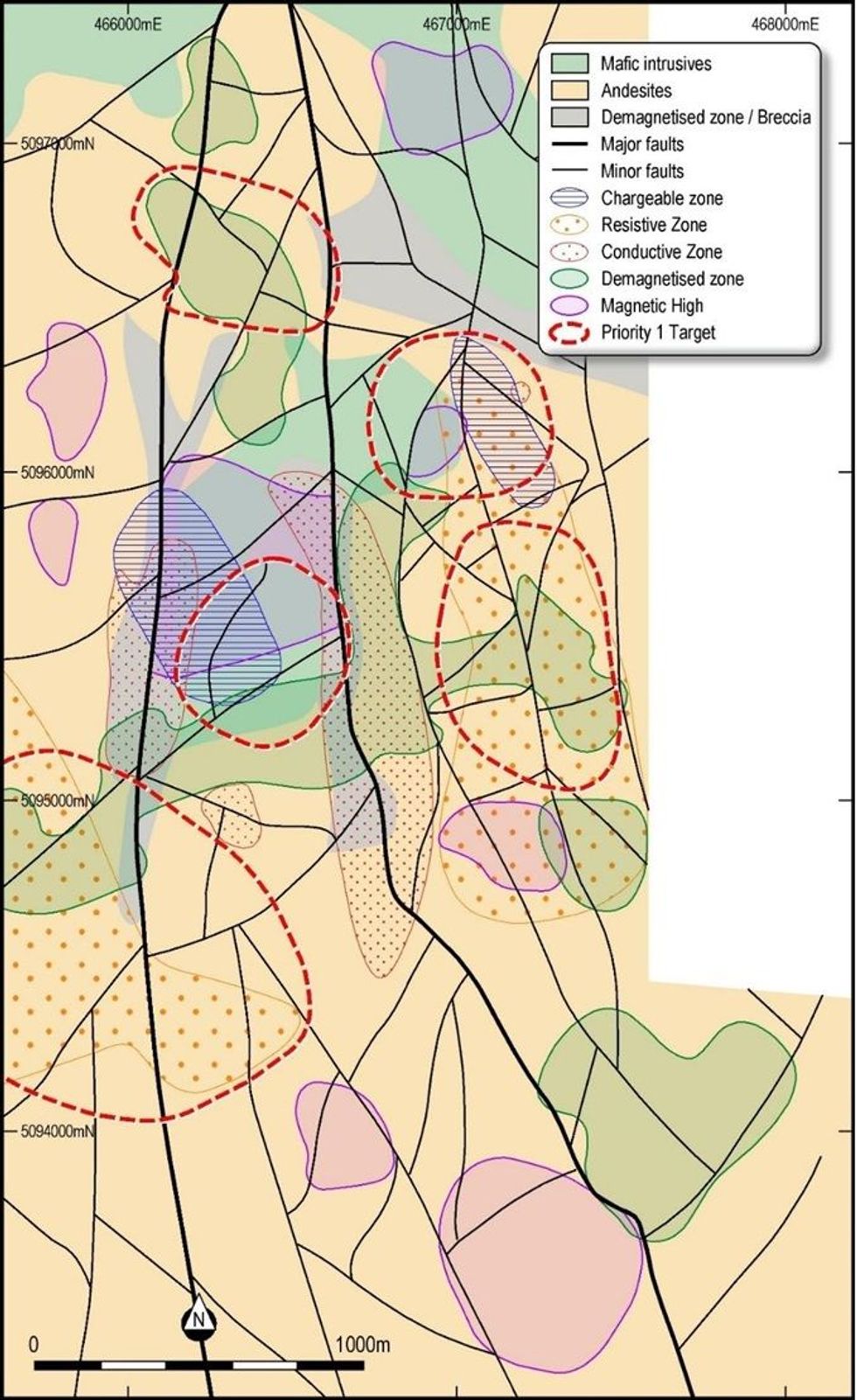

Piche Resources Limited (ASX: PR2) (“Piche” or the “Company”), is pleased to announce the completion of ground magnetic and induced polarisation (IP)/resistivity surveys over the La Javiela prospect on its Cerro Chacon project in the Chubut Province of Argentina (Figure 1). The surveys interpretation was undertaken by Southern Geoscience in Perth, Western Australia and has identified five additional high priority targets.

HIGHLIGHTS

- Detailed magnetic and IP/resistivity surveys at the Chacon Grid and La Javiela prospects at Piche’s Cerro Chacon project have identified multiple high priority targets in complex fault arrays that typically host high grade Au/Ag mineralisation.

- Interpretation of La Javiela survey data has identified five high priority drill targets.

- Southern Argentina contains numerous large, high-grade Au/Ag deposits located in Jurassic aged volcanics. Mineralisation is typically focused in structurally complex areas, particularly at the intersections of north-south faults and secondary east- west, northeast or northwest striking faults.

- Piche’s Cerro Chacon project area hosts several occurrences of gold/silver and pathfinder geochemistry with coincident structural and geophysical anomalies which typically reflect deposition of significant mineralisation in southern Argentina.

- The extent of the surface expression, the corresponding geophysical signatures, geochemistry and structural regime has led Piche to believe that the two prospects may be part of a mineralised structural corridor up to 10km in length.

- The Cerro Chacon project represents one of Argentina’s unexplored gold-rich mineralised systems, offering tremendous untapped potential and synergies with several of the large precious metal mines in the region.

This survey complements the previous magnetic and IP/resistivity surveys completed over the Chacon grid, some 5km to the north-west. Both surveys highlight the strong structural controls, the intense alteration, and the coincident geophysical signatures.

Previously the Chacon Grid had been mapped and sampled over a strike length of two kilometres, but recent reconnaissance has indicated the structure may extend for a strike length of up to six kilometres. It is expected that further mapping, geochemistry, geophysics and drilling along strike and between both the Chacon Grid and the La Javiela vein systems will highlight a mineralised structural corridor up to 10km in length.

Click here for the full ASX Release

This article includes content from Piche Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

silver-investinguranium-investingasx-stocksasx-pr2gold-explorationgold-investinggold-stockscopper-investing

PR2:AU

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

04 December 2025

Commences Maiden RC Drilling at Cerro Chacon Gold Project

Piche Resources (PR2:AU) has announced Commences Maiden RC Drilling at Cerro Chacon Gold ProjectDownload the PDF here. Keep Reading...

06 November 2025

Reinstatement to Quotation

Piche Resources (PR2:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

06 November 2025

$2million placement to advance Argentine exploration

Piche Resources (PR2:AU) has announced $2million placement to advance Argentine explorationDownload the PDF here. Keep Reading...

30 October 2025

Quarterly Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

3h

Jaime Carrasco: Gold at US$7,000 is "Conservative," Plus Silver Outlook

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, explains what's driving gold and silver prices. "The real question here is not how high silver is going — forget about that," he said. "The right question is how high does gold have to go to... Keep Reading...

4h

55 North Mining: The Economic Upside of US$5,000 Gold and High-grade Project Next to Alamos Gold

With gold prices maintaining their historic trajectory toward US$5,000 per ounce, gold exploration companies with high-grade assets offer immediate economic leverage. 55 North Mining (CSE:FFF,FWB:6YF) is emerging as a primary beneficiary of this. We sat down with CEO Bruce Reid as he discussed... Keep Reading...

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00