August 19, 2024

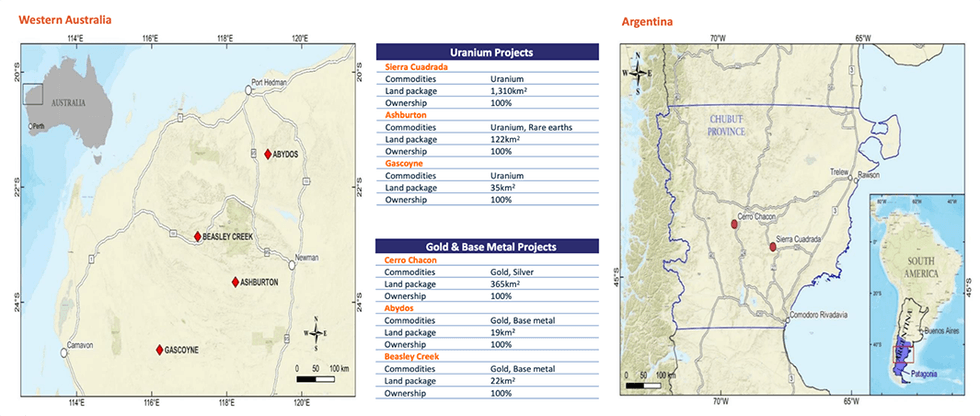

With high-quality, drill-ready assets, with world-class discovery potential, Piche Resources (ASX:PR2) is a compelling business case for investors looking to leverage a bull market for uranium and gold. The company holds a portfolio of drill-ready uranium and gold assets in Argentina and Australia which include the Ashburton uranium project in the Pilbara region; the Sierra Cuadrada uranium project in Argentina; and the Cerro Chacon gold project which shares geological similarities with the Cerro Negro mine.

The Ashburton uranium project comprises three exploration licences and has the potential to host uranium mineral deposits similar to the Pine Creek Geosyncline in Australia’s Northern Territory, and the Athabasca Basin in Saskatchewan, Canada.

iche has an internationally recognized board focused on creating long-term shareholder value, and an in-country technical team in Argentina with a proven track record of taking projects from discovery through to development.

Company Highlights

- The company’s Australian asset is the Ashburton uranium project which has been drilled previously and recorded high-grade uranium intersections over significant widths.

- In Argentina, the company’s Sierra Cuadrada uranium project in the San Jorge Basin has a significant history of high-grade, near-surface uranium mining operations.

- The company is currently drilling one of its prospects at Sierra Cuadrada and has announced visible uranium in numerous holes. Multiple other prospects are drill-ready and have the potential to host tier 1 uranium deposits.

- Exposure to gold with high-quality precious metal projects in Argentina that boast surface outcrop samples with gold grade up to 13 g/t gold.

- Internationally renowned board and management team with extensive uranium and gold exploration and development experience.

This Piche Resources profile is part of a paid investor education campaign.*

Click here to connect with Piche Resources (ASX:PR2) to receive an Investor Presentation

PR2:AU

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

04 December 2025

Commences Maiden RC Drilling at Cerro Chacon Gold Project

Piche Resources (PR2:AU) has announced Commences Maiden RC Drilling at Cerro Chacon Gold ProjectDownload the PDF here. Keep Reading...

06 November 2025

Reinstatement to Quotation

Piche Resources (PR2:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

06 November 2025

$2million placement to advance Argentine exploration

Piche Resources (PR2:AU) has announced $2million placement to advance Argentine explorationDownload the PDF here. Keep Reading...

30 October 2025

Quarterly Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

3h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

20h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00