July 07, 2024

Drilling contractor selection being finalised – drilling on track to commence mid-August

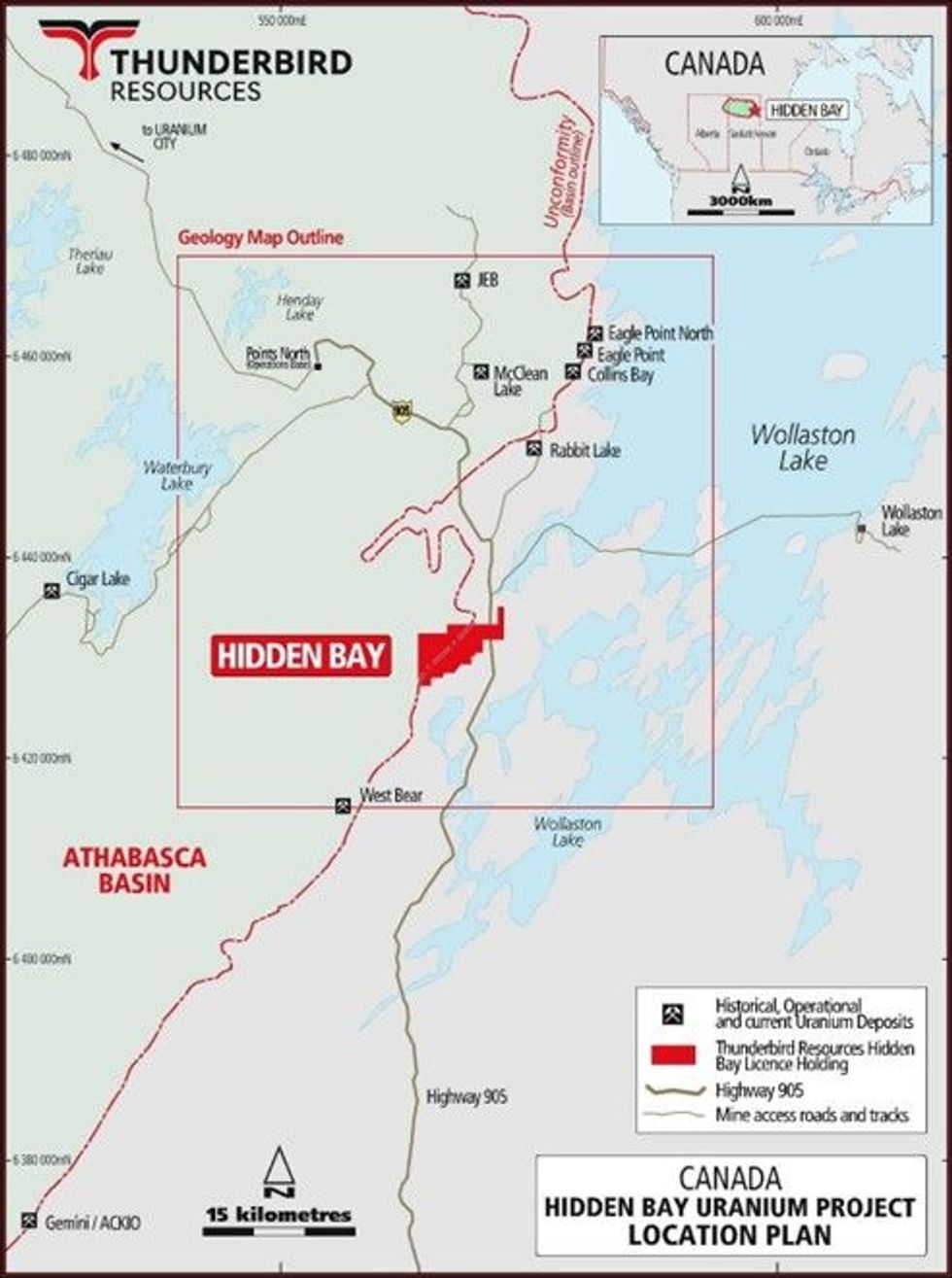

Thunderbird Resources Limited (Thunderbird) or (the Company) (ASX: THB) is pleased to advise that it is in the final stages of preparation for its maiden drilling program at the highly prospective Hidden Bay Uranium Project in the Athabasca Basin, Canada, with six quotes received from prospective drilling contractors.

Highlights

- Six drilling contractors have submitted quotes with a drilling contract on track to be signed shortly.

- 2,400m of diamond drilling planned, with drilling scheduled to commence mid-August.

- Entitlement Offer closes at 5pm WST on Wednesday 10 July 2024. Share price on Friday closed at 3.3c, a 10% premium to the Entitlement Offer price of 3c.

- Thunderbird will be fully-funded for its upcoming exploration programs following the completion of its $4.1m capital raising and a recent $1.07m share sale.

The Company is aiming to appoint its preferred drilling contractor shortly, with the drilling program on track to commence by mid-August, with Dahrouge Geological Consulting providing technical support. Hidden Bay is located 20km south-west of the Rabbit Lake uranium deposit on the eastern flank of Canada’s world-class Athabasca Basin.

The upcoming drilling program will comprise 2,400m of diamond drilling across five high-priority target areas that have been meticulously refined by the Company’s exploration team.

Entitlement Offer

The fully underwritten entitlement offer closes at 5pm on Wednesday 10 July. The share price closed on Friday at 3.3c, which is a 10% premium to the 3c price of the entitlement offer.

The Company will be fully funded for the Hidden Bay drilling program following the completion of the Entitlement Offer and Placement, as well as the recent sale of 10 million Firetail Shares (ASX: FTL) raising $1.07 million.

The Company has recently participated in the Firetail Resources Entitlement Offer, acquiring 1.5m @ 4c for $60,000. This will increase its holding to 16.5 million Firetail Shares. Based on the closing price on Friday 5 July 2024 of 10c, Thunderbird’s investment is valued at $1.65 million.

Management Comment

Thunderbird Executive Chairman George Bauk said: “We are pleased to have received proposals from six drilling contractors and look forward to finalising the contract shortly. Everything is on track to commence the Company’s maiden drilling program at Hidden Bay by mid-August.”

Hidden Bay Drilling Targets

The drill targets defined at Hidden Bay are based on airborne gravity and magnetic surveys, radon in soil surveys, and re-interpretation of historical exploration data. Six priority gravity low targets were identified within an ENE-trending structural corridor proximal to the regional Athabasca unconformity. The ENE-corridor is defined by EM conductors (historical surveys), structures and fold axes. Historical drilling in the southwest part of the property returned up to 0.13% U3O8 1 and elevated radon geochemistry occurs proximal to the gravity lows.

Hidden Bay is located approximately 20km south of the historic Rabbit Lake Uranium mine, which was the longest running uranium mine in North America with over 41 years of mining, producing over 203 million pounds of uranium concentrate1. This part of the Athabasca Basin is highly endowed with several uranium deposits and producing mines within a 40km radius including Eagle Point, Collins Bay, Cigar Lake, Roughrider, and Horseshoe-Raven (see Figures 1 and 2). Despite its proximity to multiple uranium prospects and deposits only one hole has been drilled on the property in the last 35 years (see Figure 3).

Click here for the full ASX Release

This article includes content from Thunderbird Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00