May 12, 2024

In line with its strategic plan, Element 25 Limited (E25 or Company) (ASX: E25; OTCQX: ELMTF) is accelerating activities for the planned expansion of its Butcherbird Manganese Project in WA (Butcherbird or Project), as outlined in the Feasibility Study (FS) released in January 20241. Key areas of focus include process optimisation, Front-End Engineering and Design (FEED) activities, project finance and permitting. The Company is pleased to provide the following update.

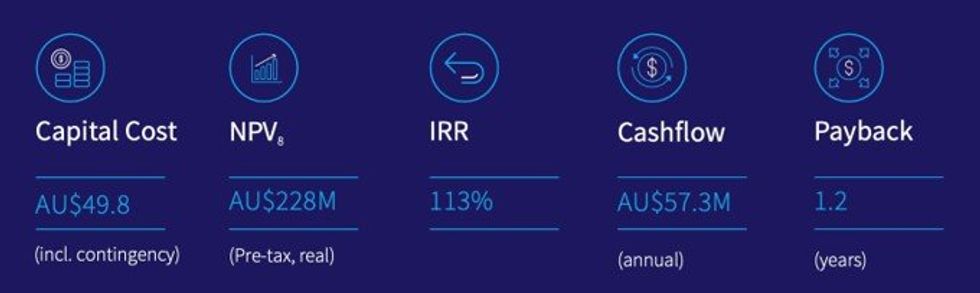

The FS published in January 2024 outlined a compelling opportunity to expand production at the Butcherbird Mine to take advantage of the large resource base and increase commercial returns by increasing production to a nominal 1.1 Mt per annum of manganese concentrate at lower unit costs. The FS estimates a modest capital cost of $49.8M.

Element 25 Managing Director Justin Brown said: “The Butcherbird Project hosts a world-class manganese deposit with more than 260Mt in resources, which will underpin the mine as a long-life producing asset2. The decision to progress with the Stage 2 expansion project comes at a time when manganese ore prices are showing strong gains after a period of depressed pricing during 20233. The decline in prices came to a halt when the extent of the damage at South 32 Limited (S32) Groote Eylandt Manganese Mine became clear with S32 recently forecasting a disruption in production until 20254. Prices in recent weeks have rebounded strongly with current pricing for 44% high-grade material quoted at U$6.93/dmtu cif Tianjin, approximately 60% higher than the quoted pricing in early April.5”

INNOVATION AT BUTCHERBIRD

There have been important advancements, particularly in the FEED phase of the Butcherbird expansion, where the Company has optimised the plant's delivery while minimising design, cost, delivery risk, processing risks and improving energy efficiency and emission profiles. This update outlines the progress in engineering design and project management, processing plant enhancements, procurement, project scheduling, environmental initiatives, technological advancements, and the Company’s commitment to technical excellence, indigenous engagement, as well as social and environmental responsibility and sustainability.

Engineering Design and Project Management

E25 has engaged local specialist engineering firm ProjX to manage the engineering design phase and serve as owner’s engineer throughout project execution. ProjX will assist with engineering, procurement and construction management activities to ensure a streamlined and well-managed project implementation plan.

Operational Improvements

The project team has made strategic improvements to the initial plant design, enhancing operational efficiency and maximising productivity. Integrating a second-stage crushing system will process larger materials directly into the primary circuit. The feed bin and apron feeder have been upsized to optimise truck cycling times and minimise feed disruptions, which has the potential to increase plant utilisation and reduce bottlenecks. The secondary crushing stage has been optimised to handle specific material sizes, ensuring a seamless process flow and eliminating the need for additional screening and material re-handling, a key focus of the design methodology.

Mining equipment sizing optimisation modelling has confirmed equipment selection to minimise unit mining costs, rehandling and ensure continuous plant feed availability. Further studies will investigate the potential to introduce electrified mining equipment and minesite light vehicles to reduce carbon emissions.

Process controls are being designed to ensure that each principal processing stage can operate as close to maximum performance as possible whilst allowing for in-process surge points and redundancy to allow for scheduled maintenance without interrupting production. Automation is being implemented at each stage to optimise equipment set points and performance.

Water consumption reduction through the potential introduction of a thickener and intelligent recycling will reduce the impact on the local water resources while reducing bore field operational costs.

Inline analysers will enable dynamic feedback to process control systems based on desired product specifications and allow for the optimisation of product blends and sales pricing based on customer requirements.

Crushing and Screening Circuit

Through extensive review, E25 has identified significant improvements to the crushing circuit at Butcherbird. These enhancements are designed to streamline operations, reduce the frequency of plant stoppages, and optimise material handling efficiencies. Key consideration was given to the clay-rich nature of the ROM feed, and several design modifications have been made to the flowsheet to eliminate the impact of these materials. Consideration has also been given to minimising double handling of material, with direct truck dump feed as the principal feed method into a feed hopper.

Click here for the full ASX Release

This article includes content from Element 25 Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

E25:AU

The Conversation (0)

14 August 2023

Element 25

Australia’s Largest Manganese Resource Driving Multiple Growth Pathways Towards a Zero-Carbon EV Battery-grade Manganese Future

Australia’s Largest Manganese Resource Driving Multiple Growth Pathways Towards a Zero-Carbon EV Battery-grade Manganese Future Keep Reading...

21 April 2024

Goldfields Exploration Update

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to provide an update on gold exploration activities within the Company’s strategic Eastern Goldfields project portfolio. RC drill hole completed under high-grade Blackfriars gold prospect (Gidji JV)New Exploration Licence... Keep Reading...

22 January

Manganese Market Forecast: Top Trends for Manganese in 2026

After taking a bearish turn in late 2024, manganese prices started 2025 on a flat note despite a robust demand outlook supported by growth in the electric vehicle (EV) battery segment. In the first half of 2025, the manganese market experienced mixed signals as supply dynamics shifted and demand... Keep Reading...

04 December 2025

Rubidium Could be Next Frontier for Critical Minerals Exploration, Investment

In the evolving landscape of critical minerals investing, the alkali metal rubidium is increasingly gaining attention as a potential growth opportunity. Historically under the radar compared to lithium, cobalt or rare earth elements, rubidium’s unique properties, constrained supply and emerging... Keep Reading...

12 November 2025

Spartan Metals Touts Eagle Project as Critical Minerals Supply Source to DoD

On the heels of the recent identification of a silver-rich deposit at its Eagle project in Nevada, Spartan Metals (TSXV:W) is ramping up exploration and drilling efforts toward a potential resource estimate.In a recent interview, Spartan President and CEO Brett Marsh highlighted the polymetallic... Keep Reading...

16 October 2025

Spartan Metals Commences Exploration Program at the Eagle Tungsten-Silver-Rubidium Project, Nevada

(TheNewswire) Vancouver, Canada, October 16, 2025 TheNewswire - Spartan Metals Corp. (" Spartan " or the " Company ") (TSX-V: W) is pleased to announce, it has initiated an exploration program (" Program ") at its Eagle Tungsten-Silver-Rubidium Project in Nevada (Figure 1). The focus of the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00