October 30, 2024

Piche Resources Limited (ASX: PR2) (“Piche” or the “Company”), is pleased to present reconnaissance drill results at the Sierra Cuadrada uranium project, Chubut province, Argentina (Figure 1).

HIGHLIGHTS

- Auger drilling at Sierra Cuadrada highlights extensive areas of near surface uranium mineralization including:

- Assay results have been received for the shallow reconnaissance holes including 6 samples >1000ppm U3O8 (to maximum 2,650 ppm U3O8) and 2 samples >500ppm U3O8 (to maximum 900 ppm U3O8)

- 30% of reconnaissance hole assays showed anomalous uranium mineralization.

- Mineralisation varies in thickness from 0.5m to 4m, with an average thickness 1.5m. The largest being 6km long and 3km wide and remains open.

- These samples were instrumental in understanding the shallow subsurface geology and on prioritising target areas. Multiple areas are being evaluated to identifying priority areas for follow up trenching, mapping and delineation.

- We are waiting on 407 samples from a further 212 drill holes that are currently being prepared for assaying.

- A second auger rig has been delivered to site accelerating the current grid drill programme.

- An additional 37 uranium tenement applications lodged - total U exploration area 2,243km2. Several of the new applications are in the adjacent Rio Negro province and are prospective for sandstone hosted uranium and in-situ recovery (ISR) mineralisation.

To date 609 auger holes have been completed to an average depth of 3.91m over both regional reconnaissance and grid drilling.

Visible uranium has been recorded in 146 of the 303 holes assayed to date and 90 of those holes have returned anomalous grades up to 2,650ppm U3O8.

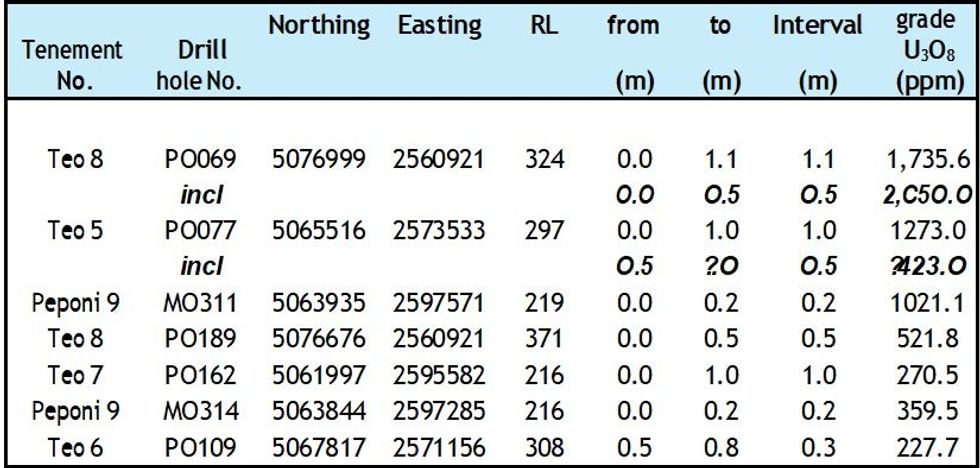

The most significant results from the earlier reconnaissance drilling are included in Table 1.

Drilling is currently being undertaken on a 400m x 400m grid, with some infill on 200m x 200m grid (Figure 2). Samples from a further 212 drill holes are currently being prepared for assaying, with visible uranium recorded in 38% of those holes.

As there is anomalous uranium on many of the tenements in the Sierra Cuadrada portfolio, and radiometric uranium anomalies on all of them, the purpose of the grid auger drilling is to determine areas of mineralisation suitable for trenching and sampling to enable the completion of a JORC compliant mineral resource estimate.

Following earlier reconnaissance sampling and auger drilling, the tenement portfolio has been divided into five priority areas (P1-5). Priority has been defined based on historical exploration, prior airborne radiometric anomalies, Piche field reconnaissance, recent field sampling and auger drilling1.

Detailed grid drilling commenced on the P4 (tenements Teo 5, Teo 6 and Peponi 3) area where land access agreements were first achieved. Access agreements have since been executed on P3 area and are expected to be confirmed on P1 & P2 areas in the near term.

Click here for the full ASX Release

This article includes content from Piche Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

silver investinguranium investingasx stocksasx:pr2gold explorationgold investinggold stockscopper investing

PR2:AU

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

25 February

Board Changes

Piche Resources (PR2:AU) has announced Board ChangesDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

04 December 2025

Commences Maiden RC Drilling at Cerro Chacon Gold Project

Piche Resources (PR2:AU) has announced Commences Maiden RC Drilling at Cerro Chacon Gold ProjectDownload the PDF here. Keep Reading...

06 November 2025

Reinstatement to Quotation

Piche Resources (PR2:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

06 November 2025

$2million placement to advance Argentine exploration

Piche Resources (PR2:AU) has announced $2million placement to advance Argentine explorationDownload the PDF here. Keep Reading...

17h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00