January 29, 2025

Canterbury Resources Limited (Canterbury or the Company) provides an update covering final assay results from its 2024 drilling program at the Briggs Copper Project (Project) in central Queensland. A Scoping Study is scheduled for completion in mid-2025, assessing potential development of a large-scale open pit mine, with ore processing via conventional froth flotation into copper and molybdenum concentrates.

HIGHLIGHTS

- Assay results have been received from the final holes in the 2024 drilling program at the large-scale Briggs copper-molybdenum project in Queensland1 (Inferred resource 415Mt at 0.25% Cu and 31ppm Mo). These cover three holes assessing higher-grade mineralisation along the southwest margin of the Central porphyry and two testing the Southern porphyry target.

- The results confirm the Southern porphyry target as a new discovery approximately 300m to the southeast of the current Briggs resource, with copper and molybdenum mineralisation evident from near surface, e.g.

- 270.5m at 0.22% Cu and 16ppm Mo from 17.7m in 24BRD0035, including

- 83.8m at 0.28% Cu and 37ppm Mo from 27.2m.

- 97m at 0.20% Cu and 66ppm Mo from 36m in 24BRD0036.

- 270.5m at 0.22% Cu and 16ppm Mo from 17.7m in 24BRD0035, including

- Results from infill drilling at the Central porphyry resource have also extended the known zone of shallow, higher-grade mineralisation, e.g.

- 203.1m at 0.36% Cu and 52ppm Mo from 98.0m in 24BRD0033, including

- 26m at 0.50% Cu and 32ppm Mo from 102m, and

- 85m at 0.43% Cu and 35ppm Mo from 148m.

- 162.4m at 0.26% Cu and 44ppm Mo from 88.7m in 24BRD0034.

- 203.1m at 0.36% Cu and 52ppm Mo from 98.0m in 24BRD0033, including

- All the 2024 drilling results are feeding into an updated Mineral Resource Estimate, being completed in the March quarter, which will be used in mining studies in the current Briggs Scoping Study. Results from the Scoping Study are expected in mid-2025.

- The metallurgical test-work component of the Scoping Study is well advanced, including comminution studies, plus assessment of copper and molybdenum recovery via flotation into sulphide concentrates. Results are expected in the March quarter. Previous test work indicated excellent metallurgical recoveries from all styles of copper mineralisation.2

- Funding for Briggs continues to be provided by Alma Metals Ltd (ASX: ALM) (Alma) under an Earn-In Agreement (Earn-In). Alma is in Stage-3 of the Earn-In whereby it can reach a 70% interest by spending an additional $10 million.

Managing Director, Grant Craighead, said: “The 2024 Briggs drilling program has been extremely successful. Importantly, we’ve outlined a higher-grade zone of mineralisation that enhances our early mining options, as well as confirming that the Southern porphyry hosts significant mineralisation providing potential to continue expanding the overall Briggs resource. We are also very encouraged by progress in our Scoping Study activities and look forward to outlining our project development concepts and indicative financial parameters in the not-too-distant future.”

The Project comprises six tenements: Briggs (EPM 19198), Mannersley (EPM 18504), Fig Tree Hill (EPM 27317), Don River (EPM 28588), Ulam Range (EPM 27894) and Rocky Point (EPM 27956). Alma is funding the Project and can reach a 70% interest by funding an additional A$10 million3.

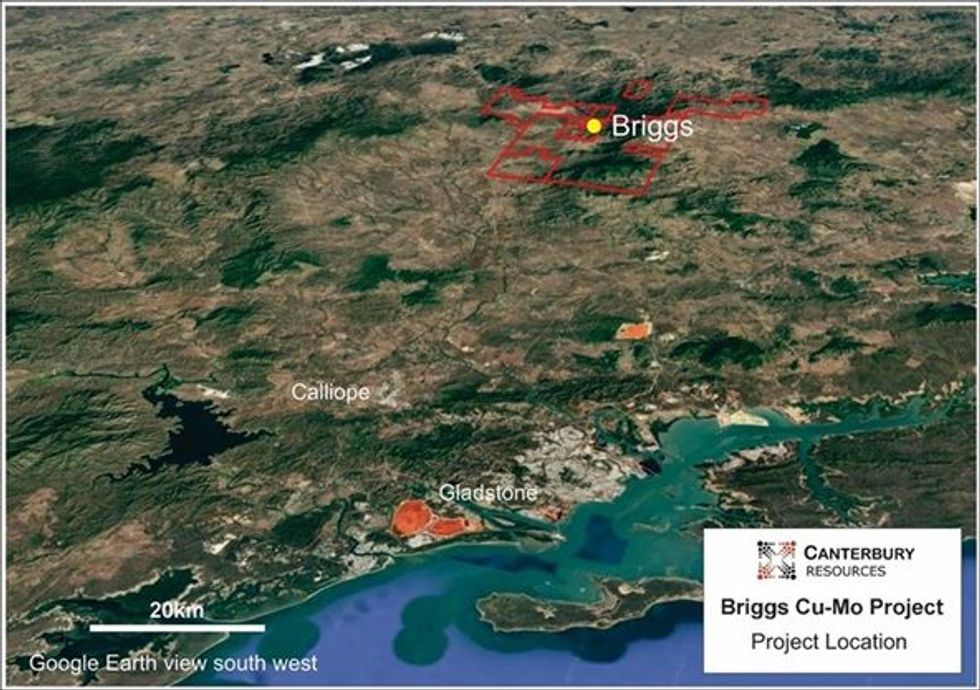

Briggs is in a tier one jurisdiction with exceptional infrastructure. It is 60km west of the deep-water port of Gladstone and 15km north of a significant road, rail and power corridor. It also benefits from a skilled local workforce and straightforward land ownership.

Briggs currently hosts an Inferred Mineral Resource Estimate (MRE) of 415Mt at 0.25% Cu and 31ppm Mo at the Central and Northern porphyry deposits (Figure 2), plus an encompassing Exploration Target of an additional 480Mt to 880Mt at 0.20% to 0.30% Cu and 25ppm to 40ppm Mo4 that has been outlined by surface mapping and geochemical sampling, plus limited shallow drilling. The potential tonnage and grade of the Exploration Target is conceptual in nature and there has been insufficient exploration to estimate a mineral resource. It is uncertain if further exploration will result in an increase in the MRE.

The 2024 core drilling program at Briggs commenced in June and the final hole was completed in early December. During the program, eleven holes (2,955.5m) were drilled, with assay results now received for the final five holes: three (24BRD0032 to 24BRD0034) at the Central porphyry and two (24BRD0035 and 24BRD0036) at the Southern porphyry (refer Figure 2 and Appendix 1).

Click here for the full ASX Release

This article includes content from Canterbury Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00