A recent report by Red Cloud KS highlight Northern Vertex Mining Corp (TSXV:NEE).

A recent report by Red Cloud KS highlight Northern Vertex Mining Corp (TSXV:NEE).

As quoted in the report:

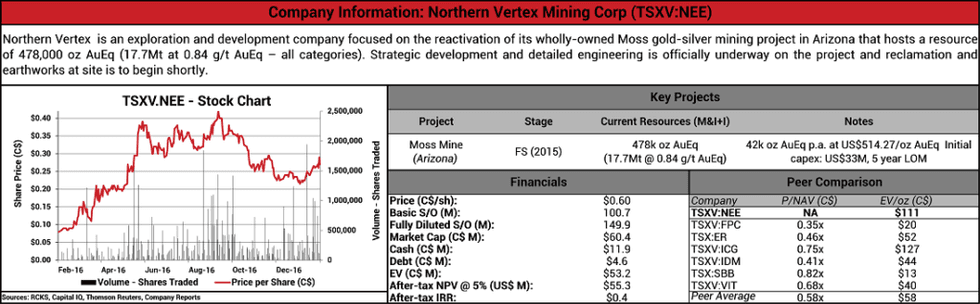

Northern Vertex Mining Corp (TSXV:NEE) announced it has initiated an incentive program to encourage the early exercise of up to ~29 million warrants in order to fund the ongoing construction of the Moss gold-silver mine in Arizona. Exercisable warrants from four out of the five eligible tranches have an exercise price of C$0.50 per warrant while warrants from one tranche have an exercise price of C$0.45 per warrant. For each full warrant exercised, holders will receive a new transferable half warrant. Each new full warrant is exercisable at a price of $1.00 for four years from the issue date (~March 22, 2021). As well, the company plans on listing the newly issued warrants. If all the warrants were exercised the total proceeds from the incentive program would amount to ~C$13.9 million. While it is not possible to determine the number of warrants that are going to be exercised, the proceeds should provide Northern Vertex’s balance sheet flexibility as it constructs the Moss mine. As we discussed in a previous post, the company completed a US$20.0 million credit facility and a US$8.5 million equipment lease facility in Q4 2016. With the project’s feasibility study suggesting initial capex of US$33 million and combined with the US$5.6 million of convertible debt raised in H2 2016, these recent financings should provide Northern Vertex with funds to construct the project. At C$111/oz, Northern Vertex currently trades at a premium to peers (C$58/oz). In our view, this premium valuation is warranted given that the Moss mine is financed and under construction. In addition, the company’s valuation does not appear to account for the potential of meaningful mine-life extension from the Phase III engineering work or the ongoing exploration program.

Connect with Northern Vertex Mining Corp (TSXV:NEE) to receive an Investor Presentation