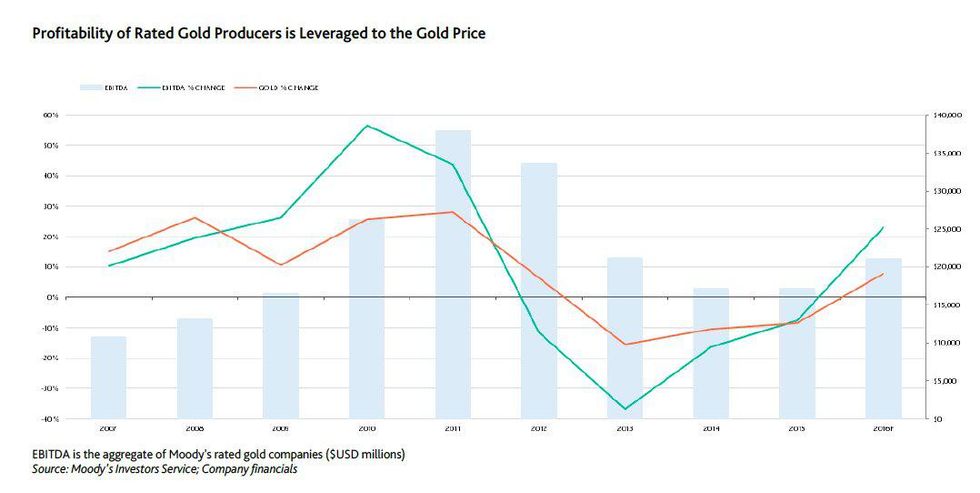

As gold miners’ profitability is strongly tied to the gold price, this has resulted in the industry generating significantly stronger cash flows and earnings, boosting their credit quality, Moody’s Investors Service says.

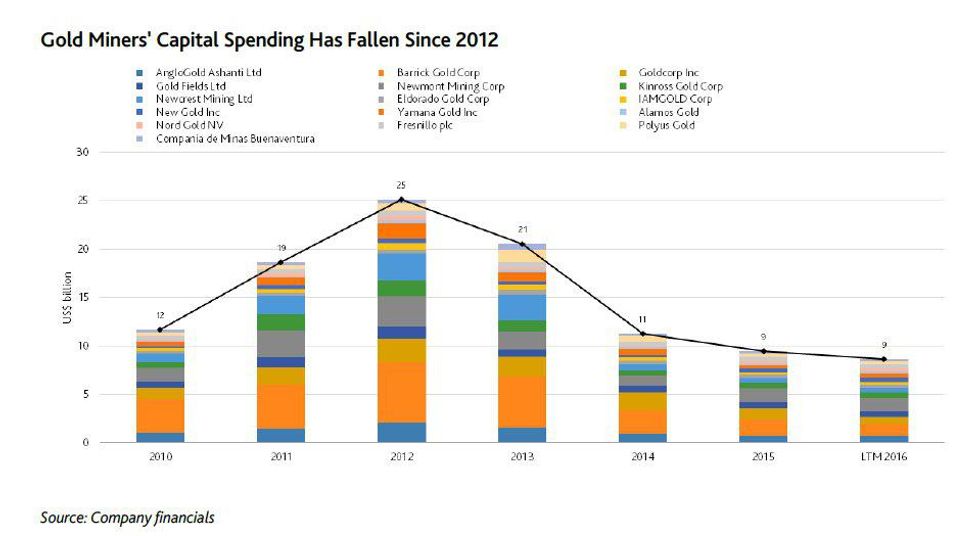

Encouraged by better gold prices, global producers are set to increase capital spending next year with the rate at which they develop new mines and how those projects are funded being the top priorities, Moody’s Investors Service says.

In its latest report, Moody’s notes that in addition to stronger prices, gold miners have benefitted this year from lower operating costs after focusing on cost cutting during a three-year slump in gold prices. As the precious metal is priced in US dollars, a stronger dollar has benefited miners based outside of the US.

Source: Moody’s Investors Service

The average spot gold price through end of October 2016 was $1,273 per ounce, 10% higher than the average price of $1,160 in 2015. As gold miners’ profitability is strongly tied to the gold price, this has resulted in the industry generating significantly stronger cash flows and earnings, boosting their credit quality, Moody’s says.

While the industry is generating significantly stronger cash flow, a trend that Moody’s expects to continue next year, higher gold prices alone will not result in ratings upgrades.

“How companies use their funds will be a very important factor in the ratings assessment,” said Jamie Koutsoukis a Vice President and Senior Analyst at Moody’s. “Although near-term spending on large projects could result in negative cash flow, future production growth would likely have a positive effect on the rating.”

Spending will likely focus on extending existing operations and phased development, rather than large-scale greenfield projects.

The post CHARTS: Gold miners to hike investment in 2017 appeared first on MINING.com.