The amount of copper available in LME warehouses has surged nearly 47 percent in the last week.

LME copper inventories have surged nearly 47 percent in the last week after inflows into mostly Asian depots, fueling concerns about global demand.

According to LME data, on-warrant stockpiles have jumped from 145,800 tonnes on June 28 to 213,900 tonnes as of Thursday (July 6). In addition, opening LME copper stocks have increased over 27 percent, to 315,925 tonnes, since last week.

“The massive stock increase seems to have taken the sting out of [news of a potential strike at the Zaldivar copper mine],” Edward Meir, an analyst at INTL FCStone in New York, said in a note on Wednesday. He added that copper prices were “knocked lower today by a 40,000 tonnes surge in LME stock holdings that has brought inventories to back over the 300,000 tonne mark.”

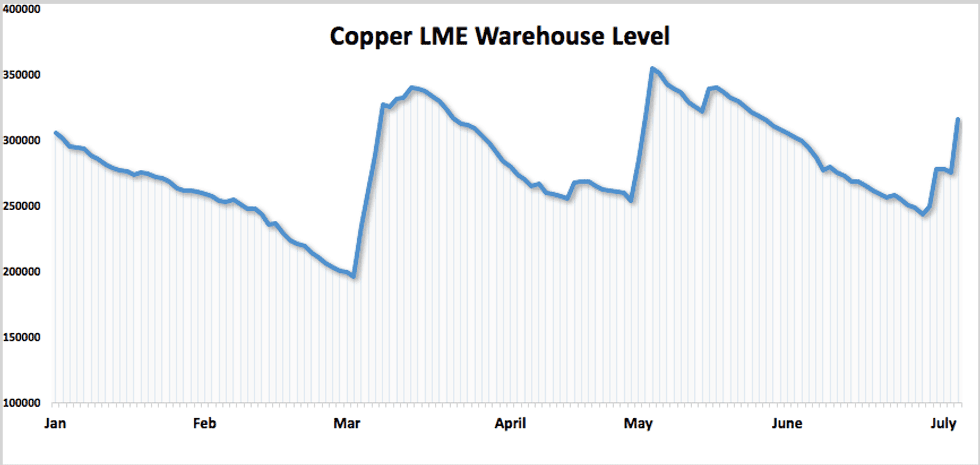

LME warehouse inventories have been volatile since the beginning of the year. In May, stockpiles increased over 40 percent in just three days, then fell back to their lowest level since March. That movement can be seen in the chart below.

“The pattern has been one of volatility, with stocks increasing sharply and then falling away,” Eugen Weinberg, an analyst at Commerzbank (OTCMKTS:CRZBY) in Frankfurt, told Bloomberg at the time. “It’s a massive inflow, but whether we will see outflows in the next few weeks remains to be seen.”

According to Bloomberg, recent history shows the LME’s incoming metal may be in strong demand. Three similarly large inflows since August were then withdrawn in the following months.

That said, some analysts are calling for weaker demand, in particular from top consumer China, in the coming months, despite recent positive Purchasing Managers’ Index data from the country.

“We think base metals have gotten somewhat ahead of themselves during the course of June,” Meir said. “China’s macro numbers remain decent, but most economists expect growth to moderate going into the second half.”

As mentioned, copper prices were hurt Thursday by the inventories report, trading near a one-week low of $5,843.50 per tonne. But a weaker dollar and strike threats at Zaldivar supported prices.

“The threat of a strike will restrict the downside, without that sort of news the price might have fallen much further,” said Robin Bhar, an analyst at Societe Generale (EPA:GLE). “The supply side and disruptions are to some extent offsetting the more bearish news surrounding the stock increases.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.