April 19, 2023

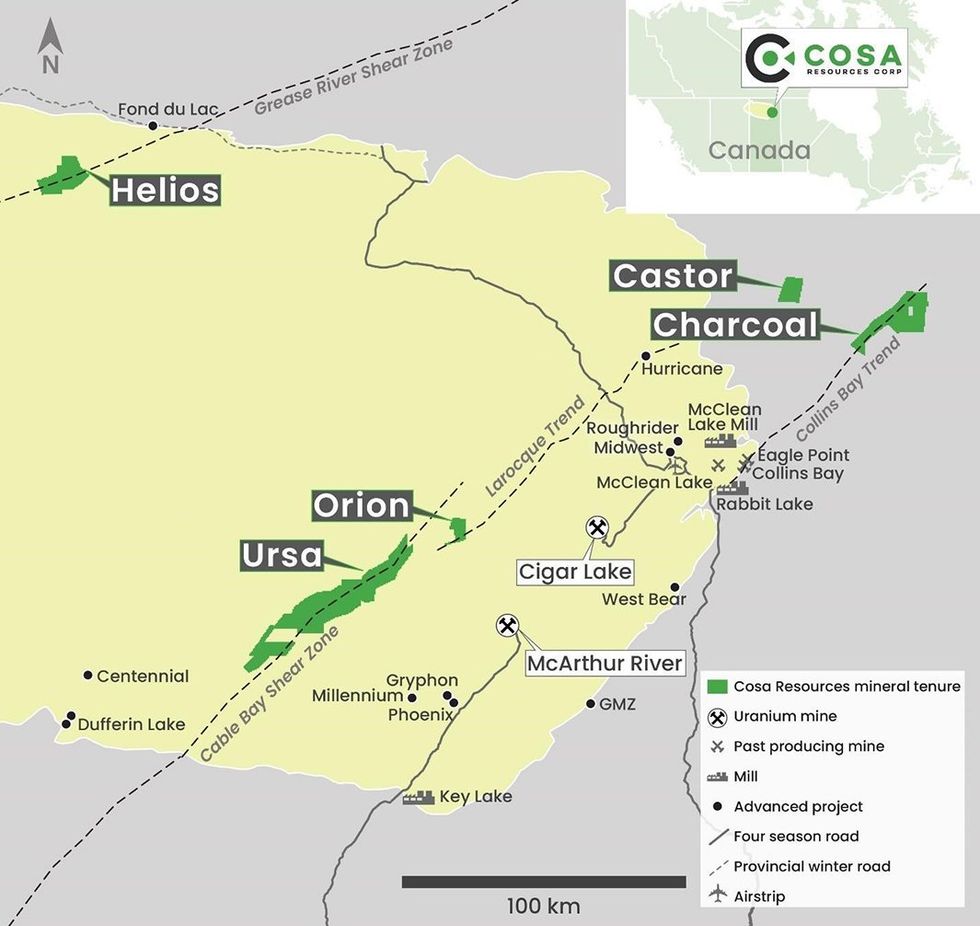

Cosa Resources (CSE:COSA) advances five uranium projects comprising more than 100,000 hectares of land within or proximal to Saskatchewan’s Athabasca Basin. Each project captures portions of highly prospective northeast trending uranium corridors and district-scale structural corridors, such as the Cable Bay and Grease River Shear Zones and the Larocque Trend.

Supported by a team of technically focused and successful geologists and mining executives, Cosa believes that a combination of new ideas and aggressive exploration in underexplored areas has the potential to yield the next Tier 1 uranium discovery.

Cosa Resources Corp. Athabasca Basin Uranium Exploration Projects

Cosa Resources Corp. Athabasca Basin Uranium Exploration ProjectsCosa has strategically assembled a management team with a history of success in the Athabasca Basin. With well over a century of combined uranium experience, Cosa’s management team has been involved with several uranium discoveries in recent years. Chairman Steve Blower was part of the discovery team behind 92 Energy’s Gemini zone, IsoEnergy’s Hurricane deposit, and Denison’s Gryphon deposit. For his role in the Hurricane discovery, he was co-recipient of the AME 2022 Colin Spence Award for excellence in global mineral exploration, alongside fellow Cosa team members Andy Carmichael, Justin Rodko and Craig Parry.

Company Highlights

- More than 100,000 hectares of uranium assets proximal to the Athabasca Basin - the heart of the Canadian uranium mining sector

- Projects near to or within highly prospective northeast trending uranium corridors and district-scale structural corridors such as the Cable Bay and Grease River Shear Zones and the Larocque Trend

- 100-percent-owned Ursa property covers a large portion of the underexplored Cable Bay Shear Zone uranium corridor

- A management team comprised of technically focused and successful geologists and mining executives with a history of success in the Athabasca Basin

This Cosa Resources profile is part of a paid investor education campaign.*

Click here to connect with Cosa Resources (CSE:COSA) to receive an Investor Presentation

COSA:CC

The Conversation (0)

05 December 2023

Cosa Resources

Exploring Uranium Assets in the Prolific Athabasca Basin

Exploring Uranium Assets in the Prolific Athabasca Basin Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00