February 26, 2024

Brightstar Resources Limited (ASX: BTR) (Brightstar) is pleased to announce the second round of priority assay results from the remaining two metallurgical diamond drillholes at Cork Tree Well (CTW) within the Laverton Gold Project (LGP). These two holes were part of a broader 20 hole diamond drilling program1 which has now been successfully completed.

HIGHLIGHTS

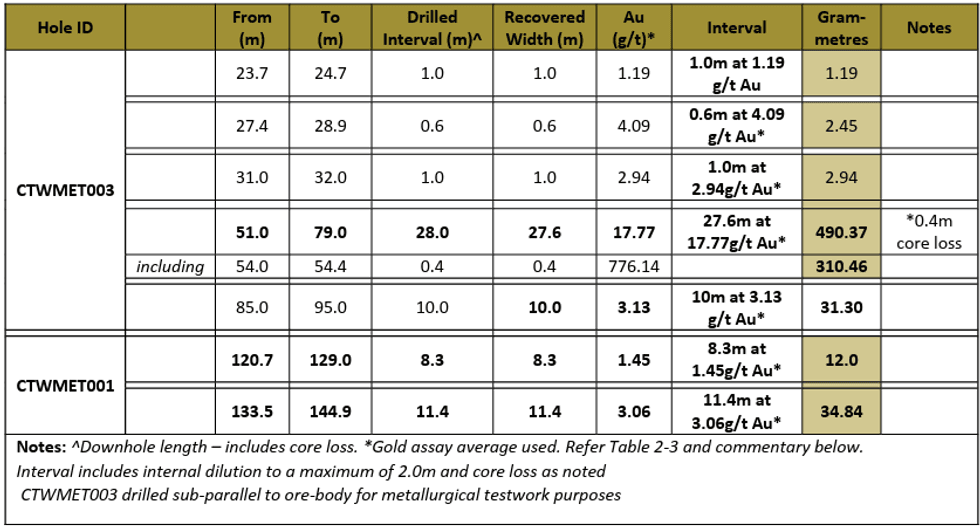

- Assays received from the final two metallurgical diamond holes completed at Cork Tree Well with bonanza-grade gold assays up to 1028.37g/t Au

- High-grade results substantiated by numerous observations of visible gold in both drill holes

- Intercepts returned include 27.6m @ 17.77g/t Au from 51m (CTWMET003)

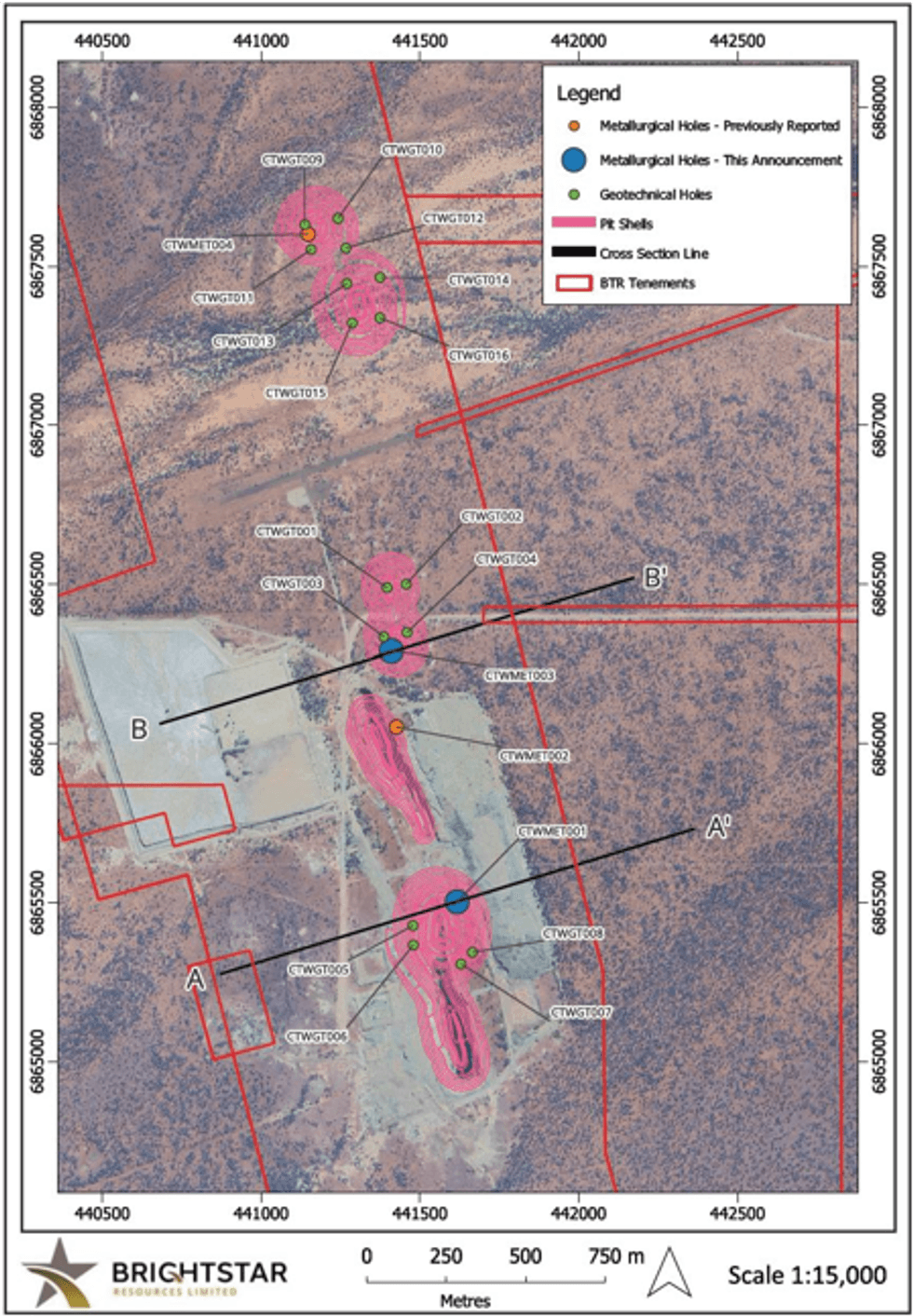

- CTWMET003 was drilled into the unmined central deposit at Cork Tree Well, with the gold mineralisation entirely contained within a dolerite - quartz breccia unit

- Intercepts returned below the historical shallow open pit within CTWMET001 include:

- 11.4m @ 3.1g/t Au from 133.5m (estimated true width), and

- 8.3m at 1.45g/t Au from 120.7m (estimated true width)

- Twenty-hole diamond drilling program successfully concluded with metallurgical and geotechnical testwork underway to feed into PFS workstreams

Brightstar’s Managing Director, Alex Rovira, commented “It is great to see further high-grades assays continuing and visible gold being observed from the diamond drilling program that has recently been completed at Cork Tree Well. CTWMET003 returned an excellent high-grade, shallow intersection of 27.6m @ 17.77g/t Au from 51m, which complements the previously announced2 intersections which included a strong result of 34.4m @ 7.94g/t Au (CTWMET004) drilled 1km to the north.

The drilling campaign represented the first diamond holes drilled at Cork Tree Well by Brightstar, with our understanding of the geology and mineralisation styles being strengthened by the knowledge being gained from this recently completed program.

Today’s results continue to reinforce our view that the gold mineralisation at Cork Tree Well is structurally hosted, with a mafic metadolerite host rock observed in CTWMET003 whilst gold mineralisation returned in CTWMET001 is positioned within the sedimentary package underneath the historically mined shallow open pit.

The four metallurgical drillholes (CTWMET001 – 004) were drilled into the known orebody locations that fall within the optimised $2,750/oz pit shells generated in the 2023 Scoping Study3, with CTWMET003 and CTWMET004 drilled down plunge to the orebody to deliver maximum rock mass for metallurgical testwork and CTWMET001 and CTWMET002 drilled perpendicular to the orebody and represent estimated true width.

Given the calibre of the assays received from the drilling to date, Brightstar continues to see strong potential to build on the existing 303koz @ 1.4g/t Au Mineral Resource4 both at depth with high-grade plunging shoots and strike extensions targeting the structurally-controlled mineralised trends. The high-grade results returned to date are significantly higher than the current 1.4g/t Au head grade of the Mineral Resource and 1.85g/t mine grade from the 2023 Scoping Study, representing significant upside.

We look forward to updating shareholders with more information on the diamond program, which forms the basis for metallurgical and geotechnical testwork workstreams within our ongoing Pre-Feasibility Study5.

Due to the nuggety and high-grade nature of the gold mineralisation observed in CTWMET001 and CTWMET003, multiple samples had repeat assays completed following from best QA/QC laboratory practice. The repeat fire-assays provided additional analytical insight into the nuggety nature of mineralisation in addition to the visible gold observed. Where multiple repeat assay runs occurred, an average of the results has been used in the reporting in Table 1 above and within this announcement. The full breakdown of the re-assayed samples are outlined below in Table 2-3.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

29 January

Updated Goldfields Feasibility Study

Brightstar Resources (BTR:AU) has announced Updated Goldfields Feasibility StudyDownload the PDF here. Keep Reading...

29 January

Updated Goldfields DFS Presentation

Brightstar Resources (BTR:AU) has announced Updated Goldfields DFS PresentationDownload the PDF here. Keep Reading...

28 January

Trading Halt

Brightstar Resources (BTR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

27 January

Material early-stage aircore drilling success at Sandstone

Brightstar Resources (BTR:AU) has announced Material early-stage aircore drilling success at SandstoneDownload the PDF here. Keep Reading...

26 January

Sandstone Strategic Plan to Deliver Long-Life Production Hub

Brightstar Resources (BTR:AU) has announced Sandstone Strategic Plan to Deliver Long-Life Production HubDownload the PDF here. Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

30 January

Ross Beaty: Gold, Silver in "Bubble Territory," What Happens Next?

Ross Beaty of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS) shares his thoughts on gold and silver's record-setting runs. While high prices are exciting, he noted that even US$50 per ounce silver is good for miners. "At the end of the day, there's still... Keep Reading...

30 January

Is it Time to Take Profits? Experts Share Gold and Silver Strategies in Vancouver

Optimism was building at last year’s Vancouver Resource Investment Conference (VRIC), with fresh capital flowing back into the mining sector, lifting project financings and investor portfolios alike.This year's VRIC, which ran from January 25 to 26, saw that optimism tip into outright... Keep Reading...

30 January

Adoption of Omnibus Incentive Plan & Private Placement Update

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company"). The Company confirms shareholders approved the adoption of a new omnibus incentive plan (the "Plan") at the annual general and special meeting (the "Meeting") of shareholders held on August 7,... Keep Reading...

30 January

Flow Metals Announces Closing of Shares for Debt

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to announce that, further to its news release dated January 23, 2026, it has closed a debt settlement transaction (the "Debt Settlement") with certain insiders' of the Company pursuant to which the Company settled... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00