October 05, 2021

Balkan Mining and Minerals Ltd (BMM or the Company) (ASX:BMM)is pleased to announce the completion of its reconnaissance and rock sampling at the Dobrinja Lithium-Borate Project.

The Company has conducted an extensive surface prospecting and a permit wide sampling program, consisting of 97 outcrops being observed and the required information being obtained and recorded into the company database. Additionally, 61 samples of lacustrine-appearing sediments were taken for geochemical analysis.

The sampling program was conducted in order to identify prospective stratigraphy with elevated lithium and boron and to allow the inference of prospective sections.

The samples have been submitted to ALS Bor for sample preparation to be conducted and once completed, the samples will be dispatched to ALS Ireland and Vancouver for multi-element ICP analysis. The Company will release the results once received.

Dobrinja

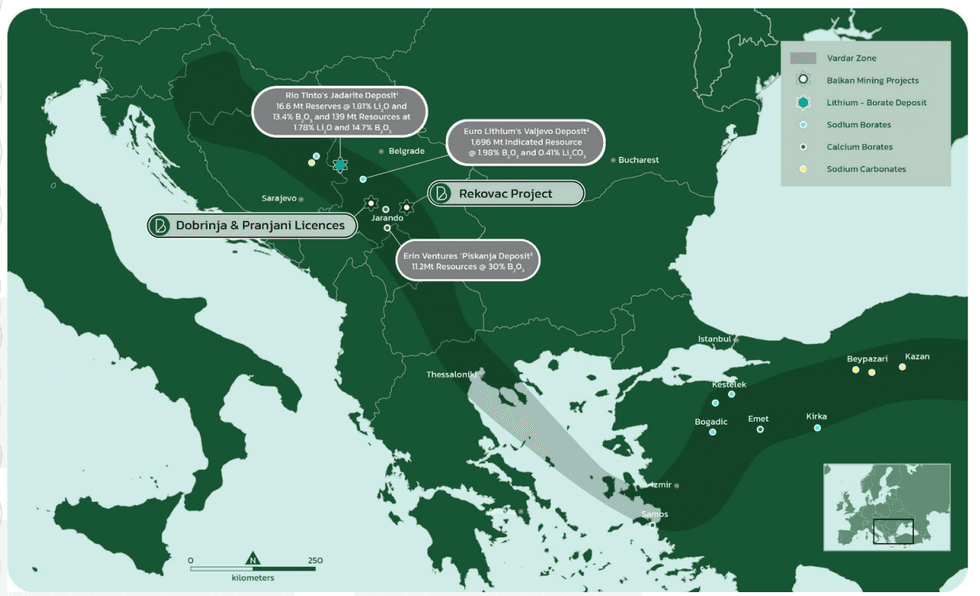

The project occupies intermontane lacustrine Neogene basin within the trend called the Vardar Zone. The Dobrinja license, covering 37.58km2, is located in western Serbia along trend where lithium– borate Mineral Resources and Ore Reserves have been defined (Rio Tinto, Euro Lithium and Erin Ventures)1.

The Dobrinja basin is generally elongated in a northwest-southeast direction, controlled by the Neogene tectonic. The targeted lacustrine sedimentary sequence comprises of Lower, Middle and Upper Miocene fine pelitic sediments, marlstone, ash-flow tuffs, oil shale and basal clastic flows.

Basement rocks vary in both age and rock type, and include Paleozoic metamorphic rocks, Mesozoic carbonates and Vardar Ophiolites formations. Northwest - southeast trending faults are thought to be major structural controls on basement fracturing and basin development and may also serve as zones of migration for mineral-bearing fluids.

For further information pls contact:

RossCotton MediaInquiries

Managing Director Nick Doherty

White Noise Communications

Authorised for release by the Managing Director of Balkan Mining and Minerals Limited

-ENDS-

BMM:AU

The Conversation (0)

05 September 2021

Bayan Mining and Minerals

Mining Critical Minerals from the Balkan Region

Mining Critical Minerals from the Balkan Region Keep Reading...

19 January 2025

Further Exploration Targets Identified at Bayan Springs

Bayan Mining and Minerals (BMM:AU) has announced Further Exploration Targets Identified at Bayan SpringsDownload the PDF here. Keep Reading...

31 October 2024

Quarterly Activities/Appendix 5B Cash Flow Report

Balkan Mining and Minerals (BMM:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00