October 04, 2021

Auroch Minerals Limited (ASX:AOU) (Auroch or the Company) is pleased to announce that the first drill-hole in the maiden diamond drill programme into the Nepean Deeps target is now complete. The drill programme was designed to test for down-plunge extensions to the high-grade nickel sulphide mineralisation below the historic Nepean mine at the Nepean Nickel Project in Western Australia (Auroch Minerals 80%).

Highlights

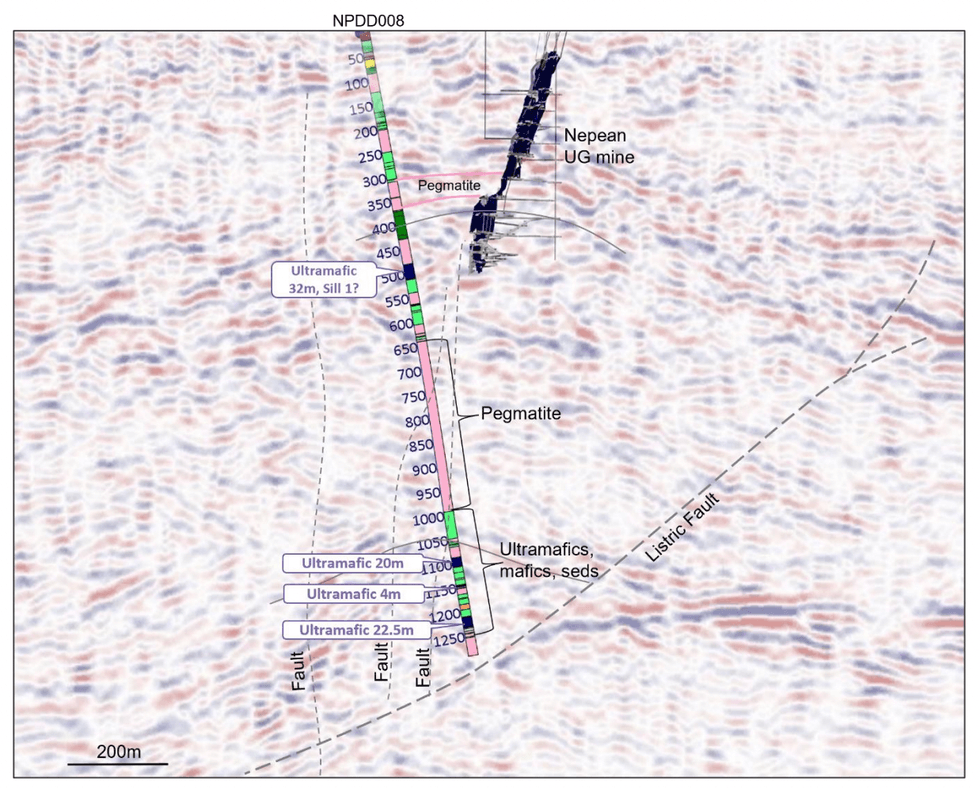

- •First drill-hole NPDD008 testing the Nepean Deeps exploration target has been completed to a final down-hole depth of 1,291m

- NPDD008 is the first hole to successfully drill through the thick pegmatite intrusion below the historic Nepean nickel mine

- The drill-hole intersected a total of 46m of prospective komatiitic ultramafics over three intervals from 1088.5 - 1108.5m, 1144.5 – 1148.35m and 1210.5 – 1233.0m, within a lower greenstone sequence starting at 993m

- NPDD008 was drilled as both a first-pass stratigraphic hole and also as a platform for DHEM and DHMMR geophysical surveys which are currently underway

- The geophysical surveying and modelling will take one to two weeks and will be used to plan further drilling into the Nepean Deeps Target

The first drill-hole, NPDD008, successfully drilled through the thick pegmatite intrusion that was previously intersected at the base of the historic mine workings. Below this pegmatite the drill-hole intersected a greenstone sequence that importantly includes 46m of prospective komatiitic ultramafics over three intervals from 1088.5 - 1108.5m (Figure 1, Photograph 1), 1144.5 – 1148.35m and 1210.5 - 1233m (Figure 1).

Auroch Managing Director Aidan Platel commented:

"This is a pivotal moment for the Nepean Project and for Auroch. Due to the lack of any deep exploration historically, we had no idea what to expect from this first drill-hole once we got to depths below the historic mine workings.

To have drilled through the pegmatite intrusion that was identified at the base of the old mine workings, which has never been done before, and to have intersected thick zones of ultramafics below the pegmatite, which are potentially the same rocks units that host the high-grade nickel sulphide mineralisation above the pegmatite, is an exceptional result and proves our theory that the mine stratigraphy does indeed continue beneath the pegmatite intrusion.

The down-hole geophysical surveys, for which the drill-hole was primarily designed, have commenced, and will test for any conductive bodies such as massive nickel sulphides that may lie within 100 – 150m of the hole. The information from the geophysics, along with the geological and geochemical data from the drill-hole itself, will be used to design the next drill-hole into this very exciting target zone."

Diamond drill-hole NPDD008 was completed to a final down-hole depth of 1,291m. Slow controlled drilling techniques were successfully used to minimise hole deviation from the planned target. As a result, the drill-hole has been very effective as a first-pass stratigraphic hole into a new target area as well as providing an excellent platform for down-hole geophysical surveys.

Read the full article here.

AOU:AU

The Conversation (0)

23 September 2021

Auroch Minerals

Exploring High-Grade Nickel Sulfides in Western Australia

Exploring High-Grade Nickel Sulfides in Western Australia Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00