October 30, 2024

Carbonxt Group Ltd (ASX:CG1) (‘‘Carbonxt” or “the Company”) has released its Appendix 4C Report for the September 2024 Quarter and provides the following update on the key areas of activity for the period -- all numbers are in A$.

Highlights

- 4-year, $24m contract extension for the ongoing supply of premium PAC products to Reworld – an existing Carbonxt customer. Post quarter-end, Carbonxt commenced full-scale delivery of additional PAC volumes to Reworld from its Black Birch facility, in accordance with the contact terms.

- Quarterly revenue of $4.3m, with Powdered Activated Carbon (PAC) sales up 31% and Activated Carbon Pellets (ACP) sales up 27%, driven by increased demand from the power generation sector.

- Successful completion of a $3.02m capital raise, via the placement of 46.4m fully paid ordinary shares at $0.065 per share which was strongly supported by a network of sophisticated and high net-worth investors and family offices.

- Carbonxt made a further $0.625m investment in NewCarbon Processing, LLC (“NewCarbon”), the investment vehicle for the new state-of-the-art AC production facility in Kentucky jointly held with Kentucky Carbon Processing, LLC (“KCP”), with a further $0.625m to be completed in this quarter.

- Key construction works at the flagship Activated Carbon production facility in Kentucky were completed in the quarter; commissioning of the plant is now imminent with business development and operating processes being ramped-up.

Principal Activities

Carbonxt is a cleantech company that develops and manufactures environmental technologies to maintain compliance with air and water emission requirements and to remove harmful pollutants. The Company’s primary operations are in the US and include a significant R&D focus as well as manufacturing plants for activated carbon pellets and powder activated carbon. Carbonxt continues to expand its pellet product portfolio to address numerous industrial applications.

Managing Director Warren Murphy commented:

“The September quarter was highlighted by continued momentum across all our key growth drivers, with increased sales from existing operations complemented by the forthcoming commissioning of our state-of-the-art production facility in Kentucky.”

“With commissioning of the Kentucky facility now imminent, Carbonxt continues to execute on its strategy to deliver a step-change in growth and earnings, significantly scaling up its production capacity to meet the growing demand for premium Activated Carbon production in the US market.”

Overview

- Customer receipts for the quarter were $1.8m. As noted in the ASX announcement of 28 May 2024, Wisconsin Public Service (“WPS”) pre-paid for the volume delivered in this quarter. The pre-payment amount was received in the previous quarter and associated volumes have now been delivered in full. New business in the waste to energy market (see announcement of 17 October 2024) commenced on 1 October 2024 and these increased revenues will be seen the next quarter.

- Activated Carbon Pellet (ACP) primary sales during this period were higher by 27% for the quarter compared to last quarter as the WPS pre-paid volumes were delivered.

- Powdered Activated Carbon (PAC) revenue was 31% higher this quarter as compared to the prior quarter due to seasonally higher PAC usage in the summer by electricity utility customers.

Revenue and Operating Cash Flow

- Total revenue for the quarter was $4.3m with PAC sales contributing to 42% of this revenue. To mitigate the impact of seasonal fluctuations, which are a feature of the power generation sector, the Company continues to diversify its product offerings and expand into other markets, particularly in the water and wastewater sectors.

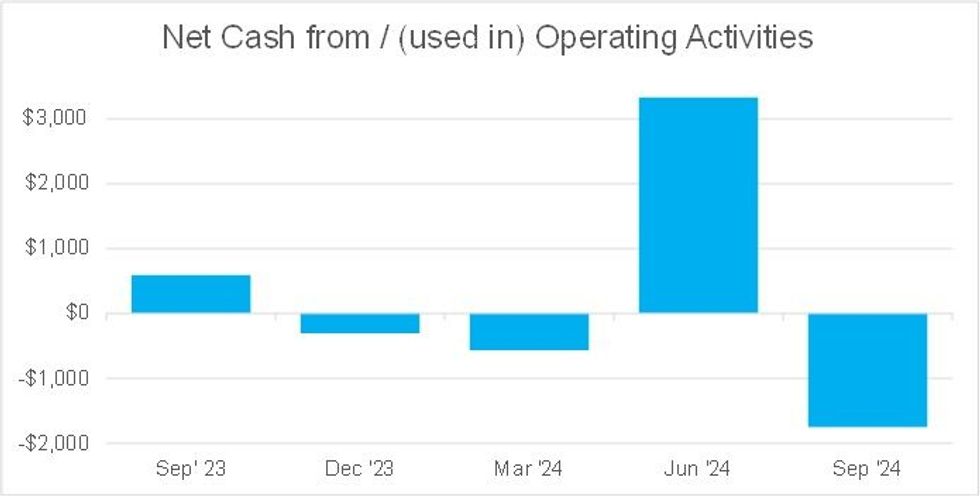

- As noted earlier, the Net Operating Cash for the quarter reflects the prepayment for 1,200 tons of ACP products from WPS in the prior quarter, with production and revenue recognition largely in this quarter.

- Revenue and cash receipts from the $6m p.a. contract extension with Reworld will be recognised in the December quarter, following the completion of first deliveries in October.

Further Investment in NewCarbon

Carbonxt utilised part of its recent fundraising (see below) to meet the next instalment of its investment in NewCarbon. The total instalment is US$1.25m, with US$0.625m made in the quarter, with the remaining balance expected to be made by 15 November 2024. Carbonxt’s ownership stake in NewCarbon at the end of this September quarter is 38%.

Click here for the Appendix 4C

Click here for the full ASX Release

This article includes content from Carbonxt Group, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CG1:AU

Sign up to get your FREE

Carbonxt Group Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

24 July 2025

Carbonxt Group

Purpose-built advanced carbon for healthier communities

Purpose-built advanced carbon for healthier communities Keep Reading...

30 January

Q2 FY26 Quarterly Activities Report & Appendix 4C

Carbonxt Group (CG1:AU) has announced Q2 FY26 Quarterly Activities Report & Appendix 4CDownload the PDF here. Keep Reading...

04 January

Placement to Fund Further Investment in New Carbon

Carbonxt Group (CG1:AU) has announced Placement to Fund Further Investment in New CarbonDownload the PDF here. Keep Reading...

28 October 2025

Q1 FY26 Quarterly Activities Report & Appendix 4C

Carbonxt Group (CG1:AU) has announced Q1 FY26 Quarterly Activities Report & Appendix 4CDownload the PDF here. Keep Reading...

16 October 2025

Convertible Note and Placement

Carbonxt Group (CG1:AU) has announced Convertible Note and PlacementDownload the PDF here. Keep Reading...

15 September 2025

Completion of Non-Renounceable Pro-Rata Entitlement Offer

Carbonxt Group (CG1:AU) has announced Completion of Non-Renounceable Pro-Rata Entitlement OfferDownload the PDF here. Keep Reading...

23 February

CHARBONE Presente a la Conference Emerging Growth le 25 fevrier 2026

(TheNewswire) Brossard, Quebec TheNewswire - le 23 février 2026 CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

23 February

CHARBONE to Present on the Emerging Growth Conference on February 25, 2026

(TheNewswire) Brossard, Quebec TheNewswire - February 23, 2026 Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, today... Keep Reading...

17 February

RZOLV Technologies Announces OTCQB Listing, DTC Eligibility and Leadership Transition

Rzolv Technologies Inc. (TSXV: RZL,OTC:RZOLF) (FSE: S711) (OTCQB: RZOLF) ("RZOLV" or the "Company") is pleased to announce that its common shares have been approved for trading on the OTCQB Venture Market ("OTCQB"), operated by OTC Markets Group Inc., under the trading symbol "RZOLF." The... Keep Reading...

17 February

RZOLV Technologies Announces OTCQB Listing, DTC Eligibility and Leadership Transition

Rzolv Technologies Inc. (TSXV: RZL,OTC:RZOLF) (FSE: S711) (OTCQB: RZOLF) ("RZOLV" or the "Company") is pleased to announce that its common shares have been approved for trading on the OTCQB Venture Market ("OTCQB"), operated by OTC Markets Group Inc., under the trading symbol "RZOLF." The... Keep Reading...

17 February

RZOLV Technologies Announces OTCQB Listing, DTC Eligibility and Leadership Transition

Rzolv Technologies Inc. (TSXV: RZL,OTC:RZOLF) (FSE: S711) (OTCQB: RZOLF) ("RZOLV" or the "Company") is pleased to announce that its common shares have been approved for trading on the OTCQB Venture Market ("OTCQB"), operated by OTC Markets Group Inc., under the trading symbol "RZOLF." The... Keep Reading...

Latest News

Sign up to get your FREE

Carbonxt Group Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00