February 26, 2024

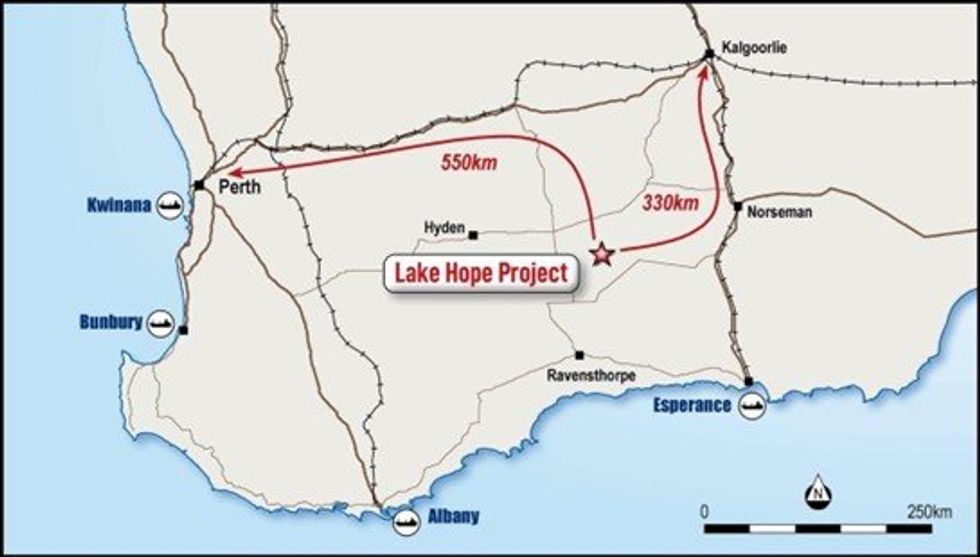

A new proprietary metallurgical process has been identified for producing high-value High Purity Alumina (HPA) from the lake clays at Impact Minerals Limited’s (ASX:IPT) Lake Hope project, located 500 km east of Perth in Western Australia (Figure 1). Impact can earn an 80% interest in Playa One Pty Limited, which owns the Lake Hope project, by completing a Pre-Feasibility Study (PFS) on the project which is in progress (ASX Release March 21st 2023 and November 9th 2023).

- 99.99% (4N) Al2O3 produced from a new low-temperature leach (LTL) and acid digestion process called the “LTL Process”:

- The LTL Process is a simpler process that may lower the Capital and Operating Costs to produce HPA compared to the Sulphate Process, which has been the focus of test work to date.

- The Sulphate Process underpinned the recent Scoping Study, which indicated an operating cost of

- The LTL Process will now be included in the ongoing Pre-Feasibility Study in parallel with the Sulphate Process at marginal extra cost to determine the best processing route to HPA.

- The PFS is due to be completed on schedule in late 2024.

Impact Minerals’ Managing Director, Dr Mike Jones, said, “Today we reveal a further exciting breakthrough for producing HPA from the unique mix of minerals that are present at Lake Hope, minerals which have allowed our new LTL Process to produce the benchmark 99.99% pure HPA very quickly after starting the test work.

The LTL Process is simpler than the Sulphate Process that underpinned our recent Scoping Study and showed that at less than US$4,000 per tonne, Lake Hope may produce HPA at up to 50% cheaper than our peers.

We think that further work on the LTL Process could result in even lower operating and capital costs, and this would only further enhance the already impressive economics of the project, which has an NPV8 of well over A$1 billion.

We have now started further optimization studies for the LTL Process and will push forward with our Pre- Feasibility Study using both process routes for the time being to determine the best strategic choice for processing at the project. Given we can run all these tests in parallel for little extra cost, we are still on course to finish the PFS later this year and continue to look forward towards producing HPA from Lake Hope”.

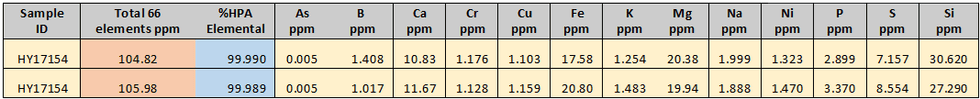

The new process, called the LTL Process, has produced High Purity Alumina (HPA) at 99.99% purity from the raw lake clay in only a few months of laboratory test work (with its attendant delays for holidays and other customer work) (Table 1). This is one of the fastest times to produce HPA from raw materials reported by ASX-listed companies and attests to the relatively straightforward nature of the process. It involves different reagents to those used in the Playa One Sulphate Process, which has also recently successfully produced 4N HPA (ASX Release 19th February 2024).

The LTL Process is a direct low-temperature leach (<90o C) that removes the requirement for sulphuric acid roasting, which was a key part of the Sulphate Process and reduces the number of steps to produce HPA from five stages to four (Figure 2). Accordingly, the new process could offer further reductions in operating costs and capital costs to produce HPA compared to the Playa One Sulphate Process.

The recently released Scoping Study on Lake Hope, which was based on the Sulphate Process, showed that at an operating cost of less than US$4,000 per tonne, Lake Hope could be the lowest-cost producer of HPA globally by a significant margin of up to 50% over Impact’s peers (ASX Release November 9th 2023). Therefore, this margin could be increased should test work on the new process support these initial results and further demonstrate the potential world-class economics of the Lake Hope project.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

10h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

15h

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

17h

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

17h

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

18h

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00