Highlights:

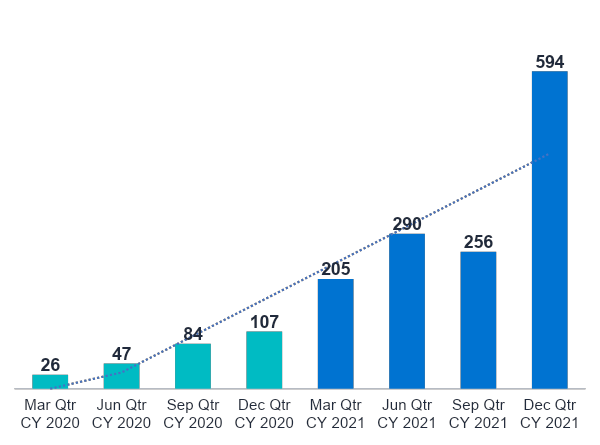

- $594 million AUD ($431 million USD) Total Transaction Value (TTV) up 461% year on year

- Revenue of $28 million AUD ($21 million USD) up over 522% year on year

- $26 million AUD ($19 million USD) in liquid assets (including cash and equivalents)

- Adjusted Positive operating cashflow for the 6 months ending Dec21

- Adjusted EBITDA loss of $1.3 million AUD ($0.9 million USD)

- Added 30 new coins/chains with current support for over 80

Banxa Holdings Inc. (TSX-V:BNXA) (OTCQX:BNXAF) (FSE:AC00) ("Banxa" or "The Company"), the world's first listed payment service provider (PSP) and RegTech platform for the digital assets industry, has today announced its October to December 2021 quarter results. The full results including MD&A are available on Sedar

Domenic Carosa, Founder and Chairman of Banxa, said: "We're happy to deliver continued market growth in our October through December quarter 2021. With the industry accelerating at such a rapid pace, and regulations shifting across each market, our transactions reflect the opportunities across the sector."

Holger Arians, CEO of Banxa, said: "Our expanding partner network and growing coin options are accelerating our market growth, delivering on our objective of expanding access to the global crypto market. In the October to December quarter alone we launched a new Layer 2 solution and added a considerable number of new partners. We're excited to continue this expansion in 2022."

Banxa has added 30 new coins and chains and now supports over 80 across multiple networks with more being added every month. These include, Binance USD on the ETH, BSC and BNB chains, Ethereum Classic on ETC and BSC, SushiSwap on ETH and BSC, Uniswap on ETH, MATIC and BSC and Solana.

Total Transaction Value increased 461% year over year to $594 million AUD ($431 million USD). Growth in Total Transaction Value was primarily driven by existing customers increasing volume, new customers, new coins and new payments added. The long term outlook of the business remains positive.

TOTAL TRANSACTION VALUE

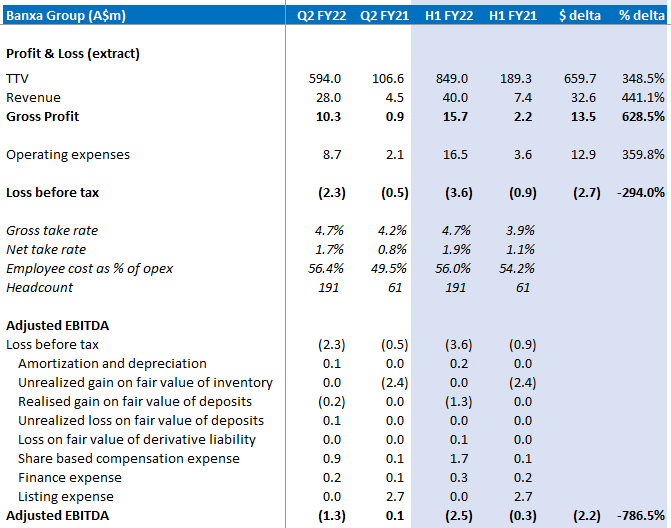

PROFIT AND LOSS

Highlights for the six months ended December 31, 2021:

- TTV expansion of $594m AUD or 461% year on year

- TTV growth underpinned by partner & user expansion

- Gross take rate of 4.7%

- Net take rate of 1.9% (GP as % of TTV) based on geographic mix and competitive market conditions

- Continued investment in product, talent and systems has resulted in opex increasing to $13m or 2% of TTV

- Employee cost is 56% of opex

- Adjusted EBITDA loss of $2.5m impacted by $3.8m of FX losses (0.45% of TTV)

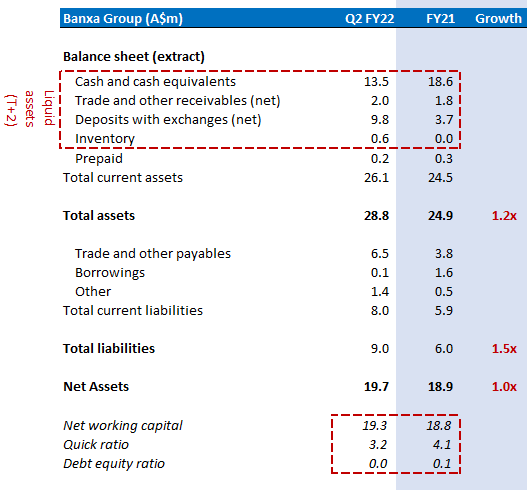

BALANCE SHEET

Highlights:

- Liquid assets of $26m AUD comprising of cash, deposits and digital assets

- Net working capital of $19m and quick ratio of 3.2x

- Payment gateway receivable is collected ~T+2 days in contrast to standard payable terms of ~30 days

- Research and development costs are expensed as incurred and not capitalised on the balance sheet

- Debt free balance sheet

Table showing Adjusted EBITDA Bridge:

Adjusted EBITDA is a non-IFRS financial measure that we calculate as net loss before tax excluding depreciation and amortization expense, share based compensation expense, unrealized loss on inventory, finance expense, realized/unrealized gain on fair value of deposits, loss on fair value of derivative, and listing expenses. Adjusted EBITDA is used by management to understand and evaluate the performance and trends of the Company's operations. The following table shows a reconciliation of adjusted EBITDA to net loss before tax, the most comparable IFRS financial measure, for the three months ended 31 December 2021 and 2020:

| Three months ended 31 December 2021 | Three months ended 31 December 2020 | |||||||

Loss before tax | $ | (2,342,061 | ) | $ | (468,335 | ) | ||

Amortization and depreciation | 96,571 | 8,724 | ||||||

Unrealized gain on fair value of inventory | - | (2,372,860 | ) | |||||

Realised gain on fair value of deposits | (244,862 | ) | - | |||||

Unrealized loss on fair value of deposits | 93,041 | - | ||||||

Share based compensation expense | 873,938 | 100,641 | ||||||

Finance expense | 180,744 | 137,276 | ||||||

Listing expense | - | 2,690,513 | ||||||

Adjusted EBITDA | $ | (1,342,629 | ) | $ | 95,959 | |||

The approx FX rate between $AUD/$USD is AUD$1 = USD 0.72 cents

EARNINGS WEBINAR @ 4pm EST - March 1st 2022

The Company will run an Earnings call webinar via zoom:

Join Webinar: https://us02web.zoom.us/j/82633362050

Or dial +1 312 626 6799 or +1 646 558 8656 and use Webinar ID: 826 3336 2050

The latest Investor deck is available at https://bit.ly/BNXA-Dec21-QTR

ON BEHALF OF THE BOARD OF DIRECTORS

Per: "DOMENIC CAROSA" https://twitter.com/dcarosa

Domenic Carosa

Chairman (1-888-218-6863)

Banxa Holdings Inc. (TSX-V:BNXA) (OTCQX:BNXAF) (FSE:AC00)

Banxa powers the world's largest digital asset platforms by providing payments infrastructure and regulatory compliance across global markets. Banxa's mission and vision are to build the bridge that provides people in every part of the world access to a fairer and more equitable financial system. Banxa is headquartered in Melbourne, Australia, with European headquarters in Amsterdam, the Netherlands.

For further information go to www.banxa.com

This news release may contain "forward-looking statements" within the meaning of applicable Canadian securities laws. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, and contingencies.

These statements generally can be identified by the use of forward-looking words such as "may", "should", "will", "could", "intend", "estimate", "plan", "anticipate", "expect", "believe" or "continue", or the negative thereof or similar variations. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause future results, performance or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by those forward-looking statements and the forward-looking statements are not guarantees of future performance.

Banxa's statements expressed or implied by these forward-looking statements are subject to a number of risks, uncertainties, and conditions, many of which are outside of Banxa's control, and undue reliance should not be placed on such statements. Forward-looking statements are qualified in their entirety by the inherent risks and uncertainties of the Company's business, including: Banxa's assumptions in making forward-looking statements may prove to be incorrect; adverse market conditions, including risks related to COVID-19 and risks that future results may vary from historical results.

Except as required by securities law, Banxa does not assume any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For Further Information, see www.banxa.com

CONTACTS:

Investor Relations:

Email: Investor@banxa.com

Brian M. Prenoveau, CFA

MZ North America

561-489-5315

BNXA@mzgroup.us

Media Contacts:

Dave Malcolm, Chief Marketing Officer / IR

Email: dave.malcolm@banxa.com

Michelle Boland, PR Group

Email: michelleb@prgroup.com.au

SOURCE: Banxa Holdings

View source version on accesswire.com:

https://www.accesswire.com/690861/Banxa-Announces-Fiscal-Results-for-December-Quarter-2021