August 06, 2024

Aurum Resources Limited (ASX:AUE) is pleased to announce the appointment of MACA Interquip Mintrex (MIM) and ALS (Perth) to undertake metallurgical study activities for its Boundiali Gold Project in Côte d’Ivoire from Scoping Study level towards Pre-Feasibility Study (PFS) level.

This appointment marks the commencement of scoping study of the Boundiali Gold Project’s potential future development.

MIM’s appointment involves both an initial metallurgical testwork scope and possible ongoing works to PFS and definitive feasibility study (DFS) levels.

At the current Scoping level, MIM will:

- Design a testwork program suitable for a scoping study, mainly consisting of:

- Comminution (BWi, RWi, CWi, Ai, SMC) – oxide samples, transition samples and fresh samples.

- Gravity – oxide, transition and fresh samples followed by various variability samples.

- Grind establishment

- Leach – samples of oxide, transitional and fresh all at the optimum grind size.

- Perform regular reviews and gap analysis on the testwork program to update program if needed;

- Manage and monitoring the progress of the testwork at ALS in Perth;

- Evaluate the final scoping testwork results;

- Provide Scoping Level Process Design Criteria inputs into scoping study work;

- Design testwork program based on scoping study results to support further engineering work up to DFS level;

- Provide advice on tests to be carried out for feasibility study.

ALS Perth will undertake Comminution Tests and Cyanide Leach Testwork.

Managing Director Dr Caigen Wang said: “We are at the beginning of a very exciting phase of preliminary studies for our Boundiali Gold Project’s development. Metallurgical studies are scheduled in line with our overall gold resources definition, project scoping study and PFS. The outcome of this preliminary met study will form a critical part of the Boundiali Gold Project’s scoping study and PFS.

Aurum’s executive team enjoyed past collaboration with Mintrex and ALS Perth on metallurgical studies on Tietto Minerals’ Abujar Gold Project in Côte d’Ivoire from scoping to PFS and DFS and we look forward to this new collaboration on the very exciting Boundiali Gold Project also in Côte d’Ivoire.”

Aurum has extensive drilling programs underway at Boundiali, aimed at delivering an initial JORC Mineral Resource Estimate (MRE) in late CY2024. Aurum expects to complete 45,000m of diamond drilling in CY2024, currently with five AUE-owned and operated diamond drill rigs operating 24 hours for 6 days a week.

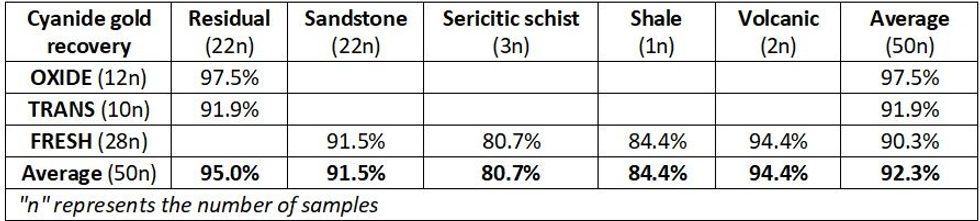

Preliminary gold recovery tests (ASX 22/7/2024) through bottle roll tests on 50 samples from Boundiali target BDT1 confirmed gold mineralisation is free milling, with cyanide leach recoveries consistently exceeding 93% for samples grading 0.25 g/t gold or higher. Results from the test work are encouraging, with calculated recoveries for oxidised samples ranging from 91% to 99%, averaging 97.5%. Samples above 0.25 g/t Au reported an average recovery of 93%. Fresh samples of all lithologies reported an average gold recovery of 90.3% (sandstone is the most common lithology) (Table 1).

Aurum is well funded with ~$23M cash available after shareholders approved Aurum’s Tranche 2 of a $17M Share Placement announced in June and $3M SPP. Aurum received approval at the company’s General Meeting held on 6 August 2024.

Click here for the full ASX Release

This article includes content from Aurum Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AUE:AU

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Aurum Resources

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa.

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

15 February

Boundiali extends strike and depth at BDT3 and BST1

Aurum Resources (AUE:AU) has announced Boundiali extends strike and depth at BDT3 and BST1Download the PDF here. Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

03 March

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

Latest News

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00