October 31, 2024

Astral continues to deliver robust resource growth with an updated Feysville MRE, including maiden MREs for Kamperman and Rogan Josh and an updated MRE for Think Big, of 196koz at 1.2g/t Au.

Astral Resources NL (ASX: AAR) (Astral or the Company) is pleased to report an updated JORC compliant (2012 Edition) Mineral Resource Estimate (MRE) for the 100%-owned Feysville Gold Project (Feysville), located 14km south of Kalgoorlie in Western Australia (refer to Figure 2 below).

HIGHLIGHTS:

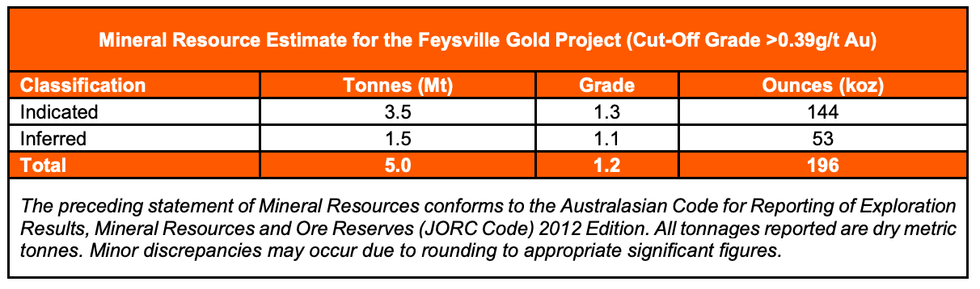

- Updated JORC 2012 Mineral Resource Estimate (MRE) of 5.0Mt at 1.2g/t Au for 196koz of contained gold completed for the 100%-owned Feysville Gold Project (Feysville), located 14km south of Kalgoorlie in WA (Feysville MRE).

- The Feysville MRE includes maiden MREs for both the Kamperman and Rogan Josh deposits, as well as an updated MRE for the Think Big deposit.

- Mineral Resources have been estimated using a 0.39g/t Au lower cut-off and constrained within pit shells derived using a gold price of A$2,500 per ounce (consistent with the price used for the current MRE at the Mandilla Gold Project (Mandilla) reported on 20 July 20231 (Mandilla MRE), noting that, at that time, the spot gold price was considerably less than it is today.

- Mineralisation encompassing the Kamperman and Rogan Josh MREs was discovered at an average cost of approximately $19 per ounce. This compares to Astral’s peer group, members of which are currently trading at enterprise values in the range of $38 to $82 per mineral resource ounce2.

- The oxide and transitional deposits at Rogan Josh and Think Big total 1.6Mt at 1.3g/t Au for 68.2koz of contained gold. Combined with the 2.0Mt at 1.3g/t Au for 83.8koz of contained gold at Kamperman, Astral considers there to be significant potential to increase the production target for the Mandilla Pre-Feasibility Study (Mandilla PFS), with work well underway.

- The Mandilla Scoping Study (Mandilla Scoping Study) reported during September 20233 included processing lower grade material of approximately 4.5Mt of Mandilla ore grading less than 0.70 g/t Au during the first five years of operations. The higher grade Feysville ore is expected to displace this ore, contributing significant economic upside to the Mandilla PFS compared to the Mandilla Scoping Study.

- The Mandilla PFS is likely to incorporate a pit shell design parameter of at least A$2,600 per ounce for mine optimisation. This exceeds the gold price parameter of A$2,500 incorporated in the calculation of Mineral Resources for both Mandilla and Feysville and, therefore, is likely to support a relatively high conversion rate of Mineral Resources into the Mandilla PFS production target.

- Including the Mandilla MRE of 37Mt at 1.1g/t Au for 1.27Moz of contained gold4, Astral’s total gold MRE is now calculated to be 42Mt at 1.1g/t Au for 1.46Moz of contained gold (Group MRE) (refer to Table 10).

Astral Resources’ Managing Director Marc Ducler said: “When we returned to drilling at Feysville in November 2022, we did so with a view to building critical mass to support our flagship Mandilla Gold Project. As our understanding of Feysville increased, we formed the view that the highly-underexplored Feysville tenement package had the potential to contribute several 100,000-ounce open pit opportunities to the broader Mandilla Gold Project as contemplated in the Mandilla Scoping Study3.

“With today’s Feysville MRE announcement, Astral is well on the way to delivering on this potential.

“The Mineral Resource Estimates across both Mandilla and Feysville are now consistently reported within pit shells incorporating a A$2,500 gold price and cut-off grades of 0.39g/t Au.

“While we acknowledge that using a gold price of A$2,500 to constrain the Feysville MRE is too conservative given the current spot gold price exceeds A$4,000, we intend to update the Group MRE using a more appropriate gold price and cost assumptions as the current data becomes available through advancement of the Mandilla PFS. To adjust revenue pricing assumptions prior to gaining certainty over cost assumptions is not considered appropriate.

“Importantly, the maiden Kamperman MRE has yielded a 1.3g/t open pit resource with a 5.9:1 strip ratio. Given our intention is to use a gold price of at least A$2,600 for pit design for the Mandilla PFS, we are very confident that a strong conversion of this resource into the production target will be achieved and, hence, make a material contribution to the economics of the Mandilla PFS.

“It is also important to note that the Kamperman deposit offers further significant growth potential based on the results of the recent 31-hole/3,834 metre reverse circulation (RC) drill program recently completed. These results are not included in the Kamperman MRE; however, one of the reported intercepts – 3 metres at 177g/t Au from 74 metres as part of a broader intersection of 25 metres at 24.3g/t Au from 68 metres in hole FRC3785 – is quite outstanding and suggests there to be scope for considerable upside with further drilling.

“Similarly, the supergene deposits present at both the Think Big and Rogan Josh MREs are also likely to have a very high conversion rate into a production target.

“Astral remains committed to further increasing the Group MRE through extensional drilling, as well as increasing the geological confidence levels – and, hence, MRE categories – through further in-fill drilling. Two rigs are currently on site at Mandilla, a diamond drill (DD) rig and an RC rig, with the RC rig expected to relocate to Kamperman before the Christmas period for further in-fill and extensional drilling.

“Astral expects to report revised MREs for both Mandilla and Feysville in Q1 next year, ahead of the anticipated completion of the Mandilla PFS in Q2 2025.”

Click here for the full ASX Release

This article includes content from Astral Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AAR:AU

The Conversation (0)

12 January

Quarterly Activities & Cashflow Report

Astral Resources (AAR:AU) has announced Quarterly Activities & Cashflow ReportDownload the PDF here. Keep Reading...

10 December 2025

Strongly Supported $65m Placement to Advance Mandilla

Astral Resources (AAR:AU) has announced Strongly Supported $65m Placement to Advance MandillaDownload the PDF here. Keep Reading...

08 December 2025

Trading Halt

Astral Resources (AAR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

01 December 2025

Theia Grade Control Confirms Geological Interpretation

Astral Resources (AAR:AU) has announced Theia Grade Control Confirms Geological InterpretationDownload the PDF here. Keep Reading...

17 November 2025

Theia In-fill - Multiple High-Grade Zones of Gold

Astral Resources (AAR:AU) has announced Theia In-fill - Multiple High-Grade Zones of GoldDownload the PDF here. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00