- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

June 07, 2024

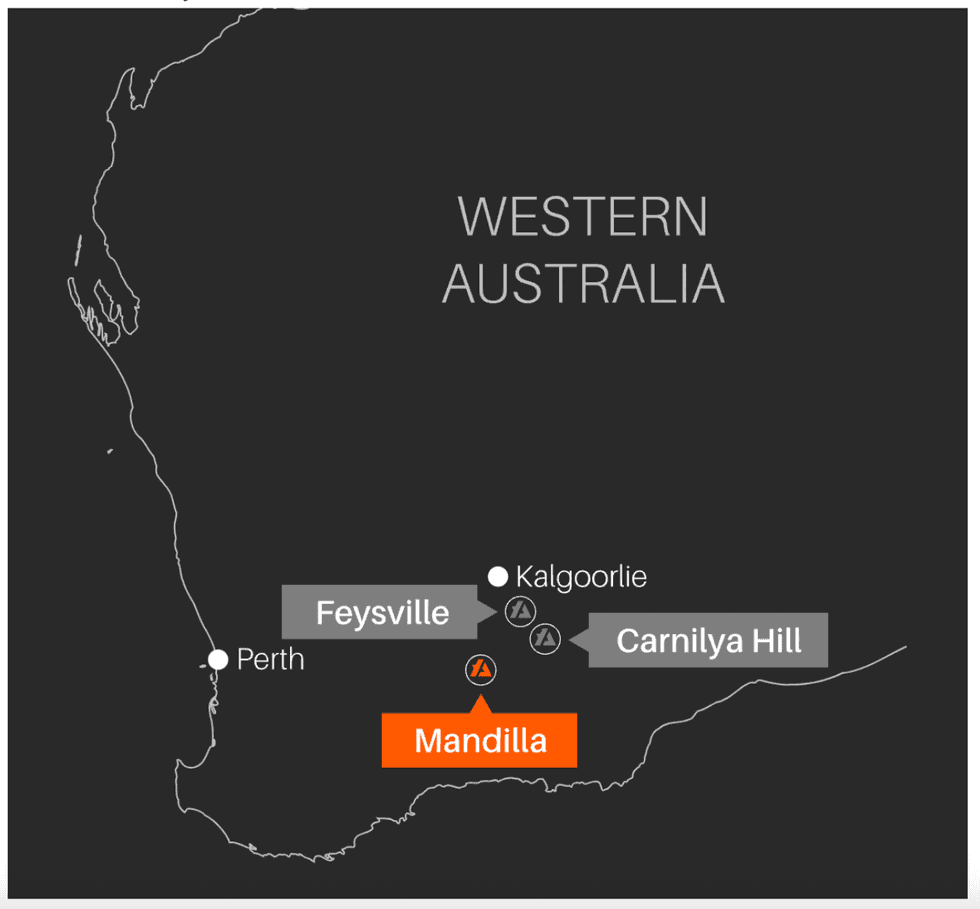

Astral Resources (ASX:AAR) is a gold mineral exploration company focusing on three assets are the Mandilla gold project, the Feysville gold project, and the Carnilya Hill gold project. Astral is advancing its flagship Mandilla gold project, with a mineral resource estimate of 37 Mt at 1.1 g/t gold for 1.27 Moz. The 100 percent owned Feysville is another key project that hosts a mineral resource estimate of 3 million tons (Mt) at 1.3 grams per ton (g/t) gold for 116,000 ounces (oz) of contained gold.

The scoping study completed at Mandilla highlighted the Theia deposit, which accounts for 81 percent of the total Mandilla mineral resource estimate. The deposit hosts a mineral resource estimate of 29 Mt at 1.1 g/t gold for 1.02 Moz of contained gold in one large open pit. The scoping study indicates a mine life of 11 years with an annual production of 100,000 oz in the first seven and a half years, dropping to 41,000 oz for the remaining three and a half years. The study outlines compelling financial metrics, including NPV@8 percent of AU$442 million, free cash flow of AU$740 million, and a payback period of nine months.

Astral continues to advance exploration and resource expansion efforts at Mandilla with plans to commence a pre-feasibility study. The company completed a six-hole 1,832 metre drilling program at Theia deposit last year. The assay results have been released and indicate a high potential for the conversion of inferred resources to higher confidence indicated resources. The assay results include: 39 metres at 5.4 g/t gold, 29 metres at 2.8 g/t gold, 28 metres at 1.4 g/t gold, 8 metres at 8.8 g/t gold.

Company Highlights

- Astral Resources is an ASX-listed gold exploration company in the Kalgoorlie region of Western Australia, a tier 1 jurisdiction and a mature mining region with successful development history and granted mining leases.

- The company has three assets - the Mandilla gold project, the Feysville gold project, and the Carnilya Hill gold exploration project.

- The focus is on advancing its flagship Mandilla gold project, with a mineral resource estimate of 37 Mt at 1.1 g/t gold for 1.27 Moz.

- The scoping study at Mandilla highlights the project’s robust economics with a mine life of 11 years, NPV@8 percent of AU$442 million, and free cash flow of AU$740 million.

- Mandilla’s cornerstone Theia deposit, which comprises 81 percent of the project’s resources, contains 29 Mt at 1.1 g/t gold, with 1.02 Moz of contained gold in one large open pit.

- Feysville project hosts a mineral resource estimate of 3 Mt at 1.3g/t gold for 116 koz of contained gold. The project could potentially become a source of satellite ore feed to Astral’s flagship Mandilla gold project.

- The company is led by an experienced team with a proven track record of advancing projects to development and M&A.

This Astral Resources profile is part of a paid investor education campaign.*

Click here to connect with Astral Resources (ASX:AAR) to receive an Investor Presentation

AAR:AU

Sign up to get your FREE

Astral Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 February

Astral Resources

Gold exploration with highly prospective assets in Western Australia

Gold exploration with highly prospective assets in Western Australia Keep Reading...

30 October

Quarterly Activities & Cashflow Report

Astral Resources (AAR:AU) has announced Quarterly Activities & Cashflow ReportDownload the PDF here. Keep Reading...

27 October

Key Appointments to Advance Mandilla Gold Project

Astral Resources (AAR:AU) has announced Key Appointments to Advance Mandilla Gold ProjectDownload the PDF here. Keep Reading...

24 October

Feysville Land Use Agreement Signed With Marlinyu Ghoorlie

Astral Resources (AAR:AU) has announced Feysville Land Use Agreement Signed With Marlinyu GhoorlieDownload the PDF here. Keep Reading...

22 October

Theia In-fill Drilling Continues to Deliver Broad Gold Zones

Astral Resources (AAR:AU) has announced Theia In-fill Drilling Continues to Deliver Broad Gold ZonesDownload the PDF here. Keep Reading...

19 October

Astral Secures Development Partner for Think Big Project

Astral Resources (AAR:AU) has announced Astral Secures Development Partner for Think Big ProjectDownload the PDF here. Keep Reading...

3h

Top 5 Canadian Mining Stocks This Week: Quarterback Resources Scores with 160 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released October’s job numbers on Friday (November 7). The data showed a... Keep Reading...

8h

Goldgroup Files Updated Technical Report on Cerro Prieto Project

Goldgroup Mining Inc. ("Goldgroup" or the "Company") (TSXV:GGA)(OTCQX:GGAZF) is pleased to announce that it has filed an updated NI 43-101 technical report on the Cerro Prieto gold project located in Sonora State, Mexico. The report is entitled "Cerro Prieto Project, Heap Leach Project,... Keep Reading...

06 November

Adrian Day: Gold Far from Top, Two Triggers for Next Price Move

Adrian Day, president of Adrian Day Asset Management, shares his thoughts on gold's price pullback, saying he currently sees no evidence of a top. "It's perfectly normal in middle of a bull market to have a significant correction. This really isn't even a correction yet, let's not forget that.... Keep Reading...

06 November

Rick Rule: Gold Strategy, Oil Stocks I Own, "Sure Money" in Uranium

Rick Rule, proprietor at Rule Investment Media, recently sold 25 percent of his junior gold stocks, redeploying the funds into physical gold, as well as Franco-Nevada (TSX:FNV,NYSE:FNV), Wheaton Precious Metals (TSX:WPM,NYSE:WPM) and Agnico Eagle Mines (TSX:AEM,NYSE:AEM). In addition to those... Keep Reading...

Latest News

Sign up to get your FREE

Astral Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00