Aclara Resources Inc. ("Aclara" or the "Company") (TSX:ARA) is pleased to provide the drilling results from its Phase 1 reverse circulation ("RC") drilling campaign executed between November 2023 and April 2024 on its regolith-hosted ion adsorption clay project, known as the "Carina Module", located in the State of Goiás, Brazil. The Phase 1 RC drilling campaign, which was comprised of 1,998 meters of drilling within 80 drill holes, has confirmed that the mineralization extends through the full depth of the regolith to the bedrock and provides a greater level of certainty regarding the geological interpretation of the deposit and the existence of rare earth elements throughout the full cross-section of the regolith

Highlights

- Depth Mineralization Confirmed: Results from the Phase 1 RC drilling campaign confirm that the mineralisation extends through the full depth of the regolith to the bedrock. The average high-grade mineralization thickness has increased from 6.1 meters reported in the previous auger drilling campaign to 11.1 meters.

- Consistent Grades and Rare Earths Distribution: The results reflect that the Total Rare Earth Oxide ("TREO") 1 and the Desorbible Rare Earth Oxide ("DREO") 2 grades as well as the Rare Earths Distribution in the product basket, are consistent with those reported in the previous auger drilling campaign. Table 1 below compares the results of the RC drilling campaign with the auger drilling campaign and Table 2 provides a selection of high-grade drillhole results.

- Improved Reliability: The results provide a greater understanding of the mineralised horizons through the full depth of the regolith to the bedrock and will support execution of the Phase 2 drilling campaign, which will seek to convert the known inferred mineral resources to a measured and indicated resource category.

- Metallurgical Compatibility: The Carina Module clays have been shown to be amenable to rare earths extraction using the same metallurgical process (the "Circular Mineral Harvesting" process) developed for the Chile-based Penco Module, which utilizes ammonium sulfate as the primary leaching solution. A 25-tonne bulk sample of Carina clays was processed in the Aclara Pilot Plant in Concepción, Chile in Q1 2024, where leaching results were consistent with the drill core assays.

The full set of results is included in Table 3 at the end of this press release. These results supplement the results obtained from the auger drilling campaign undertaken between February 2023 and September 2023, which comprised 1,630 meters within 201drill holes. The results of the auger drilling campaign also formed the basis of the maiden mineral resource estimate announced in Aclara's press release dated December 12, 2024, and which supported the preparation of the Carina Module Preliminary Economic Assessment ("PEA") dated January 12, 2024.

Next Steps

The Phase 1 RC drilling campaign results have provided the Company with a basis to further advance the following activities:

- issuance of an updated Mineral Resource Estimate planned for July 2024;

- issuance of an updated PEA of the Carina Module during Q3 2024;

- execution of a 15,200-meter Phase 2 RC drill campaign to convert inferred mineral resource to a measured and indicated mineral resource category, which is expected to commence in June 2024; and

- execution of a metallurgical test campaign during H2 2024 and H1 2025. Sample collections will be obtained through sonic drilling and sent to SGS Lakefield for mineralogical and recovery characterization, to serve as an input for the pre-feasibility study, as well as form the basis for a new semi-industrial scale piloting operation scheduled to occur in 2025.

Aclara COO, Barry Murphy, commented:

"We are very pleased with the results obtained from Aclara's recent RC drilling campaign as they have confirmed our expectation that the Carina Module deposit will increase in size to become a truly world-class heavy rare earth asset. Based on the positive Phase 1 RC drill results, the Company will be updating the Carina Module's mineral resource estimate and Preliminary Economic Assessment and proceeding with the next phase of RC drilling aimed at converting the known mineral resource from an inferred to a measured and indicated level of categorisation. The results obtained from Phase 2 RC drilling campaign are expected to provide support for the Carina Module prefeasibility study, as well as to provide samples for a more comprehensive metallurgical test work programme, which we believe will demonstrate the extraordinary value of this deposit."

Table 1. Comparison of Phase 1 RC drilling campaign results to the previously disclosed auger drilling campaign results.

Unit | RC Drilling Campaign | Auger Drilling Campaign | |

| High-Grade Mineralization Thickness | |||

| Drilling | meters | 1,998 | 1,693 |

| Drill holes | # | 80 | 236 |

| Average Drill Depth | meters /drill hole | 25.0 | 7.2 |

| High Grade Mineralization Thickness | meters | 11.1 | 6.1 |

| TREO Grades (within the High-Grade Mineralization Range) | |||

| Total Rare Earth Oxides | ppm | 1,803 | 1,510 |

| Total NdPr Oxides ("NdPr_T") | ppm | 354 | 283 |

| Total DyTb Oxides ("DyTb_T") | ppm | 57 | 46 |

| DREO Grades (within the High-Grade Mineralization Range) | |||

| Desorbible Rare Earth Oxides | ppm | 484 | 470 |

| Desorbible NdPr Oxides ("NdPr_D") | ppm | 130 | 131 |

| Desorbible DyTb Oxides ("DyTb_D") | ppm | 22 | 21 |

| Rare Earths Distribution (within the High-Grade Mineralization Range) | |||

| NdPr Weight within the Basket | % | 26.9% | 27.8% |

| DyTb Weight within the Basket | % | 4.5% | 4.5% |

Table 2. Summary of Carina Module´s top 10 RC drill hole results from the Phase 1 RC drilling campaign ordered by DREO grade, including only the regolith or saprolitization interval (the location of these drill hole collars are shown in Figure 2 below).

Drillhole | Length | From | To | TREO | DREO | NdPr_T | NdPr_D | Dy_T | Dy_D | Tb_T | Tb_D | |||

m | m | m | ppm | ppm | ppm | ppm | % of DREO | ppm | ppm | % of DREO | ppm | ppm | % of DREO | |

RCCAR23024 | 5 | 0 | 5 | 1,891 | 1,015 | 401 | 351 | 35% | 49.7 | 28.1 | 2.8% | 7.6 | 5.6 | 0.6% |

RCCAR23055 | 26 | 0 | 26 | 2,276 | 905 | 488 | 192 | 21% | 96.5 | 45.3 | 5.0% | 16.2 | 7.2 | 0.8% |

RCCAR23016 | 18 | 8 | 26 | 2,239 | 897 | 490 | 354 | 39% | 38.1 | 17.9 | 2.0% | 6.8 | 3.4 | 0.4% |

RCCAR23001 | 9 | 1 | 10 | 1,712 | 874 | 360 | 214 | 24% | 75.3 | 50.1 | 5.7% | 12.5 | 9.8 | 1.1% |

RCCAR23033 | 8 | 0 | 8 | 2,791 | 856 | 650 | 279 | 33% | 76.7 | 27.6 | 3.2% | 13.1 | 5.0 | 0.6% |

RCCAR23005 | 10 | 1 | 11 | 4,231 | 739 | 839 | 213 | 29% | 101.7 | 21.2 | 2.9% | 17.9 | 3.6 | 0.5% |

RCCAR23054 | 12 | 0 | 12 | 2,657 | 787 | 597 | 151 | 19% | 86.8 | 33.6 | 4.3% | 14.9 | 5.5 | 0.7% |

RCCAR23012 | 12 | 2 | 14 | 2,485 | 676 | 544 | 224 | 33% | 33.3 | 16.4 | 2.4% | 6.2 | 3.0 | 0.4% |

RCCAR23008 | 16 | 0 | 16 | 3,095 | 638 | 626 | 224 | 35% | 73.6 | 25.1 | 3.9% | 13.4 | 4.8 | 0.8% |

RCCAR23044 | 11 | 0 | 11 | 2,840 | 634 | 583 | 170 | 27% | 82.5 | 25.0 | 4.0% | 13.5 | 4.3 | 0.7% |

Reverse Circulation Drilling Campaign Summary

A total of 1,998 meters of drilling within 80 RC drill holes was carried out from November 2023 to April 2024 as part of an exploration drilling campaign covering approximately 700 hectares within the area of the Carina Module (see Figures 1, 2, 3 and 4 below). The primary objectives of the drilling initiative were to:

- obtain additional information to fully assess the Carina Module's potential (both laterally and at depth);

- obtain guidance for future RC drilling campaigns, as needed to contribute to the definition of the Carina Module's indicated and measured resource estimates; and

- establish a base for a future metallurgical test sample collection.

Figure 1. Images of the RC drilling campaign showing the operation and sampling methodology carried out at the Carina Module.

Geological Overview

The Rare Earth Element secondary minerals are released from the pink porphyritic monzogranite composed of quartz, oligoclase, microcline, and annite as essential minerals, which has suffered greisen alteration superimposed by weathering.

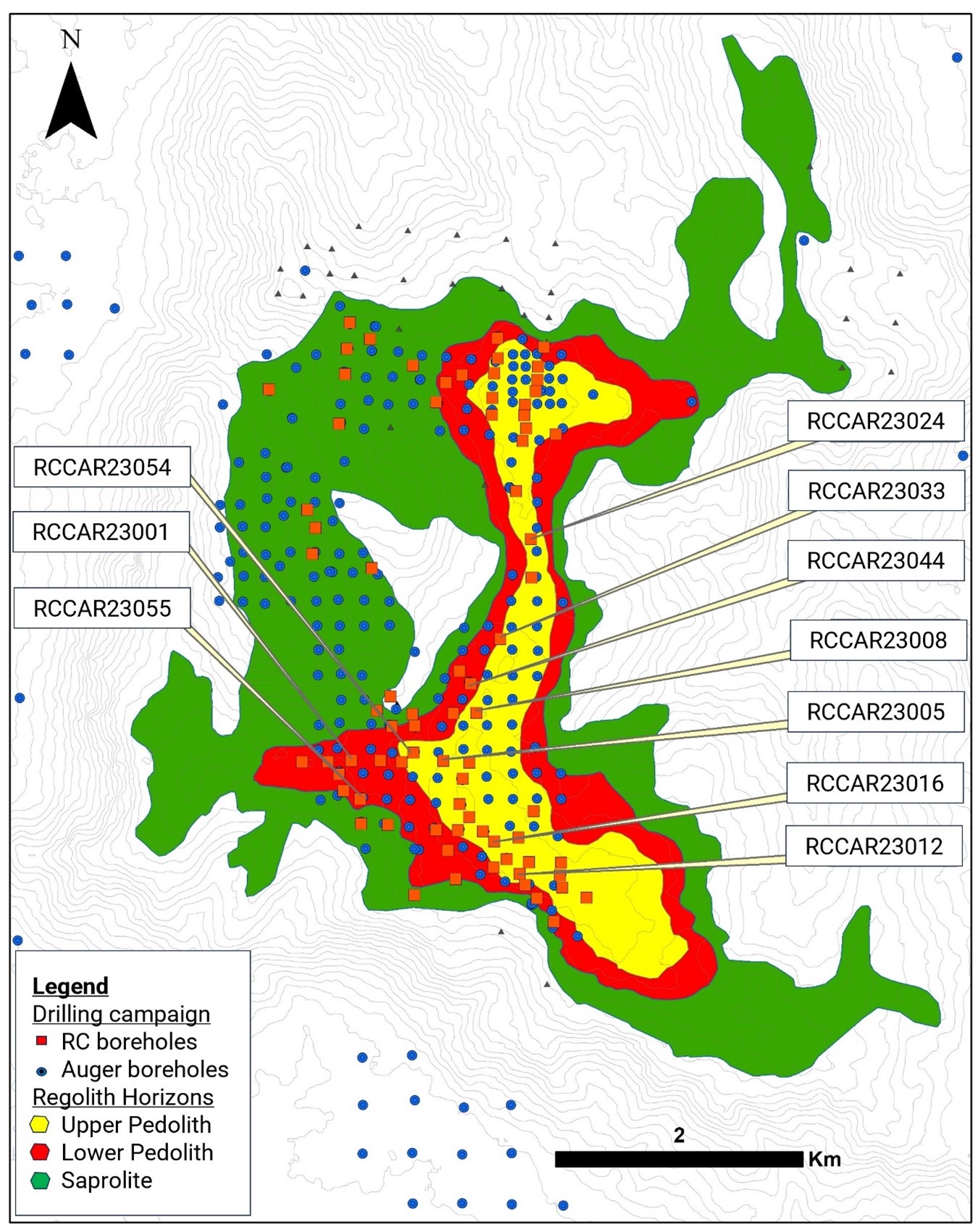

Figure 2 depicts the extensions of the upper pedolith, lower pedolith, and saprolite units, which define the mineralization overprint of the regolith-hosted ion-adsorption clay deposit. Figure 2 also demonstrates the collar locations of the previous auger drilling campaign and the Phase 1 RC drilling campaign.

Figure 2. Carina Module map with executed RC and auger drill holes, and the extension of the upper pedolith, lower pedolith and saprolite areas. RC and auger boreholes are displayed by red squares and blue dots, respectively. The ten highest DREO grade RC holes are labeled in the figure and exhibited in Table 2. Cross-sections A-A´ and B-B´ are illustrated in Figure 3.

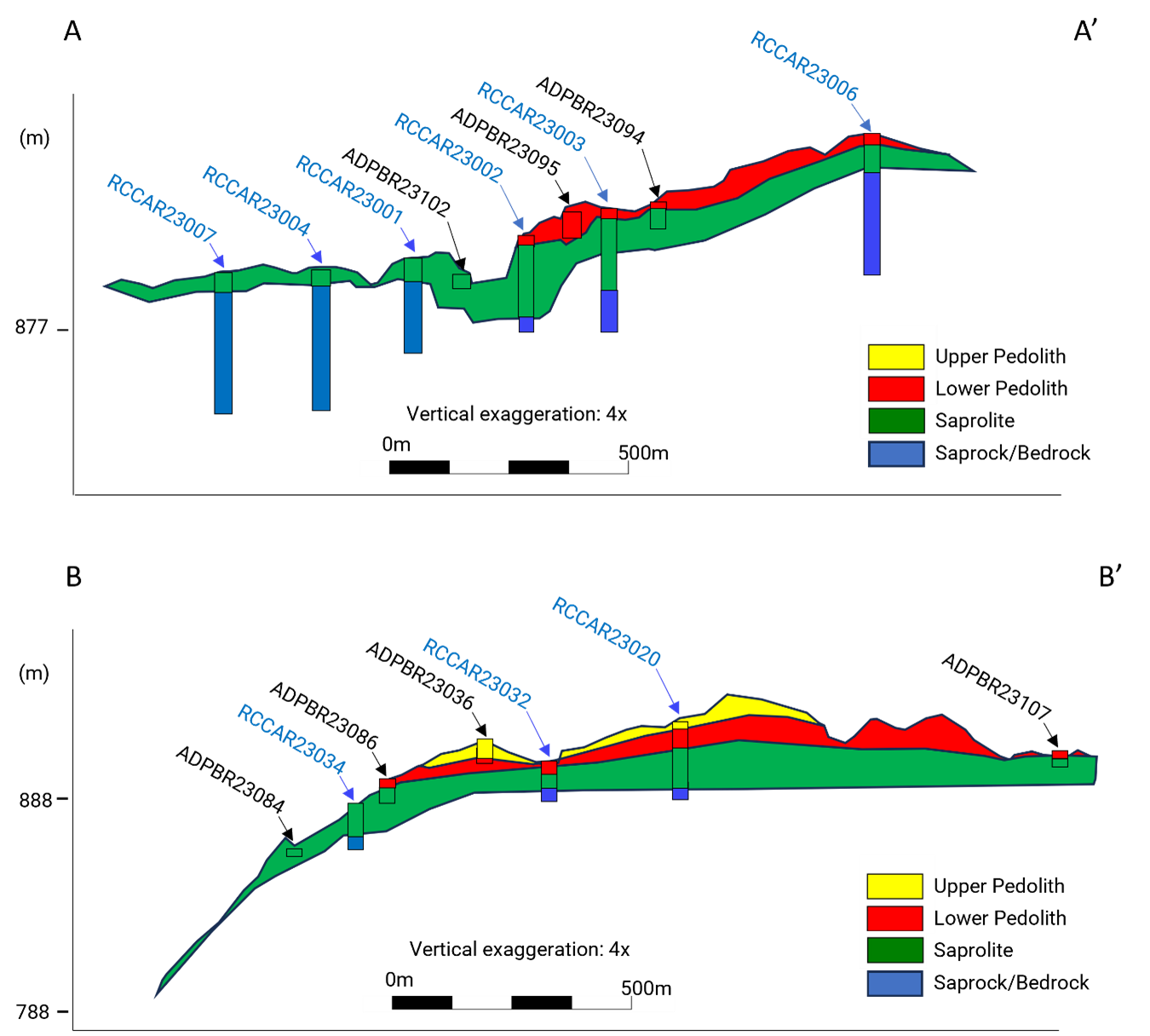

Figure 3 depicts the regolith horizons across two cross-sections, A-A' and B-B'. Here, the saprolite is better defined and thicker, and demonstrates greater continuity than the results observed during the previous auger drilling campaign. The auger holes are annotated in black font, whereas the RC drill holes are annotated in blue font.

Figure 3. Cross-sections ‘A-A‘ and ‘B-B‘ as shown in Figure 2.

Sampling and Assay Protocols

The 80 RC drill holes were sampled at intervals of one (1) meter for a total of 1,998 samples. For Total Rare Earth Elements ("TREE") analysis, 1420 samples were sent to ALS laboratory in Lima, Peru and the remaining 578 samples were sent to SGS Geosol laboratory in Vespasiano, Brazil. For the Desorbable Rare Earth Elements ("DREE") analysis, 821 samples were sent to the AGS laboratory in La Serena, Chile and 1,177 samples were sent to SGS Geosol laboratory in Vespasiano, Brazil.

For the TREE analyses, the same sampling and analytical protocols were followed as described in the Company's technical report titled "Preliminary Economic Assessment - Carina Rare Earth Element Project - Nova Roma, Goiás, Brazil" and dated January 12, 2024, prepared in accordance with National Instrument 43-101 - Standard of Disclosure of Mineral Projects (" NI 43-101 ") by GE21 Consultoria Mineral. The QA/QC program has been implemented in the SGS Geosol lab, where the results of Dy, Tb, Nd and Pr analyses are controlled to meet high standard of accuracy.

Qualified Persons

The technical information in this press release has been reviewed and approved by Luiz Jorge Frutuoso Junior (Aclara Exploration Manager) who has over 20 years of relevant experience. Mr. Frutuoso is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), a Fellow of the Australian Institute of Geoscientists (AIG), and is a Qualified Person as defined under NI 43-101.

The present study was validated by Aclara's Chief Geologist, Juan Pablo Navarro, who is a Member of the Australian Institute of Geoscientists (AIG, #9021) and is a Qualified Person as defined under NI 43-101. Aclara's Database and QA/QC Geologist, Carlos Paixao, provided an analysis of the QA/QC protocols applied to the Carina Module and has confirmed that they meet the required level of control and accuracy.

About Aclara

Aclara Resources Inc. (TSX: ARA) is a development-stage company that is focused on heavy rare earth mineral resources hosted in Ion-Adsorption Clay deposits. The Company's rare earth mineral resource development projects include the Penco Module in the BioBio Region of Chile and the Carina Module in the State of Goiás, Brazil.

Aclara's rare earth extraction process offers several environmentally attractive features. Circular Mineral Harvesting does not involve blasting, crushing, or milling. Additionally, it does not generate tailings, eliminating the need for a tailings storage facility. The extraction process developed by Aclara minimizes water consumption through high levels of water recirculation made possible by the inclusion of a water treatment facility within its patented process design. The ionic clay feedstock is amenable to leaching with a common fertilizer main reagent, ammonium sulphate. Further, harmful levels of radionuclides, typical of hard rock rare earth deposits, are not concentrated within Aclara's processing flowsheet. In addition to the development of the Penco Module and the Carina Module, the Company will continue to identify and evaluate opportunities to increase future production of heavy rare earths through greenfield exploration programs and the development of additional projects within the Company's concessions in Brazil, Chile, and Peru.

Forward-Looking Statements

This press release contains "forward-looking information" within the meaning of applicable securities legislation, which reflects the Company's current expectations regarding future events, including statements with regard to: mineral continuity, grade, and upside at the Carina Module, the Company's exploration plan and activities in Brazil and the expectations of the Company's management as to the timing, cost, scope and results of such exploration works and drilling activities and the Phase 2 RC drill campaign and updated mineral resource estimates and an updated preliminary economic assessment of the Carina Module. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company's control. Such risks and uncertainties include, but are not limited to risks related to operating in a foreign jurisdiction, including political and economic problems in Brazil; risks related to changes to mining laws and regulations and the termination or non-renewal of mining rights by governmental authorities; risks related to failure to comply with the law or obtain necessary permits and licenses or renew them; compliance with environmental regulations can be costly; actual production, capital and operating costs may be different than those anticipated; the Company may be not able to successfully complete the development, construction and start-up of mines and new development projects; risks related to mining operations; and dependence on the Penco Module and/or the Carina Module. Aclara cautions that the foregoing list of factors is not exhaustive. For a detailed discussion of the foregoing factors, among others, please refer to the risk factors discussed under "Risk Factors" in the Company's annual information form dated as of March 22, 2024 filed on the Company's SEDAR+ profile. Actual results and timing could differ materially from those projected herein. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained in this press release is provided as of the date of this press release and the Company does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required under applicable securities laws.

For further information, please contact:

Bonzi Yokomizo Baptista

Brazil General Manager

investorrelations@aclara-re.com

Table 3. Complete list of drillholes from the reverse circulation drilling at Carina Module (November 2023 - April 2024)

Drillhole | Length | From | To | Material | TREO | DREO | NdPr T | NdPr D | Dy T | Dy D | Tb T | Tb D | |||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

m | m | m | Type | ppm | ppm | ppm | ppm | % of DREO | ppm | ppm | % of DREO | ppm | ppm | % of DREO | |

| RCCAR23001 | 9 | 1 | 10 | Regolith | 1712 | 874 | 360 | 214 | 24% | 75.3 | 50.1 | 5.7% | 12.5 | 9.8 | 1.1% |

| RCCAR23001 | 30 | 11 | 40 | Rock | 989 | 50 | 142 | 5 | 10% | 42.3 | 3.0 | 6.1% | 6.4 | 0.5 | 0.9% |

| RCCAR23002 | 33 | 0 | 33 | Regolith | 2389 | 411 | 559 | 122 | 30% | 56.8 | 15.4 | 3.8% | 10.8 | 2.8 | 0.7% |

| RCCAR23002 | 7 | 33 | 40 | Rock | 1612 | 58 | 349 | 9 | 15% | 61.6 | 3.0 | 5.1% | 10.7 | 0.4 | 0.8% |

| RCCAR23003 | 21 | 0 | 21 | Regolith | 2287 | 391 | 453 | 86 | 22% | 59.6 | 17.1 | 4.4% | 10.4 | 2.9 | 0.7% |

| RCCAR23003 | 29 | 22 | 51 | Rock | 1070 | 8 | 206 | 2 | 20% | 23.5 | 0.2 | 2.8% | 4.0 | 0.0 | 0.6% |

| RCCAR23004 | 5 | 2 | 7 | Regolith | 846 | 365 | 143 | 60 | 16% | 48.7 | 22.9 | 6.3% | 7.7 | 3.8 | 1.0% |

| RCCAR23004 | 48 | 7 | 55 | Rock | 451 | 19 | 56 | 1 | 8% | 24.4 | 1.3 | 7.0% | 3.6 | 0.2 | 0.9% |

| RCCAR23005 | 19 | 0 | 19 | Regolith | 3404 | 415 | 694 | 118 | 28% | 79.1 | 11.6 | 2.8% | 13.9 | 2.0 | 0.5% |

| RCCAR23005 | 16 | 19 | 35 | Rock | 1070 | 8 | 218 | 2 | 22% | 24.9 | 0.3 | 3.2% | 4.3 | 0.0 | 0.5% |

| RCCAR23006 | 13 | 0 | 13 | Regolith | 1173 | 117 | 240 | 37 | 32% | 25.4 | 3.2 | 2.7% | 4.3 | 0.6 | 0.5% |

| RCCAR23006 | 47 | 13 | 60 | Rock | 822 | 7 | 169 | 2 | 28% | 17.4 | 0.2 | 2.4% | 2.9 | 0.0 | 0.7% |

| RCCAR23007 | 9 | 0 | 9 | Regolith | 912 | 296 | 184 | 45 | 15% | 48.7 | 16.6 | 5.6% | 8.4 | 2.8 | 0.9% |

| RCCAR23007 | 51 | 9 | 60 | Rock | 490 | 24 | 66 | 2 | 6% | 26.7 | 1.6 | 6.5% | 4.1 | 0.2 | 0.9% |

| RCCAR23008 | 22 | 0 | 22 | Regolith | 2805 | 492 | 544 | 170 | 34% | 65.9 | 19.8 | 4.0% | 11.8 | 3.8 | 0.8% |

| RCCAR23008 | 10 | 22 | 32 | Rock | 929 | 18 | 190 | 4 | 21% | 25.5 | 0.6 | 3.2% | 4.3 | 0.1 | 0.6% |

| RCCAR23009 | 20 | 0 | 20 | Regolith | 1356 | 213 | 272 | 56 | 26% | 35.6 | 9.0 | 4.2% | 6.2 | 1.5 | 0.7% |

| RCCAR23009 | 3 | 20 | 23 | Rock | 853 | 46 | 183 | 11 | 24% | 18.0 | 1.6 | 3.4% | 3.2 | 0.3 | 0.6% |

| RCCAR23010 | 10 | 0 | 10 | Regolith | 1637 | 585 | 241 | 89 | 15% | 74.5 | 40.9 | 7.0% | 11.0 | 6.0 | 1.0% |

| RCCAR23010 | 16 | 10 | 26 | Rock | 1297 | 135 | 169 | 5 | 4% | 61.0 | 8.9 | 6.6% | 8.7 | 1.1 | 0.8% |

| RCCAR23011 | 8 | 0 | 8 | Regolith | 1651 | 574 | 314 | 123 | 21% | 66.0 | 31.4 | 5.5% | 12.1 | 5.5 | 1.0% |

| RCCAR23011 | 13 | 8 | 21 | Rock | 907 | 87 | 115 | 2 | 2% | 42.8 | 6.6 | 7.5% | 6.3 | 0.9 | 1.0% |

| RCCAR23012 | 19 | 0 | 20 | Regolith | 2167 | 471 | 462 | 152 | 32% | 29.8 | 11.6 | 2.5% | 5.5 | 2.1 | 0.4% |

| RCCAR23012 | 5 | 20 | 24 | Rock | 1419 | 100 | 252 | 20 | 20% | 24.5 | 2.2 | 2.2% | 4.0 | 0.4 | 0.4% |

| RCCAR23013 | 30 | 0 | 30 | Regolith | 1218 | 357 | 239 | 121 | 34% | 21.3 | 7.4 | 2.1% | 3.5 | 1.4 | 0.4% |

| RCCAR23013 | 2 | 30 | 32 | Rock | 1197 | 114 | 247 | 30 | 26% | 21.4 | 2.4 | 2.1% | 3.9 | 0.5 | 0.4% |

| RCCAR23014 | 15 | 0 | 15 | Regolith | 2284 | 584 | 448 | 207 | 35% | 36.3 | 12.9 | 2.2% | 6.2 | 2.2 | 0.4% |

| RCCAR23014 | 7 | 15 | 22 | Rock | 1840 | 67 | 336 | 6 | 9% | 49.1 | 3.1 | 4.6% | 7.9 | 0.4 | 0.6% |

| RCCAR23015 | 8 | 0 | 8 | Regolith | 1210 | 725 | 225 | 182 | 25% | 50.8 | 34.1 | 4.7% | 7.6 | 5.6 | 0.8% |

| RCCAR23015 | 8 | 8 | 16 | Rock | 1221 | 202 | 173 | 18 | 9% | 54.7 | 10.8 | 5.3% | 8.4 | 1.5 | 0.8% |

| RCCAR23016 | 30 | 0 | 30 | Regolith | 1763 | 566 | 361 | 222 | 39% | 29.6 | 11.1 | 2.0% | 5.2 | 2.1 | 0.4% |

| RCCAR23016 | 7 | 30 | 37 | Rock | 2507 | 173 | 573 | 40 | 23% | 61.1 | 6.4 | 3.7% | 10.8 | 1.1 | 0.6% |

| RCCAR23017 | 17 | 0 | 17 | Regolith | 1413 | 406 | 321 | 156 | 38% | 27.4 | 8.8 | 2.2% | 4.6 | 1.6 | 0.4% |

| RCCAR23017 | 5 | 17 | 22 | Rock | 1359 | 79 | 272 | 13 | 16% | 38.5 | 3.5 | 4.4% | 5.8 | 0.5 | 0.7% |

| RCCAR23018 | 4 | 0 | 4 | Regolith | 1095 | 225 | 146 | 61 | 27% | 12.5 | 3.6 | 1.6% | 2.0 | 0.7 | 0.3% |

| RCCAR23018 | 7 | 4 | 11 | Rock | 1088 | 73 | 206 | 17 | 23% | 24.9 | 1.9 | 2.7% | 3.9 | 0.4 | 0.5% |

| RCCAR23019 | 40 | 0 | 40 | Regolith | 958 | 96 | 127 | 23 | 23% | 15.5 | 3.3 | 3.4% | 2.5 | 0.5 | 0.5% |

| RCCAR23019 | 14 | 40 | 54 | Rock | 1530 | 33 | 271 | 3 | 9% | 43.7 | 1.8 | 5.4% | 6.8 | 0.2 | 0.7% |

| RCCAR23020 | 29 | 0 | 29 | Regolith | 818 | 153 | 122 | 49 | 32% | 23.2 | 3.8 | 2.5% | 3.6 | 0.7 | 0.4% |

| RCCAR23020 | 1 | 29 | 30 | Rock | 2279 | 74 | 471 | 12 | 16% | 89.9 | 3.4 | 4.6% | 16.5 | 0.6 | 0.7% |

| RCCAR23021 | 5 | 0 | 5 | Regolith | 942 | 610 | 183 | 144 | 24% | 38.3 | 32.7 | 5.4% | 5.6 | 5.6 | 0.9% |

| RCCAR23021 | 5 | 5 | 10 | Rock | 1272 | 181 | 196 | 43 | 24% | 41.4 | 5.0 | 2.8% | 5.9 | 1.0 | 0.5% |

| RCCAR23022 | 12 | 0 | 12 | Regolith | 1005 | 173 | 149 | 46 | 27% | 20.2 | 4.9 | 2.8% | 3.1 | 0.9 | 0.5% |

| RCCAR23022 | 4 | 12 | 16 | Rock | 1199 | 127 | 198 | 20 | 16% | 33.3 | 4.0 | 3.1% | 5.1 | 0.6 | 0.5% |

| RCCAR23023 | 9 | 0 | 9 | Regolith | 965 | 273 | 102 | 63 | 23% | 26.1 | 8.0 | 2.9% | 3.5 | 1.3 | 0.5% |

| RCCAR23023 | 6 | 9 | 15 | Rock | 2364 | 118 | 471 | 7 | 6% | 70.1 | 4.6 | 3.9% | 10.7 | 0.6 | 0.5% |

| RCCAR23023B | 9 | 0 | 9 | Regolith | 1774 | 167 | 323 | 44 | 26% | 40.3 | 5.1 | 3.0% | 6.2 | 0.7 | 0.4% |

| RCCAR23023B | 6 | 9 | 15 | Rock | 2181 | 58 | 399 | 5 | 8% | 58.5 | 2.4 | 4.2% | 9.3 | 0.3 | 0.5% |

| RCCAR23024 | 5 | 0 | 5 | Regolith | 1891 | 1015 | 401 | 351 | 35% | 49.7 | 28.1 | 2.8% | 7.6 | 5.6 | 0.6% |

| RCCAR23024 | 6 | 5 | 11 | Rock | 1476 | 112 | 255 | 22 | 20% | 53.0 | 3.1 | 2.8% | 8.1 | 0.6 | 0.6% |

| RCCAR23025 | 7 | 0 | 7 | Regolith | 1198 | 274 | 177 | 78 | 28% | 33.3 | 9.3 | 3.4% | 5.0 | 1.5 | 0.6% |

| RCCAR23025 | 3 | 7 | 10 | Rock | 1338 | 11 | 221 | 2 | 17% | 39.2 | 0.3 | 2.5% | 6.2 | 0.1 | 0.5% |

| RCCAR23026 | 22 | 0 | 22 | Regolith | 2697 | 259 | 561 | 73 | 28% | 50.7 | 9.0 | 3.5% | 8.9 | 1.7 | 0.6% |

| RCCAR23026 | 5 | 22 | 27 | Rock | 1840 | 61 | 319 | 7 | 11% | 55.6 | 2.5 | 4.0% | 8.2 | 0.4 | 0.6% |

| RCCAR23027 | 29 | 0 | 29 | Regolith | 986 | 329 | 146 | 100 | 30% | 18.9 | 6.3 | 1.9% | 2.9 | 1.2 | 0.4% |

| RCCAR23027 | 5 | 29 | 34 | Rock | 1275 | 71 | 184 | 6 | 8% | 49.5 | 4.2 | 5.9% | 7.1 | 0.6 | 0.8% |

| RCCAR23028 | 13 | 0 | 13 | Regolith | 693 | 240 | 108 | 52 | 22% | 25.8 | 11.0 | 4.6% | 3.7 | 1.8 | 0.7% |

| RCCAR23028 | 8 | 13 | 21 | Rock | 1134 | 199 | 158 | 40 | 20% | 45.5 | 6.6 | 3.3% | 6.4 | 1.3 | 0.7% |

| RCCAR23029 | 13 | 0 | 13 | Regolith | 1973 | 429 | 359 | 72 | 17% | 51.3 | 16.4 | 3.8% | 8.1 | 2.5 | 0.6% |

| RCCAR23029 | 8 | 13 | 21 | Rock | 1470 | 83 | 260 | 13 | 15% | 38.3 | 3.6 | 4.3% | 6.3 | 0.6 | 0.7% |

| RCCAR23030 | 11 | 0 | 11 | Regolith | 445 | 182 | 71 | 28 | 15% | 22.3 | 11.4 | 6.3% | 3.4 | 1.8 | 1.0% |

| RCCAR23030 | 4 | 11 | 15 | Rock | 287 | 35 | 31 | 1 | 3% | 18.2 | 2.9 | 8.3% | 2.6 | 0.4 | 1.1% |

| RCCAR23031 | 3 | 0 | 3 | Regolith | 586 | 372 | 84 | 44 | 12% | 27.1 | 19.3 | 5.2% | 4.1 | 2.9 | 0.8% |

| RCCAR23031 | 7 | 3 | 10 | Rock | 690 | 55 | 89 | 2 | 4% | 36.0 | 3.8 | 6.9% | 5.5 | 0.5 | 0.9% |

| RCCAR23032 | 12 | 0 | 12 | Regolith | 937 | 621 | 157 | 137 | 22% | 38.6 | 35.1 | 5.6% | 6.1 | 6.1 | 1.0% |

| RCCAR23032 | 5 | 12 | 17 | Rock | 792 | 111 | 95 | 8 | 7% | 46.2 | 9.0 | 8.1% | 6.4 | 1.1 | 1.0% |

| RCCAR23033 | 8 | 0 | 8 | Regolith | 2791 | 856 | 650 | 279 | 33% | 76.7 | 27.6 | 3.2% | 13.1 | 5.0 | 0.6% |

| RCCAR23033 | 6 | 8 | 14 | Rock | 1166 | 141 | 216 | 34 | 24% | 26.2 | 3.0 | 2.1% | 4.2 | 0.6 | 0.4% |

| RCCAR23034 | 10 | 0 | 10 | Regolith | 800 | 312 | 155 | 64 | 21% | 36.2 | 17.9 | 5.7% | 6.2 | 3.3 | 1.1% |

| RCCAR23034 | 6 | 10 | 16 | Rock | 671 | 60 | 107 | 3 | 5% | 31.3 | 4.9 | 8.1% | 5.3 | 0.7 | 1.2% |

| RCCAR23035 | 5 | 0 | 5 | Regolith | 586 | 260 | 95 | 50 | 19% | 30.8 | 17.4 | 6.7% | 5.1 | 2.8 | 1.1% |

| RCCAR23035 | 10 | 5 | 15 | Rock | 473 | 74 | 59 | 3 | 4% | 24.0 | 6.0 | 8.1% | 3.6 | 0.8 | 1.1% |

| RCCAR23036 | 5 | 0 | 5 | Regolith | 1219 | 574 | 170 | 86 | 15% | 57.0 | 34.6 | 6.0% | 9.6 | 5.5 | 1.0% |

| RCCAR23036 | 6 | 5 | 11 | Rock | 707 | 58 | 84 | 4 | 6% | 36.5 | 4.1 | 7.1% | 5.9 | 0.6 | 1.0% |

| RCCAR23037 | 12 | 0 | 12 | Regolith | 1194 | 332 | 250 | 106 | 32% | 30.0 | 11.3 | 3.4% | 5.1 | 2.0 | 0.6% |

| RCCAR23037 | 4 | 12 | 16 | Rock | 909 | 105 | 188 | 24 | 23% | 20.0 | 4.1 | 3.9% | 3.5 | 0.7 | 0.7% |

| RCCAR23038 | 24 | 0 | 24 | Regolith | 1316 | 445 | 192 | 75 | 17% | 42.7 | 18.9 | 4.2% | 6.8 | 2.9 | 0.6% |

| RCCAR23038 | 4 | 24 | 28 | Rock | 1337 | 67 | 176 | 11 | 16% | 47.5 | 2.2 | 3.2% | 7.3 | 0.4 | 0.6% |

| RCCAR23039 | 28 | 0 | 28 | Regolith | 984 | 119 | 167 | 38 | 32% | 20.1 | 3.0 | 2.5% | 3.2 | 0.5 | 0.5% |

| RCCAR23039 | 7 | 28 | 35 | Rock | 1453 | 25 | 252 | 5 | 20% | 35.4 | 0.8 | 3.1% | 5.7 | 0.1 | 0.6% |

| RCCAR23040 | 10 | 0 | 10 | Regolith | 635 | 280 | 95 | 33 | 12% | 32.0 | 18.6 | 6.6% | 5.2 | 2.8 | 1.0% |

| RCCAR23040 | 13 | 10 | 23 | Rock | 424 | 58 | 53 | 2 | 3% | 24.0 | 4.8 | 8.2% | 3.5 | 0.6 | 1.1% |

| RCCAR23041 | 16 | 0 | 16 | Regolith | 1421 | 299 | 240 | 99 | 33% | 23.9 | 7.3 | 2.5% | 3.9 | 1.4 | 0.5% |

| RCCAR23041 | 2 | 16 | 18 | Rock | 2373 | 146 | 456 | 28 | 19% | 73.7 | 6.3 | 4.3% | 12.0 | 1.0 | 0.7% |

| RCCAR23042 | 2 | 0 | 2 | Regolith | 383 | 100 | 58 | 16 | 16% | 17.7 | 4.8 | 4.8% | 2.5 | 0.7 | 0.7% |

| RCCAR23042 | 8 | 2 | 10 | Rock | 508 | 46 | 65 | 2 | 4% | 27.1 | 3.2 | 6.9% | 4.0 | 0.4 | 0.9% |

| RCCAR23043 | 20 | 0 | 20 | Regolith | 2028 | 489 | 452 | 136 | 28% | 43.0 | 14.8 | 3.0% | 7.4 | 2.6 | 0.5% |

| RCCAR23043 | 4 | 21 | 24 | Rock | 1469 | 90 | 263 | 15 | 17% | 43.8 | 4.8 | 5.3% | 6.8 | 0.7 | 0.8% |

| RCCAR23044 | 12 | 0 | 12 | Regolith | 2820 | 595 | 576 | 157 | 26% | 82.0 | 23.6 | 4.0% | 13.4 | 4.0 | 0.7% |

| RCCAR23044 | 5 | 12 | 17 | Rock | 1923 | 59 | 398 | 13 | 22% | 35.3 | 1.7 | 3.0% | 6.3 | 0.3 | 0.6% |

| RCCAR23045 | 14 | 0 | 14 | Regolith | 1493 | 487 | 270 | 75 | 15% | 60.5 | 32.5 | 6.7% | 10.0 | 5.3 | 1.1% |

| RCCAR23045 | 4 | 14 | 18 | Rock | 1055 | 69 | 145 | 3 | 5% | 50.4 | 5.9 | 8.7% | 6.7 | 0.8 | 1.2% |

| RCCAR23046 | 26 | 0 | 26 | Regolith | 1344 | 231 | 259 | 66 | 29% | 26.1 | 7.0 | 3.0% | 4.7 | 1.3 | 0.6% |

| RCCAR23046 | 4 | 26 | 30 | Rock | 1830 | 67 | 377 | 14 | 20% | 37.3 | 2.3 | 3.5% | 6.8 | 0.4 | 0.6% |

| RCCAR23047 | 23 | 0 | 23 | Regolith | 1444 | 330 | 300 | 105 | 32% | 27.1 | 9.3 | 2.8% | 5.0 | 1.7 | 0.5% |

| RCCAR23047 | 8 | 23 | 31 | Rock | 1116 | 54 | 221 | 11 | 20% | 26.5 | 2.0 | 3.7% | 4.8 | 0.3 | 0.6% |

| RCCAR23048 | 13 | 0 | 13 | Regolith | 1306 | 401 | 237 | 84 | 21% | 49.1 | 19.2 | 4.8% | 7.8 | 3.2 | 0.8% |

| RCCAR23048 | 12 | 13 | 25 | Rock | 943 | 36 | 148 | 2 | 6% | 39.3 | 2.4 | 6.7% | 6.1 | 0.3 | 0.9% |

| RCCAR23049 | 35 | 0 | 35 | Regolith | 1132 | 300 | 206 | 80 | 27% | 33.6 | 10.8 | 3.6% | 5.2 | 1.8 | 0.6% |

| RCCAR23049 | 8 | 35 | 43 | Rock | 957 | 26 | 151 | 2 | 6% | 46.8 | 1.9 | 7.3% | 7.9 | 0.2 | 1.0% |

| RCCAR23050 | 8 | 0 | 8 | Regolith | 1726 | 467 | 345 | 155 | 33% | 51.6 | 17.0 | 3.6% | 8.9 | 3.1 | 0.7% |

| RCCAR23050 | 5 | 8 | 13 | Rock | 1227 | 138 | 173 | 14 | 10% | 42.5 | 6.3 | 4.6% | 5.9 | 0.9 | 0.6% |

| RCCAR23051 | 12 | 0 | 12 | Regolith | 1118 | 274 | 207 | 41 | 15% | 70.6 | 18.9 | 6.9% | 12.7 | 3.0 | 1.1% |

| RCCAR23051 | 8 | 12 | 20 | Rock | 689 | 63 | 79 | 3 | 5% | 46.0 | 4.8 | 7.6% | 7.2 | 0.6 | 1.0% |

| RCCAR23052 | 10 | 0 | 10 | Regolith | 708 | 302 | 105 | 57 | 19% | 34.6 | 18.1 | 6.0% | 5.4 | 2.8 | 0.9% |

| RCCAR23052 | 4 | 10 | 14 | Rock | 613 | 41 | 78 | 2 | 5% | 32.7 | 3.2 | 8.0% | 5.3 | 0.4 | 1.1% |

| RCCAR23053 | 3 | 0 | 3 | Regolith | 471 | 131 | 79 | 30 | 23% | 24.2 | 7.4 | 5.6% | 3.8 | 1.3 | 1.0% |

| RCCAR23053 | 7 | 3 | 10 | Rock | 493 | 69 | 70 | 6 | 9% | 26.6 | 5.0 | 7.2% | 4.2 | 0.7 | 1.1% |

| RCCAR23054 | 19 | 0 | 19 | Regolith | 2115 | 507 | 448 | 98 | 19% | 58.0 | 22.0 | 4.3% | 9.9 | 3.6 | 0.7% |

| RCCAR23054 | 5 | 19 | 24 | Rock | 2362 | 102 | 606 | 11 | 10% | 87.2 | 4.6 | 4.6% | 15.7 | 0.7 | 0.7% |

| RCCAR23055 | 33 | 0 | 33 | Regolith | 2143 | 711 | 445 | 145 | 20% | 92.2 | 36.0 | 5.1% | 15.5 | 5.7 | 0.8% |

| RCCAR23055 | 4 | 33 | 37 | Rock | 1229 | 137 | 192 | 3 | 2% | 56.9 | 10.1 | 7.3% | 9.2 | 1.3 | 0.9% |

| RCCAR23056 | 14 | 0 | 14 | Regolith | 1478 | 617 | 268 | 122 | 20% | 61.9 | 32.7 | 5.3% | 10.7 | 5.9 | 1.0% |

| RCCAR23056 | 15 | 14 | 29 | Rock | 1210 | 103 | 179 | 4 | 4% | 47.6 | 7.0 | 6.7% | 7.1 | 1.0 | 0.9% |

| RCCAR23057 | 26 | 0 | 26 | Regolith | 2278 | 250 | 520 | 83 | 33% | 34.7 | 6.4 | 2.6% | 6.1 | 1.2 | 0.5% |

| RCCAR23057 | 14 | 26 | 40 | Rock | 1622 | 65 | 291 | 5 | 7% | 41.6 | 3.2 | 4.9% | 7.0 | 0.4 | 0.7% |

| RCCAR23057B | 25 | 0 | 25 | Regolith | 1265 | 233 | 227 | 76 | 33% | 22.7 | 6.0 | 2.6% | 3.7 | 1.0 | 0.4% |

| RCCAR23057B | 15 | 25 | 40 | Rock | 1524 | 54 | 264 | 4 | 7% | 39.3 | 2.7 | 5.1% | 6.1 | 0.3 | 0.6% |

| RCCAR23058 | 24 | 0 | 24 | Regolith | 1209 | 156 | 274 | 52 | 34% | 28.4 | 4.1 | 2.6% | 4.7 | 0.7 | 0.5% |

| RCCAR23058 | 5 | 24 | 29 | Rock | 875 | 43 | 180 | 10 | 24% | 20.5 | 1.1 | 2.6% | 3.5 | 0.2 | 0.5% |

| RCCAR23059 | 9 | 0 | 9 | Regolith | 1345 | 496 | 232 | 105 | 21% | 47.3 | 23.9 | 4.8% | 7.5 | 3.9 | 0.8% |

| RCCAR23059 | 11 | 9 | 20 | Rock | 613 | 73 | 89 | 2 | 3% | 21.9 | 5.1 | 7.0% | 3.1 | 0.6 | 0.9% |

| RCCAR23060 | 4 | 0 | 4 | Regolith | 542 | 234 | 70 | 44 | 19% | 27.9 | 12.5 | 5.3% | 3.8 | 1.9 | 0.8% |

| RCCAR23060 | 10 | 4 | 14 | Rock | 499 | 57 | 72 | 5 | 8% | 24.8 | 4.0 | 6.9% | 3.9 | 0.5 | 0.9% |

| RCCAR23061 | 16 | 0 | 16 | Regolith | 571 | 223 | 78 | 39 | 18% | 31.0 | 14.6 | 6.5% | 4.9 | 2.3 | 1.0% |

| RCCAR23061 | 6 | 16 | 22 | Rock | 603 | 59 | 72 | 2 | 3% | 33.9 | 5.0 | 8.5% | 5.2 | 0.7 | 1.1% |

| RCCAR23062 | 12 | 0 | 12 | Regolith | 1664 | 519 | 271 | 114 | 22% | 73.8 | 29.6 | 5.7% | 11.6 | 4.6 | 0.9% |

| RCCAR23062 | 6 | 12 | 18 | Rock | 1257 | 175 | 162 | 9 | 5% | 55.4 | 11.7 | 6.7% | 8.0 | 1.5 | 0.9% |

| RCCAR23063 | 12 | 0 | 12 | Regolith | 1747 | 564 | 441 | 173 | 31% | 66.1 | 23.5 | 4.2% | 11.5 | 4.1 | 0.7% |

| RCCAR23063 | 24 | 12 | 36 | Rock | 1088 | 77 | 167 | 4 | 5% | 47.6 | 4.9 | 6.3% | 7.7 | 0.6 | 0.8% |

| RCCAR23064 | 4 | 0 | 4 | Regolith | 4244 | 317 | 1146 | 95 | 30% | 98.8 | 9.1 | 2.9% | 19.1 | 1.7 | 0.5% |

| RCCAR23064 | 8 | 4 | 12 | Rock | 1204 | 85 | 183 | 5 | 6% | 29.5 | 4.0 | 4.8% | 4.7 | 0.5 | 0.6% |

| RCCAR23065 | 18 | 0 | 18 | Regolith | 1425 | 172 | 309 | 61 | 35% | 29.3 | 3.9 | 2.2% | 4.9 | 0.8 | 0.4% |

| RCCAR23065 | 2 | 18 | 20 | Rock | 1460 | 39 | 260 | 9 | 22% | 39.1 | 0.9 | 2.4% | 6.5 | 0.2 | 0.5% |

| RCCAR23066 | 19 | 0 | 19 | Regolith | 1718 | 493 | 332 | 150 | 31% | 33.3 | 15.3 | 3.1% | 5.3 | 2.4 | 0.5% |

| RCCAR23066 | 3 | 19 | 21 | Rock | 1112 | 6 | 211 | 1 | 23% | 23.5 | 0.1 | 2.3% | 3.8 | 0.0 | 0.6% |

| RCCAR23067 | 18 | 0 | 18 | Regolith | 785 | 182 | 91 | 56 | 31% | 11.3 | 3.3 | 1.8% | 1.7 | 0.6 | 0.3% |

| RCCAR23067 | 5 | 18 | 23 | Rock | 2248 | 57 | 526 | 10 | 17% | 54.7 | 2.2 | 3.9% | 8.9 | 0.3 | 0.5% |

| RCCAR23068 | 15 | 0 | 15 | Regolith | 1193 | 286 | 196 | 75 | 26% | 39.2 | 11.1 | 3.9% | 6.2 | 1.9 | 0.7% |

| RCCAR23068 | 9 | 15 | 24 | Rock | 1380 | 73 | 180 | 9 | 12% | 50.8 | 2.9 | 4.0% | 7.7 | 0.4 | 0.6% |

| RCCAR23069 | 28 | 0 | 28 | Regolith | 1169 | 134 | 166 | 19 | 14% | 32.1 | 6.0 | 4.5% | 4.5 | 0.8 | 0.6% |

| RCCAR23069 | 8 | 28 | 36 | Rock | 1966 | 132 | 271 | 4 | 3% | 85.3 | 7.1 | 5.4% | 12.2 | 0.8 | 0.6% |

| RCCAR23070 | 18 | 0 | 18 | Regolith | 2190 | 394 | 334 | 61 | 16% | 60.0 | 18.9 | 4.8% | 9.1 | 2.6 | 0.7% |

| RCCAR23070 | 5 | 18 | 23 | Rock | 2586 | 61 | 436 | 5 | 8% | 60.6 | 2.6 | 4.3% | 9.7 | 0.3 | 0.6% |

| RCCAR23071 | 20 | 0 | 20 | Regolith | 1194 | 265 | 181 | 79 | 30% | 28.1 | 7.1 | 2.7% | 4.1 | 1.2 | 0.4% |

| RCCAR23071 | 3 | 20 | 23 | Rock | 1300 | 67 | 209 | 13 | 19% | 36.7 | 1.8 | 2.7% | 5.5 | 0.3 | 0.5% |

| RCCAR23072 | 19 | 0 | 19 | Regolith | 576 | 142 | 68 | 29 | 20% | 16.8 | 5.6 | 4.0% | 2.0 | 0.8 | 0.6% |

| RCCAR23072 | 5 | 19 | 24 | Rock | 1112 | 30 | 173 | 4 | 15% | 33.9 | 1.1 | 3.5% | 4.4 | 0.2 | 0.5% |

| RCCAR23073 | 24 | 0 | 24 | Regolith | 1363 | 376 | 271 | 117 | 31% | 28.5 | 10.2 | 2.7% | 4.8 | 1.7 | 0.5% |

| RCCAR23073 | 5 | 24 | 29 | Rock | 1544 | 41 | 305 | 5 | 11% | 41.5 | 2.1 | 5.0% | 7.0 | 0.3 | 0.7% |

| RCCAR23074 | 17 | 0 | 17 | Regolith | 1676 | 280 | 397 | 92 | 33% | 37.7 | 7.4 | 2.6% | 6.7 | 1.3 | 0.5% |

| RCCAR23074 | 2 | 17 | 19 | Rock | 3546 | 105 | 859 | 16 | 15% | 90.6 | 4.6 | 4.4% | 16.0 | 0.6 | 0.6% |

| RCCAR23075 | 20 | 0 | 20 | Regolith | 799 | 235 | 149 | 77 | 33% | 16.5 | 6.3 | 2.7% | 2.8 | 1.1 | 0.5% |

| RCCAR23075 | 9 | 20 | 29 | Rock | 942 | 11 | 189 | 2 | 20% | 19.6 | 0.3 | 2.8% | 3.4 | 0.0 | 0.4% |

| RCCAR23076 | 10 | 0 | 10 | Regolith | 1262 | 277 | 147 | 87 | 31% | 13.9 | 6.2 | 2.2% | 2.2 | 1.1 | 0.4% |

| RCCAR23076 | 5 | 10 | 15 | Rock | 1634 | 17 | 305 | 4 | 23% | 31.8 | 0.5 | 2.7% | 5.1 | 0.1 | 0.5% |

| RCCAR23077 | 20 | 0 | 20 | Regolith | 2332 | 390 | 488 | 128 | 33% | 34.4 | 7.6 | 1.9% | 5.7 | 1.3 | 0.3% |

| RCCAR23077 | 5 | 20 | 25 | Rock | 1574 | 62 | 269 | 9 | 15% | 43.6 | 2.6 | 4.3% | 6.9 | 0.4 | 0.6% |

| RCCAR23077B | 18 | 0 | 18 | Regolith | 2397 | 531 | 473 | 183 | 34% | 28.3 | 8.6 | 1.6% | 4.9 | 1.5 | 0.3% |

| RCCAR23077B | 7 | 18 | 25 | Rock | 1203 | 25 | 199 | 5 | 22% | 36.8 | 0.8 | 3.1% | 5.8 | 0.1 | 0.4% |

1 Total Rare Earths ("TREO"): Considers all rare earths elements represented in oxide form ((Lanthanum - La 2 O 3 , Cerium - Ce 2 O 3 , Praseodymium - Pr 6 O 11 , Neodymium - Nd 2 O 3 , Samarium - Sm 2 O 3 , Europium - Eu 2 O 3 , Gadolinium - Gd 2 O 3 , Terbium - Tb 4 O 7 , Dysprosium - Dy 2 O 3 , Holmium - Ho 2 O 3 , Erbium - Er 2 O 3 , Thulium - Tm 2 O 3 , Ytterbium - Yb 2 O 3 , Lutetium - Lu 2 O 3 , Yttrium - Y 2 O 3 ).).

2 Desorbible Rare Earths ("DREO"): DREO is the recoverable fraction of TREO using the Circular Mineral Harvesting ammonium sulfate based metallurgical process.

SOURCE: Aclara Resources Inc.

View the original press release on accesswire.com