- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

August 16, 2022

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) is pleased to announce that the construction progress at its Abra Base Metals Mine (“Abra” or the “Project”) has reached 78% complete as of 31 July 2022. New milestones have been achieved with the commencement of the installation of the ball-mill components and total underground development passing 2km in early August.

Managing Director, Tony James commented, “Construction activities have progressed past 78% complete. Most of the concrete work has been completed and structural steel installation increased to 352 tonnes (72% complete). Plant construction work is quickly progressing into the mechanical, piping, and electrical fit out stages. It’s also pleasing to see the progress being made with the operational readiness activities including first fills and critical spares, with orders placed for over 75% of the items”.

Figure 1 – Abra ball mill installation (photo: 10 August).

Three other announcements were released by the company between this monthly update and the previous monthly update dated 18 July 2022. The first was “Re-release: Abra Initial Production Guidance” (ASX: 25 July 2022). The second was “Galena Successfully Raises

$17 Million” (ASX: 26 July 2022) and “Diggers and Dealers Investor Presentation” (ASX: 1 August 2022).

Update on Abra Project progress

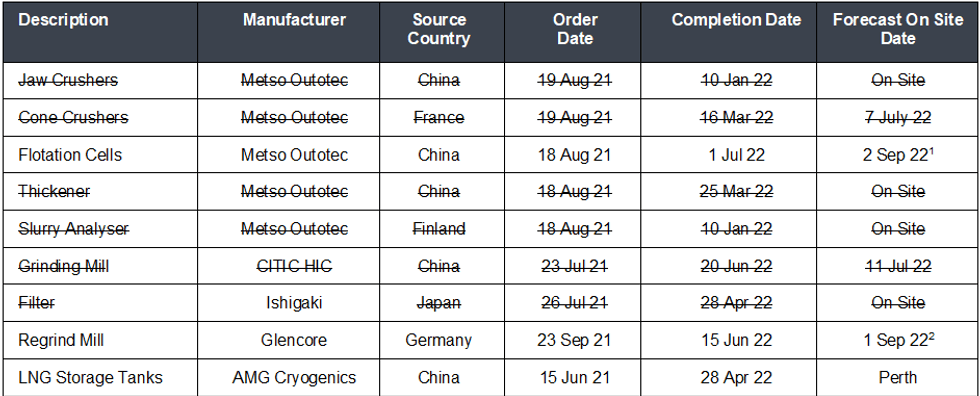

Overall progress continues to remain in line for Project completion, with first commercial production expected in Q1 CY2023. The processing plant engineering, procurement and construction has reached 85% complete. As previously advised, the remaining items on the key equipment order list shown in Table 1 below which are currently not received are the flotation cells and the regrind mill. The flotation cells and drive mechanisms are currently in shipment with 2 separate shipments delivering the flotation equipment to Fremantle. The flotation cells (bulk shipment) are currently expected to arrive by the 2nd September and the flotation drive mechanisms (container shipment) has arrived in Perth. The regrind mill is currently shipping from Germany and is now expected to arrive in Melbourne by 20th August. The regrind mill is being shipped to Melbourne so that Glencore Technology can finalise assembly with some Australian components. These revised arrival dates do not affect the project construction timelines.

Table Notes – All items with strike through have been delivered (1) Flotation equipment shipped in 2 separate parts. Flotation cells ETA now 2 September and Flotation drive mechanisms have arrived in Perth. (2) Regrind Mill ETA Melbourne 17 August for final assembly by Glencore Technology.

Table 1 – Key equipment order and delivery schedule from overseas suppliers.

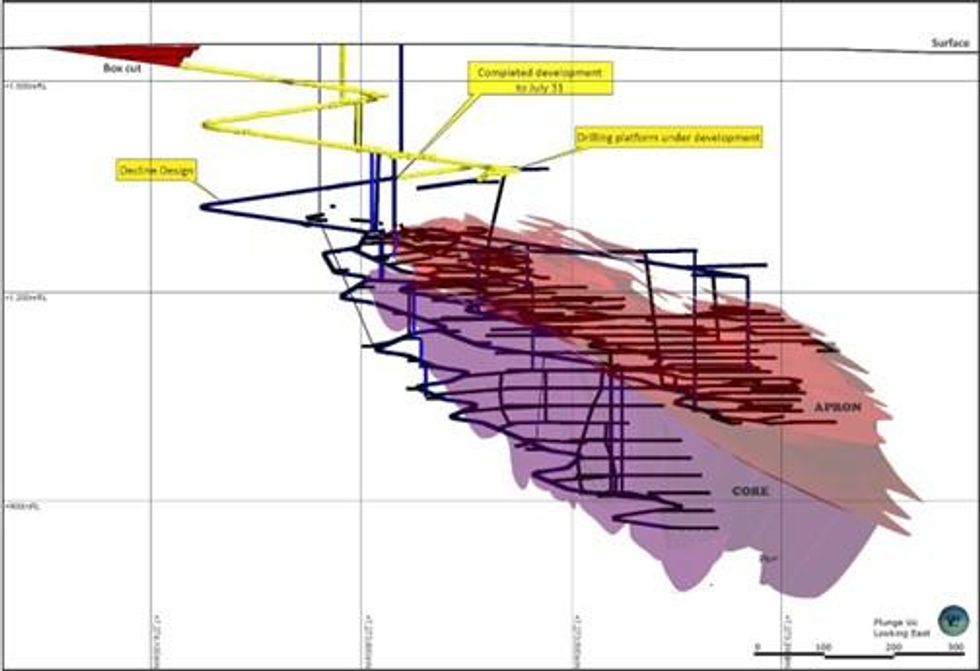

Mine decline development continued in the East Decline and the 1,375mRL diamond drill drive during July. A total of 243 metres was developed during July with the East decline reaching 1,360mRL. During July the second leg of the mines escape way system was drilled (1.5-meter raise bore) down to 1,400mRL (150m below surface). By the end of July, 16 underground diamond drill holes have been completed.

Figure 2 - Progress of the Abra underground mine development to 31 July (yellow).

In surface bulk earthworks, good progress continued with the tailing’s storage facility (“TSF”) passing 50% completion. The final works package associated with the remaining non- processing infrastructure is progressing as planned with the power station reaching 81% complete.

Owners' costs and contingencies remain within budget.

Figure 3 – Abra TSF construction.

Click here for the full ASX Release

This article includes content from GALENA MINING LTD., licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

23h

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

02 February

When Will Silver Stocks Catch Up to the Silver Price?

The silver price remains historically high despite a recent pullback, and many silver stocks haven't kept pace. Silver's strong performance over the past year is the result of a perfect storm of factors, including an entrenched supply deficit, growing industrial demand, a weakening US dollar and... Keep Reading...

02 February

BP Silver Initial Drilling Intersects Significant Mineralization Within Cosuño Lithocap

Hole CO-0001 Returns 29 Meters at 56 g/t Silver & 0.28 g/t Gold (80 g/t AgEq)

BP Silver Corp. (TSXV: BPAG) ("BP Silver" or the "Company") announces assay results ("Assays") from the first two drill holes of its eleven-hole Phase I drill program (the "Program") at the Cosuño Silver Project ("Cosuño") in Bolivia. The Company expects to release assays from the remaining nine... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00