November 30, 2022

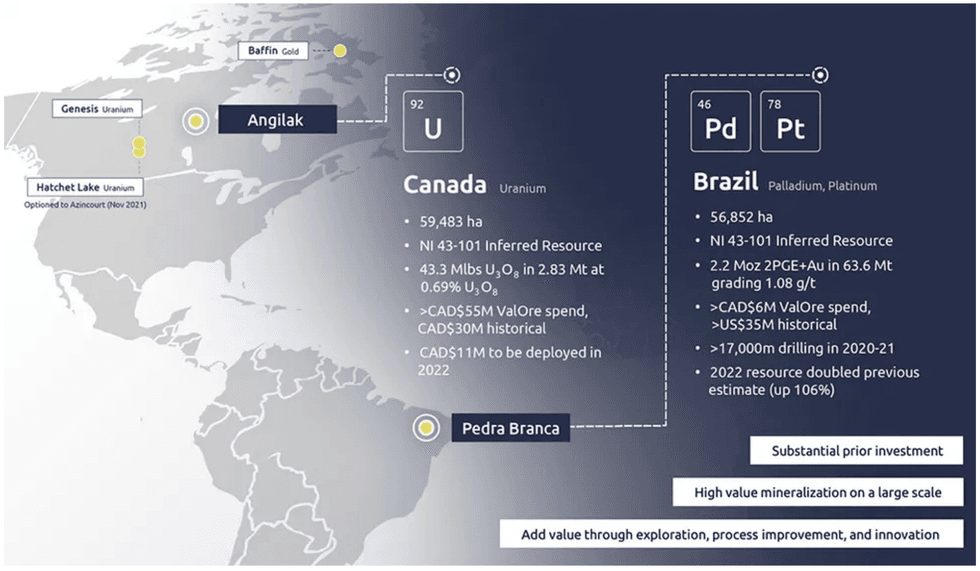

ValOre Metals (TSX:VO) focuses on high-quality metals and projects. The company's flagship uranium asset Angilak is located in Nunavut, Canada, covers 59,583 hectares, and has district-scale potential for uranium along with precious and base metals. The company is also exploring its Brazilian project targeting PGEs and gold.

The Angilak project has significant upside potential due to its land area and deposits. The area represents Canada’s highest grade uranium resource outside Saskatchewan and one of the highest grade uranium resources on a global basis, according to ValOre VP of exploration Colin Smith.

ValOre Metals is also exploring its Pedra Branca PGE project in northeastern Brazil. As another district-scale mining project, the asset covers 56,852 hectares with multiple PGE and gold deposits. Ownership of the asset gives ValOre control of an entire PGE belt. The company has three additional projects for future exploration: Hatchet Lake, Baffin Gold and Genesis.

The company a member of the Discovery Group, an alliance of nine publicly traded companies with a track record of successfully increasing shareholder value, often through tactful exits via mergers and acquisitions.

Company Highlights

- ValOre Metals is a Canadian exploration mining company focusing on district-scale, high-grade assets with uranium, PGE and gold deposits.

- The company is a member of the Discovery Group, an alliance of publicly traded companies striving to improve shareholder value through mergers and acquisitions.

- The Discovery Group has a track record of successful mergers and acquisitions that directly increase shareholder value. ValOre’s management team was involved in many of the Discovery Group’s notable transactions.

- The Angilak uranium project in Canada includes one of the highest-grade uranium deposits on a global scale. In addition, the project includes multiple notable uranium deposits, many of which reach the surface for straightforward extraction.

- ValOre’s Pedra Branca PGE-gold project in Brazil represents another district-scale opportunity and gives the company complete control over an entire PGE belt.

- An experienced management team with expertise in all aspects of the mining industry leads the company toward its goal of improving shareholder value.

This ValOre Metals profile is part of a paid investor education campaign.*

Click here to connect with ValOre Metals (TSX:VO) to receive an Investor Presentation

VO:TCM

The Conversation (0)

29 November 2022

Valore Metals

Exploring District-Scale Uranium, PGE & Gold Projects

Exploring District-Scale Uranium, PGE & Gold Projects Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00