- WORLD EDITIONAustraliaNorth AmericaWorld

December 27, 2023

Gladiator Resources Ltd (ASX: GLA) (Gladiator or the Company) is pleased to announce assay results for trenches at the SWC Target within its 724km2 Mkuju Uranium Project. The trenches have high-grade uranium mineralisation and support GLA’s model of gently dipping uraniferous sandstone layers with considerable strike extent. The next step is to drill-test the potential depth extension of these layers. No drilling, other than shallow auger holes, has been previously completed at the two identified zones which have a combined ‘strike-length’ of ~3km. The results affirm the Company’s view that there is potential for a significant sandstone-hosted uranium deposit at SWC, which is within the same geological basin as the Mantra/Uranium One’s world class “Nyota” deposit which has a Measured and Indicated MRE of 187 Mt at 306ppm U₃O₈ containing 124.6 Mlbs U₃O₈.

- Assay results for SWC target trenches received and confirm high-grade uranium in 4 of the 5 trenches and one of the mineralised layers is interpreted to be at least 6 m thick.

- Results include intervals above the upper detection limit of analytical method (4245ppm U₃O₈). These samples are being re-analysed by another method that has higher detection limits.

- Results indicate gently dipping layers of mineralised sandstone. The exposed part of the layer in Trench 4 layer has an average grade of 1727 ppm U₃O₈ and includes one sample above the upper detection limit of analytical method (4245ppm U₃O₈). This is the only trench on the north side of the target.

- The recentradiometric data and the trench and auger data define a combined ‘strikelength’ of the north and south zones of approximately 3 km.

- The excellent work by the geology team means that SWC is now drill-ready. No drilling other than shallow auger holes (in 2008) has been carried out at Gladiator’s targets.

- The trenches support the 2008 augerresults which included 8m @ 1,273ppm U₃O₈ from surface, including 2m@ 3,825ppm.

Trenching Program and results

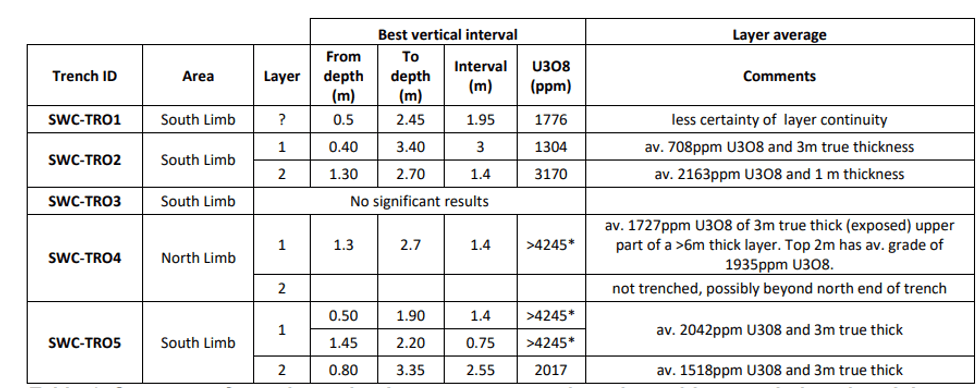

Gladiator completed 5 trenches at the SWC target in October 2023; four at the ‘South Limb’ zone and a single trench at the ‘Nouth Limb’ zone (Figure 1). A total of 454 metres of trenching was completed and the trenches were between 3.0 and 3.9 metres deep. Sampling was taken from vertical channels at 4.0 metre intervals along one sidewall of each trench. Table 1 provides the highest-grade vertical intervals from each trench and Figures 2 and 3 illustrate the results more comprehensively. Where average grades are reported these were calculated by length-weight averaging of the sample grades within each layer.

Of particular interest is trench 4 at the ‘North Limb’ zone:

- Gently northward dipping coarse-grained arkose sandstone layer with visible high-grade uranium (Figure 4).

- In the trench the upper part of the layer (~2 m true thickness) has an average grade of 1935ppm U3O8. The material lower in the trench has an average grade of 676ppm U3O8.

- A 1.4 m sample from this layer has over 4245 ppm which is the upper detection limit for the pressed powder analytical method and will be re-analysed using the fusion method to obtain the actual value.

- Based on a nearby 2008 auger hole (MRSA6, 30 m to the east) the layer in the trench may be the upper part of a layer at least 6 m in thickness - the auger hole ended in mineralisation (510 ppm U3O8) at 7 metres depth.

- This trench is the only one at the ‘North Limb’ zone of SWC. It would have been ideal to have more trenching completed but the onset of the wet season prevented further work. It is clear that drilling is needed to follow the layer ‘down-dip’.

Trench 2 and 5 at the ‘South Limb’ zone:

- These trenches are 650 m apart and both intersect what may be two southward dipping mineralised layers approximately 4m apart, hosted in coarse-grained sandstone.

- In Trench 5 the first (southernmost) layer has an average grade of 2042ppm U3O8 and has an approximate (true) thickness of 3m. Within this are 2 samples with over 4245 ppm, the upper detection limit for the analytical method. In Trench 2 the same layer has an average grade of 708ppm U3O8 and a similar average (true) thickness.

- The second and northernmost mineralised layer in Trench 5 has average grade of 1518ppm U3O8 and has an approximate (true) thickness of 3m. The same layer in Trench 2 has an average grade of 2163ppm U3O8 and is approximately 1.0 m thick

Click here for the full ASX Release

This article includes content from Gladiator Resources , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLA:AU

The Conversation (0)

29 May 2024

Gladiator Resources

Capitalizing on the uranium momentum with prolific assets in Tanzania

Capitalizing on the uranium momentum with prolific assets in Tanzania Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00