July 14, 2024

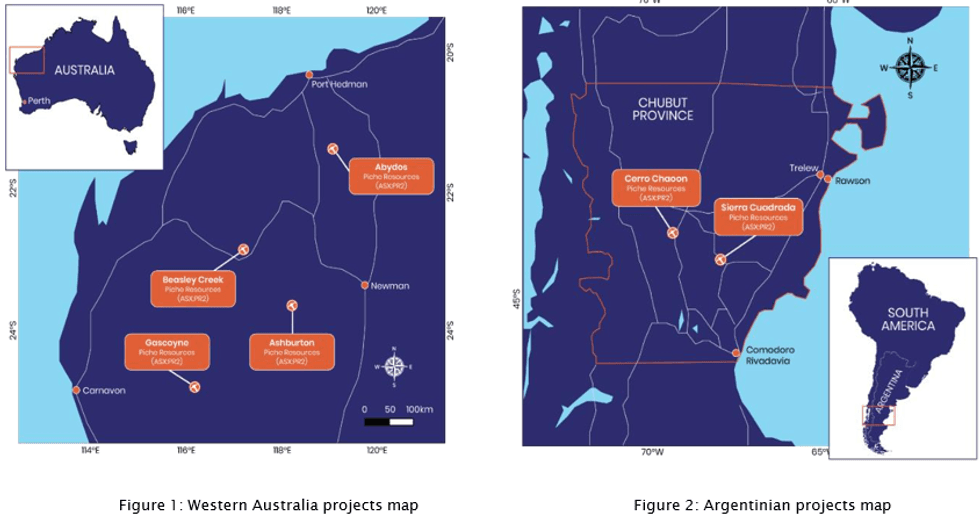

Piche Resources Limited (ASX: PR2) (“Piche” or the “Company”), a mineral exploration company focussed on uranium and gold in Western Australia (WA) and Argentina, is pleased to announce its upcoming listing on the Australian Securities Exchange (ASX) at 10:00am Perth AWST time on Monday 15 July 2024 under the ticker code PR2.

HIGHLIGHTS

- Piche Resources Limited shares to commence trading on the ASX today (Monday 15 July 2024) at 10:00am AWST (ASX: PR2)

- The IPO raised a total of $10.0 million (before costs) at A$0.20 per share with an excellent register of international & Australian funds, and high net worth and retail investors

- Capital raised will be used to advance drill ready tier 1 exploration targets in Australia and Argentina, and working capital

- Pre-IPO funds have been applied to progress land tenure, community engagement, land access agreements and prepare for the imminent drilling campaign at Sierra Cuadrada and Ashburton projects (uranium) and Cerro Chacon (gold)

Euroz Hartleys acted as Lead Manager to the IPO and introduced investor participation from a number of international & Australian funds combined with high net worth, retail investors and Piche directors and management.

Funds raised will be used to advance the Company’s drill ready exploration targets, including the Australian Ashburton project, the two Argentina projects Sierra Cuadrada & Cerro Chacon and working capital requirements. Importantly, the majority of funds raised will be allocated to exploration of the key uranium and gold projects.

Project Portfolio – Western Australia and Argentina

KEY FOCUS

With the ASX IPO now completed, Piche intends to accelerate exploration activities on three targets at the Ashburton Project in Western Australia, and at Sierra Cuadrada and Cerro Chacon in Argentina.

Piche’s immediate attention will be at the Ashburton Project in WA, where previous drilling in the 1980’S delivered high grade uranium from the Angelo River Prospect. Piche will be seeking to replicate historical drilling results to assist in driving a JORC Resource estimate at Angelo River.

Longer term, Piche aims to build a significant mining group with separate uranium, gold, and base metal companies under its banner, capitalising on an improving commodity market.

Click here for the full ASX Release

This article includes content from Piche Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

10h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

22h

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00