- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

September 17, 2024

Trillion Energy (CSE:TCF,OTCQB:TRLEF,Frankfurt:Z62) is a key player in Europe and Turkey's energy market, focusing on oil and gas exploration projects. Strategic investments and infrastructure set to meet energy demand in 2024 and beyond.

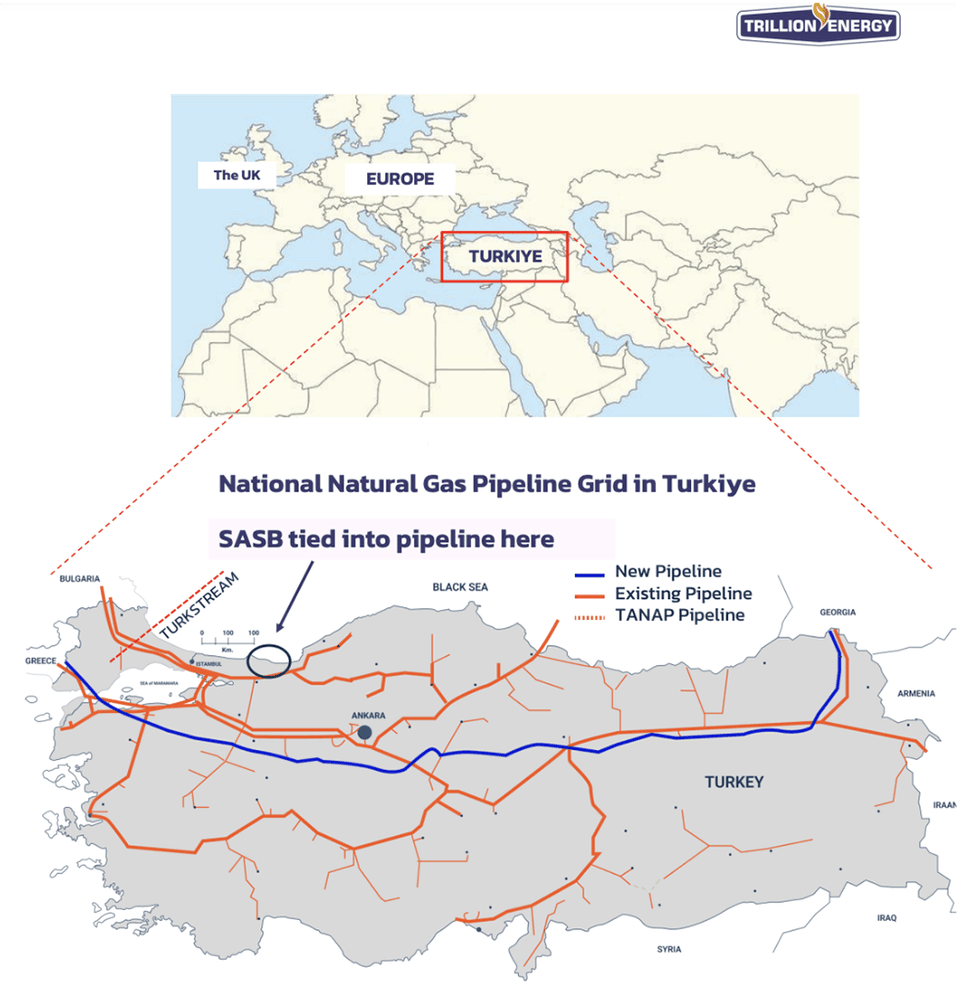

Trillion Energy operates primarily in the Black Sea region, where it has been rapidly increasing its natural gas production at SASB gas field since 2022. The company also expands into oil and gas exploration, particularly in Southeast Turkey. With established infrastructure, including gas plants and pipelines, the company is set to play a critical role in meeting the region’s energy demand in 2024 and beyond.

The SASB Gas Field in the Black Sea, off Turkey, is a significant natural gas project redeveloped by Trillion Energy. The gas field has produced over 43 billion cubic feet (BCF) of gas. SASB plays a crucial role in Turkey’s domestic energy supply

Company Highlights

- Holds a 49 percent interest in the Black Sea's SASB gas field, with 323 billion cubic feet (BCF) of original gas in place (OGIP) and proven reserves valued at USD $421 million (NPV10).

- Production increased by 300 percent from 2022 to 2023, with 17+ wells planned for development.

- Focus on high-impact oil exploration in Southeast Turkey, targeting fields with production rates of 10,000 barrels per day.

- Raised $55 million in equity and $15 million in subordinated debt for ongoing projects.

- Successfully drilled 5 long-reach natural gas production wells using novel technology in the Black Sea.

This Trillion Energy profile is part of a paid investor education campaign.*

TCF:CNX

Sign up to get your FREE

Trillion Energy International Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

16 September 2024

Trillion Energy International

Focused on exploration, production, and distribution of oil and natural gas in Turkey and Europe.

Focused on exploration, production, and distribution of oil and natural gas in Turkey and Europe. Keep Reading...

30 May

Trillion Energy Announces Debt Settlements

Trillion Energy International Inc. (" Trillion " or the "Company ") (CSE: TCF) (OTCQB: TRLEF) (Frankfurt: Z62), announces that it proposes to issue an aggregate of 2,237,082 common shares of the Company in settlement of $101,854.10 in debt owed by the Company to consultants and an officer of the... Keep Reading...

27 February

Trillion Energy Announces Payment of Director Fees and Debt Settlements

Trillion Energy International Inc. (" Trillion " or the "Company ") (CSE: TCF) (OTCQB: TRLEF) (Frankfurt: Z62), announces the issuance of an aggregate of 3,516,493 common shares of the Company in settlement of $204,436.07 in debt owed by the Company to directors, officers and consultants (the "... Keep Reading...

13 February

Trillion Energy Announces SASB Field Operational Update

Trillion Energy International Inc. (" Trillion " or the "Company ") (CSE: TCF) (OTCQB: TRLEF) (Frankfurt: Z62), is pleased to announce an operational update for the SASB offshore gas project, Turkey. During January 2025 the Company completed installation of new velocity string tubing in two... Keep Reading...

06 January

Trillion Energy Announces Completion of Alapli-2 Gas Well

Trillion Energy International Inc. (" Trillion " or the "Company ") (CSE: TCF) (OTCQB: TRLEF) (Frankfurt: Z62), is pleased to announce the successful installation of 2 38" velocity string tubing (VS) into the Alapli-2 natural gas well. This achievement marks a significant step in our ongoing... Keep Reading...

03 January

Trillion Energy Announces CEO Retirement and New Management Appointments

Trillion Energy International Inc. (" Trillion " or the "Company ") (CSE: TCF) (OTCQB: TRLEF) (Frankfurt: Z62), announces that the Company's Board of Directors has accepted Arthur Halleran's resignation and retirement as Chief Executive Officer and Director of the Company, effective December 27,... Keep Reading...

05 November

Angkor Resources Identifies Third Drill Prospect on Block VIII Oil & Gas License, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - Nov. 5, 2025 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the results of our North Bokor seismic program leading to the confirmation of a third anticlinal dome structure buried under the flat valley... Keep Reading...

05 November

CHARBONE Appoints Patrick Cuddihy as Senior Vice President - Strategic Affairs

(TheNewswire) Brossard, Quebec, November 5, 2025 TheNewswire - CHARBONE CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (" CHARBONE " or the " Company "), a North American producer and distributor specializing in clean Ultra High Purity (" UHP ") hydrogen and strategic industrial gases,... Keep Reading...

05 November

CHARBONE annonce la nomination de Patrick Cuddihy au poste de Vice-president principal - Affaires strategiques

(TheNewswire) Brossard, Quebec, le 5 novembre 2025 TheNewswire - CORPORATION CHARBONE (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« CHARBONE » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

31 October

CHARBONE Engages US-Based Investor Relations Firm RBMG

(TheNewswire) Brossard, Quebec TheNewswire - October 31, 2025 CHARBONE CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (" CHARBONE " or the " Company "), a North American producer and distributor specializing in clean Ultra High Purity (" UHP ") hydrogen and strategic industrial gases,... Keep Reading...

31 October

CHARBONE Engage la Societe Americaine de Relations aux Investisseurs RBMG

(TheNewswire) Brossard, Quebec TheNewswire - le 31 octobre 2025 CORPORATION CHARBONE (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« CHARBONE » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

31 October

Quarterly Activities/Appendix 4C Cash Flow Report

MEC Resources (MMR:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Trillion Energy International Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

E-Power Announces Results of Annual Meeting

07 November

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00