November 20, 2024

Tempest Minerals Limited (ASX: TEM) is pleased to update that recent RC drilling at the Remorse Target has identified the presence of thick, high-grade, magnetite-hosted iron in initial assays which has now been confirmed with multiple drill holes over several kilometres of strike length. The Remorse Target is situated within the Company’s 100% owned Yalgoo Project which has multiple world-class iron ore operations nearby.

Key Points

- Additional high-grade magnetite iron intercepted in RC drilling

- Consistent intercepts over >2 km of drilled strike length

- Identical outcropping geology mapped over a 5 km total strike length

- Potential for a large-scale iron ore deposit nearby other world-class processing facilities

Remorse Target

High-grade iron

In addition to the lab results for the first drillhole previously reported 1, the Company is pleased to announce the completion of drilling and that follow-up results in subsequent drillholes confirm the presence of high-grade iron at the Remorse Target. New results include:

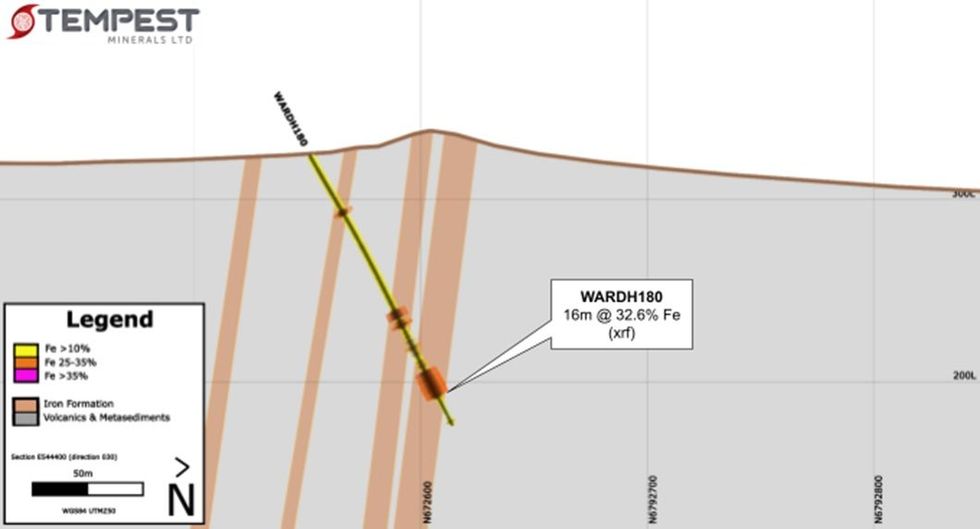

WARDH00180 16m @ 32.6% Fe from 93m (pXRF)

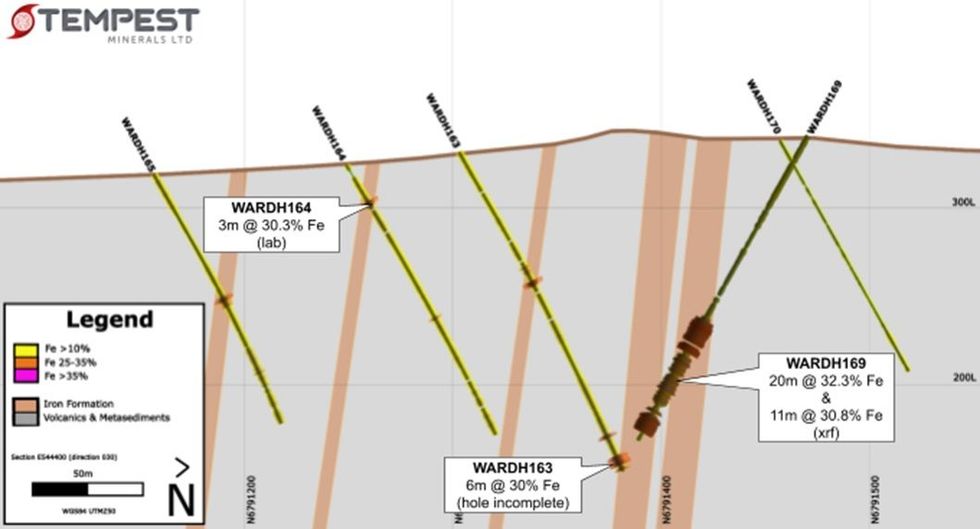

WARDH00169 20m @ 32.3% Fe from 120m (pXRF)

and 11m @ 30.8% Fe from 182m (pXRF)

WARDH00166 7m @ 32.8% Fe from 96m (Lab)

WARDH00171 8m @ 30.1% Fe from 130m (pXRF)

* Portable XRF (pxrf) results are not comparable in reliability to authorised laboratory results and should be not relied on for quantitative purposes outside indicative demonstrations of potential order of magnitude of enrichments.

Background

TEM has completed the first phase of RC drilling at the Remorse Target of its flagship Yalgoo Project. In total, 21 RC holes were drilled for 4,005m. Samples have been Boxscanned (pXRF) and submitted to the lab and final assay results are expected in December 2024.

The previously reported iron intercept from the first hole drilled at Remorse was WARDH00160 of 32m @ 30.0% Fe from 96m (including 7m @ 37% Fe) (Lab).

The Remorse Target is part of Tempest's broader Yalgoo Project which spans over 1,000 square kilometres of prospective terrain for base metals, precious metals and iron ore.

All samples collected have been analysed using a Boxscan unit which includes a mounted portable X-ray fluorescence (pXRF). Although not as accurate as laboratory analysis, pXRF data when collected in a quality and consistent manner can also exhibit high accuracy and precision. The pXRF data has been compared with assays received to date (>800 samples) and has an average variance of -4.2% and a median of -4.3%. The results indicate the accuracy is considered acceptable for current exploration reporting purposes (and potentially an overall slight underestimation by pXRF).

Remaining assay results are due in December and are expected to correlate strongly with the pxrf results announced.

As previously advised, the drill program design was focused on the strong base metal geochemical anomaly exhibited at the Remorse Target 2. The planned holes were focused strongly on testing the 'hanging wall' stratigraphy at Remorse and were not initially focused on the newly identified iron layer. However, the program did result in the 4 most northerly drill holes intercepting the main magnetite layer and numerous holes intercepting adjacent magnetite-rich layers.

The widely spaced drilling shows continuity and consistency over more than 2 kilometres and identical iron-rich stratigraphy outcrops can be traced over an extensive 5-kilometre zone correlating with the original Remorse Target footprint.

Click here for the full ASX Release

This article includes content from Tempest Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TEM:AU

The Conversation (0)

03 February 2025

Tempest Minerals

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

25 June 2025

Completion of Shortfall Offer

Tempest Minerals (TEM:AU) has announced Completion of Shortfall OfferDownload the PDF here. Keep Reading...

15 June 2025

Further Excellent Metallurgical Results From Remorse-Yalgoo

Tempest Minerals (TEM:AU) has announced Further Excellent Metallurgical Results From Remorse-YalgooDownload the PDF here. Keep Reading...

10 June 2025

Entitlement Offer Results

Tempest Minerals (TEM:AU) has announced Entitlement Offer ResultsDownload the PDF here. Keep Reading...

30 May 2025

Geochemical Sampling Extends Sanity Gold Anomalies - amended

Tempest Minerals (TEM:AU) has announced Geochemical Sampling Extends Sanity Gold Anomalies - amendedDownload the PDF here. Keep Reading...

20 May 2025

Yalgoo - Geochemical Sampling Extends Sanity Gold Anomalies

Tempest Minerals (TEM:AU) has announced Yalgoo - Geochemical Sampling Extends Sanity Gold AnomaliesDownload the PDF here. Keep Reading...

2h

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

2h

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

2h

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

12h

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00