- WORLD EDITIONAustraliaNorth AmericaWorld

July 27, 2023

Strategy: To secure additional Low-Cost Li supply for PAM’s mid-stream lithium chemical initiatives

Battery and critical metals explorer and developer Pan Asia Metals Limited (ASX: PAM) (‘PAM’ or ‘the Company’) is pleased to announce that it has entered into binding Memorandums of Understanding (MOUs) to assess a significant suite of lithium

projects situated in the Tarapaca and Antofagasta regions of the Atacama Desert in northern Chile. The projects, collectively known as the Tama-Atacama Lithium Project, are divided into six main areas and extend over 290km from north to south and encompass approximately 1400km2 of Exploration Concession applications and granted Exploration Concessions as shown in Figure 1.

HIGHLIGHTS

- Pan Asia Metals (PAM) has entered into binding MOUs to acquire highly prospective lithium (Li) brine and clay projects in northern Chile

- PAM is entering into a world-class district at an opportune time, securing projects that have the potential to be both large scale and low cost

- The Tama-Atacama Lithium Project comprises six key project areas in northern Chile extending over 290km north to south and covering an area of approximately 1400km2

- Based on well-established geology and work completed to date, the Project demonstrates strong potential for Li brine and Li in clay deposits hosted in the Pampa del Tamarugal basin in the northern part of the Atacama Desert

- Project areas adhere to PAM’s requirement for high prospective projects which are easily accessible, close to all key infrastructure, with ample water supply

- Significant lithium values and by-product/pathfinders identified in surface sampling of salt and clay layers

- Highly elevated Li in surface samples with 57 of 185 samples >250ppm Li averaging 702ppm Li and ranging up to 2200ppm Li

- Elevated boron, potassium and magnesium commonly associated with elevated Li

- Geochemical signature of surface salt crusts and clays similar to that of Salar de Atacama

- Projects have excellent infrastructure including major highway access via the Pan Americana 5 Highway, water (salt and fresh), solar power, nearby ports, airports and major logistics hubs

- Located at an altitude of 800-1100 mASL in hyper-arid environment, with little to no rainfall and extreme evaporation

- Vendor consortiums have extensive in-country experience in terms of permitting, exploration and evaluation

- Vendors will continue to be engaged with PAM in Chile to assist with evaluating current projects and assessing target opportunities in the region

- Drilling at PAM’s, and some other nearby third party projects, have identified brine and clay potential

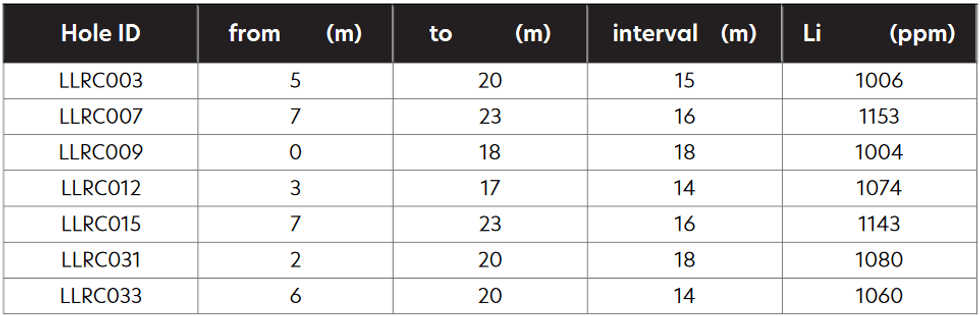

- Drilling conducted at the PAM’s Hilix project in 2008 by ASX-listed Lefroy Resources Limited encountered lithium rich clays from surface to around 30m below surface, Li mineralisation essentially remains open in all directions

- Assay results include:

Pan Asia Metals Managing Director, Paul Lock, said: “The Tama-Atacama Lithium Project is the result of many, many hours of research and enquiry. The Project comes with an agreement with Jacob Rebek to be PAM’s Geological Advisor for Chile and Thomas Eggers to be PAM’s Consulting Country Manager for Chile. This was an important step to ensure that PAM is well represented and informed, and to ensure the Project progresses speedily.

We believe that much of the commentary about Chilean lithium policy is ill-informed and has served only to create an exploration application void for companies like PAM to take the advantage of, i.e. there is very little competition, which has enabled PAM to secure very high quality projects in a hotly contested region. If anything, policy developments in Chile can only be considered positive.

When we look at the global peer group, we see many lithium exploration projects underway, but we also see that many of these will be high cost, which is being demonstrated in actual operating results. As a result of the success of PAM’s midstream lithium chemical strategy to date, we are seeing a need for supply certainty in the medium to long term. Supply certainty is front of mind for PAM’s partners and our projects in southeast Asia can only supply so much feedstock – albeit it will be low cost. As a result, PAM embarked on a strategy to secure assets which are strategic and present potential for longer term higher volume low cost supply. The beauty of PAM’s Tama-Atacama Lithium Project, which in some respects is absolutely unique, is that it has all the hallmarks of a well situated, low cost project, i.e. all infrastructure is immediately available, the project is located in close proximity to large population centres with large port facilities, a commercial airport, a workforce, and a large water supply – being the ocean. Further, the Tama-Atacama Lithium Project is an all season project. All three salars we inhabit, being Salar Dolores, Pintados and Belavista, are at much lower elevations than any other lithium rich salars in the global lithium peer group. Therefore PAM is very well positioned for evaporation and water replacement operations – i.e. sea water to replace brine – and there is ample room for photovoltaics should DLE technologies start to prove economic, allowing the use of DLE with a low carbon footprint.

All in all, the Tama-Atacama Lithium Project positions PAM very well to create a large long term, low cost supply of lithium which is complimentary to PAM’s midstream lithium chemical processing aspirations in Southeast Asia and, with the right lithium chemical processing partners, also in Chile”.Click here for the full ASX Release

This article includes content from Pan Asia Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PAM:AU

The Conversation (0)

09 July 2023

Pan Asia Metals

First-mover Advantage in Critical Metals for Southeast Asia Market

First-mover Advantage in Critical Metals for Southeast Asia Market Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00