- WORLD EDITIONAustraliaNorth AmericaWorld

Investor Insight

Adisyn’s innovative products and services leveraging a multi-billion-dollar Australian defence market and focusing on the underserved, high-potential SME market, provide a compelling investment case for technology investors.

Overview

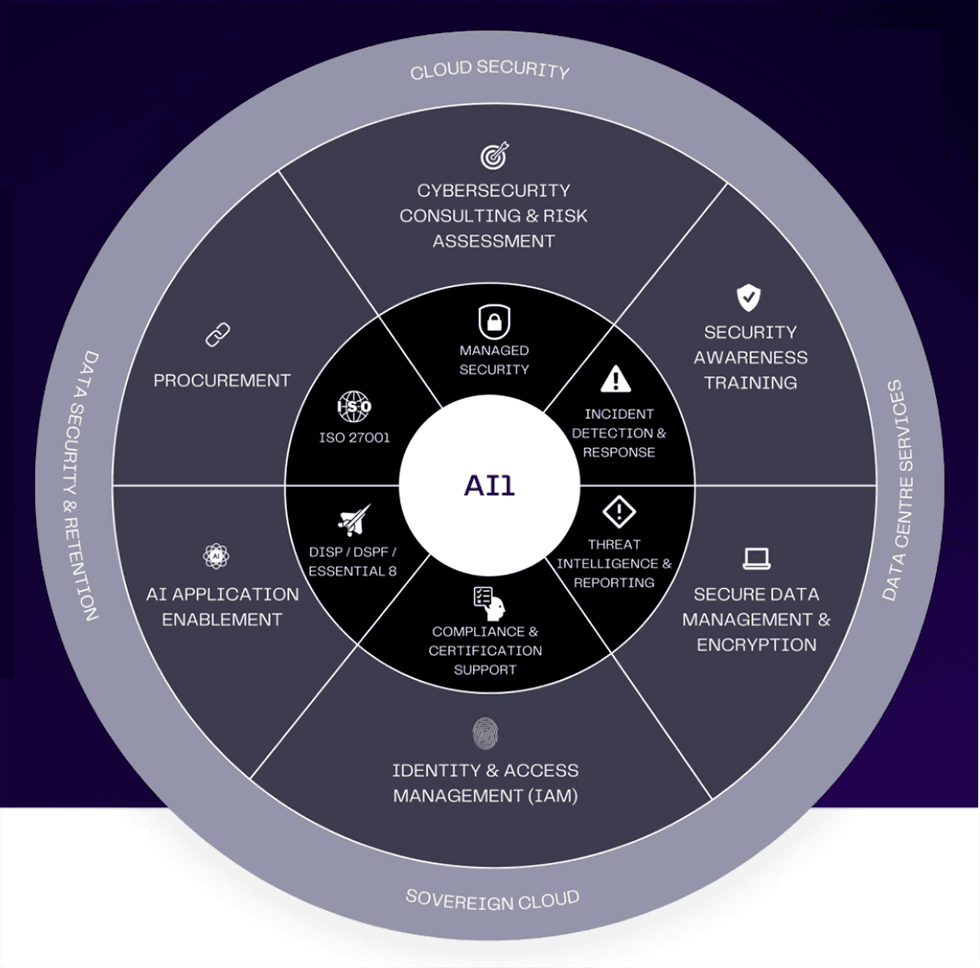

Adisyn (ASX:AI1) is an ASX-listed company offering a comprehensive suite of products and services to SMEs operating in the fast-growing Australian defence industry supply chain. The company’s service offerings revolve around data protection, management and security. Adisyn has been focusing on cybersecurity and AI as the two key growth areas, confident these two verticals will offer significant growth opportunities as the data centre and cloud markets evolve.

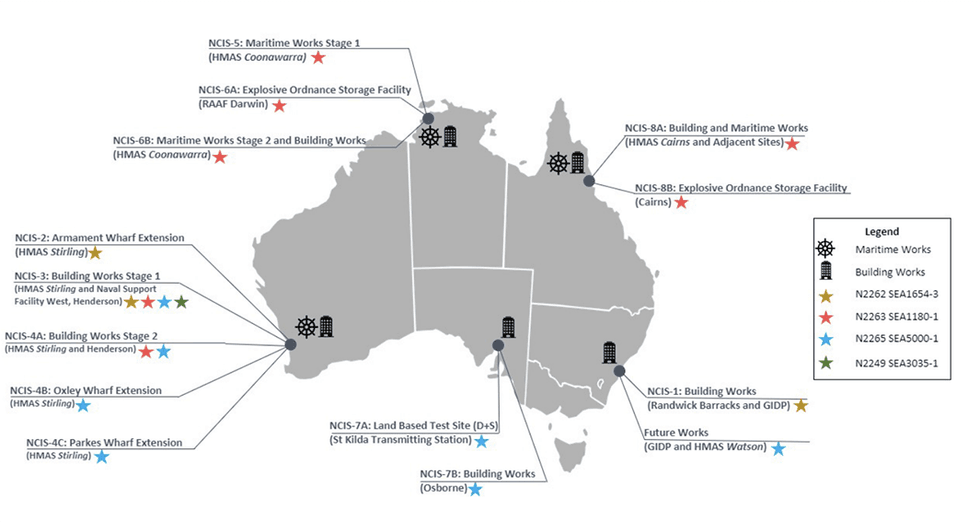

The Australian Government plans to inject an extra $5.7 billion into its defence capability by 2027-28, with an additional $50.3 billion allocated for the following decade until 2033-34, surpassing previous projections. This funding surge will escalate the defence budget to approximately $100 billion by 2033-34, totaling $765 billion over the decade. Moreover, the government will earmark $15 billion to $20 billion specifically to bolster cyber domain capabilities during this period.

The surge in Australian defence spending is fueling demand for SMEs that operate in the defence supply chain. SMEs are ill-equipped to handle cybersecurity threats and need a trusted partner who specializes in cyber threat protection, regulatory compliance, and IT security infrastructure management. Adisyn is dedicated to becoming the go-to partner for SMEs aiming to enhance their sovereign data and security practices, particularly in sectors where national security concerns necessitate rigorous data protection measures.

To achieve this, Adisyn has laid out a four-phased strategic plan. The first phase, completed in 2023, focused on business restructuring, rebranding and bringing new management. The second phase, ongoing in 2024, focuses on the expansion of the advisory board, IP development, strategic technology partnerships, and business development. The company has commenced the expansion of the advisory board with the appointment of Harry Karelis in February 2024. Karelis will focus on identifying and securing strategic partnerships and assisting with investor relations and general business development activities.

In July 2024, Adisyn announced a collaboration agreement with 2D Generation, an international semi-conductor IP business. The two companies leverage artificial intelligence to advance the development of high-performance, energy-efficient semiconductor solutions crucial for AI and data centres.

The company anticipates the announcement of several key strategic partnerships that will significantly expand its current suite of cyber capabilities and distinctly set Adisyn apart in the marketplace.

During its third and final phase, scheduled from 2025 to 2026 and beyond, the company will aim for Australia wide expansion and acquisitions and strive to establish itself as a preferred service provider to SMEs operating in the defence supply chain.

Get access to more exclusive Cybersecurity Investing Stock profiles here