September 25, 2024

Piche Resources Limited (ASX: PR2) (“Piche” or the “Company”), is pleased to announce the first outstanding intersections received from its reverse circulation drilling programme on its Ashburton project in Western Australia. The results confirm the mineralisation and its downdip continuation at the Angelo A prospect.

HIGHLIGHTS

- Assay results from the first six reverse circulation (RC) drill holes completed at the Angelo A prospect within Piche’s Ashburton project have all returned significant high grade uranium mineralisation.

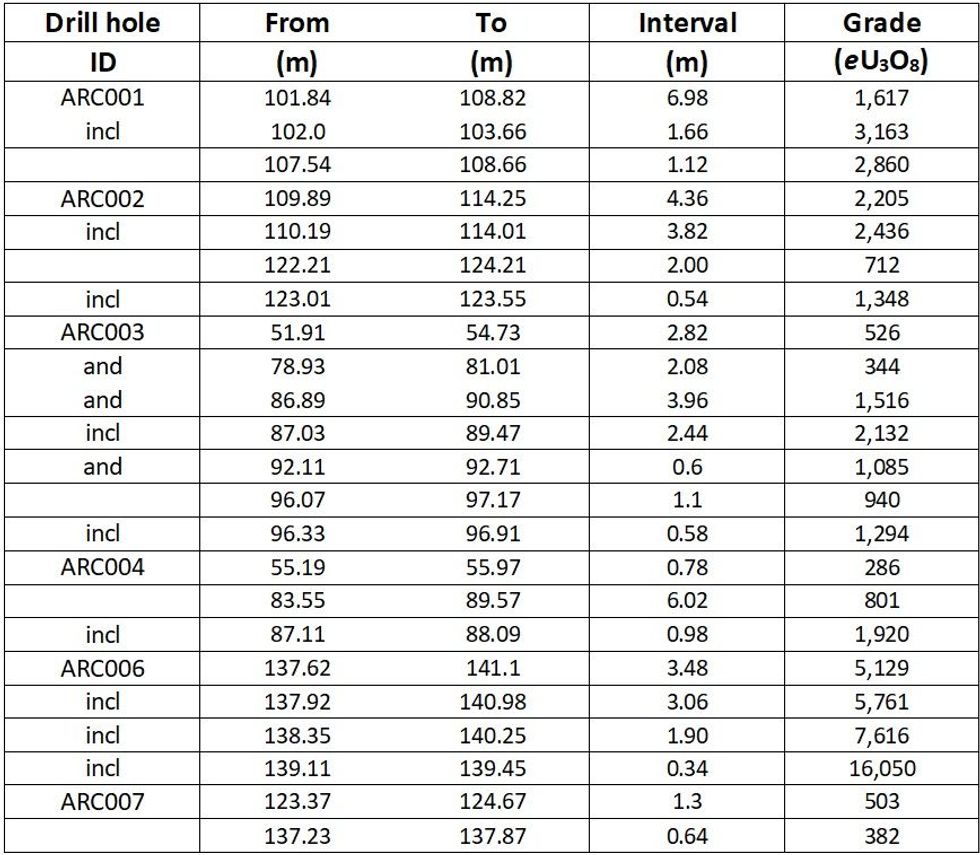

- Equivalent U3O8 concentrations have been calculated from downhole gamma surveys and results include:

- ARC001 6.98m @ 1,617 ppm eU3O8 from 101.84 metres

- ARC002 4.36m @ 2,205 ppm eU3O8 from 109.89 metres

- ARC003 3.96m @ 1,516 ppm eU3O8 from 86.89 metres

- ARC004 6.02m @ 801 ppm eU3O8 from 83.55 metres

- ARC006 3.45m @ 5,129 ppm eU3O8 from 137.62 metres incl 0.34m @ 16,050 ppm eU3O8 from 139.11 metres

- ARC007 1.30m @ 503ppm eU3O8 from 123.37 metres.

- The ongoing drilling programme is designed to confirm previous high grade uranium results at the Angelo A & B prospects, test a revised model for the controls on mineralisation and identify extensions to the existing mineralisation.

- The drilling is targeting Proterozoic unconformity style uranium mineralisation, like the Pine Creek Geosyncline in Australia and the Athabasca Basin in Canada.

- Further RC results will be released as the drilling programme continues and a diamond drill rig will be mobilised to site in the coming week.

The continuing drilling programme is being undertaken at, and along strike of, the Angelo A prospect. No exploration activities have been carried out at Angelo A over the last 40 years.

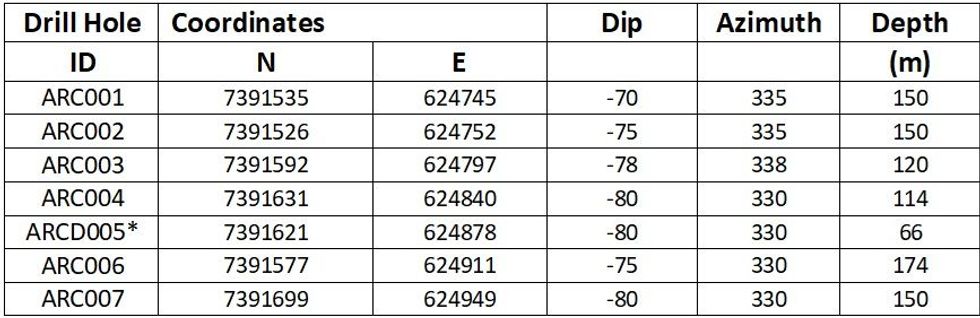

*ARCD005 is a pre-collar to a planned diamond drillhole which will be completed on arrival of the diamond drill rig

The drill rig will move to Angelo B prospect, approximately 1.3km to the northeast, following the completion of the Angelo A drilling.

This programme will be followed by a diamond drilling programme scheduled for later this month. These drilling programmes are planned to confirm the results from previous exploration by drilling several twin holes, to test a revised model for the control of the uranium mineralisation and explore for extensions to the mineralisation identified between 1973 and 1984.

The project area is located approximately 140km to the west-southwest of Newman in the Pilbara region of Western Australia (Figure 1). Piche holds three tenements totalling about 122km2 in its Ashburton Project (Figure 2).

Piche’s Managing Director, Stephen Mann, commented:

“The Company is very excited following the receipt of results from the first six holes of Piche’s initial drilling programme on its Ashburton Project. Not only have we confirmed the historical results with several twin holes, but we have shown that the mineralization continues downdip. Drilling to date has confirmed that mineralisation occurs within the typical unconformity model, with highly altered uranium rich sandstones at the unconformity, and the potential of mineralized “feeder” zones extending steeply below that unconformity zone. It is expected that further drilling in this campaign should result in more clarity of the distribution and controls of mineralization”.

Previous explorers at the Ashburton Project area focused their efforts on the unconformity between the mid Proterozoic sandstones and the early Proterozoic basement complexes.

The Ashburton Project area hosts unconformity-related uranium mineralisation. Unconformity uranium style deposits constitute approximately 20% of Australia’s total uranium resources and about one-third of the western world’s uranium resources and include some of the largest and richest uranium deposits2. Minerals are uraninite and pitchblende. The main deposits occur in Canada (the Athabasca Basin, Saskatchewan and Thelon Basin, Northwest Territories); and Australia (the Alligator Rivers region in the Pine Creek Geosyncline, NT and Rudall Rivers area, WA1). In both Canada and Australia mineralisation is often found at the unconformity and in the basement complex well below the unconformity.

Uranium mineralisation at the Ashburton Project area occurs along the Lower Proterozoic Wyloo Group/Mid Proterozoic Bresnahan Group contact. Uranium mineralisation has previously been identified from broad spaced drilling at Angelo A and B prospects (Figure 3). Mineralisation intersected in this first phase of drilling by Piche has identified significant uranium at, or near the unconformity, but also in units immediately above the unconformity and well into the underlying basement units. Mineralisation is commonly associated with hematitic alteration of felspathic medium to coarse grained sandstones and is spatially associated with carbonaceous and graphitic shales. Visible uraninite has been recognised in several intersections.

Click here for the full ASX Release

This article includes content from Piche Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

silver-investinguranium-investingasx-stocksasx-pr2gold-explorationgold-investinggold-stockscopper-investing

PR2:AU

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

25 February

Board Changes

Piche Resources (PR2:AU) has announced Board ChangesDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

04 December 2025

Commences Maiden RC Drilling at Cerro Chacon Gold Project

Piche Resources (PR2:AU) has announced Commences Maiden RC Drilling at Cerro Chacon Gold ProjectDownload the PDF here. Keep Reading...

06 November 2025

Reinstatement to Quotation

Piche Resources (PR2:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

06 November 2025

$2million placement to advance Argentine exploration

Piche Resources (PR2:AU) has announced $2million placement to advance Argentine explorationDownload the PDF here. Keep Reading...

2h

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

2h

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

13h

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

23h

Canadian Investment Regulatory Organization Trade Resumption - IMR

Trading resumes in: Company: iMetal Resources Inc. TSX-Venture Symbol: IMR All Issues: Yes Resumption (ET): 10:30 AM CIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly... Keep Reading...

26 February

iMetal Resources Intersects 16.65 Metres at 1.24 g/t Gold Within 62.25 Metres at 0.61 g/t Gold at Gowganda West

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company") has intersected 16.65 metres at 1.25 gt gold within 62.25 metres at 0.61 gt gold at its Gowganda West Gold Project, southwest of Timmins, Ontario. Drilling in the West Zone intersected broad levels... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00