TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce an annual update for its prospect generation business unit in Mexico, United States, and Canada

Highlights

- Partner-funded exploration work of $3.2 million, including four drilling campaigns totaling 6,350 metres

- Eleven option or purchase agreements completed with a total of thirteen active exploration partnerships and one alliance

- Income from share and cash payments and management fees of $1.9 million (as at December 31, 2021)

- Seven partner-funded drilling programs estimated in 2022, increasing the opportunity for exploration discovery and royalty creation

"Orogen's prospect generation business took a disciplined approach to managing our property portfolio in 2021", commented Orogen CEO Paddy Nicol. "Each option or purchase agreement resulted in cash or share payments and a royalty interest. In keeping with our strategic goal of a profitable prospect generation business, Orogen generated income that exceeded our project generation costs in 2021."

"Our prospect generation business generated a tremendous amount of exploration activity, and we are encouraged by the work completed by our partners. Orogen's geologists have also assessed prospects in western United States, British Columbia and Mexico, providing a pipeline of future opportunities for exploration partnerships."

Exploration Summary

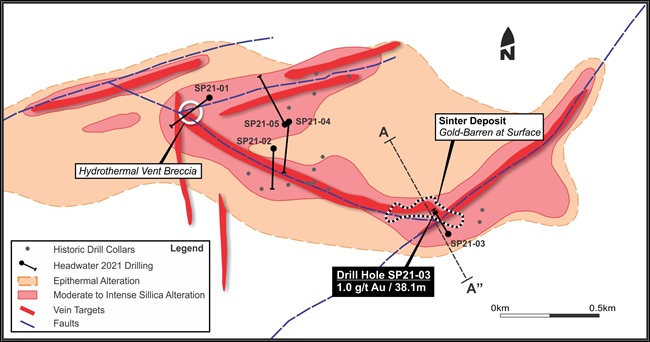

Spring Peak Epithermal Target, Nevada

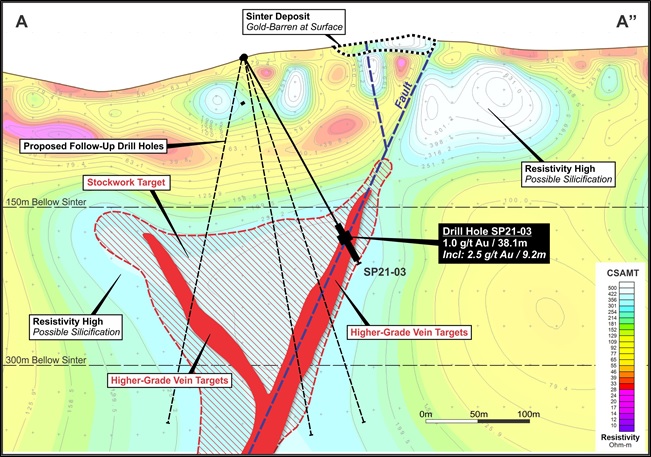

Exploration partner Headwater Gold Inc.1 ("Headwater") completed a 1,350 metre, five-hole reverse circulation drill program at Spring Peak. Gold anomalous quartz veins were returned in four of five holes with a new blind gold discovery made with drill hole SP21-03 which intersected 38.1 metres ("m") grading 1.00 grams per tonne ("g/t") gold including 9.2m grading 2.49g/t gold2 (Figure 1). Drill results confirms the presence of a laterally continuous gold-bearing epithermal boiling zone below a cap of silica sinter and barren alteration at surface. Vein textures and multi-element geochemistry suggest the mineralization encountered occurs in the top of the targeted boiling horizon, with follow-up targets immediately down dip. Headwater has expanded the Spring Peak land position through claim staking, and approximately tripled the size of the claim block. Follow-up drilling in 2022 is currently being planned by Headwater (Figure 2).

Gilbert South Epithermal Target, Nevada

Eminent Gold Corporation3 ("Eminent") conducted two mapping and sampling programs on Gilbert South that defined two multiple-kilometre long gold-anomalies in soils4 coincident with mapped fault zones and rock samples that returned up to 30.7g/t gold5. These results define numerous north south trending epithermal quartz veins on the property. Geophysical surveys were underway at the end of the year with drilling anticipated for early 2022.

Figure 1: Plan map of the Spring Peak alteration footprint and interpreted principle structural controls2

Figure 2: Interpretive geological cross section A-A"2

Maggie Creek Carlin Target, Nevada

U.S. Gold Corp. ("US Gold") completed a two-hole, 1,353m drill program on Maggie Creek6. The program successfully demonstrated that Carlin style alteration and host rocks exist at Maggie Creek with similarities to the major Carlin gold mines in the area. These prospective rock packages occur at shallower depths than previously thought, and the results warrant further exploration to vector into more anomalous gold bearing zones. (Photo 1)

Photo 1: Brecciated, decalcified and dolomitized Wispy Member Popovich with sooty pyrite and orpiment6

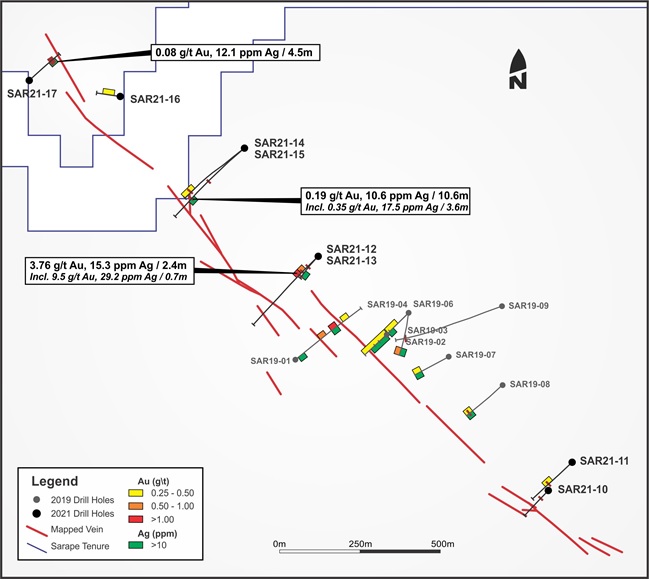

Sarape Epithermal Target, Sonora, Mexico

Hochschild Mining PLC ("Hochschild")7 funded a 3,163m drill program, with eight holes testing the Sarape vein. All eight holes intercepted weakly anomalous gold and silver within a quartz-carbonate vein with the widest section of vein, 33m downhole length in SAR 21-17 grading 0.03g/t gold and 3.39g/t silver including 1.9m grading 0.13g/t gold and 16.56g/t silver. The highest gold grade of 9.5g/t gold over 0.7m in hole SAR 21-12 was centered on several, up to five-centimetre fragments with visible gold within a tectonic breccia. The 2021 drilling confirmed that the Sarape vein continues to depth, with hole SAR 21-15 intersecting the vein 460m below the surface, and that the prospective precious metal hosting tan-green quartz stage continues to the northwest past hole SAR 21-17.

Only one hole at the Chiltepin area was ended short of the target due to concerns about the ground stability. The Chiltepin vein remains untested by drilling.

Hochschild subsequently terminated the option agreement and the Company is seeking a new exploration partner for the project.

Figure 3: Summary of 2021 drill results at Sarape

Manhattan Gap Porphyry Target, Nevada

In April 2021, Orogen optioned the Manhattan Gap project to Stampede Metals Corp. ("Stampede"), a private Nevada company8 adding to the land position Stampede already held in the area. In late 2021, Stampede completed geophysics and drilling on the combined property including over 500m of drilling on Orogen's ground. Results from this drill hole are expected in early 2022.

Lemon Lake Porphyry Target, British Columbia

Orogen optioned Lemon Lake to Acme Gold Company Limited ("Acme"), a private British Columbia based company in March 20219. Acme completed mapping, sampling and airborne magnetics on the property in 2021 which defined two drill targets that will be tested in 2022.

Additional Properties

Other option deals signed in 2021 include:

- The Ecru Carlin Target in Nevada to Moneghetti Minerals Limited in March 202110. Drilling is anticipated in 2022.

- The Kalium Canyon epithermal target in Nevada to Badger Minerals LLC (now Green Light Metals Inc.) in July 202111. The land position subject to Orogen's royalty was expanded in late 2021 by Green Light with preliminary geological and geochemical work expected in 2022.

- The Raven and Callaghan Carlin targets optioned to Yamana Gold Inc. in August 202112 combined with a generative exploration alliance in the area. Both projects saw mapping and sampling with geophysical follow up and subsequent drill testing expected in 2022.

- The Ghost Ranch Carlin target to Ivy Minerals Inc. ("Ivy") in September 202113. Ivy completed enzyme leach soil sampling and magnetic survey across the property to define multiple targets for drill testing in 2022. The land position subject to Orogen's royalty was expanded by Ivy in late 2021.

- I-80 Gold Corp. completed a geophysical survey at Tabor (formerly known as Baby Doe) and are awaiting permits to begin drill testing targets on the property.

- Trek 31 which was optioned to Pacific Imperial Mines Inc. saw no significant exploration in 2021.

Qualified Person Statement

Certain technical disclosure in this release is a summary of previously released information and the Company is relying on the interpretation provided by the relevant referenced partner. Additional information can be found on the links in the footnotes or on SEDAR (www.sedar.com).

All new technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., Exploration Manager for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

Quality Assurance quality control

Drill core samples in connection with the Sarape project were shipped to ALS in Hermosillo, Sonora, Mexico, for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are International Organization for Standardization 9001 and International Organization for Standardization/International Electrotechnical Commission 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP (inductively coupled plasma) finish and gold was assayed by 50-gram fire assay with inductively coupled plasma atomic spectrometry finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the company's quality assurance/quality control protocol.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño West gold deposit in Sonora, Mexico (2% NSR royalty) being developed by First Majestic Silver Corp. and the Silicon gold project (1% NSR royalty) in Nevada, USA, being advanced by AngloGold Ashanti N.A. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

Orogen Royalties Inc.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President of Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1201 - 510 West Hastings Street

Vancouver, BC

Canada V6B 1L8

- https://www.orogenroyalties.com/news/orogen-options-the-spring-peak-project-to-headwater-gold

- https://headwatergold.com/headwater-gold-announces-new-blind-epithermal-gold-discovery-at-spring-peak-nevada-and-triples-size-of-land-position/

- https://www.orogenroyalties.com/news/orogen-options-the-gilbert-south-property-to-eminent-gold

- https://eminentgoldcorp.com/news-media/news-releases/eminent-soil-samples-refine-multi-kilometer-hydrothermal-gold-system-at-gilbert-south/

- https://eminentgoldcorp.com/news-media/news-releases/eminent-samples-up-to-30-g-t-gold-and-identifies-multiple-kilometer-length-high-grade-epithermal-gold-zones-at-gilbert-south/

- https://www.usgoldcorp.gold/news-media/press-releases/detail/129/u-s-gold-corp-successfully-completes-2021-drilling-at

- https://www.orogenroyalties.com/news/orogen-options-the-sarape-gold-project-to-hochschild

- https://www.orogenroyalties.com/news/orogen-options-manhattan-gap-to-stampede-metals

- https://www.orogenroyalties.com/news/orogen-royalties-options-lemon-lake-for-cash-exploration-and-a-royalty

- https://www.orogenroyalties.com/news/orogen-royalties-options-the-ecru-project-to-moneghetti-minerals

- https://www.orogenroyalties.com/news/orogen-options-the-kalium-canyon-project-to-badger-minerals

- https://www.orogenroyalties.com/news/orogen-signs-option-and-generative-alliance-agreements-with-yamana-gold

- https://www.orogenroyalties.com/news/orogen-options-ghost-ranch-to-ivy-minerals

Forward-Looking Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Forward-looking information relates to statements concerning the Company's future outlook and anticipated events or results, as well as the Company's management expectations with respect to the proposed business combination (the "Transaction"). This document also contains forward-looking statements regarding the anticipated completion of the Transaction and timing thereof. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company, including expectations and assumptions concerning the receipt, in a timely manner, of regulatory and stock exchange approvals in respect of the Transaction.

Although the Company believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Orogen Royalties Inc

View source version on accesswire.com:

https://www.accesswire.com/685511/Orogen-Project-Generation-Business-Unit-Update