April 15, 2024

Exciting High Grade Gold & Base metals on Granted Mining Lease. Up to 12.64 Cu (%) & 4.12g/t Au

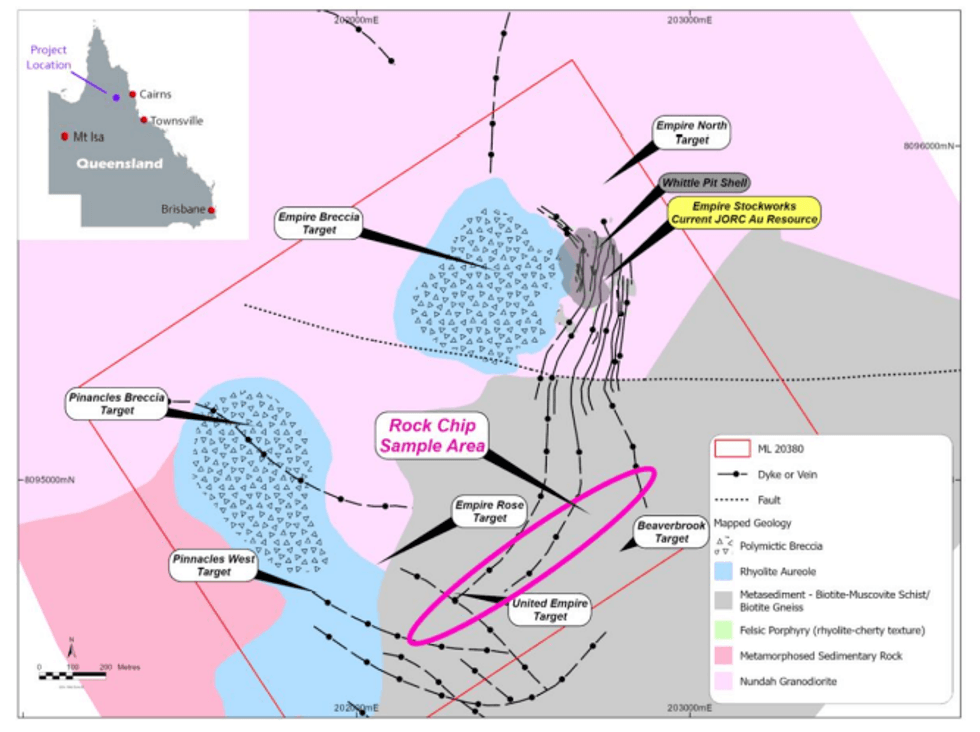

Far Northern Resources Limited (ASX: FNR, “Far Northern Resources”, “the Company”) is pleased to provide an update on exploration activities at the Empire Project, located 34km west of Chillagoe in North Queensland Australia. The Empire Mining Lease (Empire) covers an area of 252 (ha). It has a JORC 2012 Resource and will be subject to 5000m of drilling over the next two years.

HIGHLIGHTS

- Empire has a current Mineral Resource Estimate of (22,505 AuOz), refer to prospectus page 14.

- New reconnaissance (undertaken just prior to Christmas 2023 and for which assay results have now been received) away from this known resource has commenced with high grade copper and gold rock chip samples on mineralized outcrops and old prospector scratching extending the strike of known mineralization by a further 750m.

- High Grade Copper and Gold rock chips have returned assays of up to 12.64% Cu (FNRRCS24001) and 4.12 g/t gold (FNRRCS24002) (see Table 1)

- Other individual surface samples have returned copper grades of 11.59% Cu, 11.89% Cu, 9.60% Cu, 6.53% Cu and 2.61% Cu (%) (see Table 1)

- Other individual samples have returned gold grades of 0.78g/t, 0.92g/t, 1.19g/t, 2.16g/t, 0.75g/t, 1.68g/t and 0.70g/t (see Table 1)

The Managing Director of Far Northern Resources , Cameron Woodrow said:

“Far Northern Resources has been exploring this area for some time and it is pleasing to release some very exciting new copper and gold results which clearly show there is a much bigger picture at play at our Empire Project.

We are excited to now have the funding to get on the ground and drill out the potential for what is shaping as a nice copper-gold project in a proven copper-gold mining area”.

Enquires:

Cameron Woodrow

cwoodrow@farnorthernresources.com

Roderick Corps.

rcorps@farnorthernresources.com

Empire Copper Gold Project Previous exploration activity at Empire including drilling and soil geochemistry prove a very strong geochemical signature in the associate elements of Au-Ag-Bi-Cu-Mo-Sb-W typical of copper-gold porphyry systems. So far drilling has focussed only on the stockworks where an open pit mineable resource has been defined. Our latest rock chips show these stockworks extend for at least another 750m and our geologist believes these could be the part of a bigger porphyry style target.

Click here for the full ASX Release

This article includes content from Far Northern Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FNR:AU

The Conversation (0)

23 June 2025

Bridge Creek Phase 1 Assays

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 AssaysDownload the PDF here. Keep Reading...

21 May 2025

Bridge Creek Phase 1 Assay Composites Received

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 Assay Composites ReceivedDownload the PDF here. Keep Reading...

29 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Far Northern Resources (FNR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

08 April 2025

Drilling to Commence on Bridge Creek Mining Lease

Far Northern Resources (FNR:AU) has announced Drilling to Commence on Bridge Creek Mining LeaseDownload the PDF here. Keep Reading...

17 February 2025

Amended Appendix 5B

Far Northern Resources (FNR:AU) has announced Amended Appendix 5BDownload the PDF here. Keep Reading...

17h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00