Nickel Price Update: Q3 2022 in Review

Here’s an overview of the main factors that impacted the nickel market in Q3, and what’s ahead for the nickel price forecast in the rest of the year.

Click here to read the latest nickel price update.

After unprecedented price levels prompted the suspension of trading at the London Metal Exchange (LME) in the first quarter, nickel has declined to trade at around US$21,000 per metric ton (MT).

Nickel surpassed the US$100,000 mark in early March, jumping over 250 percent in just two days. But the base metal has fallen significantly since then, with Q3 seeing the metal perform in a choppy fashion.

What else happened to nickel in the third quarter of this year? Read on to learn about the main trends in the nickel market in Q3, including supply and demand dynamics and what market participants are expecting for the rest of the year.

Nickel price update: Q3 overview

As mentioned, historic price highs prompted a nickel market meltdown in the first quarter of the year. But levels declined throughout the second quarter to end at the US$22,000 level.

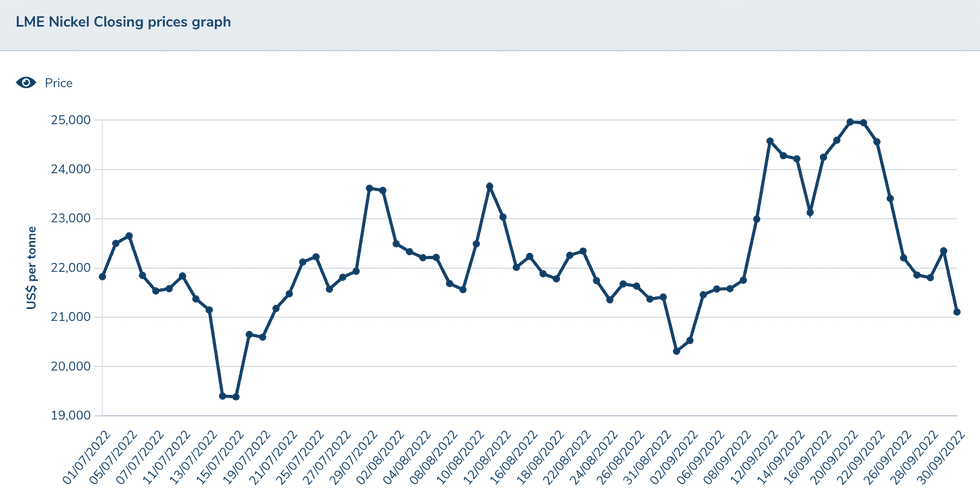

The third quarter was dominated by volatility, with nickel reaching its highest point of the period on September 21, when it almost broke the US$25,000 threshold. But prices were unable to hold on to gains, retreating to end the quarter at US$21,107.

Nickel's price performance in Q3 2022.

Chart via the London Metal Exchange.

In mid-July, the base metal touched its lowest point of the quarter when it fell below US$19,500.

“Tightening monetary policy globally, the fallout from the war in Ukraine, a wobbly property sector in China and a new Covid-19 outbreak in Shenzhen, China, all hurt activity,” analysts at FocusEconomics said in a September report. “That said, lower nickel stocks in LME warehouses provided some lift to nickel prices.”

In Q3, prices remained almost neutral, declining 3 percent quarter-on-quarter.

Speaking with the Investing News Network about the main trends seen in the nickel market in Q3, Adrian Gardner of Wood Mackenzie said prices performed as expected, with considerably more stability than seen over the past eight months.

“Push-pull price factors largely canceled each other out, giving small differences between lows-highs of monthly averages,” he said.

Nickel price update: Supply and demand dynamics

Production of stainless steel accounts for around 70 percent of nickel demand, which is largely fueled by developing countries in the midst of infrastructure expansions. But since April, a significantly weaker stainless steel sector across all major consuming areas has had a negative impact on primary nickel demand, according to Wood Mackenzie.

“This weakness will probably extend into Q4 2022, leaving growth profiles for Q1 2023 in doubt also,” Gardner said.

Nickel is also a key element used in cathodes for electric vehicle batteries, with many believing demand from this sector will increase significantly in the coming decades.

“Primary nickel demand from the batteries sector, especially in China, which controls about 80 to 85 percent of nickel demand in battery precursors, has been much stronger than expected, and Q4 2022 appears to remain on the same track,” Gardner said.

Looking over to the supply side of the nickel story, the risk seems to be on the upside. Indonesia is by far the largest producer of nickel, followed by the Philippines and Russia.

According to Wood Mackenzie, supply of finished Class II nickel, nickel pig iron (NPI) in particular, is growing — arguably too fast for stainless steel melt production to absorb it.

“We expect to see some stockpiling of NPI by the end of this year or into Q1 2023,” Gardner said. "Also, we are expecting to see a rash of intermediates producers in Indonesia (that are) making both nickel matte and mixed hydroxide precipitate containing nickel and smaller amounts of cobalt."

World primary nickel production was 2.49 million MT in 2020 and 2.608 million MT in 2021, and is forecast to reach 3.082 million MT in 2022, mainly due to expected increases in Indonesia and China, as per the International Nickel Study Group.

All in all, the nickel market is set to record a moderate surplus in 2022 upon outright contraction in the largest end use (stainless steel) despite healthy growth in the fastest-growing market (electric vehicles), according to StoneX.

“Meanwhile, production is set to post a record on capacity additions of NPI within Indonesia and alternative routes of Class I production, such as high-pressure acid leach and NPI to nickel matte,” Natalie Scott-Gray, the firm's senior metals analyst, said.

Wood Mackenzie’s Gardner agreed, saying the market will see a period of surplus, either coming into view as early as this quarter or in the first quarter of 2023.

“I don’t think it will be a 'structural' surplus because that implies supply will be in excess to demand for a period of years, rather than months,” he said. "The excess in Class II products will be resolved once Chinese and other leading consumer regions of the world work their way through the current economic doubts."

Nickel price update: What’s ahead?

Looking ahead, the nickel market is set to record growing deficits until the middle of the decade, driven by output in Indonesia.

“This will push both Class I and Class II into surplus markets,” Scott-Gray said. “On the demand side, stainless steel demand should remain fairly muted, with growth focus remaining on the electric vehicle sector.”

StoneX sees prices averaging US$25,206 this year, declining to an average of US$19,000 to US$22,000 in 2023. “Given the lack of liquidity, it is difficult to forecast nickel prices. However, as of late, nickel prices appear to be moving on macro headlines again, which are likely to stay in place to year-end,” Scott-Gray said. “Any optimism on demand will arise from a recovery in China.”

When looking at what key risk factors could impact the nickel market going forward, Scott-Gray said sanctions on Russian material, in addition to production out of Indonesia for Class I supply, will be important to watch.

Similarly, Wood Mackenzie’s Gardner expects a continuation of this narrow price range of between US$21,000 and US$22,000 through to the end of the year.

“I expect a tough time across Europe and the UK through this winter period and beyond,” he said. “Only once the region has been able to develop and implement an alternative energy supply mechanism will the dependency on Russia cease.”

For Gardner, currency trades and government bonds might attract more trader and investor attention than metals for the final quarter of this year, especially if macro uncertainties linger.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Nickel Price Update: Q1 2022 in Review ›

- Nickel Price Update: Q2 2022 in Review ›

- Top Nickel Stocks on the TSX and TSXV | INN ›

- Nickel Outlook 2022: Balanced Market Ahead, Prices to Remain ... ›