Interra Copper Corp. (CSE:IMCX)(OTCQB:IMIMF)(FRA:3MX) ("Interra" or the "Company") is pleased to announce the Company has completed its maiden diamond drilling program on its 206 square kilometer Thane Property in North Central B.C. on traditional territory of the Takla and Tsay Keh Dene First Nations. The program comprised a total of 2,774 metres in 12 holes

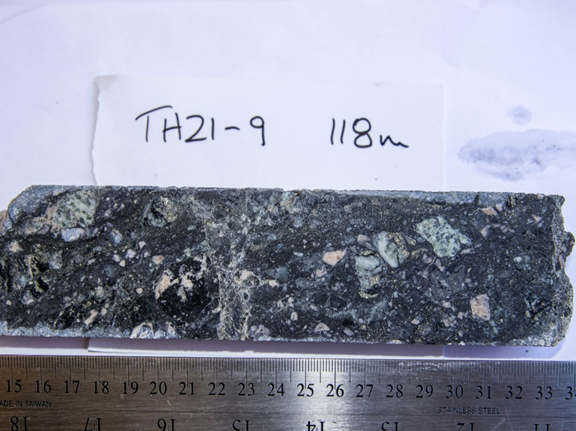

Figure 2 - Pinnacle zone core photo of arsenic-supported breccia material.

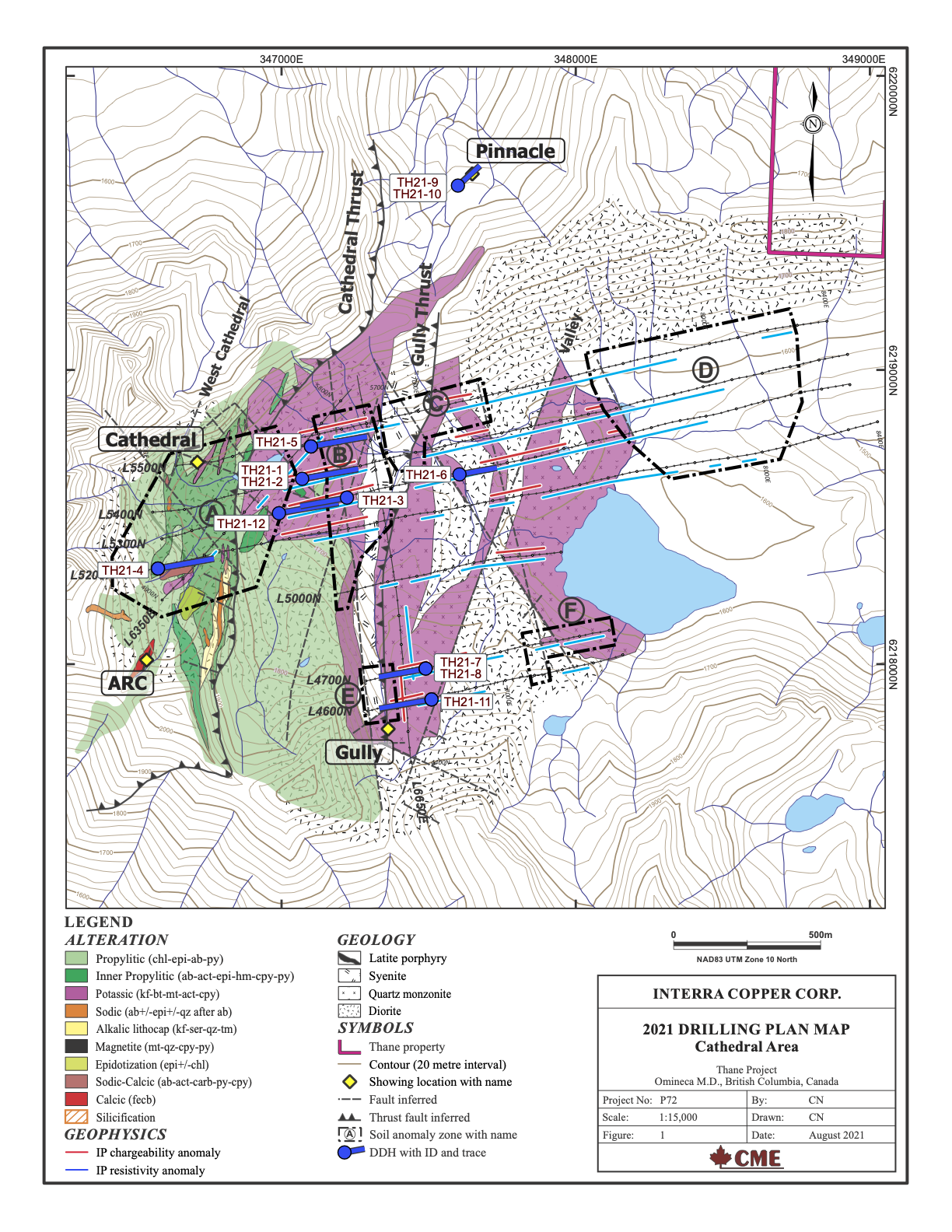

Figure 1 - 2021 Drilling Plan Map - Cathedral Area

The Company expanded its planned program targeting cathedral zone by four additional holes, two of which were drilled into the Pinnacle Zone, a structurally controlled quartz vein system similar to high grade gold/silver veins often associated with the periphery of porphyry copper systems. Pinnacle zone is located just north of the main Cathedral Area. For an illustration of drill locations, please see Figure 1 - 2021 Drilling Plan Map below.

The initial logging in cores from the Cathedral zone demonstrate strong geological, structural features along with associated periphery mineralization and alteration consistent with an alkalic porphyry deposit model, as seen in the surface geochemistry work.

With 2021 drilling completed, the Company continues its exploration program through September which is aimed at;

Increasing our understanding of the Cathedral Zone and the role of structure in the formation and deformation of the mineralized sections of intrusive host monzodiorite, diorite and syenite rocks.

Following up the encouraging drill results at the Pinnacle Zone which supports the additional geophysical and geochemical survey lines that have been established to trace this mineralized system along strike and up section

IP, magnetics, geochemistry and geological surveying at the Gail Showing has commenced with the expectation of generating further drill targets for the 2022 season.

Jason Nickel, Chief Executive Officer of the Company, stated: "We are pleased to have been able to undertake the extra drilling, which yielded further results in the Cathedral Zone and tested the gold-rich Pinnacle Zone, this season. We are eager to receive assay results for cathedral holes as well as from the arsenic-supported breccia zones observed in pinnacle drill cores from the main structure and the hanging wall veins and stringers."

Historical surface sampling at the Pinnacle Zone has returned up to 20 g/t Au, and averaged 6.1 g/t Au. in quartz veins. Arsenic is closely associated with these veins and the attendant gold. The outcrop that is exposed down-section for about 80m appears to have been truncated and displaced by a large thrust fault that is represented in the core by a 5 metre-wide matrix supported breccia. The matrix is composed of arsenopyrite, pyrite and chalcopyrite. The entire fault zone is up to 15 m wide but is not exposed at surface. It appears also that an earlier set of quartz carbonate, +/- chalcopyrite stringers was deposited in the hanging wall of the thrust. See Figure 2 - Pinnacle zone core photo of arsenic-supported breccia material.

2021 core logging and sampling will continue while geological mapping and prospecting continue on the Thane Property. Interra anticipates all core samples will be submitted to ALS Laboratories in North Vancouver by the end September.

The scientific and technical information disclosed in this news release was reviewed, verified and approved by Christopher O. Naas, P. Geo., COO of Interra Copper Corp. who is a "Qualified Person" as defined in NI 43-101.

The Company also reports it has filed its FY2021 second quarter interim financial statements and related Management's Discussion and Analysis on SEDAR (www.sedar.com).

ON BEHALF OF Interra Copper CORP.

Jason Nickel

Chief Executive Officer

Telephone: +1-604-754-7986

INVESTOR RELATIONS:

Email: invest@interracopper.com

Telephone: +1-604-588-2110

Website: https://interracopper.com

ABOUT Interra Copper CORP.

Interra is a junior exploration and development company focused on creating shareholder value through the advancements of its current assets that include the Thane Property in north-central British Columbia, and the Bullard Pass Property in Arizona. Utilizing its heavily experienced management team, Interra continues to source and evaluate assets to further generate shareholder value.

The Thane Property covers approximately 206 km2 (50,904 acres) and is located in the Quesnel Terrane of north-central British Columbia, midway between the previous operated open pit Kemess Mine and the currently operating open pit Mount Milligan mine, both two copper-gold porphyry deposits. The Thane Property includes several highly prospective mineralized areas identified to date, including the ‘Cathedral Area' on which the Company's exploration is currently focused.

Forward-Looking Statements: This news release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, relating to further exploration on the Company's Thane Property and the submission of core samples and receipt of assays thereof. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made, and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the Canadian Securities Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company's exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of regulatory or legal changes that might interfere with the Company's business and prospects. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.

SOURCE: Interra Copper Corp.

View source version on accesswire.com:

https://www.accesswire.com/662137/Interra-Copper-Completes-Drill-Program-at-Cathedral-Area-on-Thane-Property-and-Commences-IP-Surveys