(TheNewswire)

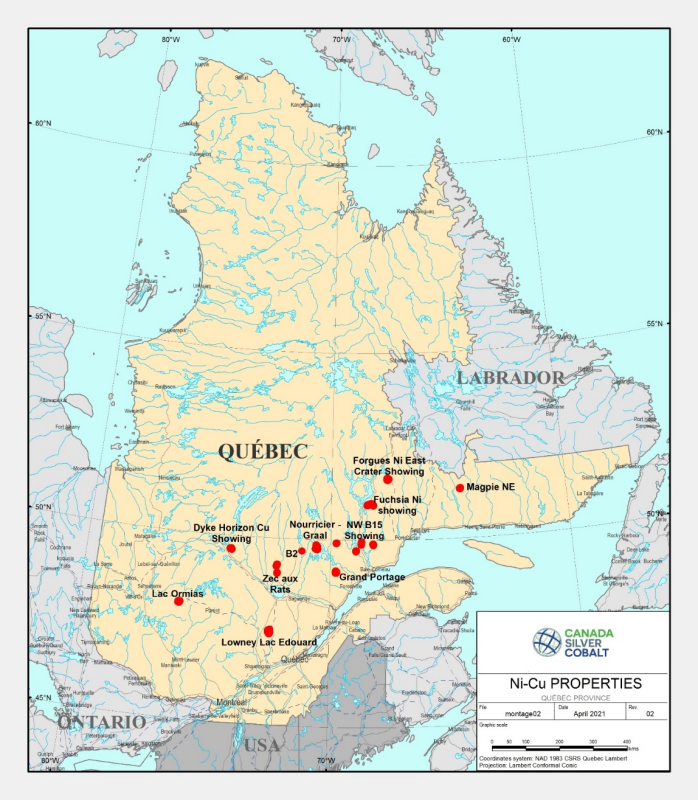

Coquitlam, BC TheNewswire - July 22, 2021 - Canada Silver Cobalt Works Inc. (TSXV:CCW) (OTC:CCWOF) (Frankfurt:4T9B) (the "Company" or "Canada Silver Cobalt") is pleased to provide an update on its early-stage exploration activities in the Province of Québec where it is evaluating 15 properties on 689 claims covering 38,129.4 hectares that are prospective for EV battery metals nickel, copper, and cobalt. (see Figure 1 below and February 16 and April 21, 2021 news releases).

The Company has now received its drill permit in order to drill the Bouguer Anomalies Targets of its Graal-Nourricier - Lac Suzanne property in northern Lac St-Jean. This property, which has not been fully explored, is one of the five included in the company's geophysical airborne surveys conducted earlier this year and it is regarded as, geologically, one of the most promising. The Company is seeking to identify significant amounts of nickel-copper-sulphide masses at the base of the magnetic chamber.

The drill program is scheduled to start in the next 30 days and, in particular, seeks to intersect the base of the hidden magmatic reservoir of immiscible sulfides bath. Past drill results appear to be indicating mineralization on the side of the magmatic reservoir and the massive sulphides are potentially still hidden at depth.

The property has shown numerous metal intercepts from past drilling/sampling with the best results recording grades of up to 10.31% nickel, 4.9% copper and 1% cobalt from diamond drilling (see details below).

CEO Frank J. Basa, P.Eng., notes: "The company's main focus remains the past-producing silver-cobalt Castle property in northern Ontario and especially the ongoing exploration of the Castle East exceptional high-grade silver discovery with drill intercepts up to 89,853 g/t Ag or 2,621 oz/ton and an initial resource of 7.6 million oz Ag with an average grade of 8,582 g/t Ag or 250.2 oz/ton (see details below). The Castle East exploration drill program is going well with 39,000 meters of the 60,000-meter program completed with numerous results pending and we expect a major increase in estimated silver resources in an update of the Resource Estimate expected in early 2022.

"The Quebec properties were acquired for their potential to host a variety of EV battery metals including nickel, copper and cobalt with the intention of expanding our current holdings and strategically positioning the Company and its shareholders to take full advantage of the evolving market conditions for EV battery base metal inputs. We are undertaking first-stage geological evaluation of the properties and, as previously announced, we are considering a potential transfer of the properties into another public company focused primarily on EV battery metals with our key precious metals assets remaining in Canada Silver Cobalt," Mr. Basa stated

The first conceptual primary target identified based on Bouguer airborne survey conceptual modelling has an extent of 1200m x 2200m on the Graal-Nourricier - Lac Suzanne property. The unknown is the elevation – or the depth at which the base of the net-textured and massive sulfides sits. The geological team believes it should be intersected at a depth range of 1500 to 2000m from surface over 100 to 150 meters thick. If the Company succeeds in the first target, the drill will be moved to define near-surface targets prior to moving to a second target of lesser magnitude in size. This plan is subject to change and depends of the findings.

For the drill program, the Company has retained the services of Saguenay-based Laurentia Exploration, which has an extensive technical knowledge of the regional geology since several members of their crew have already worked on drill programs at the adjacent Arianne Phosphate lac à Paul project. The exploration work will be under the direction of GoldMinds Geoservices which has identified the targets.

Once drilling at Graal has started, the Company will follow up its exploration plan with drilling on the other main first-level targets at:

-

- Lowney, Lac Edouard South-East

- Forgues East Manic Crater

- Fuchsia-Massif du Nord

- B15 Bouguer anomaly

The program also includes verification with field geology for the second-level properties.

The Company is not pursuing the option agreement on the B2 property as the completed drill program there has not delivered expected results in comparison to the surface sample results.

Figure 1 – Nickel - Copper Property Locations in the Province of Québec

About Graal – Nourricier Lac Suzanne property

The Graal-Nourricier - Lac Suzanne property is one of the most promising magmatic reservoirs identified in the group of recently acquired properties. The Company's intention is to drill directly on the maximum Bouguer Anomaly identified. Below are some highlights (mostly historical data retrieved from public reports and information on SIGEOM) where we are of the opinion that the results to date are only mineralization on the side of the magmatic reservoir and the massive sulphides are still hidden at depth.

This property, comprising 71 CCW claims over 3,947 hectares and 23 optioned claims from Globex comprised of 3 distinct blocks totaling 1,276 hectares for a combined total of 5,223 hectares, is the most promising target. It is southeast of the Lac à Paul Arianne Phosphate deposit. The property is located approximately 160 kilometers NNE of the city of Saguenay and 272 kilometers east of Chibougamau in NTS 22E15. The central and southern claim blocks are underlain by anorthosites, gabbros and troctolites pertaining to the anorthositic suite of Lac-St-Jean, whereas the northern block is underlain by tonalitic and trondhjemitic gneisses pertaining to the Rouvray gneissic Complex.

Previous work on the Lac Suzanne property was performed by Mines d'Or Virginia Inc. between 1997 and 2001. This work consisted of airborne geophysical surveys (magnetic and electromagnetic) followed by ground surveys (magnetic and electromagnetic – MaxMin) in order to more precisely locate the anomalies that were outlined by the airborne surveys. These surveys were followed by geological mapping, trenching, blasting, soil geochemical and rock sampling. The last exploration work done, within the limits of the present claims, consisted of diamond drilling where 13 holes were drilled totaling 1,473 meters. The MaxMin survey delineated a good electromagnetic conductor over a strike length of over 6.5 kilometers which has only been sparsely explored, with up to 800 meters drill hole spacing or more and the deepest hole investigated at merely a 100 meters vertical depth. Knowing this, there remains a lot of ground to investigate more thoroughly.

The best results from the rock and drill core sampling returned grades of up to 10.31% Nickel, 4.9% Copper and 1% Cobalt from diamond drilling . The mineralization found on the Lac Suzanne property is of the magmatic massive sulphide type where sulphides are concentrated within a magmatic chamber. The Voisey's Bay deposit in Labrador is of this same type. (for additional information regarding Voisey's Bay deposit, please see: Current Research (2003) Newfoundland Department of Mines and Energy Geological Survey, Report 03-1, pages 231-239 - VOISEY'S BAY AND THE NICKEL POTENTIAL OF LABRADOR: A SUMMARY FOR THE NONSPECIALIST by A. Kerr Voisey's Bay 2003 A. Kerr Report ). The exploration work done on the Lac Suzanne property thus far has barely scratched the surface. As exploration deepens, there is a good chance that richer grades may be encountered. There are many identified, near-surface mineralized zones which dip toward the Bouguer Anomaly sweet spot.

On the Nourricier portion, there is Nourricier A (97-01), A (97-c235), B (NB 97-01) B (NB97-02) sector. T he hole collar NA-97-01 (GM 56023 – Rapport des Travaux 1997, Mines d'Or Virginia) locates the deposit. It is near the RT-97-C238 trench which revealed even higher grades. "Recognized intrusive brec cias in the Feeder (Nourricier) Sector (A and B) with fragments of olivine containing droplets of sulphides indicating crystallization of olivines in a sulphide bath are strongly similar to mineralization at Voisey's Bay".

The host rock is gabbro or anorthosite injected with levels of pyrrhotite which give the rock an appearance of breccia. The mineralization consists of disseminated to massive pyrrhotite (max 70%) sometimes accompanied by chalcopyrite (1% or less) and garnet (35%, when the matrix is gabbro, at 45.5 m in the hole). Magmatic mineralization, dominant Nickel-Copper (± Cobalt ± PGE), is associated with anorthositic-troctolitic massifs .

MHY A (97-03) MHY (97-02) Occurrence (Lac Suzanne property) (source: GM 71373 – Compilation Report, Lac Suzanne Property, Globex Mining Enterprises, 2019)

Highlight:

MHY-97-02: 0.21% Copper, 0.22% Nickel and 338 ppm Cobalt over 0.6 m to 22.5 m; 0.12% Copper, 0.27% Nickel and 395 ppm Cobalt over 0.3 m to 34.8 m; Blasting: RT-97-C319: 0.18% Copper, 0.2% Nickel and 319 ppm Cobalt; Blasting FL-97-C 15: 0.1% Copper, 0.28% Nickel and 900 ppm Cobalt (smp689824); 0.62% Copper, 0.13% Nickel and 276 ppm Cobalt (smp689751); 0.53% Copper, 0.09% Nickel and 171 ppm Cobalt (smp689753).

MHY-97-03: 1447 ppm Copper, 5143 ppm Nickel and 533 ppm Cobalt over 0.6 m to 16.4 m; 0.6% Copper over 0.8 m to 12.3 m; SM-97-C-21: 0.52% Copper and 0.06% Nickel; RT-97-C-240: 0.22% Copper; RT-97-C-245 (400 m to the southwest): 0.34% Copper and 0.12% Nickel. GM 59143: drillhole 1279-01-35 (360 m to the northeast): 0.37% Nickel, 0.18% Copper and 0.04% Cobalt over 4.3 m including 0.95% Nickel over 0.5 m.

Lac Suzanne North

Occurrence of massive sulphide veins.

Highlight: The best values from hole 1279-01-37 show 0.29% Nickel, 0.05% Copper and 0.03% Cobalt over 1.0 m; 0.3% Copper over 0.3 m; 12.65% TiO 2 , 13.16% MgO and 0.2% P 2 O 5 over 30.6 m

Lac Suzanne

The mineralization occurs in the form of massive sulphide veins intersecting massive and very homogeneous units of amphibole anorthosite and leucogabbro.

Highlight: Drill hole 1279-01-36 has 10.31% Nickel, 0.06% Copper and 0.05% Cobalt over 0.3 m, as well as 0.14% Nickel, 4.27% Copper and 0.03% Cobalt over 1.0 m. This interval corresponds to a centimetric vein of sulphides rich in chalcopyrite intersecting the drillhole at a low angle.

Qualified person

The technical information in this news release has been reviewed by Claude Duplessis, P.Eng., GoldMinds Geoservices Inc. m ember of Québec Order of Engineers and a qualified person in accordance with National Instrument 43- 101 standards.

About Canada Silver Cobalt Works Inc.

Canada Silver Cobalt Works released the first-ever resource in the Gowganda Camp and greater Cobalt Camp in May 2020. A total of 7.56 million ounces of silver in Inferred resources, comprising very high-grade silver ( 8,582 grams per tonne un-cut or 250.2 oz/ton) in 27,400 tonnes of material from two sections (1A and 1B) of the Castle East Robinson Zone beginning at a vertical depth of approximately 400 meters, was identified. The discovery remains open in all directions (1A and 1B are approximately 800 meters from the Capitol Mine workings) (mineral resources that are not mineral reserves do not have demonstrated economic viability) (refer to Canada Silver Cobalt Works Press Release May 28, 2020. Report reference: Rachidi, M. 2020, NI 43-101 Technical Report Mineral Resource Estimate for Castle East, Robinson Zone, Ontario, Canada , with an effective date of May 28, 2020 and a signature date of July 13, 2020).

Canada Silver Cobalt's flagship Castle mine and 78 sq. km Castle Property feature strong exploration upside for silver, cobalt, nickel, gold, and copper in the prolific past-producing Gowganda high-grade Silver District of Northern Ontario. With underground access at Castle, an exceptional high-grade silver discovery at Castle East, a pilot plant to produce cobalt-rich gravity concentrates on site, a processing facility (TTL Laboratories) in the town of Cobalt, and a proprietary hydrometallurgical process known as Re-2Ox for the creation of technical-grade cobalt sulphate as well as nickel-manganese-cobalt (NMC) formulations, Canada Silver Cobalt is strategically positioned to become a Canadian leader in the silver-cobalt space.

"Frank J. Basa"

Frank J. Basa, P. Eng.

Chief Executive Officer

For further information, Contact:

Frank J. Basa, P.Eng.

Chief Executive Officer

416-625-2342

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements.

Copyright (c) 2021 TheNewswire - All rights reserved.