February 12, 2024

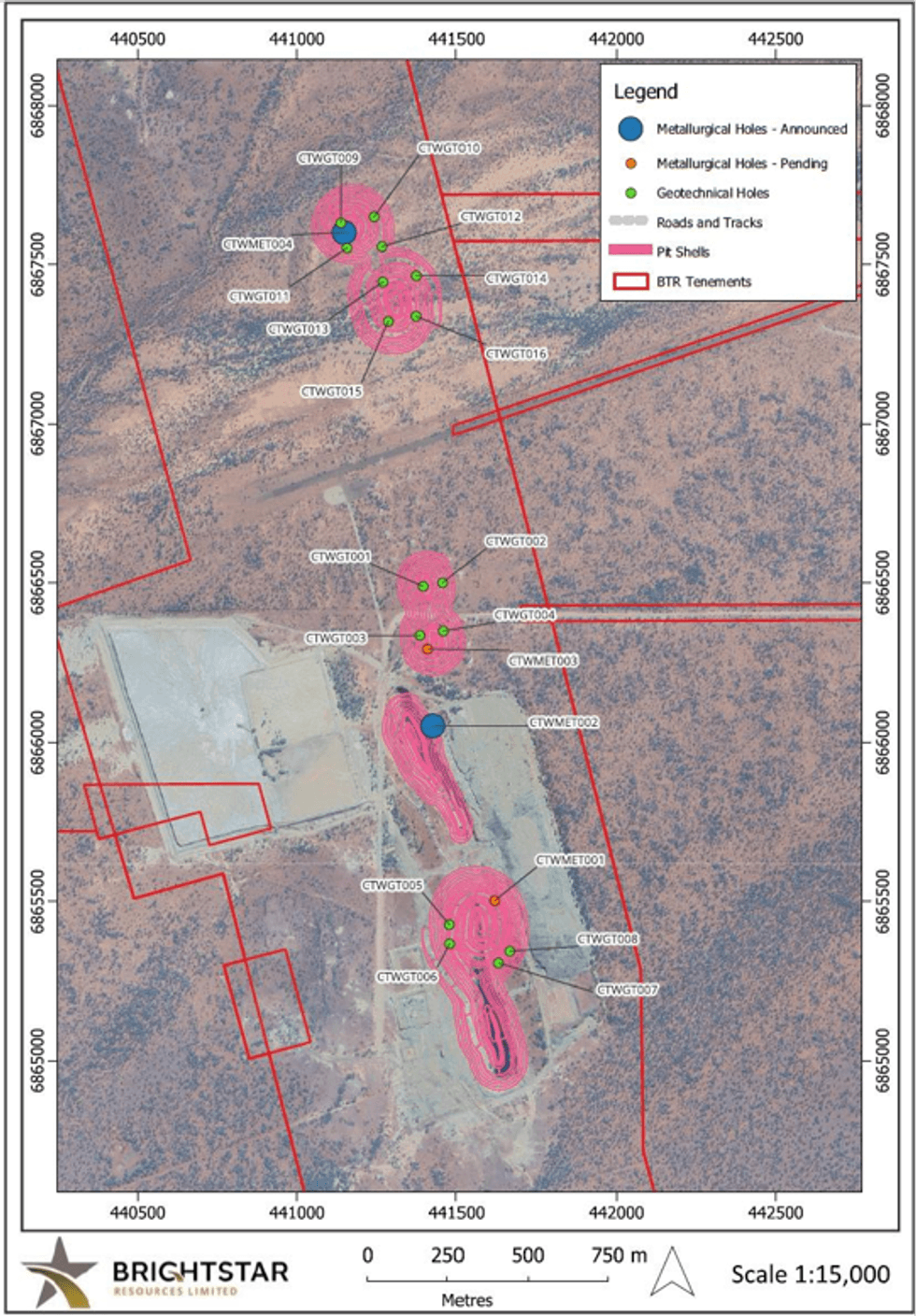

Brightstar Resources Limited (Brightstar or the Company) (ASX: BTR) is pleased to announce the initial assay results from the first two diamond drillholes at Cork Tree Well (CTW) within the Laverton Gold Project (LGP). These two holes, as part of a broader 20 hole program1, were completed in January 2024 with satisfying progress being made by Brightstar’s diamond drilling contractor and geology team.

HIGHLIGHTS

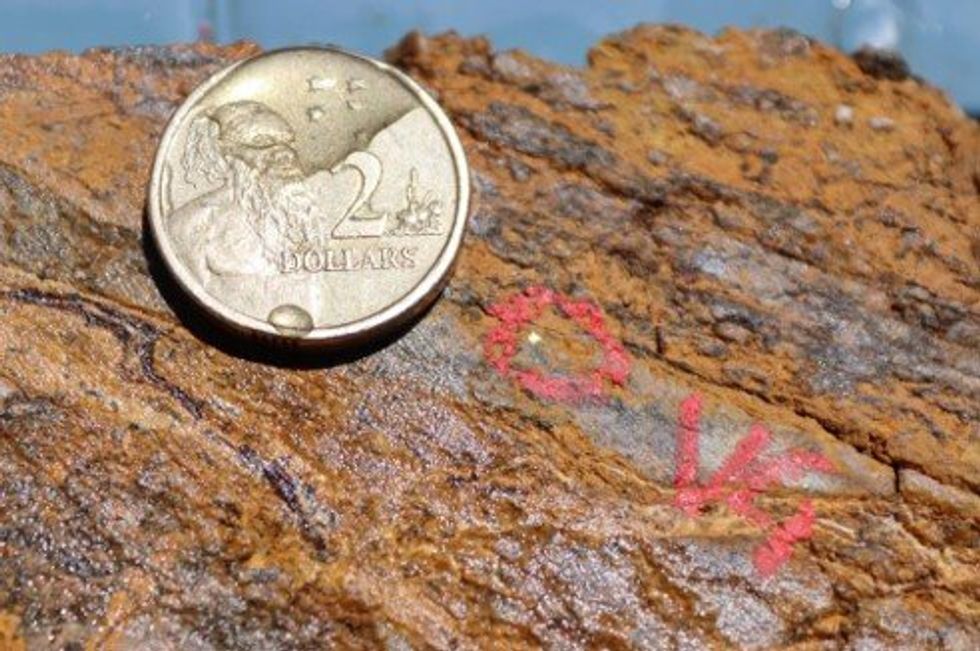

- Assays received from first two diamond holes completed at Cork Tree Well with numerous high grade gold assays up to 172.41g/t Au returned

- Multiple instances of visible gold observed in cut core supports high grade results

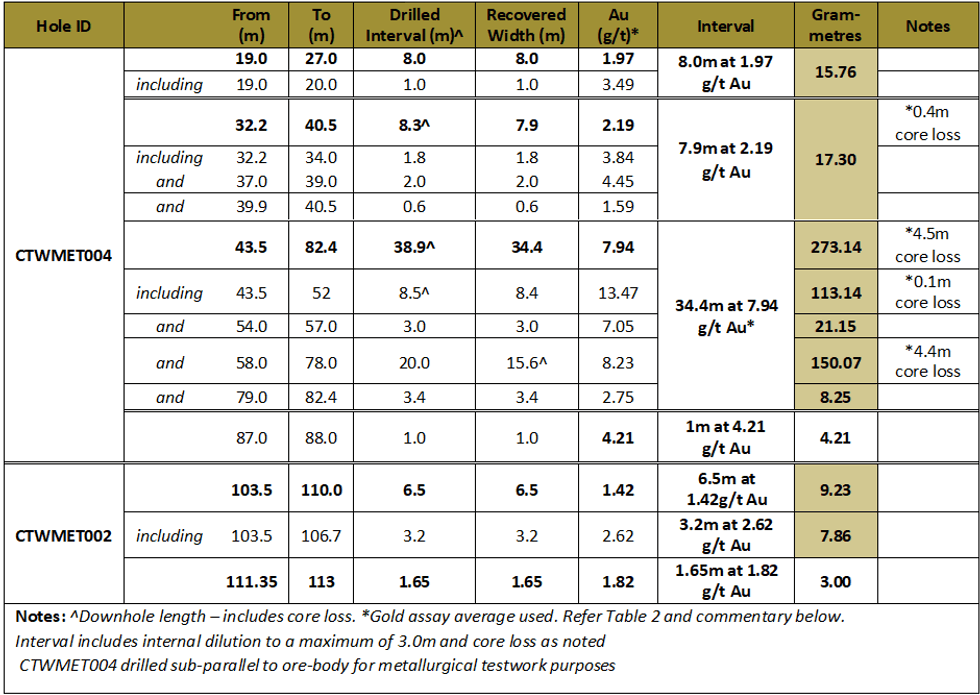

- Intercepts returned include 34.4m at 7.94g/t Au from 43.5m (CTWMET004), including

- 8.4m at 13.47g/t Au from 43.5m, and

- 3m at 7.05g/t Au from 54m, and

- 15.6m at 8.23g/t Au from 58m

- CTWMET004 was drilled in the virgin Delta deposit at Cork Tree Well North, with the gold mineralisation entirely contained with a mafic metadolerite and quartz breccia unit

- The Delta deposit remains completely open at depth, with the deepest hole previously drilled intercepting 31m @ 2.12g/t Au from 172m beneath the current open pit shell

- Assays received from CTWMET002 below the historical open pit at Cork Tree Well include:

- 6.5m at 1.42g/t Au (from 104m)

- 1.65m at 1.82g/t Au (from 112m)

- Two remaining holes (CTWMET003 and CTWMET001) prioritised for expedited turn- around, with another 16 holes pending drill completion & processing for PFS workstreams

Brightstar’s Managing Director, Alex Rovira, commented “These holes were the first diamond holes drilled at Cork Tree Well by Brightstar, with our understanding of the geological model and mineralisation styles defined by over 28km of previous Brightstar RC drilling being enhanced by the knowledge being gained from this +2,000m diamond core program currently in progress.

We have reinforced our view that the gold mineralisation at Cork Tree Well is structurally hosted, with a mafic metadolerite host rock observed in CTWMET004 at Delta, whilst gold mineralisation returned in CTWMET002 is positioned within a chert-breccia horizon in the sedimentary package underneath the shallow historically mined open pit.

Due to the high grades returned, several re-assays were completed to cross-check the veracity of the initial result in certain cases, with multiple high-grade re-assays and visible gold supporting a coarse-grained nuggety gold mineralisation model at Delta.

In order to provide sufficient rock mass for the metallurgical test work purposes across all oxidation states at the Delta (oxide, transitional and fresh), CTWMET004 was drilled sub-parallel to the ore body at Delta. Importantly, Delta is still open at depth with the deepest hole in the vicinity, SDR126001, returning 31m at 2.12g/t Au2 highlighting the immense potential for high grade depth extensions.

Given the inaugural diamond drilling results thus far, we remain of the view that we’ve barely scratched the surface at Cork Tree Well, with strong potential to build on the existing 303koz @ 1.4g/t Au Mineral Resource3 both at depth with high-grade plunging shoots and strike extensions targeting the structurally-controlled mineralised trends across geological units.

We look forward to updating our stakeholders with more information on our diamond program, including the expedited assays for CTWMET001 and CTWMET003. These four diamond holes will form the basis for metallurgical testwork within our Pre-Feasibility Study4 which envisages the broader Cork Tree Well project to form the baseload ore feed to our wholly owned processing plant and associated infrastructure located ~30km south of Laverton”.

Due to the nuggety and high-grade nature of the gold mineralisation observed in CTWMET004, multiple samples had repeat assays completed following from best QA/QC laboratory practice. The repeat fire-assays provided additional analytical insight into the nuggety nature of mineralisation in addition to the visible gold observed. Where multiple repeat assay runs occurred, an average of the results has been used in the reporting in Table 1 above and within this announcement. The full break-down of the re-assayed samples are outlined below in Table 2. Repeat assays were not conducted on all fire-assay samples and significant intercepts reported in this announcement will be re-evaluated following from planned additional analyses using a larger sample mass, towards a better representation of the mineralisation at Cork Tree Well and within the ‘Delta’ deposit.

Brightstar will be conducting continued analysis into the effects of the nuggety gold at Cork Tree Well, and specifically within the ‘Delta’ deposit, in future drilling programs. Metallurgical analyses in addition to re- assaying more samples using additional analytical methods (incorporating a greater sample mass) will assist with continued understanding of the nature of mineralisation. Additional analytical methods will commence with screen fire assaying to identify and better quantify the presence of coarse gold with photon analyses considered in conjunction with screen fire assaying processes.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

03 March

Brightstar Secures US$120M Bond to Fund Goldfields Project

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields ProjectDownload the PDF here. Keep Reading...

02 March

Results of Oversubscribed Share Purchase Plan

Brightstar Resources (BTR:AU) has announced Results of Oversubscribed Share Purchase PlanDownload the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00