December 11, 2024

GTI Energy Ltd (GTI or Company) is pleased to update the uranium Mineral Resource Estimate (MRE) at its Lo Herma Project (Lo Herma or the Project) located in Wyoming’s Powder River Basin (Figure 1). The MRE for the Project is focused on mining by In-Situ Recovery (ISR) methods and is reported at an appropriate cut-off grade of 200 ppm U3O8 and a minimum grade thickness (GT) of 0.2 per mineralised horizon as:

6.21 million tonnes of total mineralisation at average grade of 630 ppm eU3O8 for 8.57 million pounds (Mlbs) of eU3O8 contained metal classified as 2.78Mlbs of Indicated (32%) and 5.79Mlbs of Inferred.

Highlights

- Lo Herma Mineral Resource Estimate increased 50% to 8.57Mlbs eU3O8 incl. 2.78Mlbs Indicated (32%) & 5.79Mlbs Inferred

- Lo Herma Exploration Target increased from recent drilling and new staking

- Lo Herma Scoping Study commenced - targeting completion in 1st half of 2025

- GTI’s combined Wyoming uranium resources increased to 10.23Mlbs

The Lo Herma Exploration Target Range (ETR) for Lo Herma is also updated & increased (Table 1), since first reported to ASX on 05/07/2023, and now stands at a range of between 5.59 to 7.10 million tonnes at a grade range of 500 ppm to 700 ppm U3O8. GTI’s combined uranium MRE across its Wyoming projects, including the Great Divide Basin, is now 10.32Mlbs with an additional exploration target (Table 6).

The potential quantity and grade of Exploration Targets is conceptual in nature and there has been insufficient exploration to estimate a JORC-compliant Mineral Resource Estimate. It is uncertain if further exploration will result in the estimation of a MRE in the defined exploration target areas. In addition to drilling conducted in 2024, Exploration Targets have been estimated based on historical drill maps, drill hole data, aerial geophysics (reported during 2023) and drilling by GTI conducted during 2023 to verify the historical drilling information. There are now 954 drill holes in the Lo Herma project area with the 2023 and 2024 drill programs conducted by GTI designed, in part, to test the Lo Herma Exploration Target.

“We are delighted with the major uplift in Lo Herma’s uranium resource, now 50% larger at 8.57Mlbs. This important milestone positions Lo Herma favourably in size against Ur-Energy’s nearby 8.8Mlb Shirley Basin ISR build, and Encore Energy’s 8.1Mlb Gas Hills ISR project (refer Schedule 1). Importantly, over 30% of Lo Herma’s resource is lifted into Indicated classification with an expanded Exploration Target pointing the way to even greater potential for growth. Given Lo Herma's proximity to several major ISR production facilities within 60 miles, we believe this project has strong potential to transition into production. Our immediate focus is completing a Scoping Study in the first half of 2025. This material resource upgrade plus the significant exploration target confirms our belief that 8.57Mlbs is just the starting point for Lo Herma.” Bruce Lane, Executive Director, GTi Energy.

LO HERMA URANIUM PROJECT – LOCATION & BACKGROUND

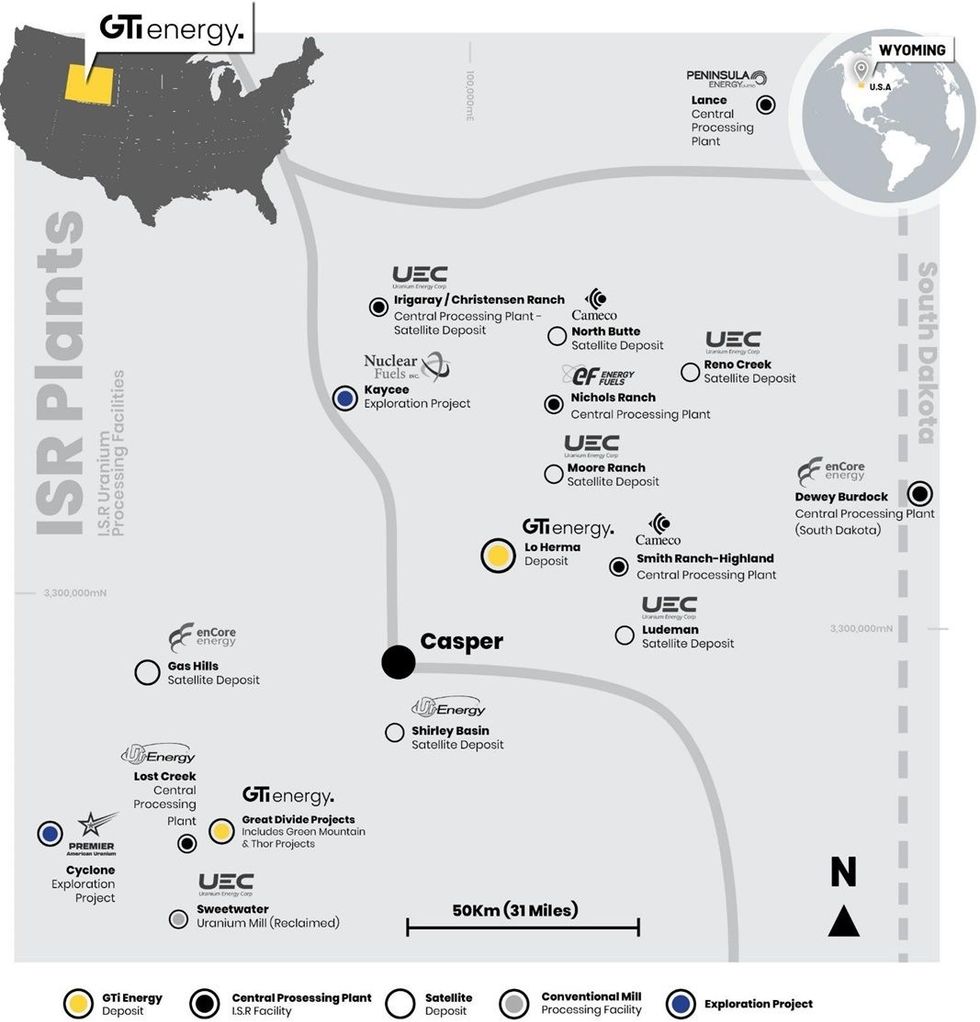

The Lo Herma ISR Uranium Project is located in Converse County, Powder River Basin (PRB), Wyoming. The Project lies approximately 15 miles north of the town of Glenrock and within ~60 miles of six (6) permitted ISR uranium production assets. These assets include UEC’s Willow Creek (Irigaray & Christensen Ranch) & Reno Creek ISR plants, Cameco’s Smith Ranch-Highland ISR facilities, Energy Fuels Nichols Ranch ISR plant & Ur-Energy’s Shirley Basin (Figure 1).

The Powder River Basin region has extensive ISR uranium production history with numerous defined ISR uranium resources, central processing plants (CPPs) and satellite deposits (Figure 1). The Powder River Basin region has been the backbone of Wyoming uranium production since the 1970s.

As reported to ASX on 14/03/2023, GTI acquired a comprehensive historical data package, with an estimated replacement value of over A$15m, for the Lo Herma region. The data package included original data for circa 1,771 drill holes for ~530,00 feet (~162,000m) of drilling in the Lo Herma region.

The original drill data was used to prepare an inferred MRE and an ETR for Lo Herma using the original exploration results. Subsequently GTI conducted a 26-hole exploration drill program in the winter of 2023 followed by a 73-hole resource development drill program in the summer of 2024, the results of which were previously reported on 20/12/2023, 31/07/24, 12/09/2024 & 19/09/2024 and support the updated MRE and ETR for Lo Herma shown in Table 1.

The potential quantity and grade of Exploration Targets is conceptual in nature and there has been insufficient exploration to estimate a JORC-compliant MRE. It is uncertain if further exploration will result in the estimation of a MRE in the defined exploration target areas. In addition to drilling conducted in 2024, Exploration Targets have been estimated based on historical drill maps, drill hole data, aerial geophysics (reported during 2023) and drilling by GTI conducted during 2023 to verify the historical drilling information. There are now 954 drill holes in the Lo Herma project area with drill programs conducted by GTI during 2023 and 2024 designed, in part, to test the Lo Herma Exploration Target.

LO HERMA MINERAL RESOURCE ESTIMATE (MRE) UPDATE

The updated Lo Herma MRE, in accordance with the JORC Code (2012), is presented in Table 2:

The MRE has been calculated by applying a cutoff grade of 200 ppm eU3O8 and a grade thickness (GT) cutoff of 0.2 GT. All available exploration data was evaluated using roll-front mapping techniques and modelled using GT contour methodology. GT contour modelling is widely accepted and used within the uranium industry for modelling roll-front style deposits. A range of criteria has been considered in determining resource classification including data quality, geologic continuity, and drill hole spacing which is discussed in Appendix 1, JORC code Table 1 report.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00