June 13, 2023

Leocor Gold Inc. (the “ Company ” or “ Leocor ”) (CSE:LECR ) , ( OTC:LECRF) is pleased to announce that RAB drilling has begun on the Dorset Project within the Company’s Baie Verte District landholdings, Newfoundland, Canada.

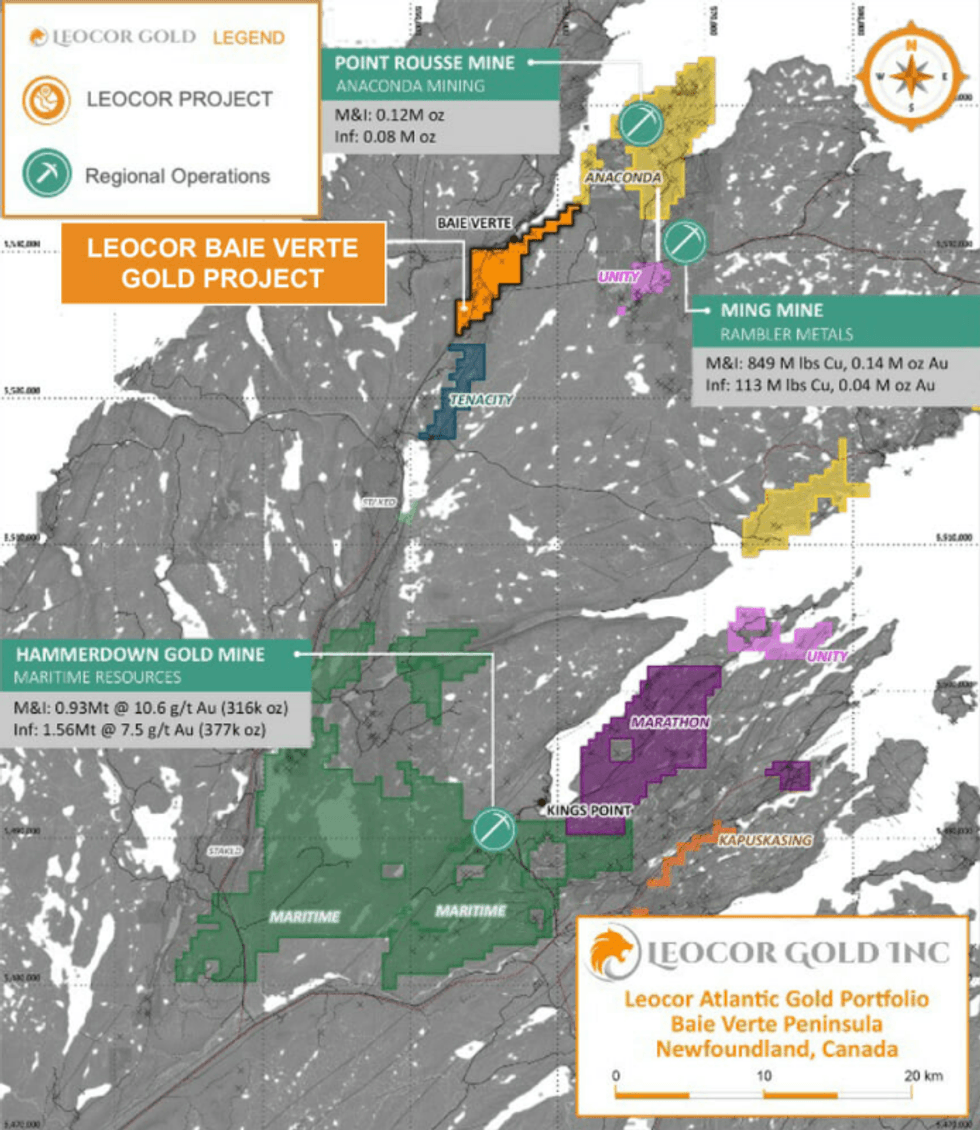

The Baie Verte District is home to the Point Rousse gold mine now owned by Signal Gold and the Ming copper and gold mine belonging to Rambler Metals and Mining (Figure 1).

“We are excited to announce the beginning of our RAB drilling at Dorset as part of Leocor’s planned $1.2 million 2023 exploration program,” said CEO, Alex Klenman. “RAB drilling is a very mobile and cost-effective tool we are utilizing to target the sub-surface with instant XRF analysis and downhole optical viewing. The Dorset Project remains a top priority for Leocor based on our impressive inaugural RAB results from 2022, and we’re looking forward to continuing the project’s development,” continued Mr. Klenman.

Dorset (Baie Verte District)

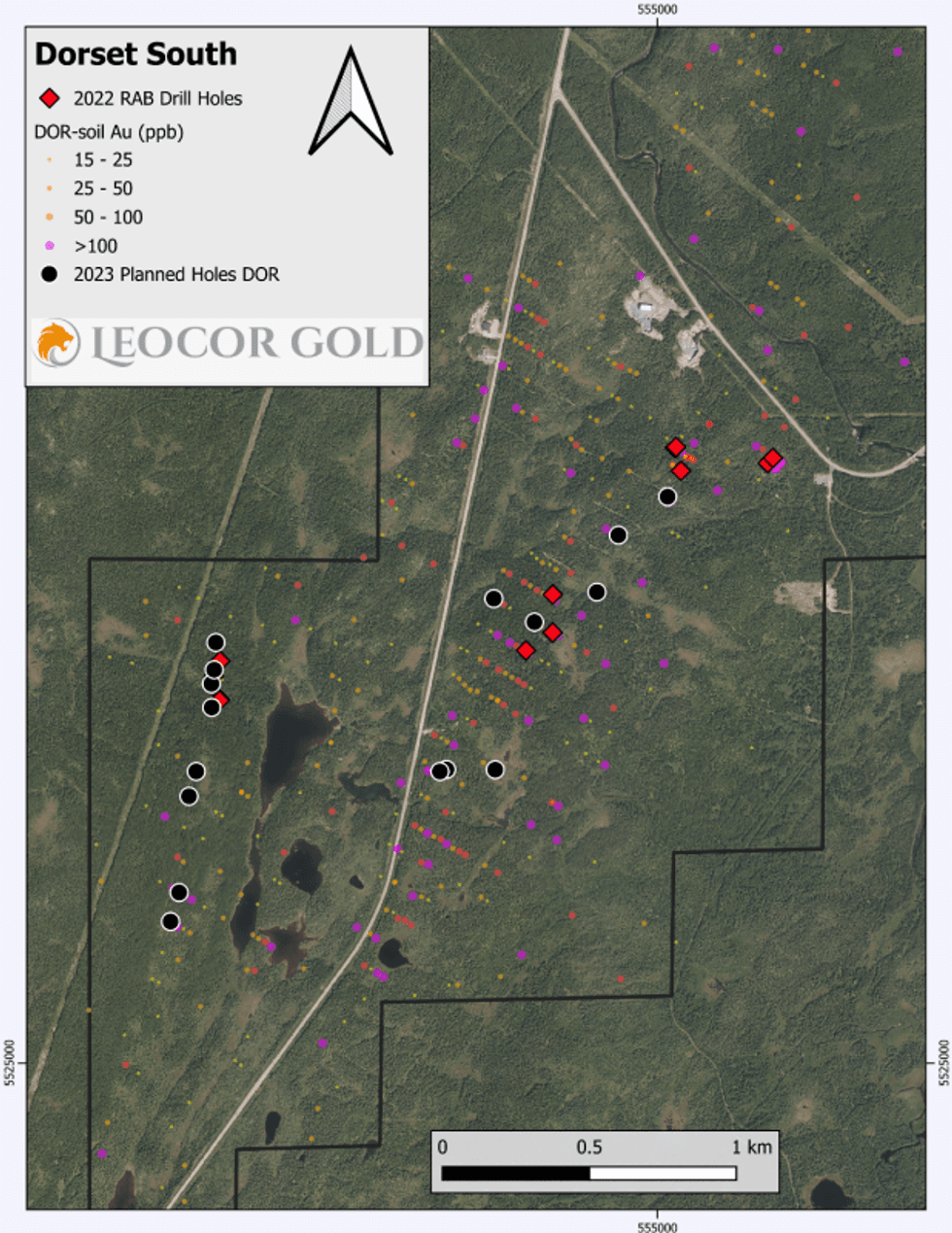

A total of 16 RAB drill holes are planned for the Dorset Project. RAB drilling will continue to test and expand on the Sharpie Ridge gold occurrence with seven RAB holes where in late 2022 drilling returned 2.32 g/t Au over 10.67 m and 10.2 g/t Au over 1.52m . An additional two RAB holes will be completed at Copper Creek target where in 2022 drilling returned 0.58% % Cu over 9.12m, which includes 1.095% Cu over 1.52m .

Two RAB holes will be completed at the Dorset Gunshot/Braz occurrence where in 2022 drilling returned 3.18 g/t Au over 4.57 m . An additional seven RAB holes will target the Dorset Trend where a large 1 x 2 km gold-in-soil anomaly was outlined by 2022 soil sampling efforts (Figure 2). The extensive gold-in-soil anomaly is “one of the most clustered and anomalous” he has seen, says Leocor’s Technical Advisor, Shawn Ryan.

RAB Drilling

The RAB drilling will be completed by GroundTruth Exploration Inc. using their “GT RAB Drill,” a Heli-Portable, wireless remote-controlled, rubber tracked platform with a hydraulic tilting mast assembly and rotary drill head. The GT RAB Drill is environmentally friendly with low-ground pressure and minimal surface disturbance. Individual drill holes can be up to 100m in depth and are paired with onsite XRF analysis and optical televiewer surveys, allowing rapid evaluation of the target areas.

Qualified Person

Mike Kilbourne, P. Geo, an independent qualified person as defined in National Instrument 43-101, has reviewed, and approved the technical contents of this news release on behalf of the Company.

About Leocor Gold Inc.

Leocor Gold Inc. is a British Columbia-based resource company involved in the acquisition and exploration of precious metal projects, with a current focus in Atlantic Canada. Leocor, through outright ownership and earn-in agreements, currently controls several gold-copper projects in prime exploration ground located within the prolific Baie Verte Mining District. Leocor’s Bae Verte portfolio includes the Dorset, Dorset Extension, Copper Creek and Five Mile Brook projects, creating a contiguous nearly 2,000-hectare exploration corridor. The Company also controls the 6,847-ha grassroots Startrek project near Gander, as well as three district scale land packages in North Central Newfoundland, known as Robert’s Arm, Hodge’s Hill, and Leamington, (collectively “Western Exploits”) representing over 144,000 hectares (1,440 square kilometers) of prospective exploration ground.

Contact Information

Leocor Gold Inc.

Alex Klenman, Chief Executive Officer

Email : aklenman@leocorgold.com

Telephone : (604) 970-4330

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release .

Cautionary Statements Regarding Forward-Looking Information

This press release contains forward-looking information within the meaning of Canadian securities laws. Such information includes, without limitation, information regarding the terms and conditions of the Option. Although Leocor believes that such information is reasonable, it can give no assurance that such expectations will prove to be correct.

Forward looking information is typically identified by words such as: “believe”, “expect”, “anticipate”, “intend”, “estimate”, “postulate” and similar expressions, or are those, which, by their nature, refer to future events. Leocor cautions investors that any forward-looking information provided by Leocor is not a guarantee of future results or performance, and that actual results may differ materially from those in forward looking information as a result of various factors, including, but not limited to: the agreement of the parties to proceed with the proposed transaction on the terms set out in the Option Agreements or at all; Leocor's ability to exercise the Options; the state of the financial markets for Leocor's securities; the state of the natural resources sector in the event the Option, or any of them, are completed; recent market volatility; circumstances related to COVID-19; Leocor's ability to raise the necessary capital or to be fully able to implement its business strategies; and other risks and factors that Leocor is unaware of at this time. The reader is referred to Leocor's initial public offering prospectus for a more complete discussion of applicable risk factors and their potential effects, copies of which may be accessed through Leocor’s issuer page on SEDAR at www.sedar.com.

The forward-looking statements contained in this press release are made as of the date of this press release. Leocor disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

LECR:CC

The Conversation (0)

16 March 2022

Leocor Gold

Newfoundland Exploration Led by Renowned Prospector Shawn Ryan

Newfoundland Exploration Led by Renowned Prospector Shawn Ryan Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00