June 13, 2023

Leocor Gold Inc. (the “ Company ” or “ Leocor ”) (CSE:LECR ) , ( OTC:LECRF) is pleased to announce that RAB drilling has begun on the Dorset Project within the Company’s Baie Verte District landholdings, Newfoundland, Canada.

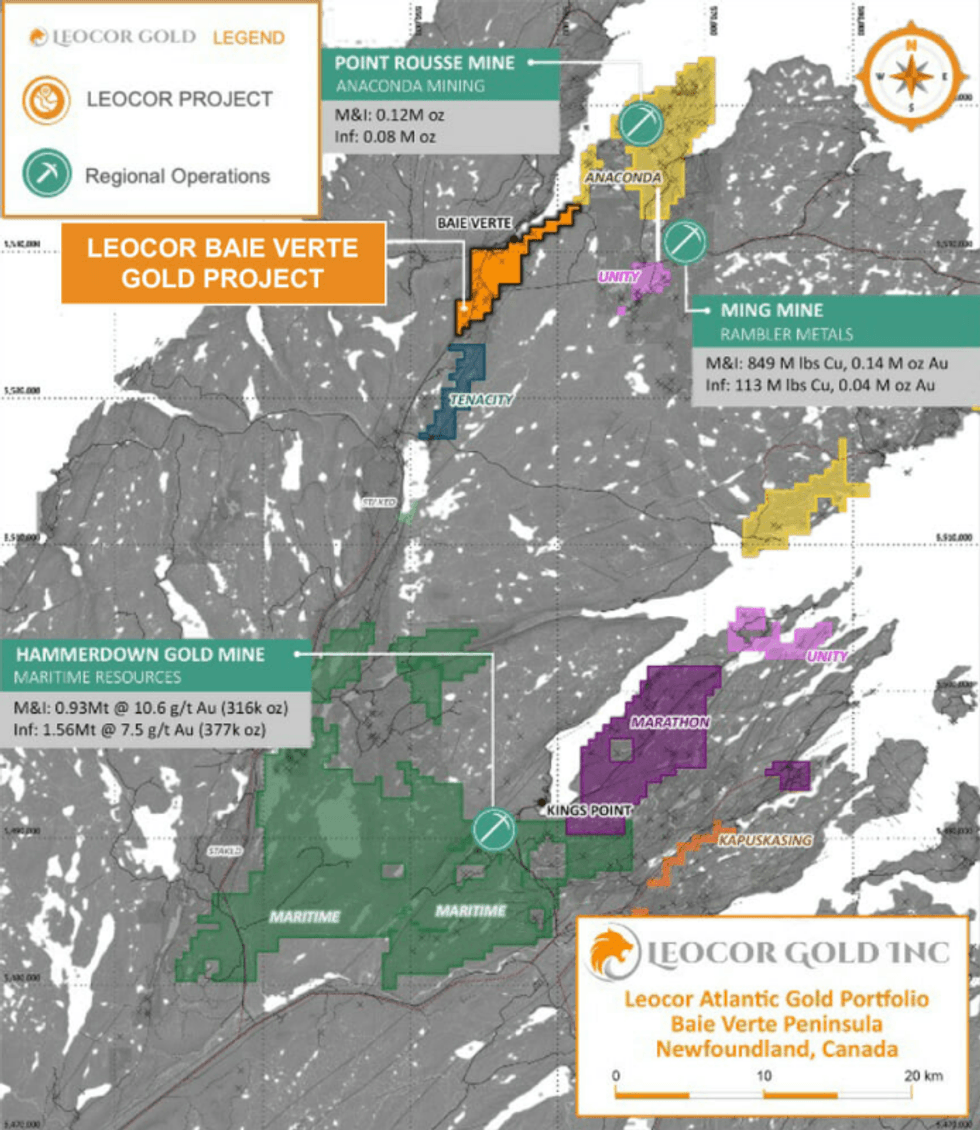

The Baie Verte District is home to the Point Rousse gold mine now owned by Signal Gold and the Ming copper and gold mine belonging to Rambler Metals and Mining (Figure 1).

“We are excited to announce the beginning of our RAB drilling at Dorset as part of Leocor’s planned $1.2 million 2023 exploration program,” said CEO, Alex Klenman. “RAB drilling is a very mobile and cost-effective tool we are utilizing to target the sub-surface with instant XRF analysis and downhole optical viewing. The Dorset Project remains a top priority for Leocor based on our impressive inaugural RAB results from 2022, and we’re looking forward to continuing the project’s development,” continued Mr. Klenman.

Dorset (Baie Verte District)

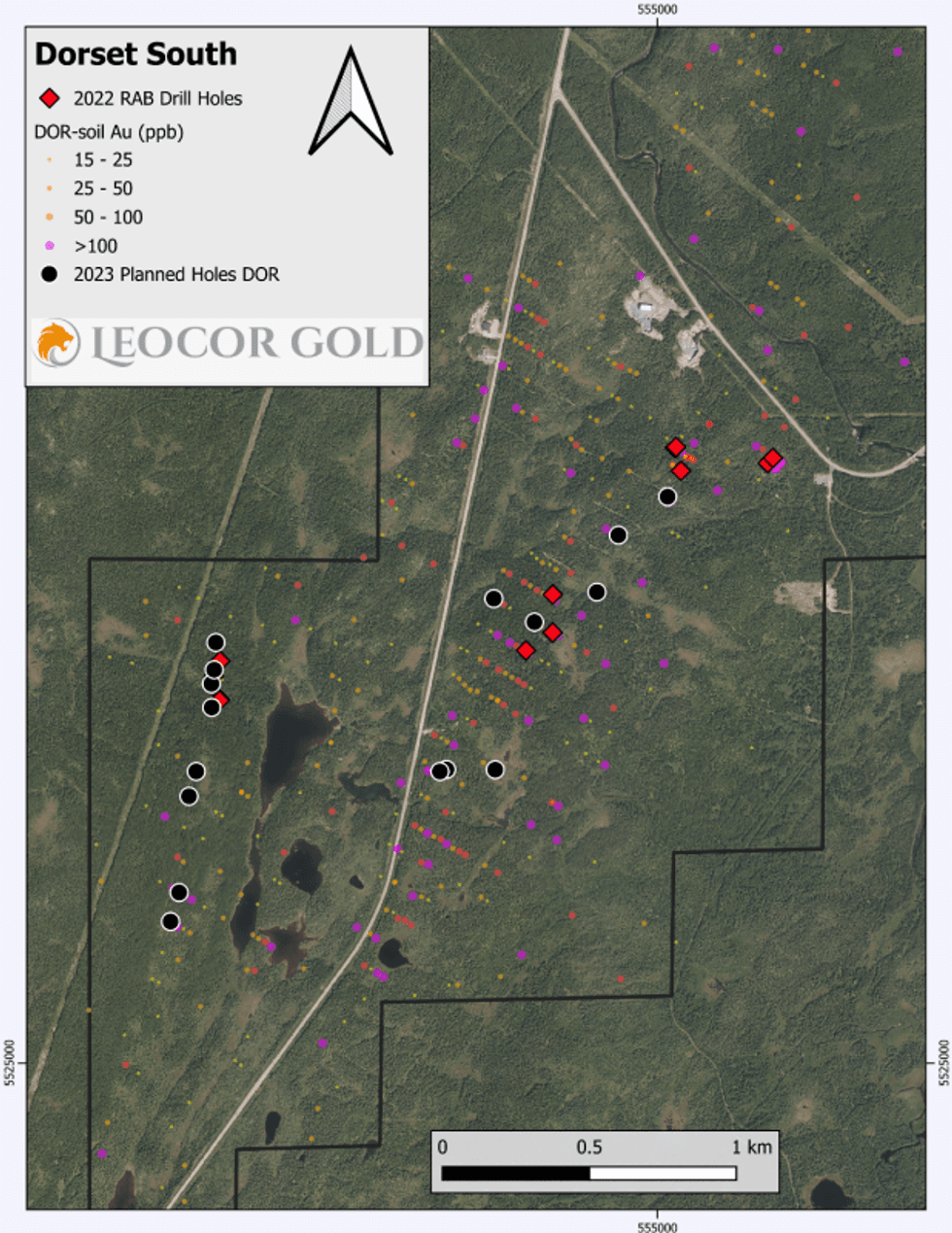

A total of 16 RAB drill holes are planned for the Dorset Project. RAB drilling will continue to test and expand on the Sharpie Ridge gold occurrence with seven RAB holes where in late 2022 drilling returned 2.32 g/t Au over 10.67 m and 10.2 g/t Au over 1.52m . An additional two RAB holes will be completed at Copper Creek target where in 2022 drilling returned 0.58% % Cu over 9.12m, which includes 1.095% Cu over 1.52m .

Two RAB holes will be completed at the Dorset Gunshot/Braz occurrence where in 2022 drilling returned 3.18 g/t Au over 4.57 m . An additional seven RAB holes will target the Dorset Trend where a large 1 x 2 km gold-in-soil anomaly was outlined by 2022 soil sampling efforts (Figure 2). The extensive gold-in-soil anomaly is “one of the most clustered and anomalous” he has seen, says Leocor’s Technical Advisor, Shawn Ryan.

RAB Drilling

The RAB drilling will be completed by GroundTruth Exploration Inc. using their “GT RAB Drill,” a Heli-Portable, wireless remote-controlled, rubber tracked platform with a hydraulic tilting mast assembly and rotary drill head. The GT RAB Drill is environmentally friendly with low-ground pressure and minimal surface disturbance. Individual drill holes can be up to 100m in depth and are paired with onsite XRF analysis and optical televiewer surveys, allowing rapid evaluation of the target areas.

Qualified Person

Mike Kilbourne, P. Geo, an independent qualified person as defined in National Instrument 43-101, has reviewed, and approved the technical contents of this news release on behalf of the Company.

About Leocor Gold Inc.

Leocor Gold Inc. is a British Columbia-based resource company involved in the acquisition and exploration of precious metal projects, with a current focus in Atlantic Canada. Leocor, through outright ownership and earn-in agreements, currently controls several gold-copper projects in prime exploration ground located within the prolific Baie Verte Mining District. Leocor’s Bae Verte portfolio includes the Dorset, Dorset Extension, Copper Creek and Five Mile Brook projects, creating a contiguous nearly 2,000-hectare exploration corridor. The Company also controls the 6,847-ha grassroots Startrek project near Gander, as well as three district scale land packages in North Central Newfoundland, known as Robert’s Arm, Hodge’s Hill, and Leamington, (collectively “Western Exploits”) representing over 144,000 hectares (1,440 square kilometers) of prospective exploration ground.

Contact Information

Leocor Gold Inc.

Alex Klenman, Chief Executive Officer

Email : aklenman@leocorgold.com

Telephone : (604) 970-4330

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release .

Cautionary Statements Regarding Forward-Looking Information

This press release contains forward-looking information within the meaning of Canadian securities laws. Such information includes, without limitation, information regarding the terms and conditions of the Option. Although Leocor believes that such information is reasonable, it can give no assurance that such expectations will prove to be correct.

Forward looking information is typically identified by words such as: “believe”, “expect”, “anticipate”, “intend”, “estimate”, “postulate” and similar expressions, or are those, which, by their nature, refer to future events. Leocor cautions investors that any forward-looking information provided by Leocor is not a guarantee of future results or performance, and that actual results may differ materially from those in forward looking information as a result of various factors, including, but not limited to: the agreement of the parties to proceed with the proposed transaction on the terms set out in the Option Agreements or at all; Leocor's ability to exercise the Options; the state of the financial markets for Leocor's securities; the state of the natural resources sector in the event the Option, or any of them, are completed; recent market volatility; circumstances related to COVID-19; Leocor's ability to raise the necessary capital or to be fully able to implement its business strategies; and other risks and factors that Leocor is unaware of at this time. The reader is referred to Leocor's initial public offering prospectus for a more complete discussion of applicable risk factors and their potential effects, copies of which may be accessed through Leocor’s issuer page on SEDAR at www.sedar.com.

The forward-looking statements contained in this press release are made as of the date of this press release. Leocor disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

LECR:CC

The Conversation (0)

16 March 2022

Leocor Gold

Newfoundland Exploration Led by Renowned Prospector Shawn Ryan

Newfoundland Exploration Led by Renowned Prospector Shawn Ryan Keep Reading...

2h

Top 7 ASX Gold ETFs for Australian Investors in 2026

The price of gold reached record highs in 2026, driven by global economic uncertainty stemming from shifting US trade policy and escalating geopolitical tensions in the Middle East.For many investors, gold is a tool for diversification. The precious metal is known for its ability to act as a... Keep Reading...

4h

Wheaton Precious Metals Announces Record Annual Revenue, Earnings and Cash Flow for 2025

FOURTH QUARTER AND FULL YEAR FINANCIAL RESULTS "Wheaton's portfolio of high-quality, long-life assets delivered another outstanding year in 2025, surpassing our production guidance and achieving record revenue, earnings, and operating cash flow," said Randy Smallwood, Chief Executive Officer of... Keep Reading...

5h

FOKUS MINING CORP. ANNOUNCES RECEIPT OF INTERIM ORDER AND UPDATE REGARDING PROPOSED ACQUISITION BY GOLD CANDLE LTD.

(All amounts expressed in Canadian Dollars unless otherwise noted)Fokus Mining Corporation ("Fokus" or the "Company") (TSXV: FKM,OTC:FKMCF) (OTCQB: FKMCF) announced today the filing of its management information circular (the "Circular") and related materials for the special meeting (the... Keep Reading...

5h

Visible Gold Intersected at Roy, Sunbeam

First Class Metals PLC ("First Class Metals", "FCM" or the "Company") the UK listed company focused on the discovery of economic metal deposits across its exploration properties in Ontario, Canada, is pleased to provide an update on the ongoing drilling programme at the Roy prospect on the... Keep Reading...

8h

Galway Metals Enters into Letter of Engagement with Eskar Capital Corporation for Investor Relations Services

TORONTO, ON / ACCESS Newswire / March 12, 2026 / Galway Metals Inc. (TSX-V:GWM)(OTCQB:GAYMF) ("Galway Metals" or the "Company") is pleased to announce that it has entered into a six (6) month Capital Markets Advisory Agreement (the "Agreement") with Eskar Capital Corporation ("Eskar Capital"),... Keep Reading...

13h

Peruvian Metals Announces Private Placement

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that it has arranged a non-brokered private placement for gross proceeds of up to $750,000 which will be used to make improvements and additions for expansion to its Aguila Norte processing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00