December 11, 2024

Lahontan Gold Corp. (TSXV:LG)(OTCQB:LGCXF) (the "Company" or "Lahontan") is pleased to announce results from a positive Preliminary Economic Assessment ("PEA") on its flagship Santa Fe Mine gold-silver project located in Nevada's prolific Walker Lane Trend. The PEA was prepared by Kappes, Cassiday & Associates ("KCA") of Reno, Nevada with mine planning and production scheduling contributions from RESPEC Company LLC ("Respec"), Reno, Nevada and mineral resource estimation by Equity Exploration Consultants Ltd. ("Equity"), of Vancouver, British Columbia, in accordance with Canadian National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101").

PEA Highlights:

- Pre-tax Net Present Value at a 5% discount rate ("NPV5") of US$265.1 M with a 41.0% IRRwith an After-tax NPV5 of US$200.0 M with a 34.2% IRR utilizing a $2,705/oz gold price and a $32.60/oz silver price ("spot metal prices") (see spot metal price to base case metal price comparison in Table 1).

- Total Life-of-Mine ("LOM") Pre-tax net cash flow of US$373.3 M and After-tax net cash flow of US$288.9 M over a nine-year project life using spot metal prices.

- Total projected LOM revenue of US$930.8 M over a nine-year project life using spot metal prices.

- LOM strip ratio of only 1.54 (waste to mineralized material ratio).

- Estimated pre-production capital costs of US$135.1 M including a 20% contingency, with a payback of 2.9 years using spot metal prices.

Kimberly Ann, Lahontan Gold Corp Executive Chair, CEO, President, and Founder commented: "Lahontan is very excited about the results of the PEA: a low-capex, highly profitable mining project with a quick payback certainly bodes well for the future of Lahontan and all stakeholders. There is considerable potential to expand gold and silver resources, therefore this is just the first step in restarting mining operations at Santa Fe. With mine permitting well under-way, targeting a 2026 mine ground-breaking, the potential for the Company to realize the economic outcomes outlined in the PEA is very real, especially given current trends in gold and silver prices. Continued optimization of the mine plan, resource expansion drilling, and refining the metallurgical flow sheet are planned for 2025, in parallel with our permitting activities."

The PEA is preliminary in nature, includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The Company has not defined any Mineral Reserves at the Santa Fe Mine project.

Economic Sensitivities

Sensitivity of the project economics to metals prices is shown in Table 1, showing the base case metal prices used for the PEA, as well as a low case, a high case and the spot case.

Table 1: Santa Fe Project 2024 PEA Economics

Low Case | Base Case | High Case | Spot Case (1) | |

Gold Price (US$/oz) | 1,800 | 2,025 | 2,200 | 2,705 |

Silver Price (US$/oz) | 21.50 | 24.20 | 26.3 | 32.60 |

Net Revenue (US$) | 618.6 M | 696.2 M | 756.5 M | 930.8 M |

Pre-Tax NCF(2) (US$) | 65.0 M | 141.6 M | 201.2 M | 373.3 M |

Pre-Tax NPV5(3) (US$) | 21.7 M | 82.2 M | 129.2 M | 265.1 M |

Pre-Tax IRR(4) | 8.5% | 17.4% | 23.9% | 41.0% |

After-Tax NCF(2) (US$) | 47.8 M | 107.7 M | 154.1 M | 288.9 M |

After-Tax NPV5(3) (US$) | 8.7 M | 56.5 M | 93.3 M | 200.0 M |

After-Tax IRR(4) | 6.4% | 14.0% | 19.5% | 34.2% |

Payback Period(5) (years) | 5.1 | 4.2 | 3.8 | 2.9 |

(1) As of December 10, 2024

(2) NCF means net cash flow

(3) NPV5 refers to net present value at 5% discount rate

(4) IRR means internal rate of return

(5) Pre-production capital, excluding sustaining capital

Capital Costs

Capital costs for the project are summarized in Table 2. Capital costs associated with the mining operation were estimated by RESPEC and based on mining by contractor. Pre-stripping costs were based on the operating costs discussed below. Capital costs associated with processing such as crushing, heap leaching and metal recovery, along with support and infrastructure costs associated with laboratory, water and power distribution and general site services were estimated by KCA. Reclamation and closure costs of $12.5 M were estimated by KCA.

Table 2: Project Capital Costs

Pre-Production (US$ M) | LOM Sustaining (US$ M) | |

Mining | 2.5 | 0.8 |

Processing, Support & Infrastructure | 116.0 | 17.0 |

Owner's Costs | 5.3 | 0.0 |

Initial Fills | 0.5 | 0.0 |

Working Capital(1) | 10.7 | 0.0 |

TOTAL(2) | 135.1 | 17.8 |

- Working capital is credited in Year 9

- Values are rounded and may not sum perfectly

Operating Costs

Operating costs for the project are summarized in Table 3. Mining operating costs were estimated by RESPEC and based on estimated anticipated equipment hours and personnel requirements at a 25% markup for contractor rates. The off-road red-dye diesel fuel price in this estimate was assumed to be $0.74/L. All other operating costs were estimated by KCA and based on first principles on certain components where possible, such as reagent and power consumption, along with benchmarking with similar operations for other components, such as labor, maintenance and discretionary expenses

Table 3: Project Operating Costs

LOM Total (US$ M) | Per Tonne Processed ($/t) | |

Mining | 204.2 | 7.36 |

Processing | 138.7 | 5.00 |

Support & Infrastructure | 17.3 | 0.62 |

G&A | 35.8 | 1.29 |

TOTAL(1) | 402.5 | 14.28 |

(1) Values are rounded and may not sum perfectly

Mine Production Schedule

The PEA mine production schedule includes mining of leach material and waste for the Santa Fe, Calvada, Slab, and York deposits. Leach material was assumed to be sent to a centralized crushing plant and then stacked on a leach pad and the waste material was sent to designed waste rock storage facilities (WRSF) or used as partial backfill into the Calvada pit.

Because the Santa Fe Mine is a brown-field project, minimal pre-stripping is required to develop sufficient stockpiles to feed the crusher. The mine production schedule requires 2 months of preproduction which begins in the Santa Fe deposit. The Calvada deposit is started in year 2 and mined concurrently with Santa Fe. Calvada mining is followed by mining of Slab and York deposits.

The process schedule was developed with a ramp up of production from year 1 through year 3 to a full 4.56 million tonnes per year. Table 4 shows the process production schedule.

Table 4: Projected Production Summary

Year | Tonnes Processed (kt) | Gold Grade (g/t) | Silver Grade (g/t) | Gold Produced (koz) | Silver Produced (koz) | Gold Equivalent Produced(1) (koz) |

1 | 3,468 | 0.47 | 4.1 | 30.3 | 88.1 | 31.4 |

2 | 4,517 | 0.58 | 4.6 | 51.4 | 168.9 | 53.4 |

3 | 4,563 | 0.66 | 3.7 | 60.2 | 155.7 | 62.0 |

4 | 4,563 | 0.70 | 3.0 | 60.5 | 124.2 | 62.0 |

5 | 4,563 | 0.73 | 2.5 | 62.0 | 93.5 | 63.1 |

6 | 4,563 | 0.61 | 2.2 | 49.9 | 56.9 | 50.5 |

7 | 1,497 | 0.58 | 2.1 | 20.1 | 23.1 | 20.4 |

8(2) | 0 | 2.3 | 4.2 | 2.3 | ||

TOTAL(3) | 27,731 | 0.63 | 3.3 | 336.7 | 714.7 | 345.2 |

- Equivalent gold calculation is based on base case metal prices

- Residual leaching production only

- Values are rounded and may not sum perfectly

Table 5 shows the key production parameters for the mine and processing units used in the generation of the production and cash flow profiles.

Table 5: Key Mining and Processing Production Parameters

LOM | |

Mining | |

Total Waste Tonnes Mined (Mt) | 42.9 |

Total Processed Tonnes Mined (Mt) | 27.7 |

Total Tonnes Mined (Mt) | 70.6 |

Heap Recovery - Gold | |

Santa Fe Oxide | 71% |

Santa Fe Transition | 49% |

Calvada Oxide | 71% |

Calvada Transition | 45% |

Slab Oxide | 50% |

York Oxide | 60% |

York Transition | 45% |

Heap Recovery - Silver | |

Santa Fe Oxide | 30% |

Santa Fe Transition | 30% |

Calvada Oxide | 13% |

Calvada Transition | 0% |

Slab Oxide | 12% |

York Oxide | 0% |

York Transition | 0% |

Mining and Processing

The mineralized material will be mined by standard open-pit mining methods using a contractor-owned and operated mining fleet consisting of 92-tonne haul trucks and 11.5-m3 loading units and transported to the crushing circuit for processing.

Mineralized material from the Santa Fe, Calvada, Slab and York deposits will be processed by conventional heap leaching methods. The nominal processing rate will be 4.6 million tonnes per annum or 12,500 tonnes per day. Three-stage crushing of the material to 12.7 mm, will be followed by conveyor stacking on to a multi-lift heap leach pad. Dilute sodium cyanide solution will be applied to the heap, with the pregnant gold and silver-bearing solution effluent from the heap being processed in a carbon adsorption-desorption-recovery (ADR) plant. Gold and silver will be produced in the form of doré bars from the on-site smelting process.

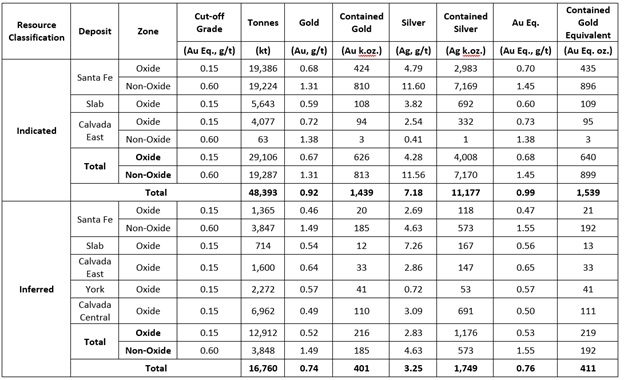

Mineral Resource Estimation

The mineral resource estimate ("MRE") was prepared in accordance with the CIM Definition Standards and Canadian National Instrument NI-43-101. The effective date of the MRE prepared by Equity is October 9, 2024. The MRE is shown in Table 6.

Table 6: Project-wide Resources, Santa Fe Mine, Mineral County, Nevada

Notes to Table 6:

- Mineral Resources have an effective date of October 9, 2024. The Mineral Resource Estimate for the Santa Fe Mine was prepared by Trevor Rabb, P.Geo., of Equity Exploration Consultants Ltd., an independent Qualified Person as defined by NI 43-101.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Inferred Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be classified as Mineral Reserves. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- Resources are reported in accordance with NI43-101 Standards of Disclosure for Mineral Projects (BCSC, 2016) and the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014).

- Mineral Resources were estimated for gold, silver, and gold equivalent (Au Eq) using a combination of ordinary kriging and inverse distance cubed within grade shell domains.

- Mineral resources are reported using a cut-off grade of 0.15 g/t Au Eq for oxide resources and 0.60 g/t Au Eq for non-oxide resources. Au Eq for the purpose of cut-off grade and reporting the Mineral Resources is based on the following assumptions gold price of US$1,950/oz gold, silver price of US$23.50/oz silver, and oxide gold recoveries ranging from 45% to 79%, oxide silver recoveries ranging from 10% to 30%, and non-oxide gold and silver recoveries of 71%, mining costs for resource and waste of US$2.50/t, processing cost (oxide) US$3.49/t, processing cost (non-oxide) US$25/t.

- An optimized open-pit shell was used to constrain the Mineral Resource and was generated using Lerchs-Grossman algorithm utilizing the following parameters: gold price of US$1,950/oz gold, silver price of US$23.50/oz silver, and selling costs of US$29.25/oz gold. Mining costs for resource and waste of US$2.50/t, processing cost (oxide) US$3.49/t, processing cost (non-oxide) US$25/t, G&A cost US$1.06/t. Royalties for the Slab, York and Calvada deposits are 1.25%, and maximum pit slope angles of 50 degrees.

- Totals may not sum due to rounding.

Estimation Approach: Lithology and gold and silver bearing domains were modelled using Leapfrog 2024. These domains are mainly defined by logged jasperoid and limestone-breccia lithologies and continuity of gold grades above 0.1 g/t gold. Metallurgical domains for oxide, transition and non-oxide were modelled based on ratio of cyanide leachable gold assay values to fire assay gold values in addition to drillhole logs recording abundance of pyrite and oxidation intensity. Transition material represents approximately 35% of oxide tonnes and comes almost entirely from the Santa Fe deposit. Transition domain material is included in the oxide resource. Domains representing lithology, weathering and mineralization models were assigned to a block model with a block size of 5 m x 5 m x 6 m. Average bulk densities representative of the mineralization and lithology models were assigned to the block model and vary from 2.4 t/m3 to 2.6 t/m3.

Grade capping and outlier restrictions were applied to gold and silver values and interpolation parameters respectively. Top cut values for gold and silver were evaluated for each domain independently prior to compositing to 1.52 m lengths that honor domain boundaries. Estimation was completed using Micromine Origin with Ordinary Kriging (OK) and Inverse Distance cubed (ID3) interpolants. Blocks were classified in accordance with the 2014 CIM Definition Standards. The nominal drillhole spacing for Indicated Mineral Resources is 50 m or less. The nominal drillhole spacing for Inferred Mineral Resources is 100 m or less.

Prospects for eventual economic extraction were evaluated by performing pit optimization using Lerchs-Grossman algorithm with the following parameters: gold price of US$1,950/oz gold, silver price of US$23.50/oz silver, selling costs of US$29.25/oz gold. Mining costs for resource and waste of US$2.50/t, processing cost (oxide) US$3.49/t, processing cost (non-oxide) US$25/t, G&A cost US$1.06/t. Royalties for the Slab, York and Calvada deposits are 1.25%. Maximum pit slope is 50 degrees. Processing recoveries range from 45% to 79% for oxide, silver recoveries range from 10% to 30% for oxide and non-oxide gold and silver recoveries are 71%.

More information regarding the Santa Fe Mine project's MRE update is included in the NI 43-101 Technical Report titled Santa Fe Project Technical Report with an effective date of October 9, 2024, Report Date: November 27, 2024*.

Qualified Persons

The qualified persons are Kenji Umeno, P.Eng. of Kappes, Cassiday & Associates; Thomas Dyer, P.E. of RESPEC; Trevor Rabb, P.Geo. and Darcy Baker, P.Geo. of Equity Exploration Consultants Ltd. each of whom is an independent "Qualified Person" under NI 43-101. A technical report supporting the results disclosed herein will be published within 45 days. The effective date of the technical report will be December 10, 2024.

About Lahontan Gold Corp.

Lahontan Gold Corp. is a Canadian mine development and mineral exploration company that holds, through its US subsidiaries, four top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 26.4km2 Santa Fe Mine project, had past production of 356,000 ounces of gold and 784,000 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing (Nevada Division of Minerals, www.ndomdata.com). The Santa Fe Mine has a Canadian National Instrument 43-101 compliant Indicated Mineral Resource of 1,539,000 oz Au Eq(grading 0.99 g/t Au Eq) and an Inferred Mineral Resource of 411,000 oz Au Eq (grading 0.76 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report*). For more information, please visit our website: www.lahontangoldcorp.com

* Please see the Santa Fe Project Technical Report, Authors: Trevor Rabb, P. Geo, Darcy Baker, PhD, P. Geo., and Kenji Umeno, P. Eng., Effective Date: October 9, 2024, Report Date: November 27, 2024. The Technical Report is available on the Company's website and SEDAR+.

On behalf of the Board of Directors

Kimberly Ann

Founder, CEO, President, and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, Director

Phone: 1-530-414-4400

Email: Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of Canadian and United States securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are forward-looking statements. Forward-Looking statements in this news release relate to, among other things: the Company's strategic plans; the results of the PEA; the economic potential and merits of the Project; the estimated amount and grade of mineral resources at the Project; precious metals prices; the PEA representing a viable development option for the Santa Fe Mine project ("the Project"); the timing and particulars of the development phases as identified in the PEA; estimates with respect to LOM, operating costs, sustaining capital costs, capex, AISC, cash costs, LOM production, processing plant throughput, NPV and after-tax IRR, payback period, production capacity and other metrics; the estimated economic returns from the Project; mining methods and extraction techniques; the exploration potential of the Project and its inclusion in future mining studies.

These forward-looking statements reflect the Company's current views with respect to future events and are necessarily based upon several assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include, among other things: conditions in general economic and financial markets; tonnage to be mined and processed; grades and recoveries; prices for silver and gold remaining as estimated; currency exchange rates remaining as estimated; reclamation estimates; reliability of the updated MRE and the assumptions upon which it is based; future operating costs; prices for energy inputs, labor, materials, supplies and services (including transportation); the availability of skilled labor and no labor related disruptions at any of the Company's operations; no unplanned delays or interruptions in scheduled production; performance of available laboratory and other related services; availability of funds; all necessary permits, licenses and regulatory approvals for operations are received in a timely manner; the ability to secure and maintain title and ownership to properties and the surface rights necessary for operations; and the Company's ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedar.com

LG:CA

Sign up to get your FREE

Lahontan Gold Corp. Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 January

Lahontan Gold Corp.

Near-term gold production pathway in the highly prolific Walker Lane district in Nevada

Near-term gold production pathway in the highly prolific Walker Lane district in Nevada Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Lahontan Gold Corp. Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00