January 17, 2023

Lahontan Gold Corp. (TSX.V:LG)(OTCQB:LGCXF) (the "Company" or "Lahontan") is pleased to announce the maiden Mineral Resource Estimate ("MRE") for its flagship Santa Fe Mine, a past-producing open pit, heap leach gold and silver mine located in Mineral County, Nevada. The MRE for Santa Fe is based upon 1,275 drill holes totaling 125,435 metres, including 50 drill holes totaling 13,118 metres drilled by Lahontan since 2021.

Highlights of the MRE include:

- Project-wide pit constrained Indicated Mineral Resources of 1,112,000 contained gold equivalent ("Au Eq") ounces and Inferred Mineral Resources of 544,000 contained Au Eq ounces (assumptions for Au Eq are described in the Notes to Tables 1 and 2).

- Project-wide average grade for the Indicated Mineral Resource is 1.14 g/t Au Eq; the average grade of the Project-wide Inferred Mineral Resource is 1.00 g/t Au Eq.

- Indicated Oxide Resources total 21.6 Mt grading 1.03 g/t Au Eq for 712,000 Au Eq ounces and Inferred Oxide Resources total 11.1 Mt grading 0.73 g/t Au Eq for 262,000 Au Eq ounces.

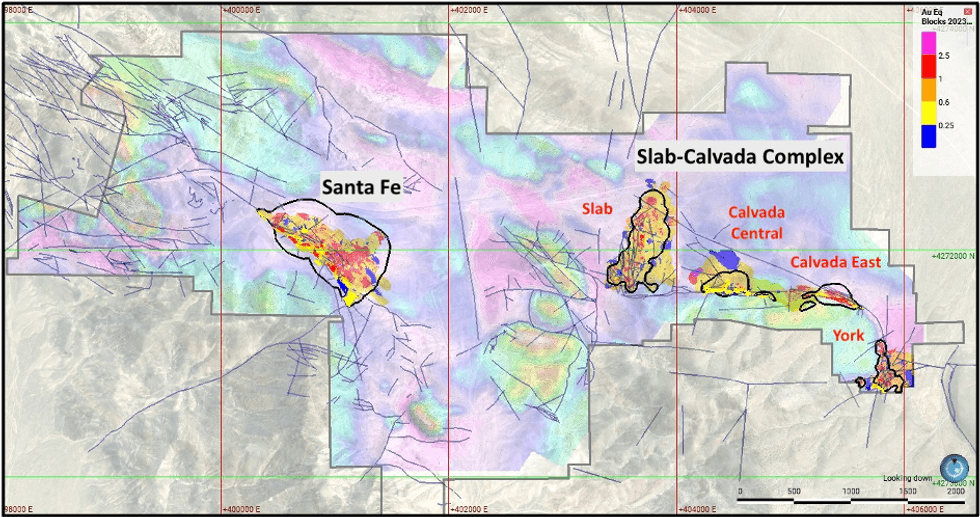

- The conceptual pit shells returned preliminary strip ratios (waste:ore) of 3.6:1 at the Santa Fe deposit and 2.3:1 at the Slab-Calvada-York Complex. Within both conceptual pits, gold and silver deposits crop out at the surface providing opportunities for rapid, low-cost mining operations.

- The MRE block model shows that gold and silver mineralization extends well beyond the conceptual pit shells, generating high-quality targets for additional drilling and resource growth.

Kimberly Ann, Founder, CEO, and President of Lahontan Gold Corp commented: "Lahontan is thrilled with the results of this MRE for the Santa Fe Mine, validating our business concept focusing on brownfield exploration and development opportunities. The MRE demonstrates the presence of a large, readily exploitable, oxide gold resource and importantly, higher-grade non-oxide gold resources. Shallow, good grade oxide gold mineralization in the high-wall of the Santa Fe pit and outcropping oxide resources in Slab-Calvada-York complex, give the Company a clear option for rapid mine development at a significant production rate. We intend to take advantage of the technical and metallurgical data generated over six years of historical mining and heap-leach processing to quickly evaluate the economic potential of the oxide portion of the mineral resource. All deposits comprising the Santa Fe Mine remain open for resource expansion and we look forward to continued drilling at Santa Fe as we grow and expand the size and scale of the project".

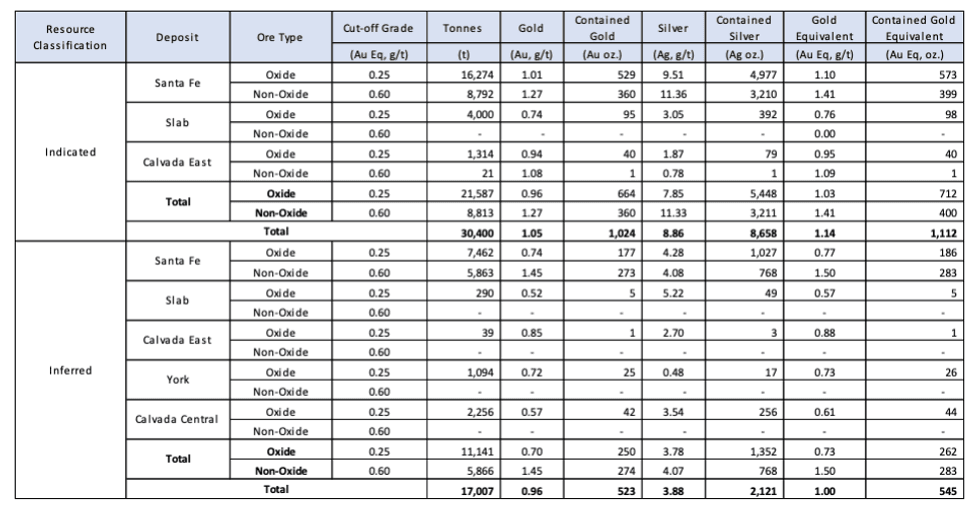

Table 1: Project-wide Resources, Santa Fe Mine, Mineral County, Nevada.

Notes to Tables 1 and 2:

- Mineral Resources have an effective date of December 7, 2022. The Mineral Resource Estimate for the Santa Fe Mine was prepared by Trevor Rabb, P.Geo., of Equity Exploration Consultants Ltd., an independent Qualified Person as defined by NI 43-101.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Inferred Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be classified as Mineral Reserves. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- Resources are reported in accordance with NI43-101 Standards of Disclosure for Mineral Projects (BCSC, 2016) and the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014).

- Mineral Resources were estimated for gold, silver, and gold equivalent (Au Eq) using a combination of ordinary kriging and inverse distance cubed within grade shell domains.

- Mineral resources are reported using a cut-off grade of 0.25 g/t Au Eq for oxide resources and 0.60 g/t Au Eq for non-oxide resources. Au Eq for the purpose of cut-off grade and reporting the Mineral Resources is based on the following assumptions gold price of US$1,770/oz gold, silver price of US$22.00/oz silver, and oxide gold recoveries ranging from 60% to 77%, oxide silver recoveries ranging from 40% to 55%, and non-oxide gold and silver recoveries of 71%, mining costs for ore and waste of US$2.20/t, crushing cost of US$2.71/t, processing cost (oxide) US$6.80/t, processing cost (non-oxide) US$25/t.

- An optimized open-pit shell was used to constrain the Mineral Resource and was generated using Lerchs-Grossman algorithm utilizing the following parameters: gold price of US$1,770/oz gold, silver price of US$22/oz silver, gold selling costs of US$56/oz gold, and silver selling costs of US$3/oz silver. Mining costs for ore and waste of US$2.20/t, crushing cost of US$2.71/t, processing cost (oxide) US$6.80/t, processing cost (non-oxide) US$25/t, G&A cost US$3.99/t. Royalties for the Slab, York and Calvada deposits are 1.25%, and maximum pit slope angles of 50 degrees.

About the Santa Fe Mine:

The Santa Fe Mine is in the Walker Lane mineral belt of western Nevada approximately 50 km from the town of Hawthorne in Mineral County. Nearby operating gold and silver mines include Isabella Pearl (Fortitude Gold) and Borealis (Waterton). The Santa Fe Mine consists of four past-producing open-pits, including the Santa Fe, Slab, Calvada East, and York deposits, within a 19 km2 land package 100% controlled by Lahontan. Gold and silver production occurred between 1988 and 1995 utilizing heap-leach processing that produced a reported 345,000 oz of gold and 711,000 oz of silver (Nevada Bureau of Mines and Geology, 1995). Mineralization occurs as disseminated gold and silver hosted by Triassic age calcareous rocks. Strong stratigraphic and structural controls of mineralization is evident. Considerable exploration potential remains at Santa Fe and the Company intends to continue its aggressive exploration program during 2023.

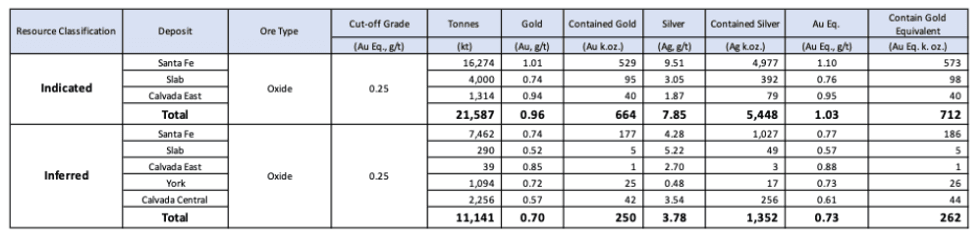

Table 2: Project-wide Oxide Resources, Santa Fe Mine, Mineral County, Nevada

Oxide Resources:

Oxide resources at the Santa Fe Mine occur at both the Santa Fe deposit and the Slab-Calvada Complex which includes the Slab, Calvada East, York, and Calvada Central deposits. The contained Au Eq oxide ounces for the Slab-Calvada Complex accounts for approximately 19% of the total Indicated Au Eq oxide ounces and 29% of the total Inferred Au Eq oxide ounces. Mineral Resources at the Slab-Calvada Complex are exposed at surface. Oxide resources are open to the north and east of the Slab open pit, along the Calvada Fault, and at the York open pit.

The Santa Fe deposit accounts for 81% of Indicated contained Au Eq oxide ounces, and 71% of Inferred contained AuEq oxide ounces. Oxide Mineral Resources within the Santa Fe deposit are primarily located in the high wall of the Santa Fe open pit. The average grade of the Santa Fe deposit Indicated oxide resource is 1.10 g/t Au Eq, and Inferred oxide resource is 0.77 g/t Au Eq. Oxide resources at the Santa Fe deposit are open to the northeast, south, and southeast.

Santa Fe Non-Oxide Resources:

Non-oxide resources at the Santa Fe Mine are principally located in the Santa Fe deposit below the oxide resources within the resource pit shell. The average grade of the Santa Fe deposit Indicated non-oxide resource is 1.41 g/t Au Eq and the Santa Fe deposit Inferred non-oxide mineral resource is 1.50 g/t Au Eq. Gold is very fine-grained and associated with pyrite. Within the southeastern portion of the Santa Fe deposit, higher-grade gold and silver resources may positively influence project economics. Higher grade gold and silver mineralization extends to the southeast of the Santa Fe deposit, along strike and down-rake, providing excellent exploration opportunities to grow the non-oxide resources at Santa Fe.

Estimation Approach:

Lithology and gold and silver bearing domains were modelled using Leapfrog Geo 2022. These domains are mainly defined by logged jasperoid and limestone-breccia lithologies and continuity of gold grades above 0.1 g/t gold. Ore type domains for oxide, transition and non-oxide were modelled based on ratio of cyanide leachable gold assay values to fire assay gold values in addition to drillhole logs recording abundance of pyrite and oxidation intensity. Transition material represents less than 5% of oxide tonnes and is included in the oxide resource. Domains representing lithology, weathering and mineralization models were assigned to a block model with a block size of 5 m x 5 m x 6 m. Average bulk densities representative of the mineralization and lithology models were assigned to the block model and vary from 2.4 t/m3 to 2.6 t/m3.

Grade capping and outlier restrictions were applied to gold and silver values and interpolation parameters respectively. Top cut values for gold and silver were evaluated for each domain independently prior to compositing to 1.52 m lengths that honor domain boundaries. Estimation was completed using Micromine Origin with Ordinary Kriging (OK) and Inverse Distance cubed (ID3) interpolants. Blocks were classified in accordance with the 2014 CIM Definition Standards. The nominal drillhole spacing for Indicated Mineral Resources is 50 m or less. The nominal drillhole spacing for Inferred Mineral Resources is 100 m or less.

Prospects for eventual economic extraction were evaluated by performing pit optimization using Lerchs-Grossman algorithm with the following parameters: gold price of US$1,770/oz gold, silver price of US$22/oz silver, gold selling costs of US$56/oz gold, and silver selling costs of US$3/oz silver. Mining costs for ore and waste of US$2.20/t, crushing cost of US$2.71/t, processing cost (oxide) US$6.80/t, processing cost (non-oxide) US$25/t, G&A cost US$3.99/t. Royalties for the Slab, York and Calvada deposits are 1.25%. Maximum pit slope of 50 degrees. Processing recoveries range from 60% to 77% for oxide, silver recoveries range from 40% to 55% for oxide and non-oxide gold and silver recoveries are 71%.

Filing of Report:

To support this Santa Fe MRE, a technical report prepared according to National Instrument 43-101 ("Report") will be filed on SEDAR within the next 45 days.

About Lahontan Gold Corp:

Lahontan Gold Corp. is a Canadian mineral exploration company that holds, through its US subsidiaries, three top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 19 km2 Santa Fe Mine, is a past producing gold and silver mine that utilized heap-leach processing (past production of 345,000 ounces of gold and 711,000 ounces of silver between 1988 and 1995; Nevada Bureau of Mines and Geology, 1995). The Santa Fe Mine has an Indicated Mineral Resource of 1,112,000 oz Au Eq (grading 1.14 g/t Au Eq) and an Inferred Mineral Resource of 544,000 oz Au Eq (grading 1.00 g/t Au Eq), all pit constrained. The Company plans to continue to aggressively explore the entire property during 2023 and begin the process of evaluating development scenarios to bring the Santa Fe Mine back into production. For more information, please visit our website: www.lahontangoldcorp.com

The independent Qualified Person responsible for the MRE disclosure for the Santa Fe Mine is Trevor Rabb, P.Geo., of Equity Exploration Consultants Ltd. In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Quinton J. Browne, P.Geo., Consulting Geologist to Lahontan Gold Corp., is the Qualified Person for the Company and approved the technical content of this news release.

On behalf of the Board of Directors

Kimberly Ann

Founder, CEO, President, and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, Director

Phone: 1-530-414-4400

Email: Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedar.com

LG:CA

Sign up to get your FREE

Lahontan Gold Corp. Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 January

Lahontan Gold Corp.

Near-term gold production pathway in the highly prolific Walker Lane district in Nevada

Near-term gold production pathway in the highly prolific Walker Lane district in Nevada Keep Reading...

2h

Filing of Initial Prospectus

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to announce that it has filed a preliminary non-offering prospectus (the "Prospectus") with the Ontario Securities Commission (the "Commission") and has applied to the Canadian Securities... Keep Reading...

12 February

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

12 February

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Sign up to get your FREE

Lahontan Gold Corp. Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00