April 09, 2025

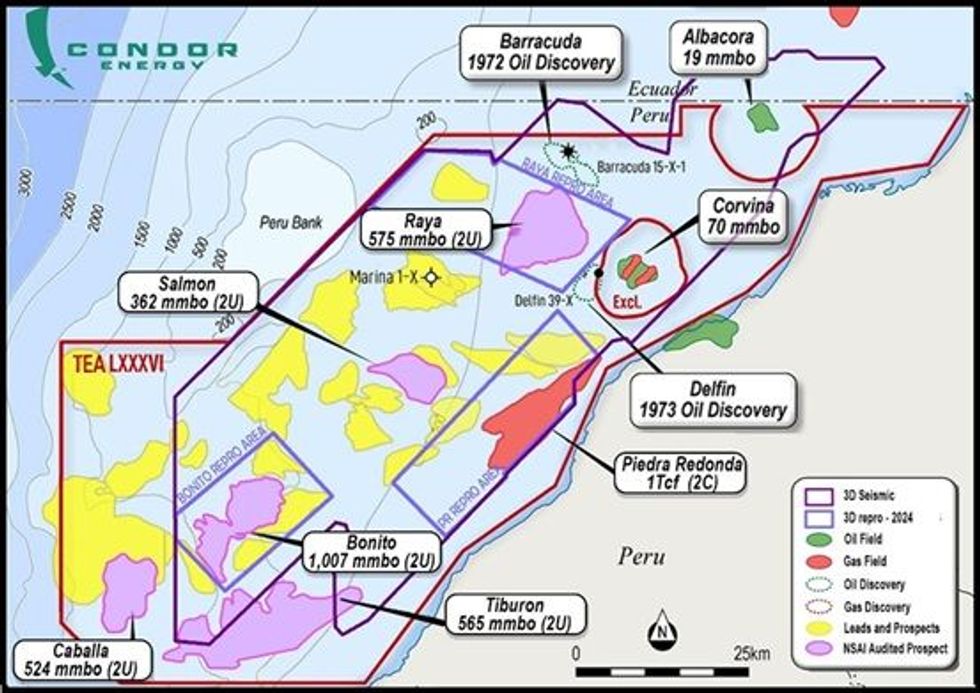

Condor Energy Limited (ASX: CND) (Condor or the Company) is pleased to announce the results of an independent prospective resource assessment conducted by international resource consultancy Netherland Sewell & Associates Inc. (NSAI) across five selected prospects in the Company’s Tumbes Basin Technical Evaluation Area LXXXVI (TEA or Block) offshore northern Peru.

Highlights

- New independent estimate confirms multibillion barrel prospective resource across five prospects in Tumbes TEA

- Total Best Estimate (2U) of 3 billion barrels of oil prospective resources1 (100% gross unrisked) across Bonito, Raya, Salmon, Caballa and Tiburon prospects

- The largest prospect, Bonito, has a Best Estimate (2U) of 1 billion barrels of oil prospective resource1 (100% gross unrisked)

- Majority of the resources are contained within Lower Miocene Zorritos Formation, a proven reservoir within the basin

- Resource potential determined by leading international petroleum consultancy Netherland Sewell and Associates (NSAI)

- World class multibillion barrel exploration potential builds on Condor’s substantial discovered gas field at Piedra Redonda (1 Tcf 2C)2

- Farmout process commenced with multiple parties in data room

- Shareholder briefing to be held Thursday 10 April, to detail resource estimate update

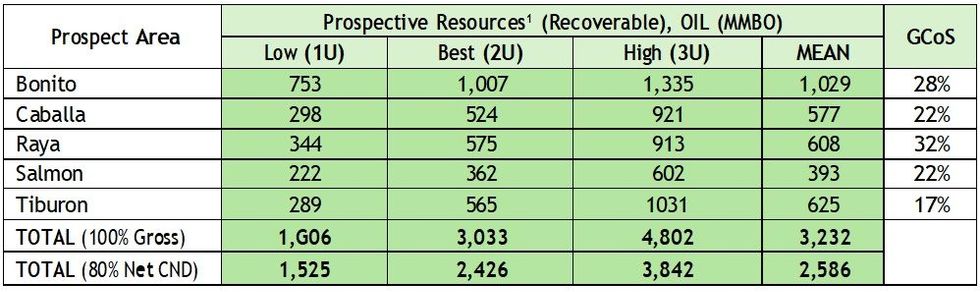

The NSAI evaluation confirms multibillion barrel potential, with a combined best estimate gross unrisked 2U prospective resource of 3 billion barrels of oil (2.4 billion barrels net to Condor) across the Bonito, Raya, Salmon, Caballa and Tiburon prospect areas (Table 1).

Prospective resources shown are aggregated by prospect area (Table 1). The geological chance of success (GCoS) has been assessed for the primary target reservoir within each prospect. Each prospect contains multiple stacked reservoir intervals, which may increase the effective chance of success due to multiple opportunities within a single structure.

Click here for the full ASX Release

This article includes content from Condor Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CND:AU

The Conversation (0)

26 September 2024

Condor Energy

Rare world-class hydrocarbon exploration opportunity

Rare world-class hydrocarbon exploration opportunity Keep Reading...

29 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Condor Energy (CND:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

22 January 2025

A$3M Placement to Advance High-Impact Workplan for Peru

Condor Energy (CND:AU) has announced A$3M Placement to Advance High-Impact Workplan for PeruDownload the PDF here. Keep Reading...

20 January 2025

Trading Halt

Condor Energy (CND:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

15 January 2025

Piedra Redonda Gas Field Best Estimate Resource of 1 Tcf

Condor Energy (CND:AU) has announced Piedra Redonda Gas Field Best Estimate Resource of 1 TcfDownload the PDF here. Keep Reading...

13 January 2025

Trading Halt

Condor Energy (CND:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00