(TheNewswire)

Mineralization Discovered 700 m along strike of the Alligator Zone

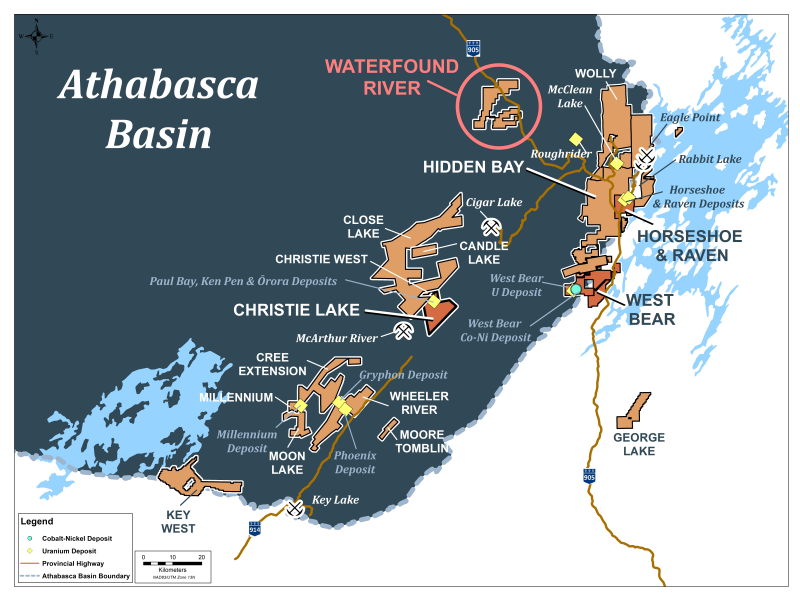

UEX Corporation (TSX:UEX) (OTC: UEXCF) ("UEX" or the "Company") is pleased to announce that its 50% owned company JCU (Canada) Exploration Company, Limited "(JCU") has been informed by the operator of the Waterfound River Joint Venture (see Figure 1) that three holes have encountered high-grade uranium mineralization approximately 700 m west and along strike of the Alligator Zone

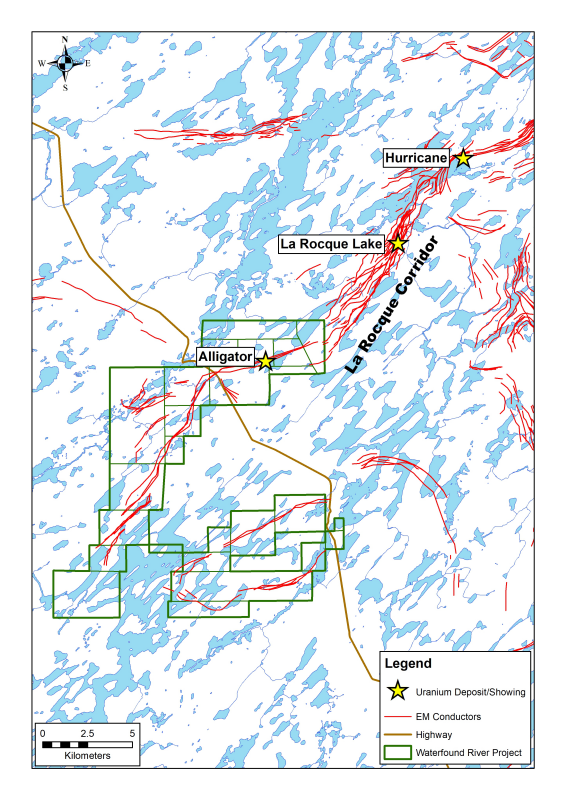

The Alligator Zone is located within the La Rocque Corridor, host of IsoEnergy's Hurricane Zone and Cameco's La Rocque Deposit which are located approximately 16 km and 10 km northeast of the Alligator Zone respectively (see Figure 2).

Project operator Orano Canada Inc. ("Orano") reported to the joint venture partners that hole WF-68 encountered unconformity-style uranium mineralization over three intervals that averaged 0.92% eU 3 O 8 over 1.6 m (calculated from 0.78% eU) from 460.3 m to 461.9, 1.03 % eU3O8 over 3.0 m (calculated from 0.87% eU) from 467.0 to 470.0 m, and 5.91% U 3 O 8 over 3.9 m (calculated from 5.01% eU) from 473.6 m to 477.5 m using a 0.05 % eU cut-off for probe equivalent data.

Hole WF-68 followed up hole WF-67, which encountered unconformity-style uranium mineralization that averaged 0.99% eU 3 O 8 over 9.0 m (calculated from 0.84% eU) from 474.2 m to 483.2 m, and 0.31% eU 3 O 8 over 4.7 m (calculated from 0.26% eU) from 483.6 to 488.3 m (using a 0.05% eU cut-off for probe equivalent data). UEX is not privy to the data in the 40 cm space between these two probe equivalent intervals, the potential remains that assay sampling will connect these two intervals. WF-68 intersected the unconformity approximately 7 m north and on section with WF-67.

As a follow up to WF-68, WF-68-1 targeted the unconformity a further 12 m north of WF-68 and intersected two intervals of uranium mineralization hosted in the sandstone. The first averaged 1.27% eU 3 O 8 over 5.3 m (calculated from 1.08% eU) from 466.4 m to 471.7 m. The second subinterval averaged 2.19% eU 3 O 8 over 2.4 m (calculated from 1.86% eU) from 480.3 m to 482.7 m (using a 0.05% eU cut-off for probe equivalent data).

Table 1 : 2022 Waterfound River Exploration Drilling Highlights

| Drill Hole | From (m) | To (m) | Length (m) | eU (%) | eU 3 O 8 (%) |

| WF-67 | 474.2 | 483.2 | 9.0 | 0.84 | 0.99 |

| WF-67 | 483.6 | 488.3 | 4.7 | 0.26 | 0.31 |

| WF-68 | 460.3 | 461.9 | 1.6 | 0.78 | 0.92 |

| WF-68 | 467.0 | 470.0 | 3.0 | 0.87 | 1.03 |

| WF-68 | 473.6 | 477.5 | 3.9 | 5.01 | 5.91 |

| WF-68-1 | 466.4 | 471.7 | 5.3 | 1.08 | 1.27 |

| WF-68-1 | 480.3 | 482.7 | 2.4 | 1.86 | 2.19 |

This new fence of mineralization remains open for expansion along the current section to the north, remains open for approximately 700 m along strike to the east-northeast to the Alligator Zone and 400 m to the south-southwest. The new holes are located approximately 800 m south-southwest and along strike of the 1991 Alligator Zone discovery hole WF-08 that interested 4.49% U 3 O 8 over 10.53 m ( see UEX News Release of January 12, 2022 ). True widths of the mineralization reported in holes WF-67, WF-68, and WF-68-1 are not known at this time but are estimated to be approximately 90-95% of the mineralized core lengths reported above.

The operating partner Orano has completed the winter program with 3,175.4 m drilling in 6 drill holes and has begun demobilization from the field. Drilling is scheduled to resume in the summer season.

About Radiometric Equivalent Grades and %eU and %eU 3 O 8

Orano follows the European convention of reported uranium grades as %U, whereas UEX follows the North American convention of reporting uranium grades using %U 3 O 8 . %U is converted to %U 3 O 8 by multiplying the %U concentration by 1.17924. UEX has reported the grades above as %U 3 O 8 and were calculated from Orano's original grade reporting in %U.

When U or U 3 O 8 is preceded by an ‘e' such as %eU or %eU 3 O 8 , this indicates that the concentration reported is a Radiometric Equivalent Grade ("REG") determined within the drill hole in-situ using a calibrated radiometric gamma probe. The estimation of uranium grades using down-hole probe radioactivity is an industry standard practice and is used by Athabasca Basin uranium producers and explorers to calculate REGs in both mine and exploration settings.

JCU's Waterfound River Project

The Waterfound River Project is located in the Eastern Athabasca Basin approximately 22 km from Points North and is a joint venture between JCU (25.8010%) Orano Canada Inc (62.4223%), and Denison Mines Inc. (11.7767%).

A total of 7,400 m of drilling in 10-12 drill holes and 18 line km of Moving Loop Electromagnetic surveying is planned for the Waterfound River Project in 2022 along the D1 conductor trend, which hosts the Alligator Zone where unconformity uranium mineralization was encountered in several holes, including hole WF-08, which interested 4.49% U 3 O 8 over 10.53 m.

Qualified Persons and Data Acquisition

The technical information in this news release has been reviewed and approved by Roger Lemaitre, P.Eng., P.Geo., UEX's President and CEO who is considered to be a Qualified Person as defined by National Instrument 43-101.

About UEX

UEX is a Canadian uranium and cobalt exploration and development company involved in an exceptional portfolio of uranium projects.

UEX's directly-owned portfolio of projects is located in the eastern, western and northern perimeters of the Athabasca Basin, the world's richest uranium region which in 2020 accounted for approximately 8.1% of the global primary uranium production. In addition to advancing its uranium development projects through its ownership interest in JCU, UEX is currently advancing several other uranium deposits in the Athabasca Basin which include the Paul Bay, Ken Pen and Ōrora deposits at the Christie Lake Project , the Kianna, Anne, Colette and 58B deposits at its currently 49.1%-owned Shea Creek Project, the Horseshoe and Raven deposits located on its 100%-owned Horseshoe-Raven Project and the West Bear Uranium Deposit located at its 100%-owned West Bear Project.

UEX is also 50:50 co-owner of JCU (Canada) Exploration Company, Limited with Denison Mines Corp. JCU's portfolio of projects includes interests in some of Canada's key future uranium development projects, notably a 30.099% interest in Cameco's Millennium Project, a 10% interest in Denison's Wheeler River Project, and a 33.8123% interest in Orano Canada's Kiggavik Project, located in the Thelon Basin in Nunavut, as well as minority interests in nine other grassroots uranium projects in the Athabasca Basin.

UEX is also leading the discovery of cobalt in Canada, with three cobalt-nickel exploration projects located in the Athabasca Basin of northern Saskatchewan, including the only primary cobalt deposit in Canada. The 100% owned West Bear Project hosts the West Bear Cobalt-Nickel Deposit, the newly discovered Michael Lake Co-Ni Zone, and the West Bear Uranium Deposit. UEX also owns 100% of two early-stage cobalt exploration projects, the Axis Lake and Key West Projects.

FOR FURTHER INFORMATION PLEASE CONTACT

Roger Lemaitre

President & CEO

(306) 979-3849

www.uexcorp.com

Forward-Looking Information

This news release contains statements that constitute "forward-looking information" for the purposes of Canadian securities laws. Such statements are based on UEX's current expectations, estimates, forecasts and projections. Such forward-looking information includes statements regarding UEX's drill hole results, uranium, cobalt and nickel prices, outlook for our future operations, plans and timing for exploration activities, and other expectations, intentions and plans that are not historical fact. Such forward-looking information is based on certain factors and assumptions and is subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking information. Important factors that could cause actual results to differ materially from UEX's expectations include uncertainties relating to the, interpretation of drill results and geology, assay confirmation, additional drilling results, continuity and grade of deposits, fluctuations in uranium, cobalt and nickel prices and currency exchange rates, changes in environmental and other laws affecting uranium, cobalt and nickel exploration and mining and other risks and uncertainties disclosed in UEX's Annual Information Form and other filings with the applicable Canadian securities commissions on SEDAR. Many of these factors are beyond the control of UEX. Consequently, all forward-looking information contained in this news release is qualified by this cautionary statement and there can be no assurance that actual results or developments anticipated by UEX will be realized. For the reasons set forth above, investors should not place undue reliance on such forward-looking information. Except as required by applicable law, UEX disclaims any intention or obligation to update or revise forward-looking information, whether as a result of new information, future events or otherwise.

Figure 1 – UEX and JCU Projects – Athabasca Basin

Figure 2 – Waterfound River Project and the La Rocque Corridor

Copyright (c) 2022 TheNewswire - All rights reserved.