March 10, 2024

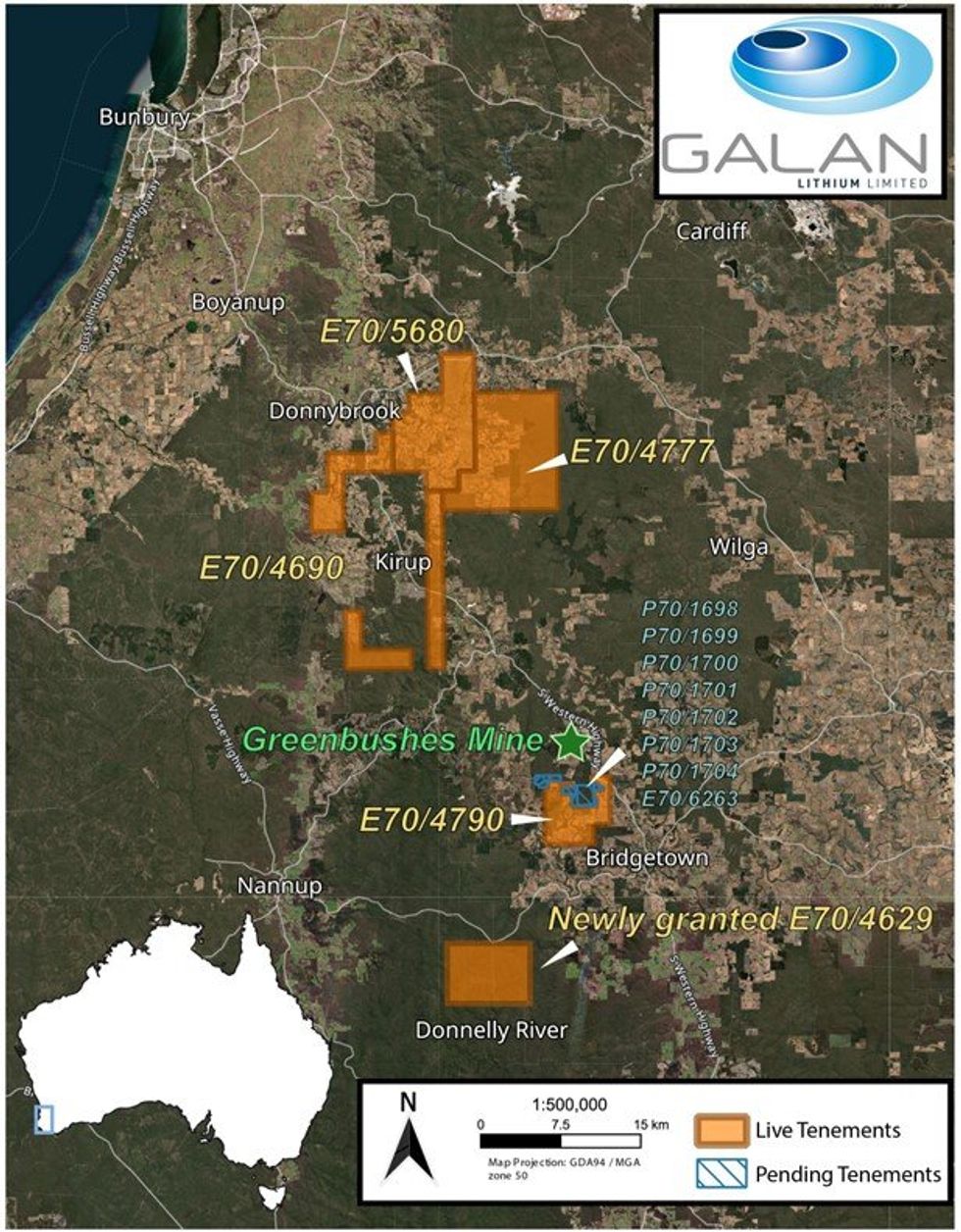

Galan Lithium Limited (ASX:GLN) (Galan or the Company) is pleased to announce the grant of an additional key tenement, E70/4629 targeting lithium-bearing pegmatites. The exploration licence has been granted for a period of 5 years to February 2029. The tenement is approximately 260 km south of Perth, the capital of Western Australia, and less than 30 km south of the Greenbushes pegmatite at the Greenbushes Mine (Talison Lithium). The area covers roughly 43 km2 and expands Galan’s 100% owned tenement package to a total area of 315 km2.

- Newly granted tenement (E70/4629) located less than 30 km south of Greenbushes mine

- Importantly, tenement contains the historic tin workings associated with lithium-bearing pegmatites

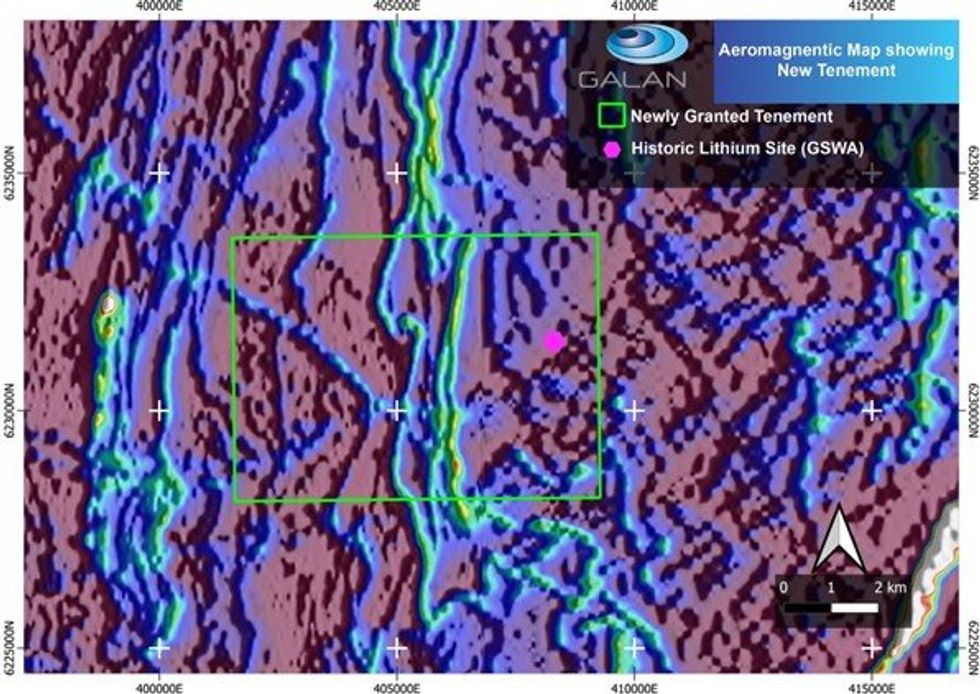

- A re-interpretation of historical geophysical data acquired by Galan indicates that the Donnybrook-Bridgetown Shear Zone extends into E70/4629 and may be responsible for the emplacement of pegmatites.

- Processing of previous airborne geophysical data provides initial exploration targets

- Maiden exploration campaign, including hand sampling and ground, geophysics set for H2 2024 over this highly prospective tenure

The Company is excited to commence exploration activities on the newly acquired tenement, leveraging our previously acquired data set of high-resolution radiometric and magnetic geophysical data from the airborne geophysical campaign flown in March 2022 (refer ASX Announcement dated 24 March 2022). Currently, the Company’s primary targets are historic tin workings in the Smithfield pegmatite area in the eastern portion of the tenement. These historic workings provide valuable geological insights and indicate potential spodumene mineralisation patterns within the region. Tin and tantalum are often associated with lithium-bearing pegmatites, and alluvial tins were the precursor to the Greenbushes Mine. Galan’s initial exploration activities will include geologic mapping, soil sampling and rock chipping, as well as ground geophysical surveys set to commence later this year.

Commenting on this important milestone, Galan’s Managing Director, Juan Pablo Vargas de la Vega said ”The grant of this key exploration licence is an important pillar of Galan’s exploration and evaluation activities at Greenbushes South. The tenure is highly prospective and its geological setting gives us the confidence to commence a maiden field campaign at the earliest opportunity. We look forward to updating the market as we advance the project.”

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00