October 02, 2024

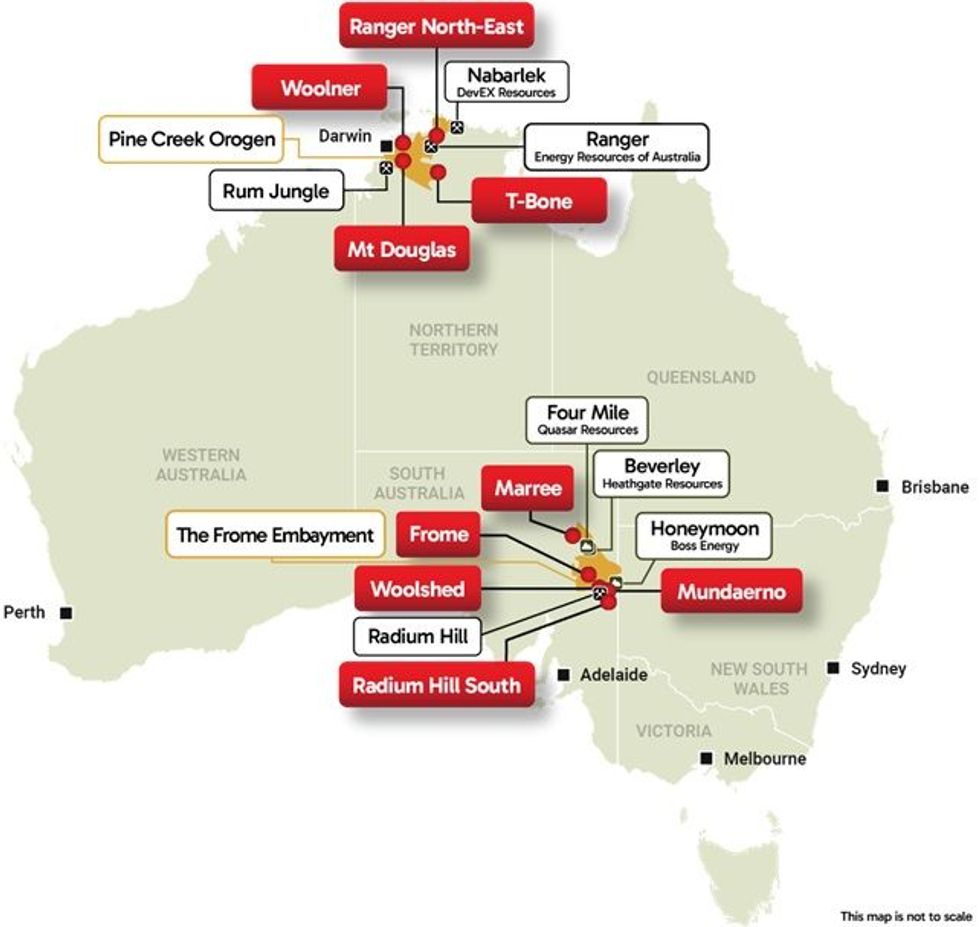

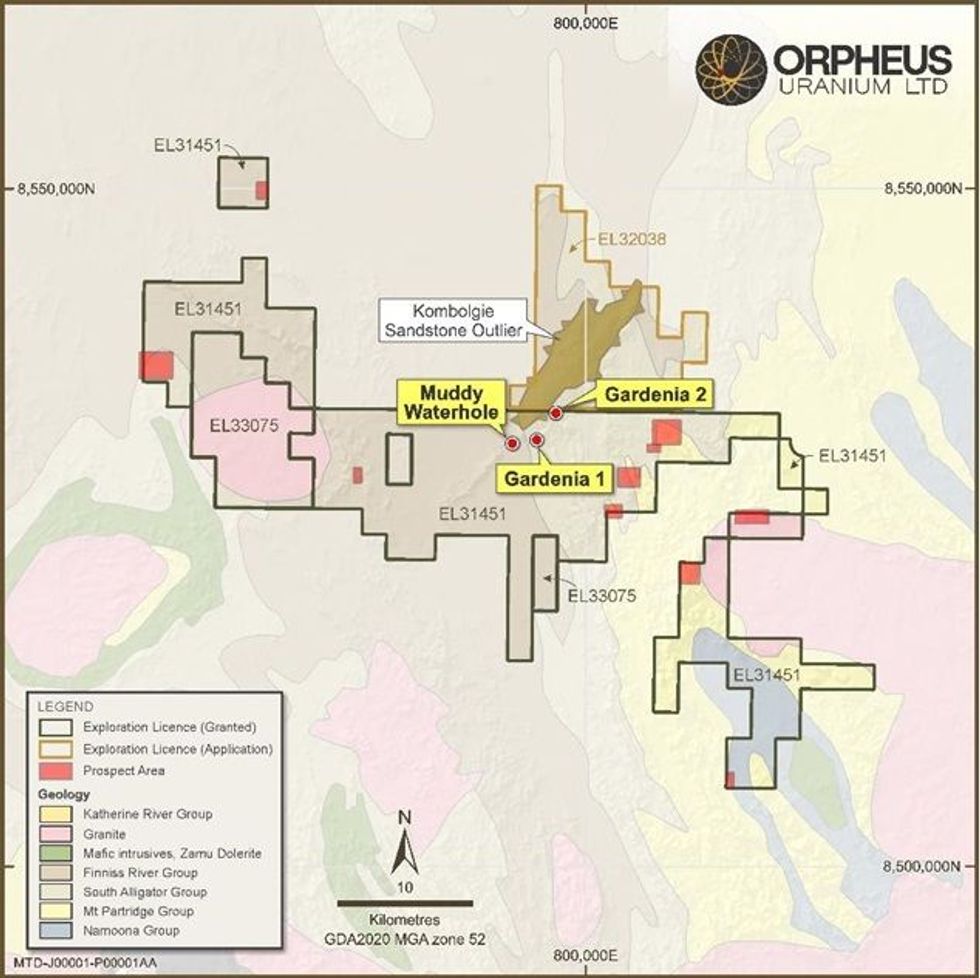

Orpheus Uranium Limited (ASX: ORP) (Orpheus or the Company) is pleased to announce that on-ground exploration activities have commenced within the Company’s Mt Douglas Project in the Northern Territory (see Figure 1 & Figure 2).

Highlights

- Geological reconnaissance and sampling have commenced at Mount Douglas (NT) targeting unconformity-style uranium mineralisation similar to other uranium deposits in the Pine Creek Orogen.

- Initial focus on airborne and surface radiometric anomalies coincident with structures.

- Localised gravity survey to be completed in collaboration with the NTGS/Geoscience Australia’s regional gravity survey planned for commencement in 2024.

- Approval received from the Northern Territory Government for a Mining Management Plan (MMP) allowing Orpheus to undertake advance-stage exploration activities at Mt Douglas.

The exploration program will “ground truth” extensive anomalies within the project defined from historical airborne and surface radiometric surveys (see Figure 3). The program will include geological mapping and systematic rock chip sampling to identify zones of potential primary uranium mineralisation.

To date, observed outcropping minerology confirms uranium occurs in primary ore minerals that are mobilised (see Figure 4). As such, uranium mineralisation appears to be structurally controlled similar to unconformity style deposits, including those found in the nearby Rum Jungle Uranium Field, the site of Australia’s first large-scale uranium mine. This will provide targets for immediate drill testing.

Complementing on-ground field activities, Orpheus has collaborated with the Northern Territory Geological Survey (NTGS) to undertake a locally (500m) spaced helicopter-supported ground gravity survey over the project area. The survey will be run simultaneously with the regionally spaced Pine Creek ground gravity survey being conducted by the NTGS and targeted for completion by the end of the calendar year.

Results of the gravity survey will be combined with historic magnetic and radiometric datasets to refine target areas of interest. The primary output of this work will assist in identifying locally derived alteration zones that are associated with regional structures with potential to control uranium deposit formation.

The results of these preliminary programs will continue to develop an understanding of the geological setting of the project area. This will ultimately guide advanced-stage activities including trenching and/or drilling for which Orpheus’ has recently received government approval to undertake within nominated areas associated with these preliminary activities.

Commenting on the exploration program, Orpheus Chief Executive Officer Clint Dubieniecki commented:

“We are excited to commence on-ground activities within the Mt Douglas project. The project was acquired by Orpheus on the basis that the geology and historical radiometric data shows all the hallmarks of a large and high-grade unconformity-style uranium district, similar to the Rum Jungle (Pine Creek) or Ranger (Alligator Rivers) deposits. This work represents an important first step in delineating key structures and defining surface uranium mineralisation that will be prioritsed for drilling.”

Click here for the full ASX Release

This article includes content from Orpheus Uranium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00