August 22, 2024

Golden Mile Resources (ASX:G88) is a project development and mineral exploration company focusing on multi asset and multi commodity strategy by advancing core projects, acquiring high-quality assets, and forging tactical alliances with joint venture partners. Golden Mile’s value proposition is driven by a highly experienced leadership team with proven expertise across the resources sector from exploration to development and production.

The company is advancing its newly acquired Pearl copper project in Arizona, and the Quicksilver nickel-cobalt project, located in Western Australia, which has an indicated and inferred resource of 26.3 Mt @ 0.64 percent nickel and 0.04 percent cobalt.

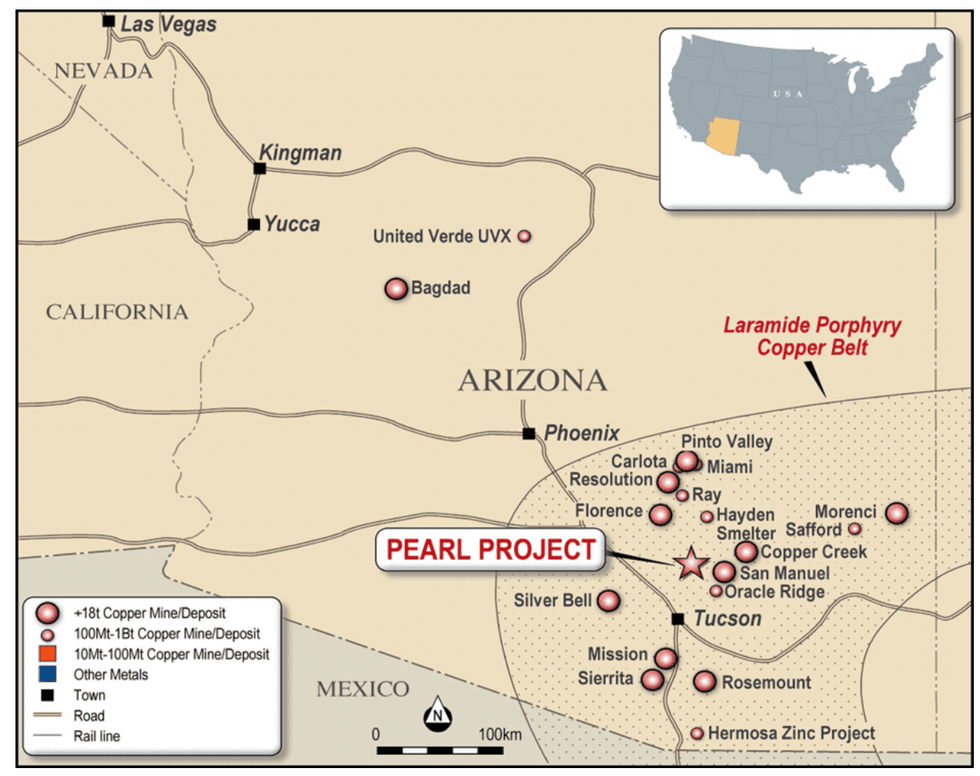

Golden Mile secured the Pearl copper project in August 2024. Located in Arizona, the asset hosts more than 50 artisanal copper workings and shares similar geological characteristics to the San Manuel-Kalamazoo and Pinto Valley porphyry copper mines. The project exhibits widespread surface alteration highlighted by rock chip samples of 7.3 percent copper, 0.43 percent molybdenum, 19.9 percent lead, 4.9 percent zinc and 360 g/t silver.

Company Highlights

- Golden Mile Resources has a diversified portfolio of both advanced projects and exploration assets in tier 1 jurisdictions of Australia and the US.

- The recently acquired Pearl copper project in Arizona is located in the renowned Laramide Porphyry Belt.

- The Quicksilver nickel-cobalt project near Perth has an indicated and inferred mineral resource of 26.3 Mt @ 0.64 percent nickel and 0.04 percent cobalt.

- Golden Mile is backed by a highly experienced management team with proven success in project engineering and development from exploration to production across multiple continents.

This Golden Mile Resources profile is part of a paid investor education campaign.*

Click here to connect with Golden Mile Resources (ASX:G88) to receive an Investor Presentation

G88:AU

The Conversation (0)

18 February 2025

Golden Mile Resources

Multiple exploration opportunities across base and precious metals in Australia and the US

Multiple exploration opportunities across base and precious metals in Australia and the US Keep Reading...

22 August 2025

Private Placement to Raise $510.8K

Golden Mile Resources (G88:AU) has announced Private Placement to Raise $510.8KDownload the PDF here. Keep Reading...

20 August 2025

Trading Halt

Golden Mile Resources (G88:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 July 2025

June 2025 Quarterly Activities and Cashflow Reports

Golden Mile Resources (G88:AU) has announced June 2025 Quarterly Activities and Cashflow ReportsDownload the PDF here. Keep Reading...

07 July 2025

Aurora Prospect Delivers High-Grade Gold Assays

Golden Mile Resources (G88:AU) has announced Aurora Prospect Delivers High-Grade Gold AssaysDownload the PDF here. Keep Reading...

02 July 2025

Maiden Drilling Campaign Intersects Copper and Lead

Golden Mile Resources (G88:AU) has announced Maiden Drilling Campaign Intersects Copper and LeadDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00