June 28, 2023

GMV Minerals (TSXV:GMV, OTCQB:GMVMF) is a well-established junior gold development company that shifted its focus knowing that current lithium production simply cannot keep up with soaring demand, unless there is an exponential increase in available supply.

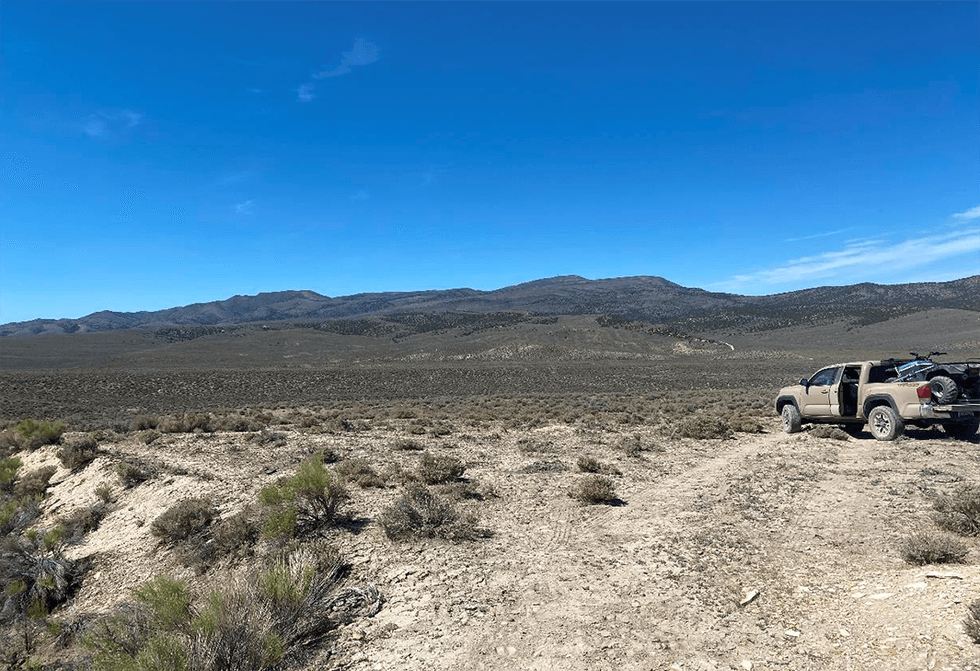

GMV intends to explore the Daisy Creek lithium project, located in Lander County, Nevada, to assess its potential for expansion prior to development. Daisy Creek was first identified as a rich potential source of lithium in the 1980s after high-grade lithium was noted to have been likely contained in lithium-bearing clay found in altered volcanic tuffs. Geologists staked claims in the area after seeing similarities between the geology of Daisy Creek and Lithium America’s significant Thacker Pass discovery.

The Daisy Creek Lithium project was initially targeted for uranium by multiple oil and mining companies in the late 1970s and early 1980s, the project instead proved rich in lithium, displaying values of up to 2 percent in clay-altered volcanic tuffs, which geologists noted was likely hectorite-based.

Company Highlights

- GMV Minerals is a junior gold development company with a recently added claim block focusing on lithium.

- Driven by investor interest and market conditions, the company entered into an agreement to obtain 100-percent ownership of the highly prospective Daisy Creek lithium project.

- GMV also maintains 100-percent ownership of the Mexican Hat gold project, notable for its estimated 10-year mine life, low capex and a pre-tax $153-million NPV using a US$1,600 per oz base case.

- Mexican Hat hosts an inferred 688,000 ounces of gold, excellent metallurgical results and a low strip ratio.

- Both Daisy Creek and Mexican Hat are situated in safe, mining-friendly jurisdictions with readily available and experienced service providers. Each asset is also situated in close proximity to existing infrastructure, further reducing initial capex.

- GMV is also noteworthy for its tightly-held share structure, with 24 percent of shares held by management and advisors.

This GMV Minerals profile is part of a paid investor education campaign.*

Click here to connect with GMV Minerals (TSXV:GMV, OTCQB:GMVMF) to receive an Investor Presentation

GMC:CC

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00