June 11, 2024

The Empire IRGS Project in North QLD.

Far Northern Resources Limited ASX (FNR) is pleased to announce that it has successfully completed the Pole Dipole Induced Polarisation (PDIP) geophysical survey covering the Empire Mining Lease (ML20380) in far north Queensland.

Highlights

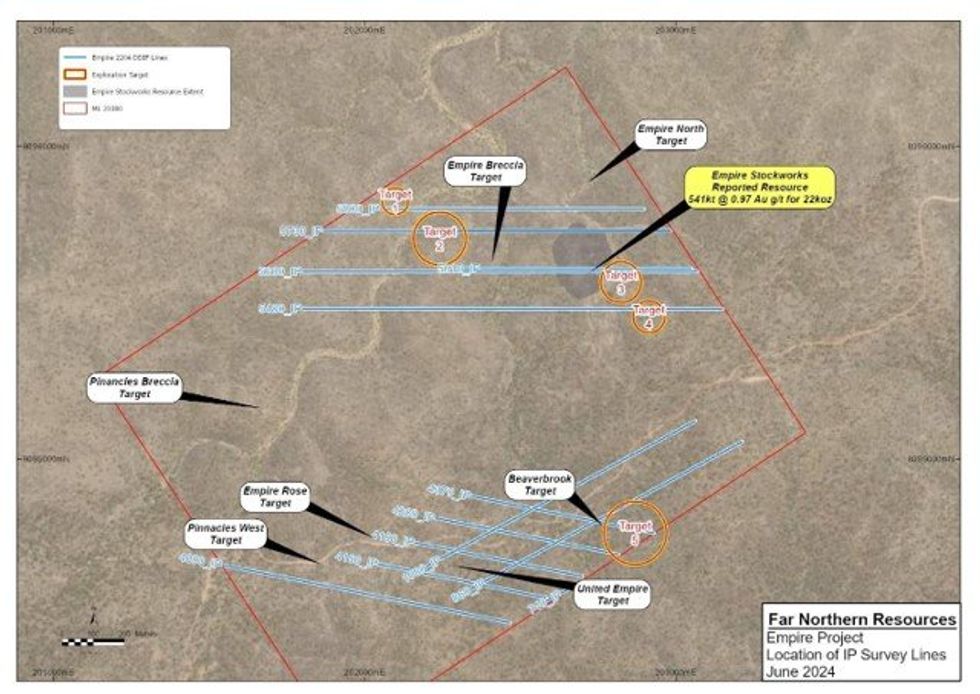

- Pole Dipole Induced Polarisation has delineated five new chargeability high anomalies over the Empire North and Empire South on ML20380. (Fig 1)

- The survey covered 13 lines over 19.7km using 50m & 100 dipole-dipole.

- The five new anomalies are characterised by high chargeability with associated structurally controlled resistivity low.

- Targets 1 and 2 appear to be close to surface and structurally controlled with chargeability high over some 400m. (Fig 3 & 4) with Target 1 appearing to dip to the northwest.

- Target 3,4 & Target 5 appear to be connected on an arcuate structure, some 800m in length. (Fig 5, 6 & 7)

- This is the first systematic IP survey over the Mining Lease. No part of the 5 anomalies has been drill tested to date.

- FNR is finalising a drilling plan for mid July 2024.

- The Mining Lease incorporates two breccia pipes with gold bearing epithermal quartz veins mantling the eastern flank totalling a JORC of 23,000Oz Au.

Empire Mining Lease IP Lines

The survey was designed to test first the extent of the porphyry discovered at depth beneath Empire North from the latest drilling by FNR. Secondly, to help delineate the area to the south over the copper gold projects that were highlighted by airborne magnetic survey and the recent rock chips reported in April (ASX Announcement 15/04/2024). The key focus of the PDIP survey was to better define the structural controls of the Mining Lease taking into consideration the magnetic low anomalies, the two breccia pipes and the historic mine shafts and pits at Empire South.

The survey data has confirmed three new large and two smaller chargeability anomalies associated with the magnetics (Fig 2) and has allowed FNR’s technical team to locate and plan new drill targets within the project area ahead of the planned drilling in July this year.

This article includes content from Far Northern Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FNR:AU

The Conversation (0)

23 June 2025

Bridge Creek Phase 1 Assays

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 AssaysDownload the PDF here. Keep Reading...

21 May 2025

Bridge Creek Phase 1 Assay Composites Received

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 Assay Composites ReceivedDownload the PDF here. Keep Reading...

29 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Far Northern Resources (FNR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

08 April 2025

Drilling to Commence on Bridge Creek Mining Lease

Far Northern Resources (FNR:AU) has announced Drilling to Commence on Bridge Creek Mining LeaseDownload the PDF here. Keep Reading...

17 February 2025

Amended Appendix 5B

Far Northern Resources (FNR:AU) has announced Amended Appendix 5BDownload the PDF here. Keep Reading...

10h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

11h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

11h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

12h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

12h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

09 February

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00