November 07, 2023

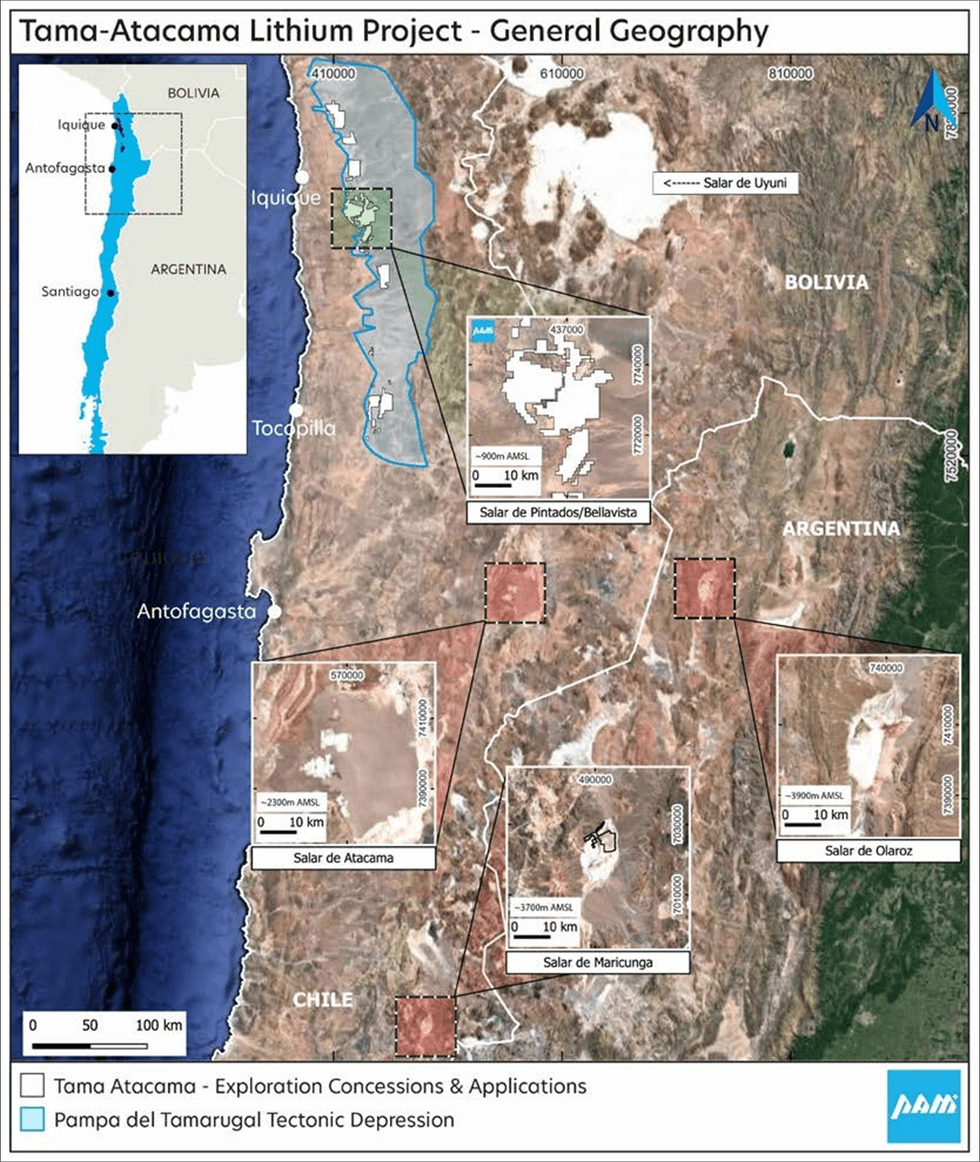

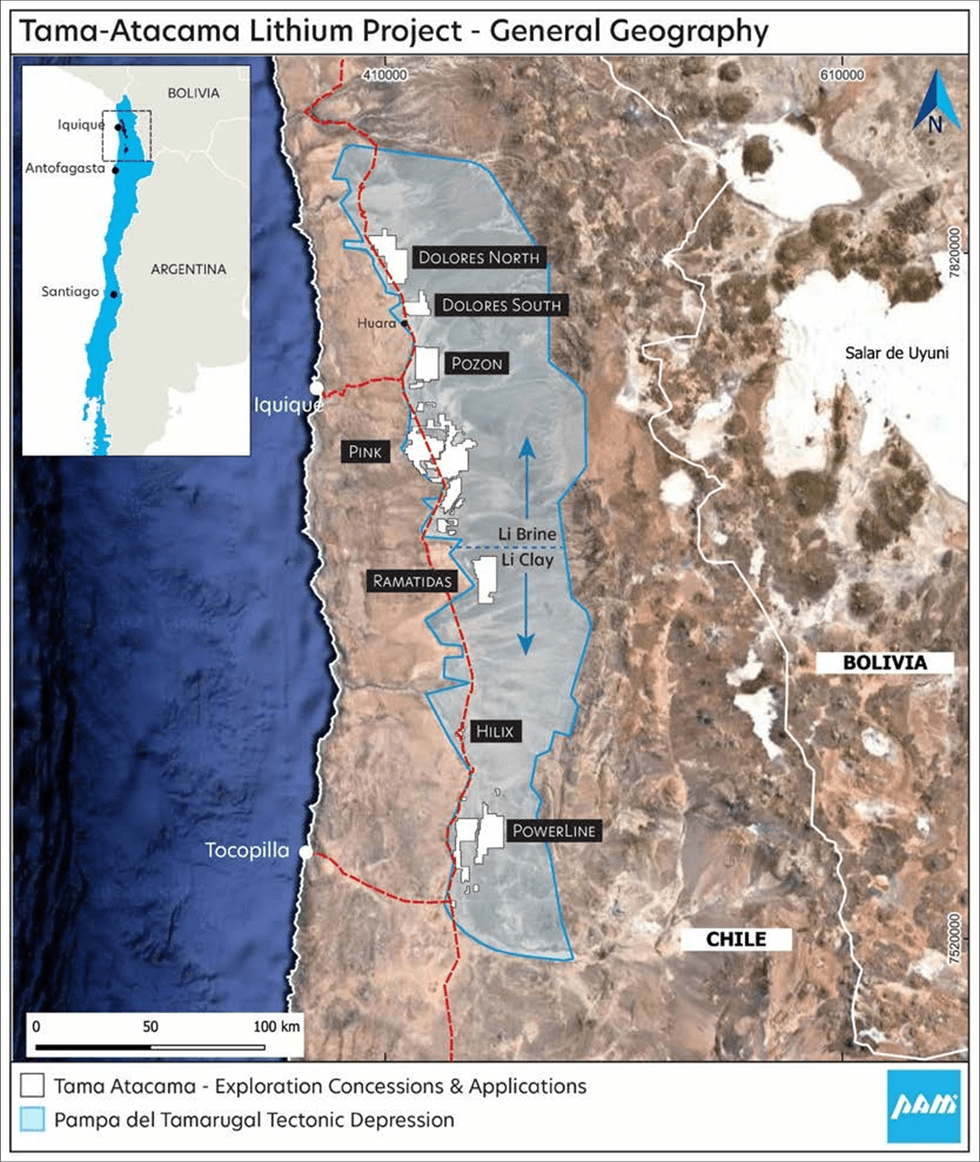

Battery and critical metals explorer and developer Pan Asia Metals Limited (ASX: PAM) (‘PAM’ or ‘the Company’) is pleased to provide an update on activities at its Tama Atacama Lithium Project (TALP) located in northern Chile (See Figures 1 and 2). This update specifically relates to Li assays from surface samples collected at the Dolores North Lithium Prospect, the most northern prospect in PAM’s Li brine holdings.

HIGHLIGHTS

- Elevated Lithium (Li) from geochemical sampling of surface salt crusts at Salar Dolores

- 11 of 33 samples >200ppm Li

- Assays range up to 1250ppm and average of 404ppm Li

- Elevated boron, potassium and magnesium commonly associated with elevated Li

- Elevated Li values at Dolores delineated over a strike length of approximately 20km

- Geochemical signature of surface salt crusts at Dolores similar to Salar de Atacama

- Located at an altitude of 800-1100 mASL in hyper-arid environment, with little to no rainfall and extreme evaporation

- Dolores prospect forms part of the Tama-Atacama Lithium Project comprises four lithium in brine prospect areas in northern Chile extending over 140km north to south and covering an area of approximately 1,000km2 with additional Li brine potential to the south.

- PAM assesses Salar Dolores as highly prospective with excellent infrastructure including major highway access via the Pan Americana 5 Highway, water (salt and fresh), solar power, nearby ports, airports and major logistics hubs

Pan Asia Metals Managing Director, Paul Lock, commenting on the Mineral Resource Estimate update said: “Another set of great results which help build the big picture for the Tama Atacama Lithium Project. PAM’s target Li brine concessions span 140km in length and have an area of 1,000km2, with further Li brine potential to the south of this area. The geochemical program discussed herein identifies elevated Li values at Dolores delineated over a strike length of approximately 20km, building on the bigger picture.

Tama Atacama is strategically unique as it is at 800-1100m altitude, in a hyper arid environment with high evaporation rates. Further, the project has all required transport and energy infrastructure, is located 40-60km from the coast and 75km from Iquique, a coastal city with a population of 200,000, a deep water bulk and container port, and daily flights to Santiago. The project’s positioning, i.e. its altitude and coastal location, with a large portion of the project area abutting large tracts of historic and current nitrate and other mining, means it will offer PAM easy access and simpler operations in the future.“

The prospects, collectively known as the Tama-Atacama Lithium Project, are divided into seven main areas and extend over 290km from north to south and encompass approximately 1,600km2 of Exploration Concession applications and granted Exploration Concessions. The Dolores North prospect forms the northernmost extent of the Tata- Atacama project as shown in Figure 2.

Click here for the full ASX Release

This article includes content from Pan Asia Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PAM:AU

The Conversation (0)

09 July 2023

Pan Asia Metals

First-mover Advantage in Critical Metals for Southeast Asia Market

First-mover Advantage in Critical Metals for Southeast Asia Market Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00