May 30, 2024

Tempest Minerals Limited (ASX: TEM) (“Tempest” or the “Company”) is pleased to announce that it will undertake a non-underwritten non renounceable 1-for-5 pro-rata Entitlement Offer (Offer) of shares (New Shares) to raise up to $0.83 million to progress the next phase of exploration at its exploration projects in Western Australia.

Key Points

- Pro-rata 1-for-5 non-renounceable Entitlement Offer priced at $0.008 per share to raise gross proceeds of $0.83 million.

- Offer price represents a 20% discount to the 10-day VWAP price of $0.01.

- Tempest to conduct RC drilling at the Remorse copper target where TEM has a compelling copper-zinc geochemical anomaly coincident with a geophysical (electromagnetic) anomaly and RC drilling at the Sanity gold target which sits several kilometres to the south of the Remorse target.

Entitlement Offer

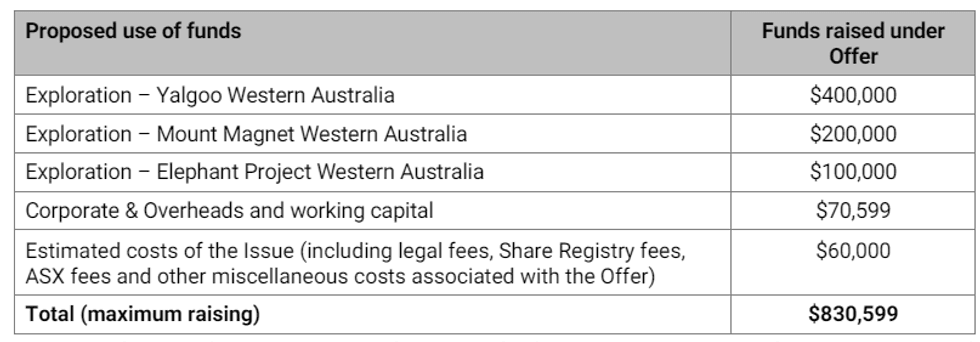

The Offer is available to all shareholders with registered addresses in Australia and New Zealand and provides the opportunity to subscribe for 1 New Share for every 5 shares held at an offer price of $0.008 per New Share. The proceeds from the Offer (assuming it is fully subscribed) is proposed to be allocated in the following manner:

However, in the event that circumstances change, or other better opportunities arise the Directors reserve the right to vary the proposed uses to maximise the benefit to Shareholders.

Additional Entitlement Offer details

New Shares issued under the Offer will rank equally with existing shares on issue and the Company will apply for official quotation of the New Shares. Option-holders are not entitled to participate in the Offer without first exercising their options to be registered as a shareholder (in Australia and New Zealand) on the Record Date, in accordance with the terms and conditions of the options.

The Company will welcome applications for shareholders to apply for New Shares in addition to shareholders’ existing entitlements and will retain the right to place the Shortfall on the same terms in the three months following the completion of the Offer.

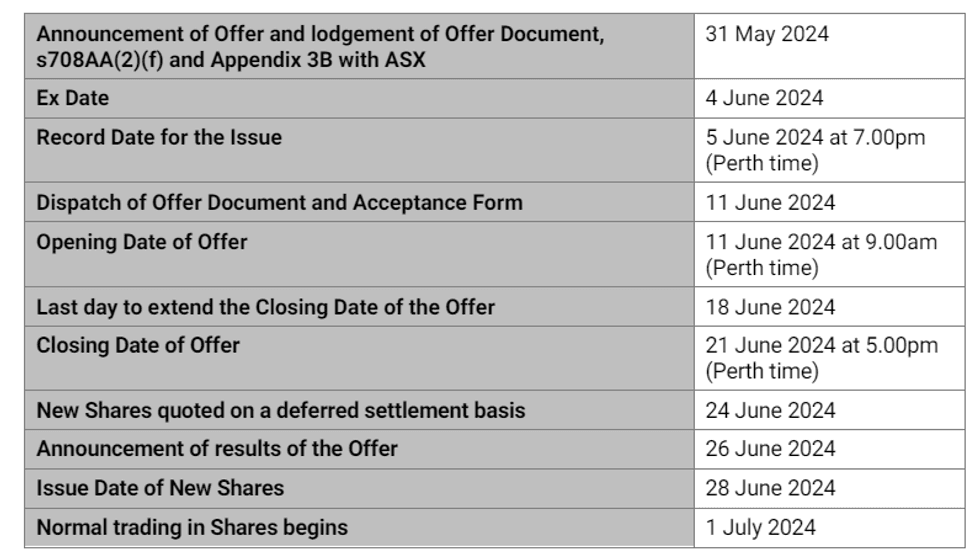

The proposed timetable for the Offer is as follows:

The Board of the Company has authorised the release of this announcement to the market.

Click here for the full ASX Release

This article includes content from Tempest Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TEM:AU

The Conversation (0)

03 February 2025

Tempest Minerals

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

25 June 2025

Completion of Shortfall Offer

Tempest Minerals (TEM:AU) has announced Completion of Shortfall OfferDownload the PDF here. Keep Reading...

15 June 2025

Further Excellent Metallurgical Results From Remorse-Yalgoo

Tempest Minerals (TEM:AU) has announced Further Excellent Metallurgical Results From Remorse-YalgooDownload the PDF here. Keep Reading...

10 June 2025

Entitlement Offer Results

Tempest Minerals (TEM:AU) has announced Entitlement Offer ResultsDownload the PDF here. Keep Reading...

30 May 2025

Geochemical Sampling Extends Sanity Gold Anomalies - amended

Tempest Minerals (TEM:AU) has announced Geochemical Sampling Extends Sanity Gold Anomalies - amendedDownload the PDF here. Keep Reading...

20 May 2025

Yalgoo - Geochemical Sampling Extends Sanity Gold Anomalies

Tempest Minerals (TEM:AU) has announced Yalgoo - Geochemical Sampling Extends Sanity Gold AnomaliesDownload the PDF here. Keep Reading...

14h

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

20h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

21h

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00