February 11, 2025

Brightstar Resources Limited (ASX: BTR) (Brightstar) is pleased to announce that a binding Term Sheet has been executed with Cazaly Resources Limited (ASX: CAZ, Cazaly), under which Cazaly is granted an option to elect to earn up to an 80% interest in the Goongarrie Gold Project, by incurring exploration expenditure of up to $3 million.

HIGHLIGHTS

- Brightstar has signed a binding Term Sheet with Cazaly Resources Limited under which Cazaly is granted an option to elect to earn up to an 80% interest in the Goongarrie Gold Project by sole funding exploration expenditure of up to $3 million, as follows:

- Upon exercising the option, Cazaly to spend $1 million on expenditure over an initial 12-month period to earn a 25% interest;

- Cazaly to spend an additional $1 million on expenditure over a further 18-month period to earn an additional 26% interest (aggregate 51% interest); and

- Cazaly to spend an additional $1 million on expenditure over a further 18-month period to earn an additional 29% interest (aggregate 80% interest)

- Upon Cazaly earning an interest in the Goongarrie Gold Project, Brightstar and Cazaly shall form a Joint Venture

- The earn-in allows Brightstar to prioritise operational and development activities, with Definitive Feasibility Study workstreams advancing and current mining operations at Second Fortune complemented by start-up works at the Fish underground project

- Brightstar’s exploration strategy remains focused on improving and growing existing mineral resources at projects with granted mining leases and near-term commercialisation pathways, such as the Sandstone, Menzies and broader Laverton project areas

Brightstar’s Managing Director, Alex Rovira, commented:

“With our focus on development and mining operations across the broader Eastern Goldfields and Murchison regions, we are delighted to have attracted a quality partner in Cazaly to explore the Lake Goongarrie area in greater detail, while retaining exposure and upside to exploration success with the joint venture.

Our focus in the general Menzies area is on the Lady Shenton System where we are defining a large open pit mining complex as part of our DFS, whilst we continue to explore and assess other deposits such as Yunndaga and the Link Zone for future mining opportunities to increase our operational footprint in the Menzies area.”

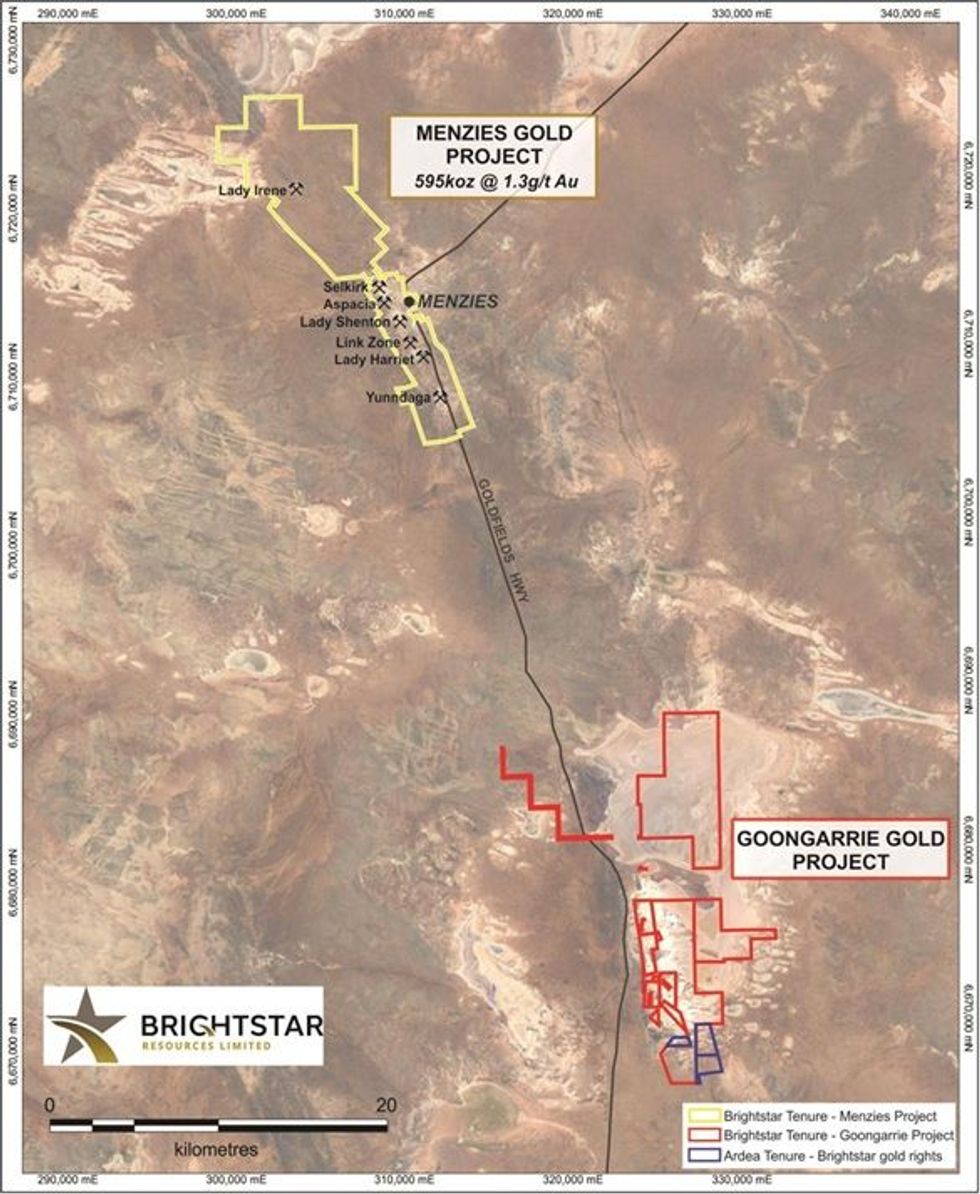

Under the Term Sheet, Cazaly is granted an option, exercisable within 90 days, to elect to earn up to an 80% interest in the Goongarrie Gold Project shown in Figure 1 (which is a combination of wholly owned tenements and tenements where Brightstar holds gold rights). The exercise of the option by Cazaly is subject to satisfaction of certain conditions precedent, including due diligence on the Goongarrie Gold Project by Cazaly, the tenements being in good standing and certain deeds of assignment being entered into with parties that have rights in respect of the Goongarrie Gold Project.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

03 March

Brightstar Secures US$120M Bond to Fund Goldfields Project

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields ProjectDownload the PDF here. Keep Reading...

02 March

Results of Oversubscribed Share Purchase Plan

Brightstar Resources (BTR:AU) has announced Results of Oversubscribed Share Purchase PlanDownload the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

19h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00